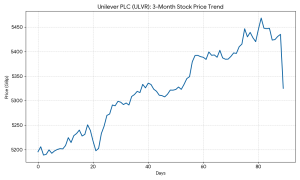

Unilever PLC Shares Rise as Q4 and Full-Year 2025 Results Are Released

Unilever PLC (UL) shares closed at 5,325.00p on Thursday, marking an intraday increase of 1.45 percent from the previous close.

The company’s market capitalization reached £116.24 billion ($150.1 billion) at the conclusion of today’s trading on the London Stock Exchange.

Latest Quarterly and Full-Year Results

For the fourth quarter and full year ended December 31, 2025, Unilever reported underlying sales growth of 3.9 percent for the quarter and 3.5 percent for the full year. Annual turnover for 2025 was recorded at €60.1 billion, compared to €60.8 billion in 2024, reflecting the impact of business disposals. Underlying operating profit for the full year stood at €12.1 billion, with an underlying operating margin of 20.0 percent, representing a 65-basis point improvement over the prior year.

Segment performance (Underlying Sales Growth) for the final quarter is as follows:

Beauty & Wellbeing: 5.1 percent

Personal Care: 4.1 percent

Home Care: 3.1 percent

Nutrition (formerly Foods): 3.4 percent

Ice Cream: 3.7 percent (reported as a separate group prior to demerger completion)

FINANCIAL TRENDS

Full-Year 2025 Results Context

Unilever’s full-year 2025 results show a directional trend toward margin expansion and volume-led growth. Underlying volume growth for the year was 1.5 percent, while price growth accounted for 2.0 percent. The company completed its €1.5 billion share buyback program during the first half of the year. The transition to a more focused portfolio is evidenced by the growth of “Power Brands,” which now account for approximately 78 percent of group turnover.

Business & Operations Update

Unilever has completed the formal demerger of its Ice Cream business, which has begun trading as a separate entity. The company also announced the sale of its Home Care business in Colombia and Ecuador to Alicorp and the divestment of the Graze brand to Katjes International. To enhance internal capabilities, Unilever invested £80 million in a new fragrance facility in the UK. Furthermore, the company appointed Srinivas Phatak as the new Chief Financial Officer.

M&A or Strategic Moves

The company confirmed an annual M&A budget of approximately €1.5 billion, with a primary strategic focus on the United States market. Recent transactions include the acquisition of the men’s personal care brand Dr. Squatch. Additionally, the subsidiary Hindustan Unilever Limited (HUL) announced the full acquisition of the wellness brand OZiva, while simultaneously exiting its joint venture in Nutritionalab (Wellbeing Nutrition).

Guidance & Outlook

For the fiscal year 2026, Unilever management expects underlying sales growth to be within the multi-year target range of 4 percent to 6 percent. Factors to watch include the integration of recent acquisitions in the Beauty and Wellbeing segment and the impact of continued portfolio rationalization. The company anticipates a modest improvement in underlying operating margin as productivity programs continue to deliver cost savings.

Performance Summary

Unilever PLC shares rose 1.45 percent following the announcement of full-year 2025 results. Underlying sales grew by 3.5 percent for the year, supported by a 20.0 percent operating margin. Strategic moves in 2025 included the Ice Cream demerger and a focus on premium Power Brands, while 2026 guidance points to sustained sales growth within the 4-6 percent range.