The core challenge of retirement planning has long centered on one fundamental problem: getting people to start saving in the first place. But Morningstar experts say that dynamic is changing.

Processing Content

In a recent webinar about the “new rules” of retirement planning, analysts from the investment research firm laid out a roadmap for where retirement planning is headed over the coming years, one focused on personalization, income generation and decumulation strategies.

“Participants today are just far more financially aware of their situation than they were a decade ago. They understand that they need to be saving. … It doesn’t mean that the behavior has caught up. Many still are not saving enough,” Brock Johnson, president of Morningstar Retirement, said during the webinar. “But it does mean that the conversation within plans has shifted from educating people about the importance of saving to instead about how much you should be saving, what you should be investing in and how you translate that into retirement income. That shift opens up the door to more sophisticated solutions, more personalization and more outcome-focused tools in the marketplace.”

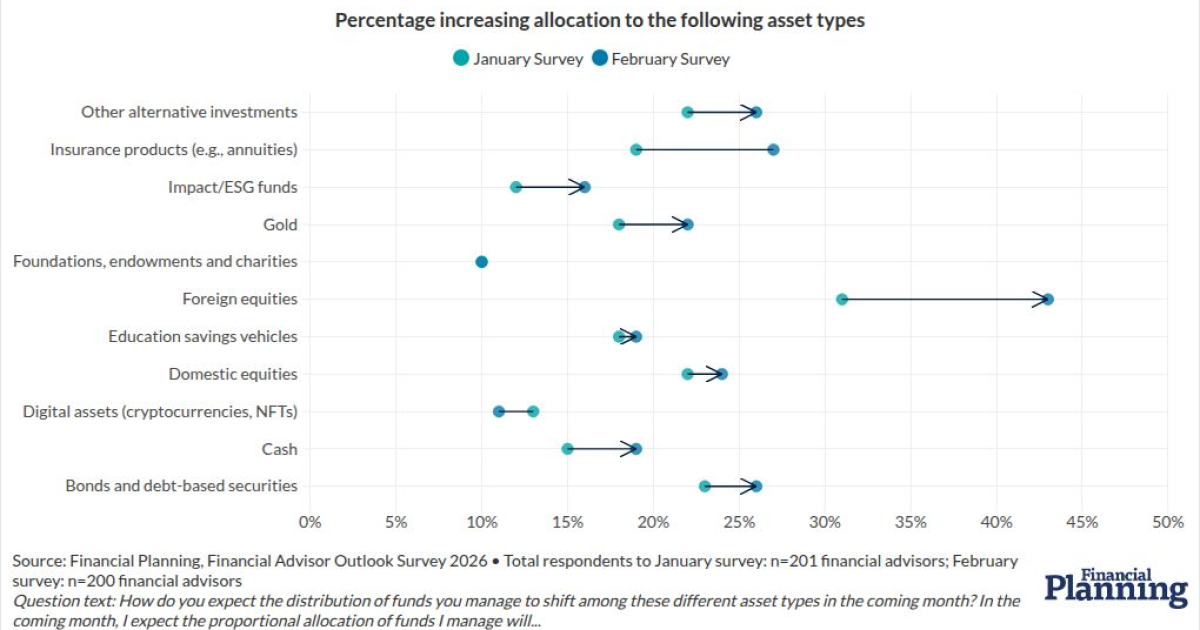

READ MORE: Foreign equities top advisors’ list for increased allocations

The push for personalization

Standardized investment solutions like target-date funds have become staples of retirement saving. Yet as more workers fall behind on key benchmarks, experts say personalized guidance needs to evolve from an optional upgrade into a default feature.

“Our research continues to show that personalized advice, things like managed accounts, tend to lead to better outcomes for employees,” Johnson said.

Managed accounts have emerged as a central feature of today’s 401(k) plans. According to Fidelity, access has increased from 17% in 2014 to 42% in 2023, reflecting a broad industry push toward personalized investing at scale.

But that growth has been accompanied by skepticism over fees — namely, whether the personalization alpha is worth the cost for the average saver.

Morningstar’s latest research suggests the higher fees may be worth it. After analyzing millions of data points, the firm found that adopting a managed account increased the typical investor’s wealth-to-salary ratio at age 65 by 7.7%, compared with target-date funds and self-directed portfolios.

That premium reflects behavioral differences more than superior stock selection, Johnson said.

“People tend to, in managed accounts, they tend to save more because they’re seeing it as an overall financial picture,” he said. “Our research also shows that in up and down markets, regardless of what the markets are doing, people in a managed account offering tend to course a little bit longer.”

“I would argue that target-date funds were a fantastic default vehicle 20-plus years ago, and I still think it’s a good one today,” he added. “But we have so much more data today. We have so much more technical integration that we can provide personalized advice at scale, and so a managed account can just do some things that [we couldn’t before].”

READ MORE: Advisors are the new go-to source for estate planning — here’s why

Shifting from wealth creation to income generation

Building retirement savings is only half the battle. When it comes time to turn those balances into income, experts say most plans still have significant room for improvement.

“I think there’s more work to be done to help support people as they move into that drawdown phase,” Christine Benz, Morningstar’s director of personal finance, said during the webinar. “It’s really kind of a missing link in our retirement landscape today. There are some innovations that are happening, and more people are staying in-plan in their 401(k) plans, and so I think there is an opportunity there to help them. But right now, that seems to be one of the main spots where advisors can add value.”

Benz said the expanding menu of in-plan annuity options could help investors address the challenge of generating income in retirement.

The Secure Act’s fiduciary safe harbor removed a major liability roadblock, paving the way for employers to more easily offer lifetime income products. Following that change, major plan providers including BlackRock, Vanguard and Fidelity have all incorporated annuities into their product offerings.

Survey data signals a massive demand for such products among workers. A Nuveen and TIAA Institute survey of 2,100 401(k) participants found that 93% believe workplace plans should let savers convert part of their balances into guaranteed lifetime monthly income.

Advisors are generally less enthusiastic about annuities, due in part to their often complicated fee structures. But research finds that guaranteed income is far more appealing than drawing down investments for many retirees, especially for those adjusting to life in the spending phase.

READ MORE: Health care inflation on track to consume Social Security in retirement

Moving beyond convenient spending heuristics

Retirement isn’t just a savings problem. For many people, it’s a question of how — or whether — they actually spend those savings.

Research shows that the typical American spends about 80% of their available lifetime income throughout their retirement, including only about half of their available savings. That cautious approach to spending becomes a concern as many retirees enter retirement with savings below recommended levels.

Benz said that a tendency among workers to adhere to convenient rules of thumb like the 4% rule is partially to blame for the spending problem.

“They anchor on these heuristics that they may have heard, the 4% guideline, for example,” Benz said. “It’s a really handy rule of thumb if you’re, say, in your 40s and 50s, trying to figure out the viability of what you’ve managed to save in terms of supporting your retirement. But once you come into retirement, it’s helpful to shift away from that, to embrace a mindset of flexibility rather than anchoring on this idea that I will spend the same amount unwaveringly year in and year out. In reality, people don’t spend that way.”

Benz noted that spending tends to decline gradually with age. Without factoring in this natural slowdown, retirees often end up spending too little, leaving large sums unspent by the time they pass away.

For some retirees, leaving unspent money as an inheritance may not be an inherent problem, but those with tighter budgets face real consequences, often sacrificing their quality of life to preserve assets for later, she added.

“[Retirees] really struggle with this, that the thing that made you good as a saver makes you uncomfortable as a spender,” Benz said. “And I do think that a financial advisor can really help in this context, to give clients that permission to spend, to give them a sense of how much they can reasonably spend.”