Updated on January 30th, 2026 by Bob CiuraSpreadsheet data updated daily

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

Their strength makes them appealing investments for comparatively safe, reliable dividends and capital appreciation versus less established stocks.

This research report has the following resources to help you invest in blue chip stocks:

Resource #1: The Blue Chip Stocks Spreadsheet List

This list contains important metrics, including: dividend yields, payout ratios, dividend growth rates, 52-week highs and lows, betas, and more.

There are currently more than 500 securities in our blue chip stocks list.

We categorize blue chip stocks as companies that have increased their dividends for more than 10 consecutive years.

Resource #2: The 7 Best Blue Chip Stocks To Buy NowSee the top 7 best blue-chip stock buys now using expected total returns from the Sure Analysis Research Database. We use the following criteria for our rankings:

Dividend Risk Score of “C” or better

Rank highest to lowest by expected total returns

Resource #3: Other Blue Chip Stock ResearchFind more compelling blue chip stock research from Sure Dividend.

The 7 Best Blue Chip Stocks To Buy Now

The 7 best blue chip stocks as ranked using data from the Sure Analysis Research Database (excluding REITs and MLPs) are analyzed in detail below.

We use the following criteria for our rankings:

Dividend Risk Score of “C” or better

Rank by expected total returns

The table of contents below allows for easy navigation.

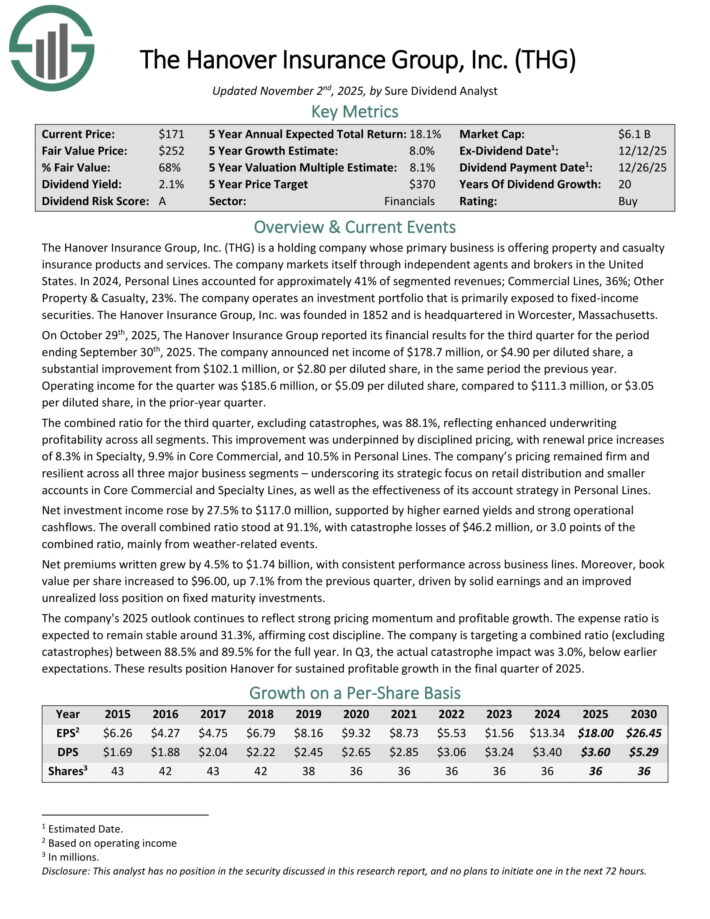

Blue-Chip Stock #7: Hanover Insurance Group (THG)

Dividend History: 21 years of consecutive increases

Expected Total Return: 17.8%

The Hanover Insurance Group is a holding company whose primary business is offering property and casualty insurance products and services.

The company markets itself through independent agents and brokers in the United States. In 2024, Personal Lines accounted for approximately 41% of segmented revenues; Commercial Lines, 36%; Other Property & Casualty, 23%. The company operates an investment portfolio that is primarily exposed to fixed-income securities.

On October 29th, 2025, The Hanover Insurance Group reported its financial results for the third quarter for the period ending September 30th, 2025.

The company announced net income of $178.7 million, or $4.90 per diluted share, a substantial improvement from $102.1 million, or $2.80 per diluted share, in the same period the previous year.

Operating income for the quarter was $185.6 million, or $5.09 per diluted share, compared to $111.3 million, or $3.05 per diluted share, in the prior-year quarter.

The combined ratio for the third quarter, excluding catastrophes, was 88.1%, reflecting enhanced underwriting profitability across all segments.

This improvement was underpinned by disciplined pricing, with renewal price increases of 8.3% in Specialty, 9.9% in Core Commercial, and 10.5% in Personal Lines.

Net investment income rose by 27.5% to $117.0 million, supported by higher earned yields and strong operational cash flows. The overall combined ratio stood at 91.1%, with catastrophe losses of $46.2 million, or 3.0 points of the combined ratio, mainly from weather-related events.

Click here to download our most recent Sure Analysis report on THG (preview of page 1 of 3 shown below):

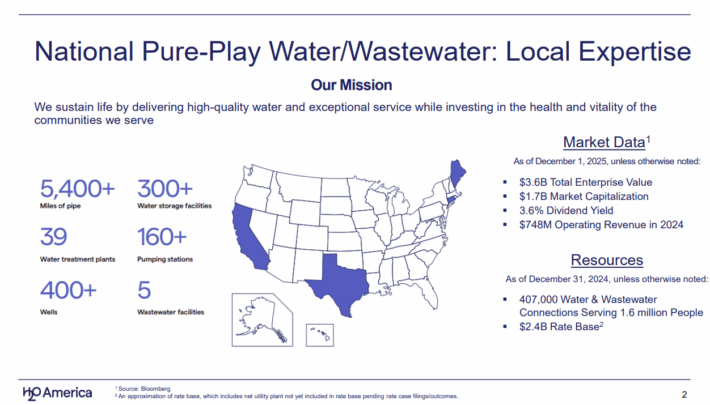

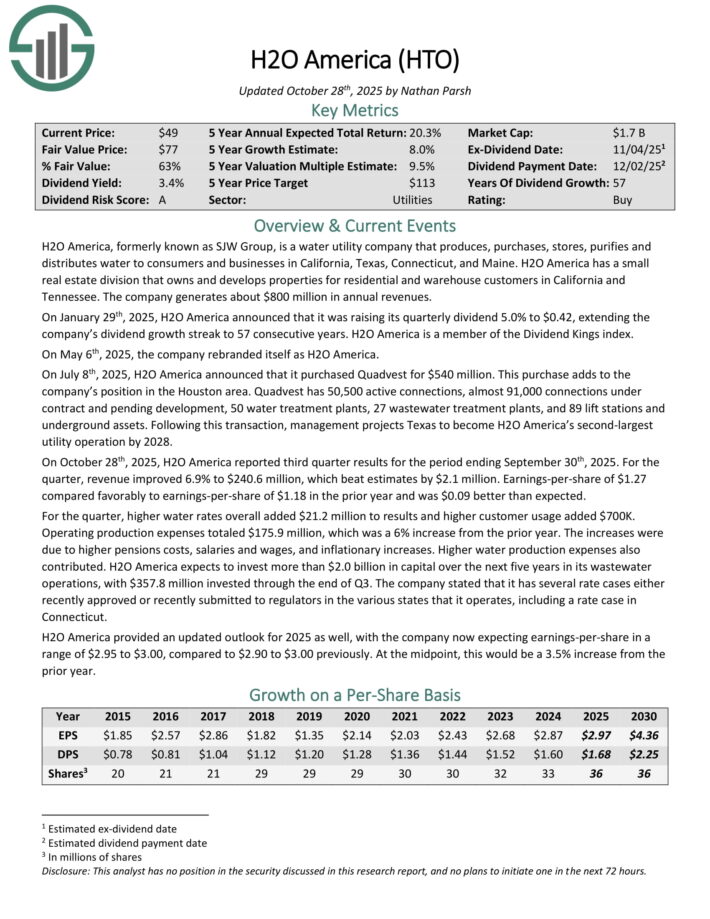

Blue-Chip Stock #6: H2O America (HTO)

Dividend History: 58 years of consecutive increases

Expected Total Return: 18.9%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in California, Texas, Connecticut, and Maine.

H2O America has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee.

Source: Investor Relations

H2O America reported third-quarter results on October 28th, 2025. Revenue for the period grew 6.9% to $240.6 million and topped expectations by $2.1 million. Earnings-per-share of $1.27 was up from $1.18 in the same period of the prior year and was $0.09 ahead of estimates.

Water rates added $21.2 million to results while higher customer usage contributed $700K. Operating expenses increased 6% to $175.9 million as pensions costs, salaries and wages, and inflationary increases did impact the business.

H2O America expects to invest more than $2 billion in capital over the next five years in its wastewater operations. The company invested nearly $358 million through the end of the third-quarter.

The company also noted it had received approval for several rate cases during the quarter as well as recently submitted rate cases to regulators.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

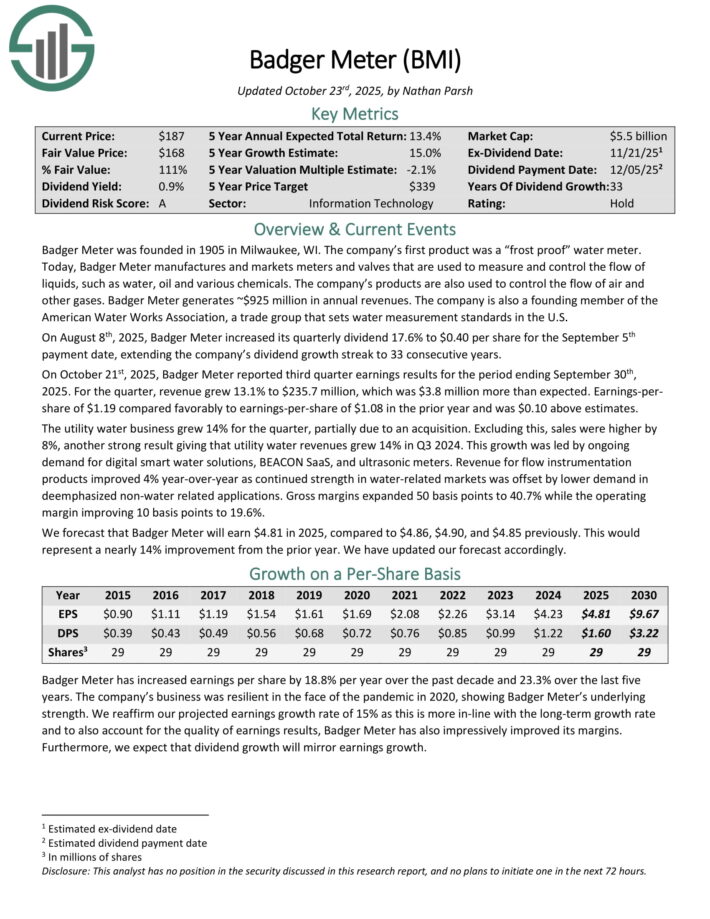

Blue-Chip Stock #5: Badger Meter Inc. (BMI)

Dividend History: 33 years of consecutive increases

Expected Total Return: 19.3%

Badger Meter manufactures and markets meters and valves that are used to measure and control the flow of liquids, such as water, oil and various chemicals.

The company’s products are also used to control the flow of air and other gases. Badger Meter generates ~$925 million in annual revenues.

On August 8th, 2025, Badger Meter increased its quarterly dividend 17.6% to $0.40 per share for the September 5th payment date, extending the company’s dividend growth streak to 33 consecutive years.

On October 21st, 2025, Badger Meter reported third quarter earnings results. For the quarter, revenue grew 13.1% to $235.7 million, which was $3.8 million more than expected.

Earnings-per-share of $1.19 compared favorably to earnings-per-share of $1.08 in the prior year and was $0.10 above estimates.

The utility water business grew 14% for the quarter, partially due to an acquisition. Excluding this, sales were higher by 8%, another strong result giving that utility water revenues grew 14% in Q3 2024. This growth was led by ongoing demand for digital smart water solutions, BEACON SaaS, and ultrasonic meters.

Revenue for flow instrumentation products improved 4% year-over-year as continued strength in water-related markets was offset by lower demand in de-emphasized non-water related applications.

Click here to download our most recent Sure Analysis report on BMI (preview of page 1 of 3 shown below):

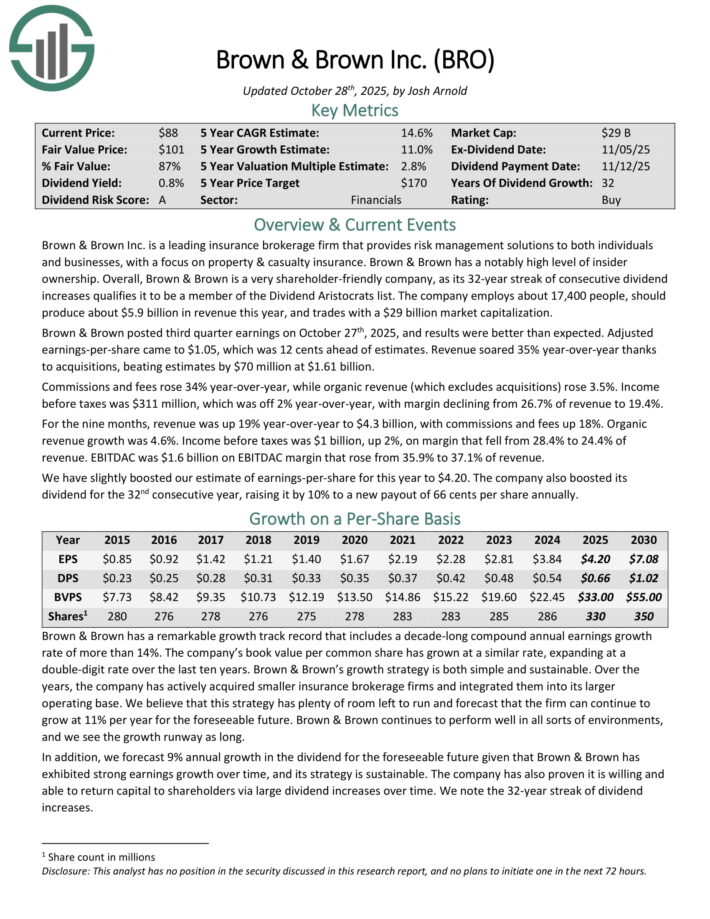

Blue-Chip Stock #4: Brown & Brown (BRO)

Dividend History: 32 years of consecutive increases

Expected Total Return: 19.4%

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.

Brown & Brown posted third quarter earnings on October 27th, 2025, and results were better than expected. Adjusted earnings-per-share came to $1.05, which was 12 cents ahead of estimates. Revenue soared 35% year-over-year thanks to acquisitions, beating estimates by $70 million at $1.61 billion.

Commissions and fees rose 34% year-over-year, while organic revenue (which excludes acquisitions) rose 3.5%. Income before taxes was $311 million, which was off 2% year-over-year, with margin declining from 26.7% of revenue to 19.4%.

For the nine months, revenue was up 19% year-over-year to $4.3 billion, with commissions and fees up 18%. Organic revenue growth was 4.6%. Income before taxes was $1 billion, up 2%, on margin that fell from 28.4% to 24.4% of revenue. EBITDAC was $1.6 billion on EBITDAC margin that rose from 35.9% to 37.1% of revenue.

We have slightly boosted our estimate of earnings-per-share for this year to $4.20. The company also boosted its dividend for the 32nd consecutive year, raising it by 10% to a new payout of 66 cents per share annually.

Click here to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below):

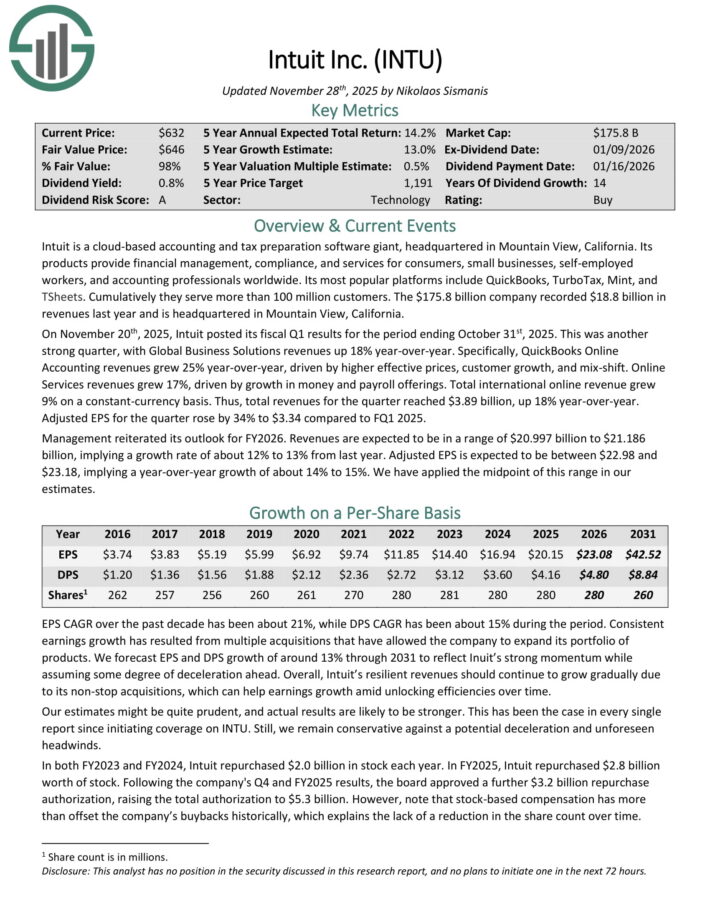

Blue-Chip Stock #3: Intuit Inc. (INTU)

Dividend History: 14 years of consecutive increases

Expected Total Return: 19.5%

Intuit is a cloud-based accounting and tax preparation software giant. Its products provide financial management, compliance, and services for consumers, small businesses, self-employed workers, and accounting professionals worldwide.

Its most popular platforms include QuickBooks, TurboTax, Mint, and TSheets. Cumulatively they serve more than 100 million customers. The company recorded $18.8 billion in revenues last year and is headquartered in Mountain View, California.

On November 20th, 2025, Intuit posted its fiscal Q1 results for the period ending October 31st, 2025. This was another strong quarter, with Global Business Solutions revenues up 18% year-over-year.

QuickBooks Online Accounting revenues grew 25% year-over-year, driven by higher effective prices, customer growth, and mix-shift.

Online Services revenues grew 17%, driven by growth in money and payroll offerings. Total international online revenue grew 9% on a constant-currency basis. Thus, total revenues for the quarter reached $3.89 billion, up 18% year-over-year.

Adjusted EPS for the quarter rose by 34% to $3.34 compared to FQ1 2025.

Management reiterated its outlook for FY2026. Revenues are expected to be in a range of $20.997 billion to $21.186 billion, implying a growth rate of about 12% to 13% from last year.

Adjusted EPS is expected to be between $22.98 and $23.18, implying a year-over-year growth of about 14% to 15%.

Click here to download our most recent Sure Analysis report on INTU (preview of page 1 of 3 shown below):

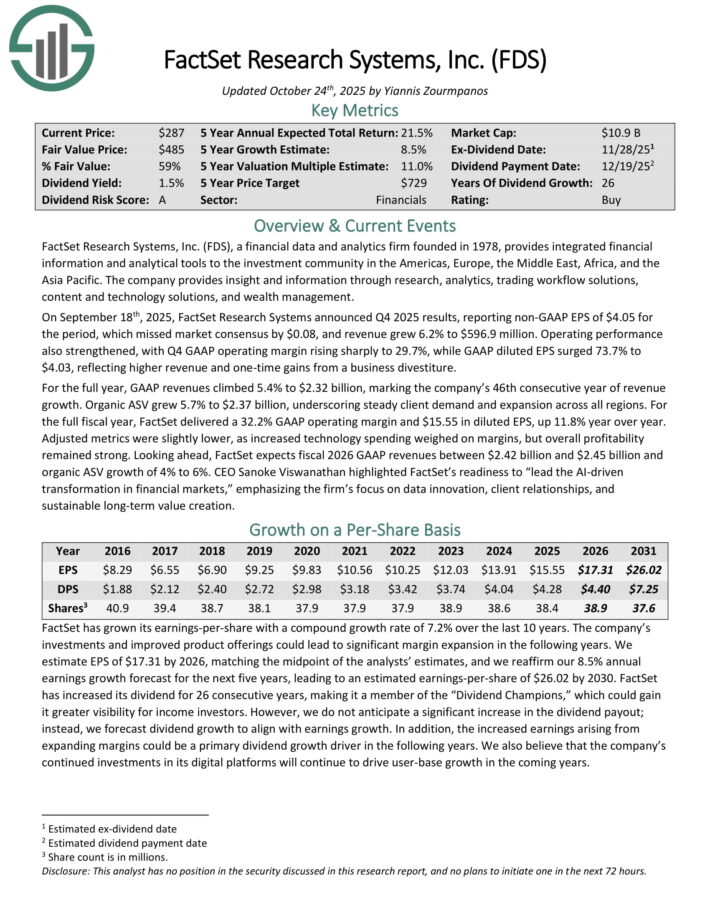

Blue-Chip Stock #2: Factset Research Systems (FDS)

Dividend History: 26 years of consecutive increases

Expected Total Return: 24.9%

FactSet Research Systems, a financial data and analytics firm founded in 1978, provides integrated financial information and analytical tools to the investment community in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

The company provides insight and information through research, analytics, trading workflow solutions, content and technology solutions, and wealth management.

On September 18th, 2025, FactSet Research Systems announced Q4 2025 results, reporting non-GAAP EPS of $4.05 for the period, which missed market consensus by $0.08, and revenue grew 6.2% to $596.9 million. Operating performance also strengthened, with Q4 GAAP operating margin rising sharply to 29.7%.

GAAP diluted EPS surged 73.7% to $4.03, reflecting higher revenue and one-time gains from a business divestiture. For the full year, GAAP revenues climbed 5.4% to $2.32 billion, marking the company’s 46th consecutive year of revenue growth.

Organic ASV grew 5.7% to $2.37 billion, underscoring steady client demand and expansion across all regions. For the full fiscal year, FactSet delivered a 32.2% GAAP operating margin and $15.55 in diluted EPS, up 11.8% year over year.

Adjusted metrics were slightly lower, as increased technology spending weighed on margins, but overall profitability remained strong. Looking ahead, FactSet expects fiscal 2026 GAAP revenues between $2.42 billion and $2.45 billion and organic ASV growth of 4% to 6%.

Click here to download our most recent Sure Analysis report on FDS (preview of page 1 of 3 shown below):

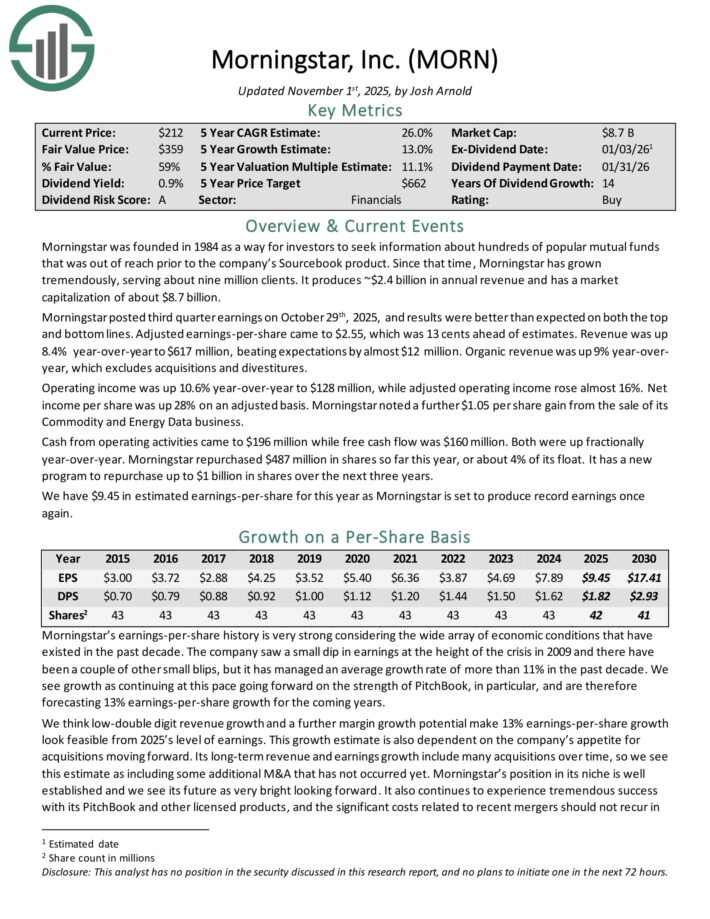

Blue-Chip Stock #1: Morningstar Inc. (MORN)

Dividend History: 15 years of consecutive increases

Expected Total Return: 27.4%

Morningstar was founded in 1984 as a way for investors to seek information about hundreds of popular mutual funds that was out of reach prior to the company’s Sourcebook product.

Since that time, Morningstar has grown tremendously, serving about nine million clients. It produces ~$2.4 billion in annual revenue.

Morningstar posted third quarter earnings on October 29th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.55, which was 13 cents ahead of estimates.

Revenue was up 8.4% year-over-year to $617 million, beating expectations by almost $12 million. Organic revenue was up 9% year-over-year, which excludes acquisitions and divestitures.

Operating income was up 10.6% year-over-year to $128 million, while adjusted operating income rose almost 16%. Net income per share was up 28% on an adjusted basis.

Morningstar noted a further $1.05 per share gain from the sale of its Commodity and Energy Data business.

Cash from operating activities came to $196 million while free cash flow was $160 million. Both were up fractionally year-over-year.

Morningstar repurchased $487 million in shares so far this year, or about 4% of its float. It has a new program to repurchase up to $1 billion in shares over the next three years.

Click here to download our most recent Sure Analysis report on MORN (preview of page 1 of 3 shown below):

Other Blue Chip Stock Resources

Blue chip stocks tend to have many or all of the following characteristics:

Market leaders

Popular / well-known

Large-cap market capitalization

Long history of paying rising dividends

Consistent profitability even during recessions

That’s why they can make excellent investments for the long-run. And their strength and reliability make them compelling investments for investors of all experience levels, from beginners to experts.

This article featured several resources for finding compelling blue chip stock investments:

The Blue Chip Stocks List (see below)

The resources below will give you a better understanding of dividend growth investing:

Dividend Growth Investing

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].