Shares of Lamb Weston Holdings, Inc. (NYSE: LW) stayed green on Tuesday. The stock has dropped 27% in the past three months. The frozen potato products maker continues to operate in a fluid and competitive environment and has been battling a few headwinds. However, the company has been focusing on what it can control and this has helped it make progress in certain areas of its business.

Sales and volume growth against price/mix challenges

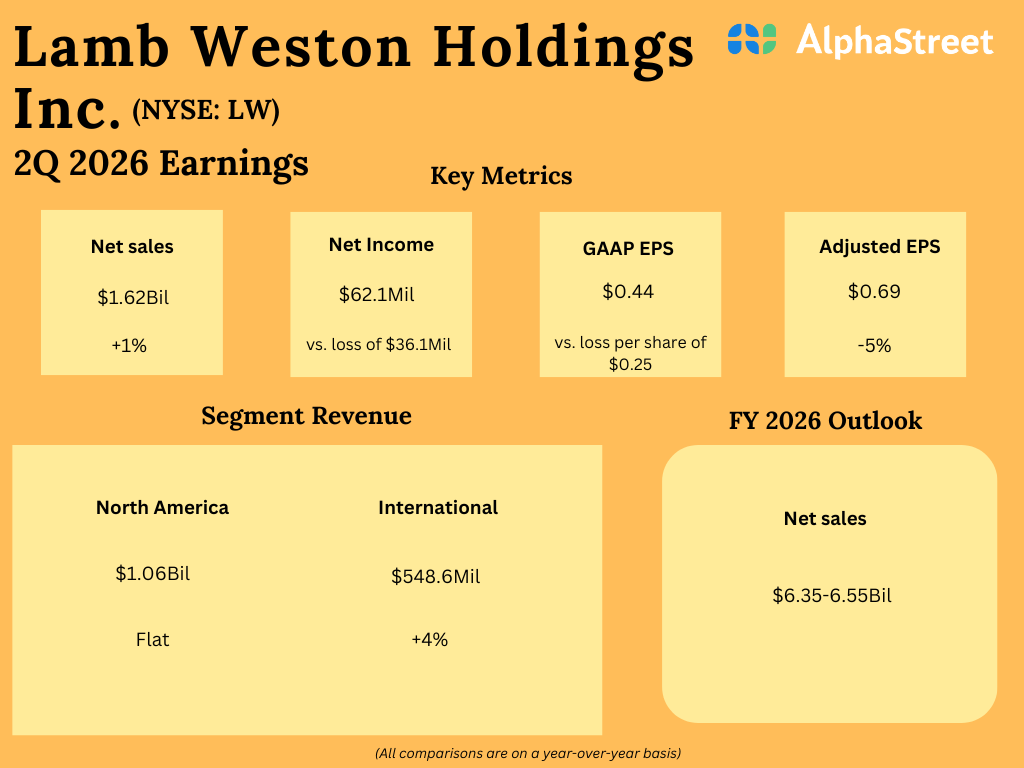

Lamb Weston’s net sales rose 1% to $1.62 billion in the second quarter of 2026 compared to the previous year. Volume increased 8%, driven by customer wins, share gains and strong retention, particularly in North America and Asia. The company continued to gain share even with new and growing customers and this helped it grow volume despite softness in restaurant traffic.

As mentioned on the Q2 earnings call, QSR, or quick-service restaurant, traffic in the US remained flat during the three-month period of August, September and October, with growth in QSR chicken and declines in QSR burger. French fry volume in North America foodservice gained slightly, reflecting resilient demand. Restaurant traffic in most international markets declined, with the largest market, the UK, witnessing a 3% drop.

Lamb Weston’s volume growth in Q2 was offset by a decline in price/mix. Price/mix fell 8%, due to impacts from pricing and trade to support customers, as well as mix shifts towards lower-margin sales. The impact from unfavorable price/mix led to a decrease in adjusted gross profit, which in turn caused earnings per share, on an adjusted basis, to decline 5% year-over-year to $0.69.

Price/mix declined across the company’s business segments as well during the second quarter, and is anticipated to remain unfavorable in the second half of the year although to a lesser extent than the first half.

Stable North America business and International expansion

Lamb Weston’s North America business segment remains stable. In Q2, net sales of $1.07 billion were flat year-over-year, but volume grew 8%, driven by customer contract wins, share gains, and growth across channels. The company also restarted its previously curtailed production lines in North America to maintain its high service levels.

LW is meaningfully expanding its international presence. Net sales in the International segment increased 4% to $548.6 million in the second quarter versus the previous year. Volume grew 7%, helped by growth in Asia and with multinational chain customers.

The company’s global manufacturing footprint and supply chain network can help build customer partnerships that will allow it to capture volume in fast-growing markets such as Asia and Latin America. Its new facility in Argentina has started production and with the rapid growth in the region, the French fry maker sees opportunity for meaningful share gains.

However, international markets remain competitive. In Q2, LW faced softness in restaurant traffic, lower export demand, and pricing pressures in Europe. The company expects to continue supporting customers with price and trade through fiscal year 2026.

Outlook

Lamb Weston expects strong sales and volume for the remainder of fiscal year 2026. North America is expected to see volumes in the second half grow at or above first-half rates, helped by strong demand. International volumes are expected to be flat as the company laps prior-year customer wins. LW expects net sales to range between $6.35-6.55 billion in FY2026.