Crypto stocks have slumped in the past few months as Bitcoin and most altcoins have entered a bear market. HOOD and COIN stocks have dropped by double digits from their 2025 highs, a trend that may continue now that a senior crypto analyst has warned that Bitcoin may drop to $10,000.

Crypto stocks at Risk as Top Analyst Warns Bitcoin Price May Crash to $10,000

Top crypto analysts are turning bearish on the Bitcoin price this year. In a recent statement, Mike McGlone, a top Bloomberg analyst, warned that the coin may drop to $10,000 in the coming months. He pointed to the view that the crypto bubble was imploding, with the Trump euphoria marking the peak.

Similarly, analysts at Standard Chartered lowered the target for the Bitcoin price last week. In the note, analysts lowered their estimate from $150,000 to $100,000. At the same time, he warned that the coin may drop to the key support level at $50,000, much lower than the current $69,000.

Technical analysis and the futures market point to more downside in the near term. For example, Bitcoin’s futures open interest has dropped to $43 billion, down sharply from last year’s high of $95 billion. Falling open interest is a sign that demand among investors has continued falling recently.

The same is happening in the ETF market, where Bitcoin funds have shed billions in assets in the past few months. Their cumulative inflows is $54 billion, while their net assets have moved below the key support level at $100 billion.

The ongoing crypto market crash is having an impact on top companies in the industry, like Robinhood and Coinbase. In the most recent results, Coinbase said that its revenue dropped to $1.7 billion in the fourth quarter from the previous $2.27 billion. It also reported a $666 million loss, a big reversal from the $1.29 billion it made in the same period last year.

Robinhood, which has become a major player in the crypto industry, also reported weak financial results as its crypto revenue dropped by 38% in the fourth quarter of last year.

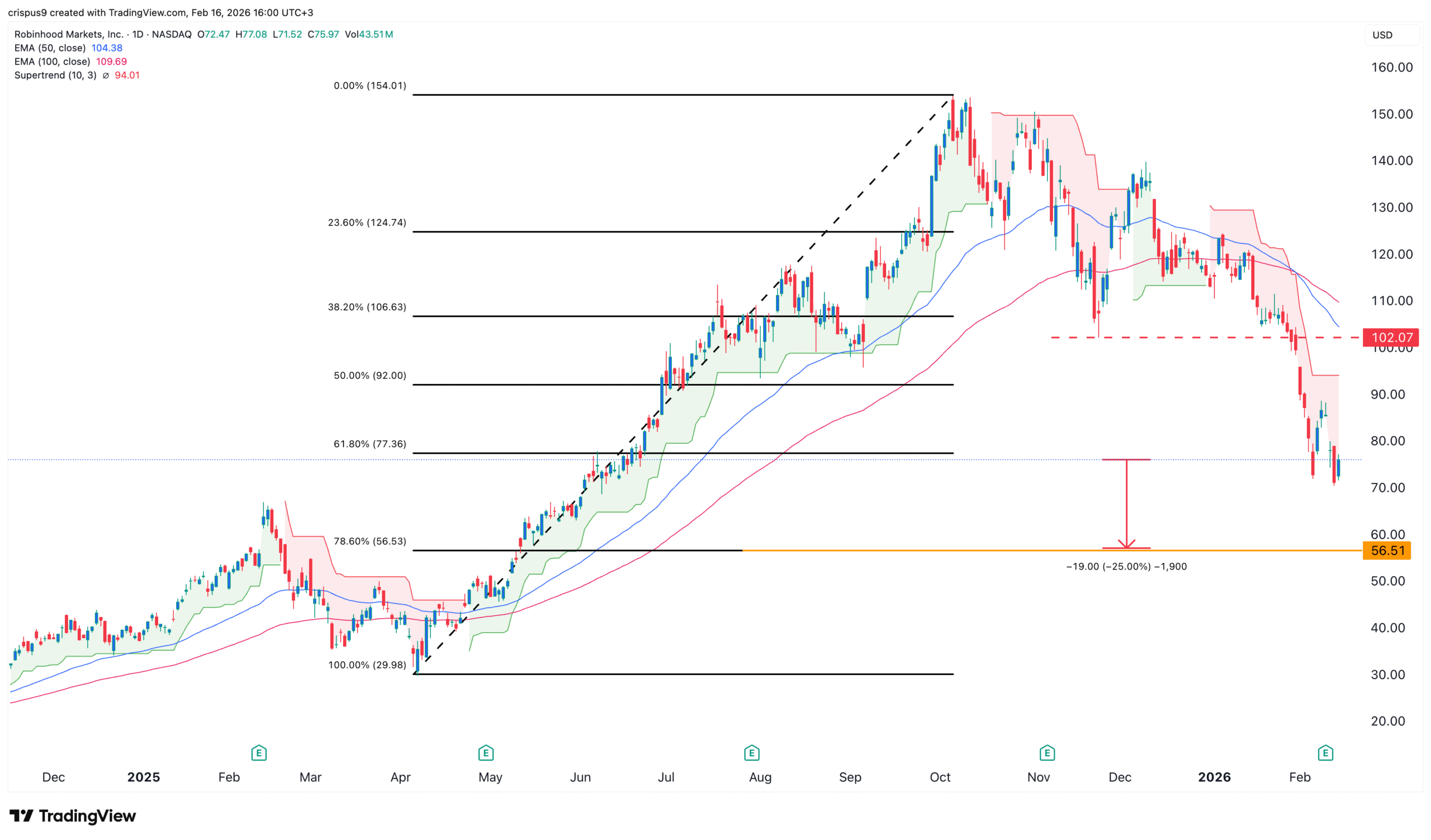

HOOD Stock Price Technical Analysis

The daily timeframe chart shows that the HOOD stock price has retreated in the past few months, dropping from a high of $154 in 2025 to the current $75. It has moved to the 61.8 % Fibonacci Retracement level.

The stock has remained below the key support level at $102, its lowest level in November last year, which was slightly below the 38.2% Fibonacci Retracement level. It remains below all moving averages and the Supertrend indicator.

Therefore, the stock will likely continue falling as sellers target the next key support level at $57, the 78.6% Fibonacci Retracement level, which is about 25% below the current level.

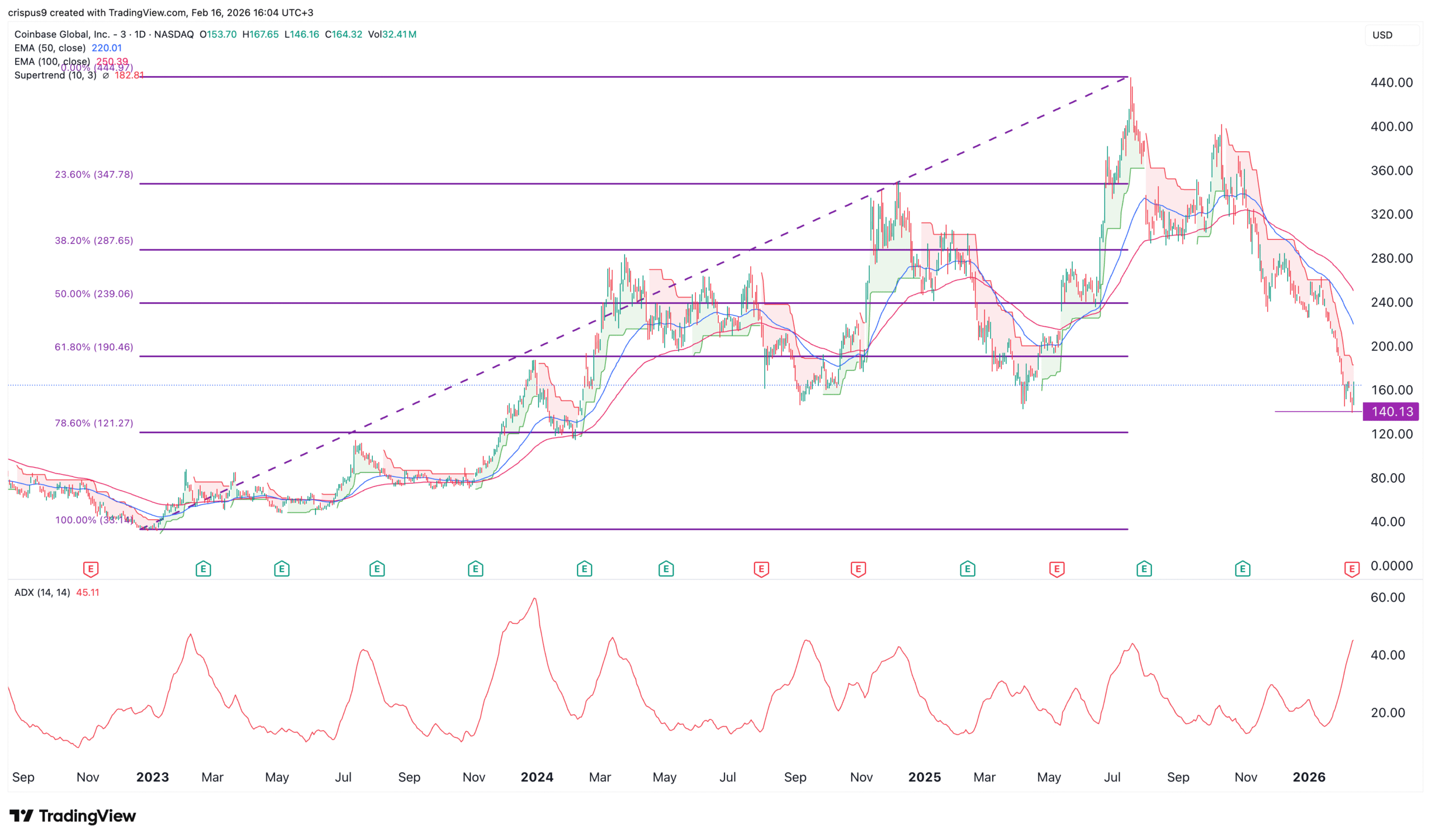

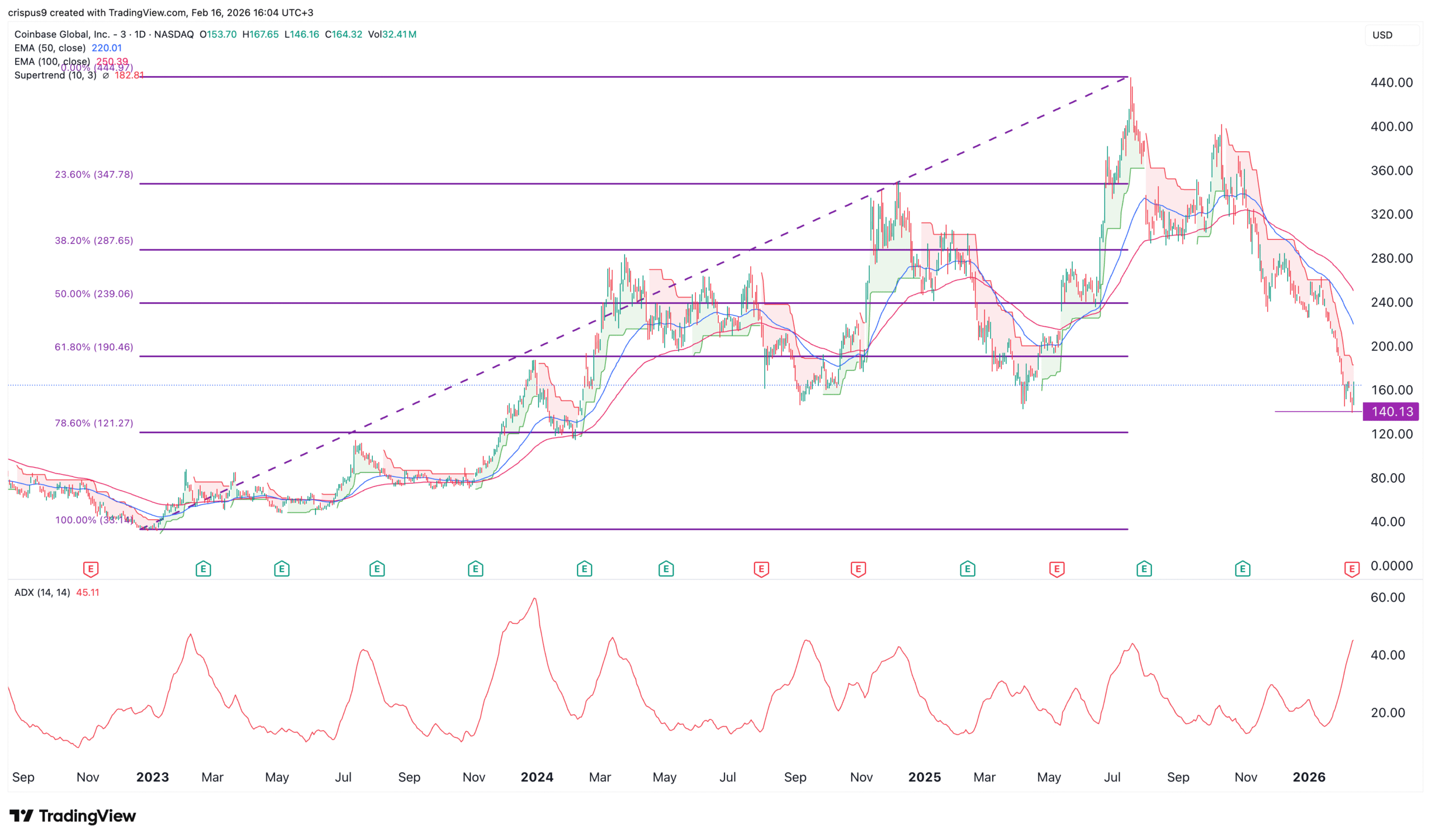

COIN Stock Price Technical Analysis

The COIN stock price has crashed in the past few months, moving from a high of $445 in July last year to the current $164. It has dropped below the 61.8% Fibonacci Retracement level.

Like other top crypto stocks, COIN has remained below the Supertrend and the Ichimoku cloud indicators, a sign that bears are in control. The Average Directional Index (ADX) has jumped to 44, a sign that the downtrend is gaining momentum.

Therefore, the most likely scenario is where the stock continues falling, potentially to the psychological level of $100.