Published on December 30th, 2025 by Bob Ciura

As 2025 marches to a close, it is an opportune time for investors to reassess their portfolios for 2026.

The S&P 500 Index is about to wrap up another strong year, registering a year-to-date total return of nearly 19%. As a result, the S&P 500 now trades at a P/E ratio above 31.

The good news is that there are still undervalued stocks with attractive dividend yields to choose from, despite the market’s strong performance in 2025.

For example, blue chip stocks that have increased their dividends for at least 10 consecutive years.

You can download our free blue chip stocks list with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

There are currently more than 500 securities in our blue chip stocks list.

Blue-chip stocks are established, financially strong, and consistently profitable publicly traded companies.

As investors position their portfolios for 2026, quality dividend growth stocks should be in focus.

The following 10 blue chip stocks have increased their dividends for at least 10 years, have Dividend Risk Scores of ‘A’ in the Sure Analysis Research Database, with the highest expected returns.

The 10 blue chip stocks are sorted by expected returns, in ascending order.

Table of Contents

The table of contents below allows for easy navigation.

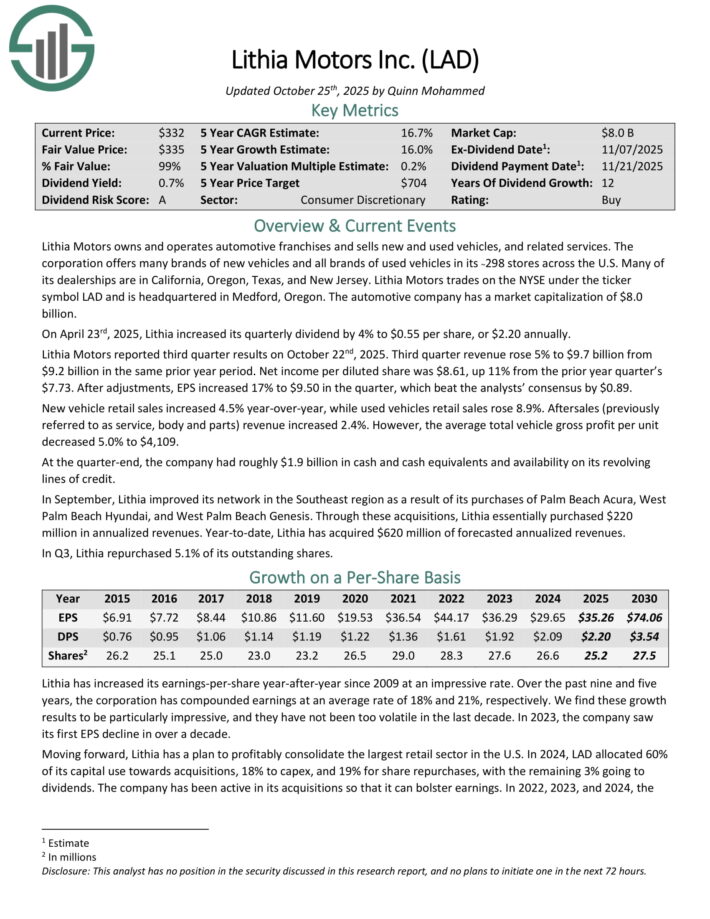

Blue Chip For 2026 #10: Lithia Motors (LAD)

Annual Expected Returns: 16.2%

Lithia Motors owns and operates automotive franchises and sells new and used vehicles, and related services. The corporation offers many brands of new vehicles and all brands of used vehicles in its ~298 stores across the U.S. Many of its dealerships are in California, Oregon, Texas, and New Jersey.

On April 23rd, 2025, Lithia increased its quarterly dividend by 4% to $0.55 per share, or $2.20 annually.

Lithia Motors reported third quarter results on October 22nd, 2025. Third quarter revenue rose 5% to $9.7 billion from $9.2 billion in the same prior year period.

Net income per diluted share was $8.61, up 11% from the prior year quarter’s $7.73. After adjustments, EPS increased 17% to $9.50 in the quarter, which beat the analysts’ consensus by $0.89.

New vehicle retail sales increased 4.5% year-over-year, while used vehicles retail sales rose 8.9%. Aftersales (previously referred to as service, body and parts) revenue increased 2.4%. However, the average total vehicle gross profit per unit decreased 5.0% to $4,109.

At the quarter-end, the company had roughly $1.9 billion in cash and cash equivalents and availability on its revolving lines of credit.

In September, Lithia improved its network in the Southeast region as a result of its purchases of Palm Beach Acura, West Palm Beach Hyundai, and West Palm Beach Genesis. Through these acquisitions, Lithia essentially purchased $220 million in annualized revenues.

Click here to download our most recent Sure Analysis report on LAD (preview of page 1 of 3 shown below):

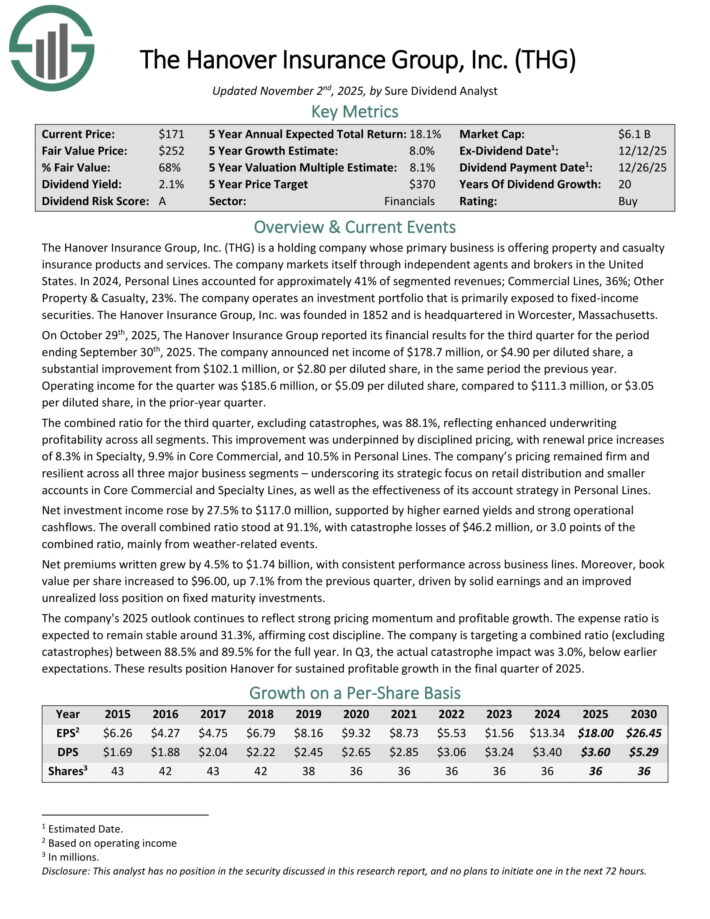

Blue Chip For 2026 #9: Hanover Insurance Group (THG)

Annual Expected Returns: 16.3%

The Hanover Insurance Group is a holding company whose primary business is offering property and casualty insurance products and services.

The company markets itself through independent agents and brokers in the United States. In 2024, Personal Lines accounted for approximately 41% of segmented revenues; Commercial Lines, 36%; Other Property & Casualty, 23%. The company operates an investment portfolio that is primarily exposed to fixed-income securities.

On October 29th, 2025, The Hanover Insurance Group reported its financial results for the third quarter for the period ending September 30th, 2025.

The company announced net income of $178.7 million, or $4.90 per diluted share, a substantial improvement from $102.1 million, or $2.80 per diluted share, in the same period the previous year.

Operating income for the quarter was $185.6 million, or $5.09 per diluted share, compared to $111.3 million, or $3.05 per diluted share, in the prior-year quarter.

The combined ratio for the third quarter, excluding catastrophes, was 88.1%, reflecting enhanced underwriting profitability across all segments.

This improvement was underpinned by disciplined pricing, with renewal price increases of 8.3% in Specialty, 9.9% in Core Commercial, and 10.5% in Personal Lines.

Net investment income rose by 27.5% to $117.0 million, supported by higher earned yields and strong operational cash flows. The overall combined ratio stood at 91.1%, with catastrophe losses of $46.2 million, or 3.0 points of the combined ratio, mainly from weather-related events.

Click here to download our most recent Sure Analysis report on THG (preview of page 1 of 3 shown below):

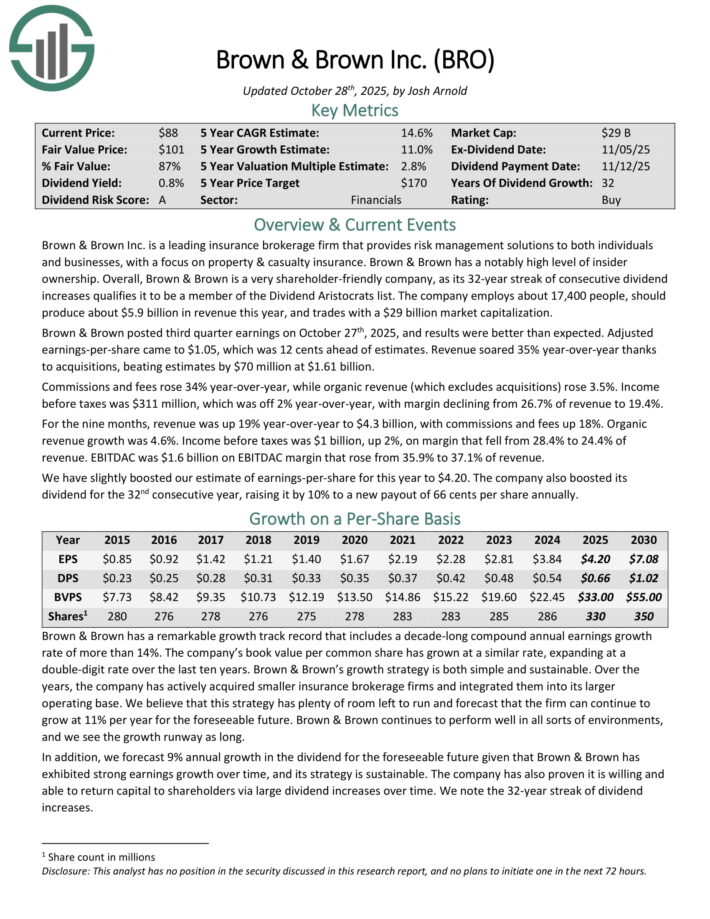

Blue Chip For 2026 #8: Brown & Brown (BRO)

Annual Expected Returns: 16.6%

Brown & Brown Inc. is a leading insurance brokerage firm that provides risk management solutions to both individuals and businesses, with a focus on property & casualty insurance. Brown & Brown has a notably high level of insider ownership.

Brown & Brown posted third quarter earnings on October 27th, 2025, and results were better than expected. Adjusted earnings-per-share came to $1.05, which was 12 cents ahead of estimates. Revenue soared 35% year-over-year thanks to acquisitions, beating estimates by $70 million at $1.61 billion.

Commissions and fees rose 34% year-over-year, while organic revenue (which excludes acquisitions) rose 3.5%. Income before taxes was $311 million, which was off 2% year-over-year, with margin declining from 26.7% of revenue to 19.4%.

For the nine months, revenue was up 19% year-over-year to $4.3 billion, with commissions and fees up 18%. Organic revenue growth was 4.6%. Income before taxes was $1 billion, up 2%, on margin that fell from 28.4% to 24.4% of revenue. EBITDAC was $1.6 billion on EBITDAC margin that rose from 35.9% to 37.1% of revenue.

We have slightly boosted our estimate of earnings-per-share for this year to $4.20. The company also boosted its dividend for the 32nd consecutive year, raising it by 10% to a new payout of 66 cents per share annually.

Click here to download our most recent Sure Analysis report on BRO (preview of page 1 of 3 shown below):

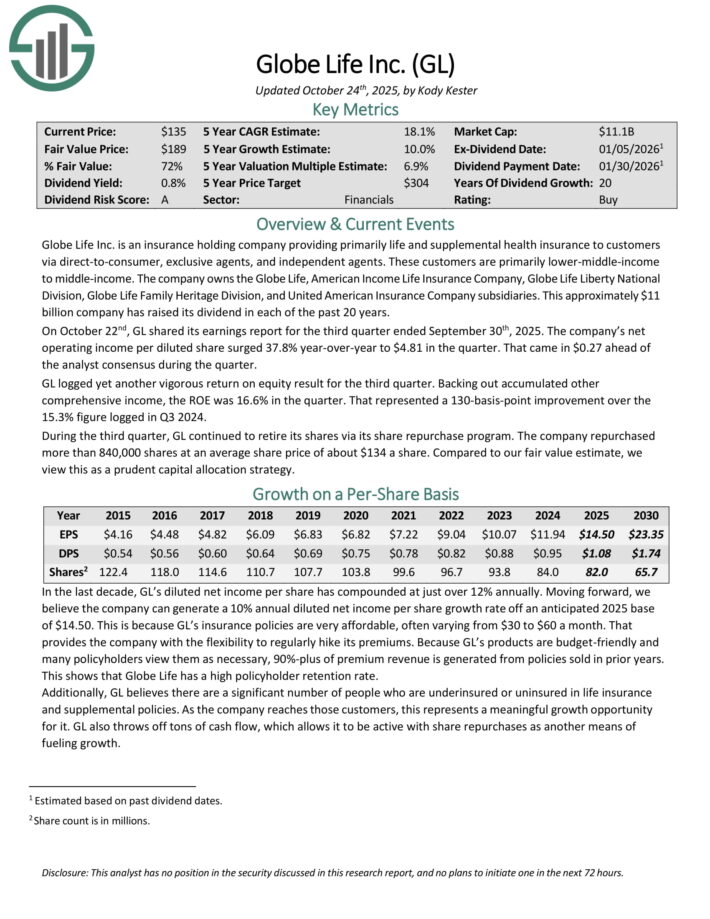

Blue Chip For 2026 #7: Globe Life (GL)

Annual Expected Returns: 17.1%

Globe Life is an insurance holding company providing primarily life and supplemental health insurance via direct to consumer, exclusive agents, and independent agents. Founded in 1979, Globe Life has raised its dividend every year for the past 20 years.

On October 22nd, GL shared its earnings report for the third quarter ended September 30th, 2025. The company’s net operating income per diluted share surged 37.8% year-over-year to $4.81 in the quarter. That came in $0.27 ahead of the analyst consensus during the quarter.

GL logged yet another vigorous return on equity result for the third quarter. Backing out accumulated other comprehensive income, the ROE was 16.6% in the quarter. That represented a 130-basis-point improvement over the 15.3% figure logged in Q3 2024.

During the third quarter, GL continued to retire its shares via its share repurchase program. The company repurchased more than 840,000 shares at an average share price of about $134 a share.

Click here to download our most recent Sure Analysis report on GL (preview of page 1 of 3 shown below):

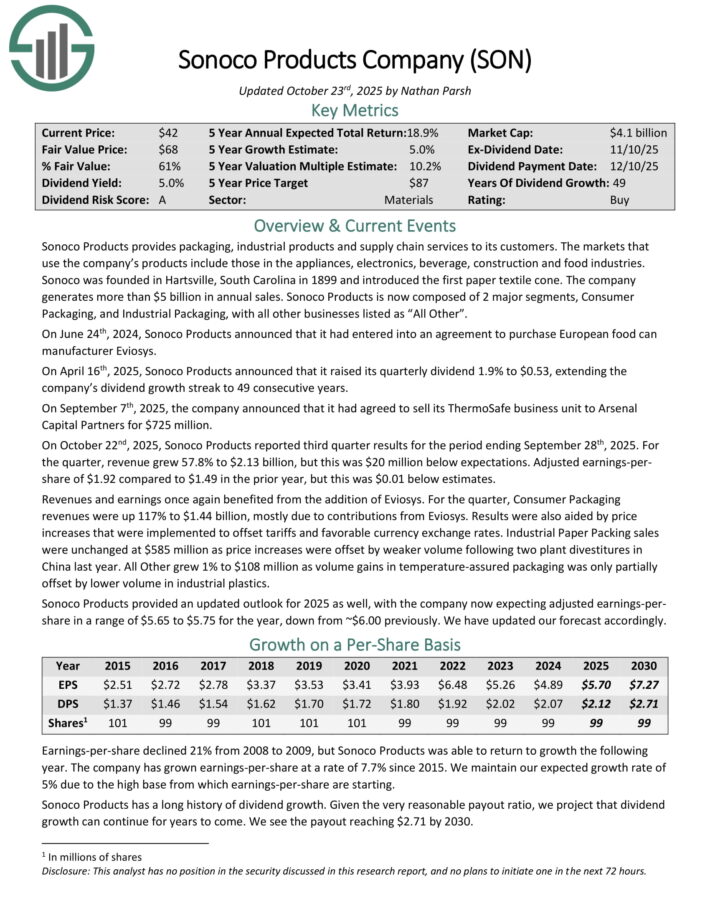

Blue Chip For 2026 #6: Sonoco Products (SON)

Annual Expected Returns: 17.6%

Sonoco Products Company provides packaging, industrial products, and supply chains services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

Sonoco Products reported third-quarter results on October 22nd, 2025.

Source: Investor Presentation

Revenue for the quarter surged 58% to $2.13 billion, though this was $20 million less than expected. Adjusted earnings-per-share of $1.92 compared favorably to $1.49 in the prior year, but this was $0.01 below estimates.

As with prior quarters, revenue and earnings-per-share benefited from the company’s purchase of Eviosys in December of 2024.

Revenue for Consumer Packing was up 117% to $1.44 billion, mostly due to contributions from Eviosys. Results were also positively impacted by price increases that were implemented to offset tariffs.

Industrial Paper Packing sales were unchanged at $585 million as price increases were offset by weaker volume resulting from two plant divestitures in China last year.

All Other grew 1% to $108 million due to volume gains in temperature-assured packaging.

Click here to download our most recent Sure Analysis report on SON (preview of page 1 of 3 shown below):

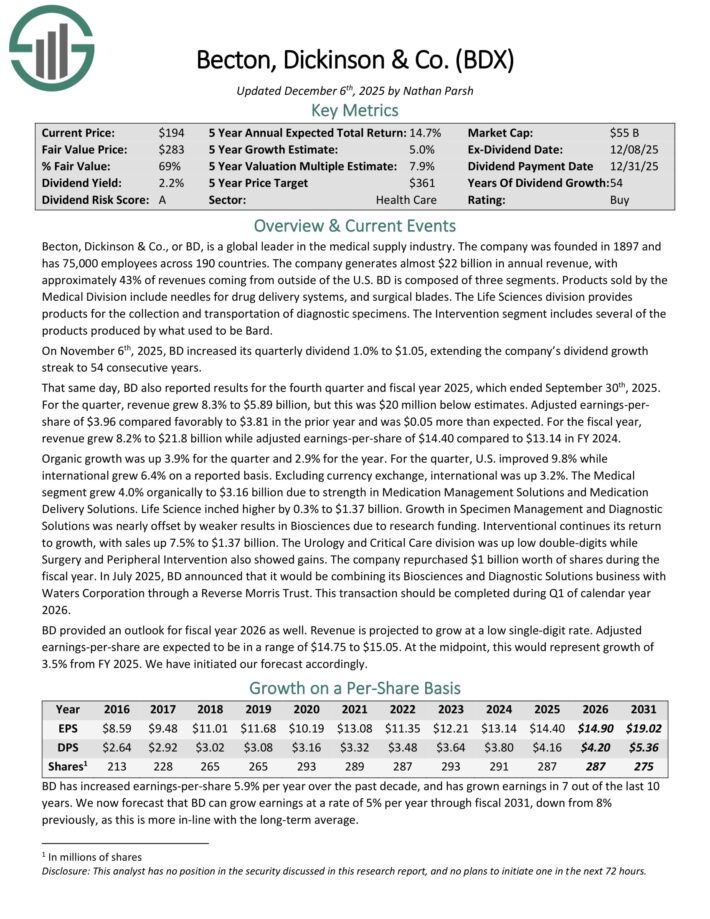

Blue Chip For 2026 #5: Becton Dickison & Co. (BDX)

Annual Expected Returns: 17.7%

Becton, Dickinson & Co. is a global leader in the medical supply industry. The company was founded in 1897 and has 75,000 employees across 190 countries.

The company generates about $20 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

Becton, Dickinson & Co., or BD, is a global leader in the medical supply industry. The company generates almost $22 billion in annual revenue, with approximately 43% of revenues coming from outside of the U.S.

On November 6th, 2025, BD increased its quarterly dividend 1.0% to $1.05, extending the company’s dividend growth streak to 54 consecutive years.

BD also reported results for the fourth quarter and fiscal year 2025, which ended September 30th, 2025. For the quarter, revenue grew 8.3% to $5.89 billion, but this was $20 million below estimates.

Adjusted earnings-per-share of $3.96 compared favorably to $3.81 in the prior year and was $0.05 more than expected. For the fiscal year, revenue grew 8.2% to $21.8 billion while adjusted earnings-per-share of $14.40 compared to $13.14 in FY 2024.

BD provided an outlook for fiscal year 2026 as well. Revenue is projected to grow at a low single-digit rate. Adjusted earnings-per-share are expected to be in a range of $14.75 to $15.05.

At the midpoint, this would represent growth of 3.5% from FY 2025.

Click here to download our most recent Sure Analysis report on BDX (preview of page 1 of 3 shown below):

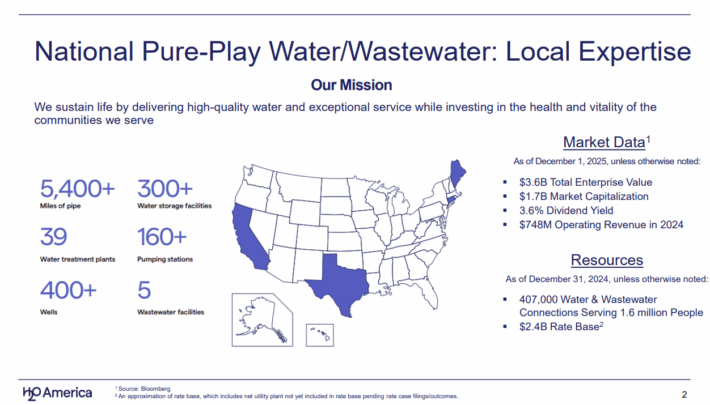

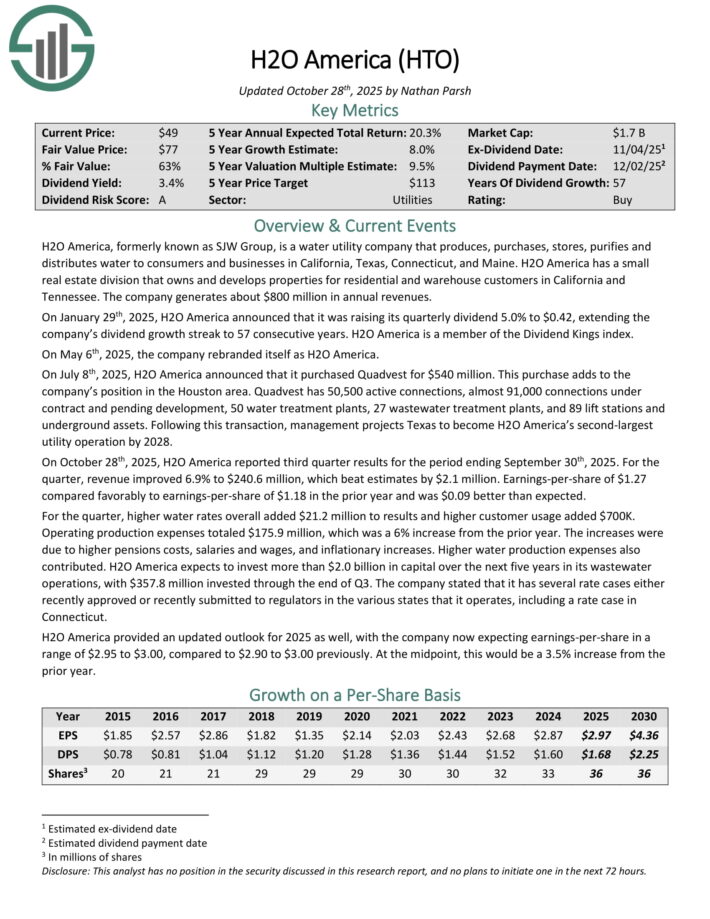

Blue Chip For 2026 #4: H2O America (HTO)

Annual Expected Returns: 20.3%

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in California, Texas, Connecticut, and Maine.

H2O America has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee.

Source: Investor Relations

H2O America reported third-quarter results on October 28th, 2025. Revenue for the period grew 6.9% to $240.6 million and topped expectations by $2.1 million. Earnings-per-share of $1.27 was up from $1.18 in the same period of the prior year and was $0.09 ahead of estimates.

Water rates added $21.2 million to results while higher customer usage contributed $700K. Operating expenses increased 6% to $175.9 million as pensions costs, salaries and wages, and inflationary increases did impact the business.

H2O America expects to invest more than $2 billion in capital over the next five years in its wastewater operations. The company invested nearly $358 million through the end of the third-quarter.

The company also noted it had received approval for several rate cases during the quarter as well as recently submitted rate cases to regulators.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

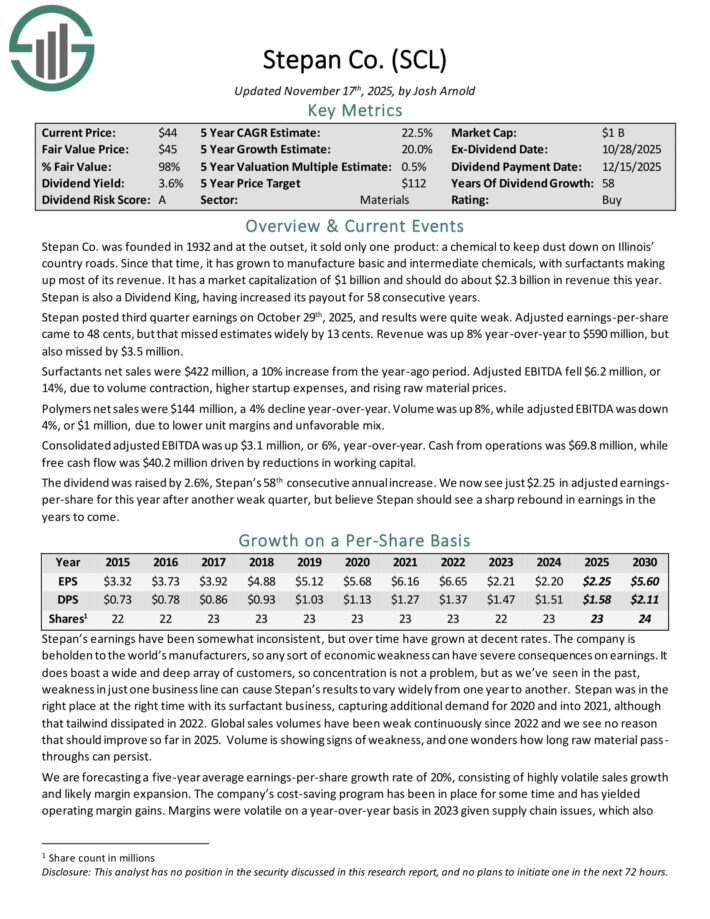

Blue Chip For 2026 #3: Stepan Co. (SCL)

Annual Expected Returns: 20.8%

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets, meaning that Stepan is not beholden to just a handful of industries.

The surfactants business is Stepan’s largest by revenue, accounting for ~68% of total sales in the most recent quarter. A surfactant is an organic compound that contains both water-soluble and water-insoluble components.

Stepan posted third quarter earnings on October 29th, 2025. Adjusted earnings-per-share came to 48 cents, but that missed estimates widely by 13 cents. Revenue was up 8% year-over-year to $590 million, but also missed by $3.5 million.

Surfactants net sales were $422 million, a 10% increase from the year-ago period. Adjusted EBITDA fell $6.2 million, or 14%, due to volume contraction, higher startup expenses, and rising raw material prices.

Polymers net sales were $144 million, a 4% decline year-over-year. Volume was up 8%, while adjusted EBITDA was down 4%, or $1 million, due to lower unit margins and unfavorable mix.

Consolidated adjusted EBITDA was up $3.1 million, or 6%, year-over-year. Cash from operations was $69.8 million, while free cash flow was $40.2 million driven by reductions in working capital.

The dividend was raised by 2.6%, Stepan’s 58th consecutive annual increase.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

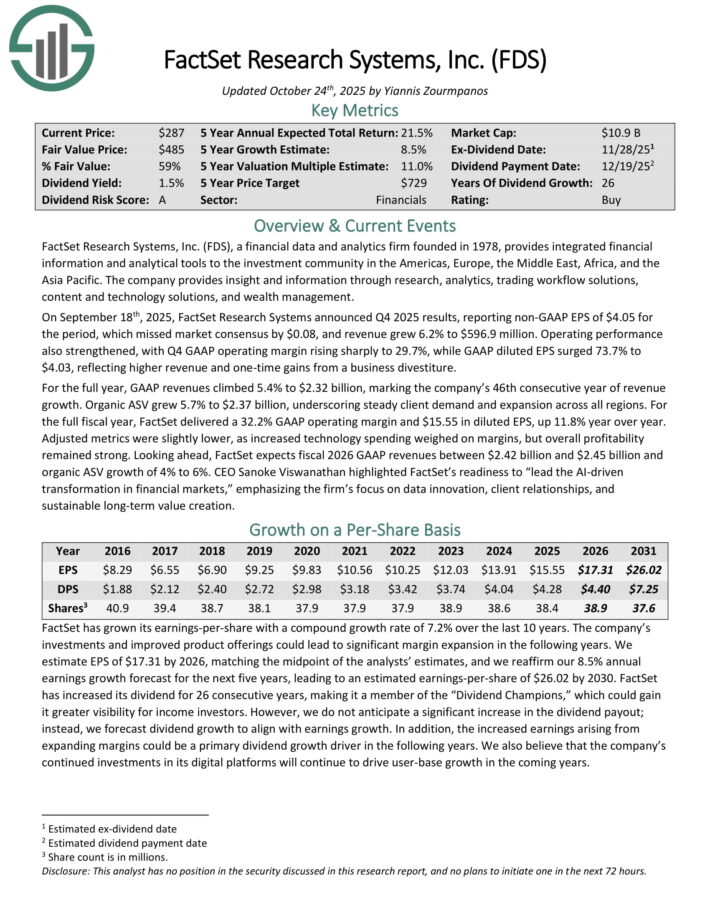

Blue Chip For 2026 #2: FactSet Research Systems (FDS)

Annual Expected Returns: 21.0%

FactSet Research Systems, a financial data and analytics firm founded in 1978, provides integrated financial information and analytical tools to the investment community in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

The company provides insight and information through research, analytics, trading workflow solutions, content and technology solutions, and wealth management.

On September 18th, 2025, FactSet Research Systems announced Q4 2025 results, reporting non-GAAP EPS of $4.05 for the period, which missed market consensus by $0.08, and revenue grew 6.2% to $596.9 million. Operating performance also strengthened, with Q4 GAAP operating margin rising sharply to 29.7%.

GAAP diluted EPS surged 73.7% to $4.03, reflecting higher revenue and one-time gains from a business divestiture. For the full year, GAAP revenues climbed 5.4% to $2.32 billion, marking the company’s 46th consecutive year of revenue growth.

Organic ASV grew 5.7% to $2.37 billion, underscoring steady client demand and expansion across all regions. For the full fiscal year, FactSet delivered a 32.2% GAAP operating margin and $15.55 in diluted EPS, up 11.8% year over year.

Adjusted metrics were slightly lower, as increased technology spending weighed on margins, but overall profitability remained strong. Looking ahead, FactSet expects fiscal 2026 GAAP revenues between $2.42 billion and $2.45 billion and organic ASV growth of 4% to 6%.

Click here to download our most recent Sure Analysis report on FDS (preview of page 1 of 3 shown below):

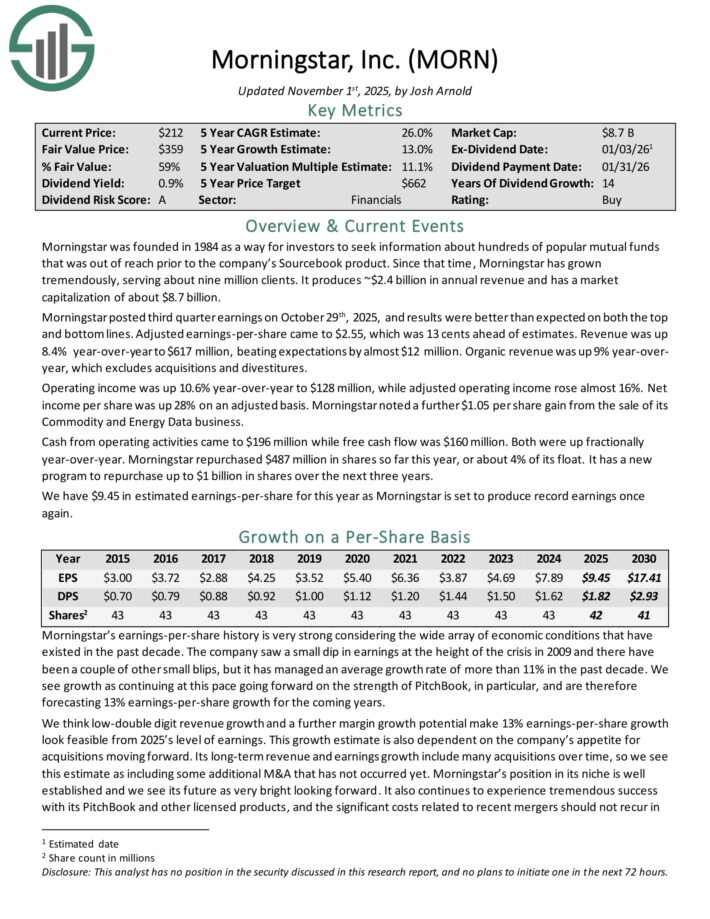

Blue Chip For 2026 #1: Morningstar Inc. (MORN)

Morningstar was founded in 1984 as a way for investors to seek information about hundreds of popular mutual funds that was out of reach prior to the company’s Sourcebook product.

Since that time, Morningstar has grown tremendously, serving about nine million clients. It produces ~$2.4 billion in annual revenue.

Morningstar posted third quarter earnings on October 29th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $2.55, which was 13 cents ahead of estimates.

Revenue was up 8.4% year-over-year to $617 million, beating expectations by almost $12 million. Organic revenue was up 9% year-over-year, which excludes acquisitions and divestitures.

Operating income was up 10.6% year-over-year to $128 million, while adjusted operating income rose almost 16%. Net income per share was up 28% on an adjusted basis.

Morningstar noted a further $1.05 per share gain from the sale of its Commodity and Energy Data business.

Cash from operating activities came to $196 million while free cash flow was $160 million. Both were up fractionally year-over-year.

Morningstar repurchased $487 million in shares so far this year, or about 4% of its float. It has a new program to repurchase up to $1 billion in shares over the next three years.

Click here to download our most recent Sure Analysis report on MORN (preview of page 1 of 3 shown below):

Additional Reading

If you are interested in finding more dividend growth stocks, the following Sure Dividend resources may be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].