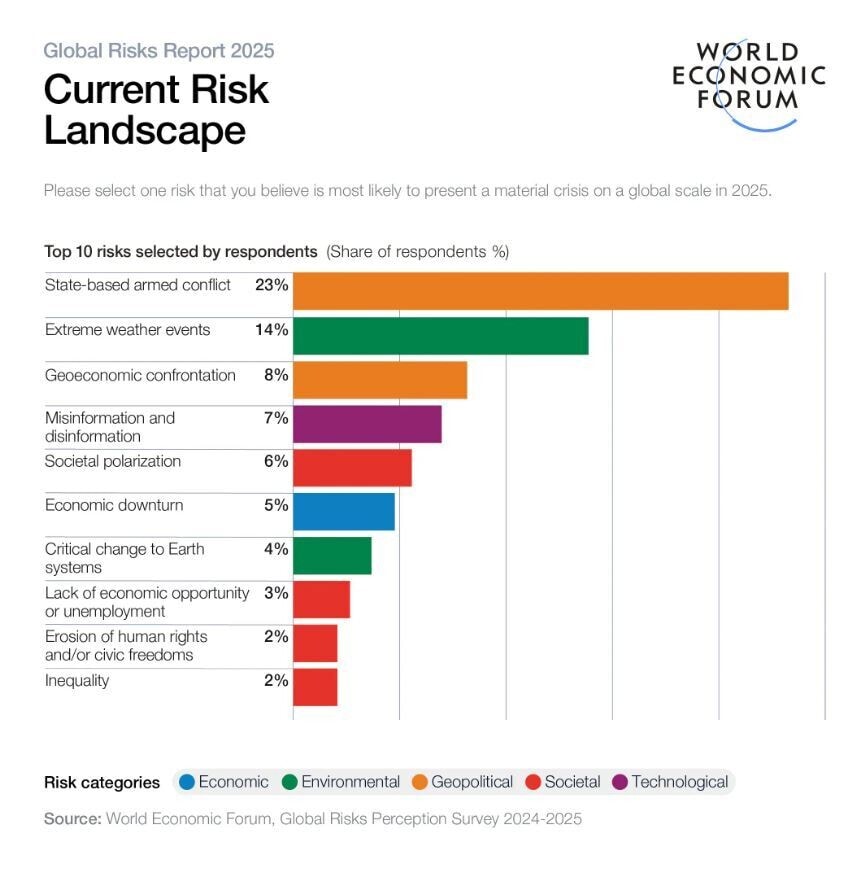

The year 2025 was not defined by a single shock, but by a decisive break in confidence. Governments repositioned, as did central banks, but both have realized they are unable to stop the cycle in motion. The public no longer trusts those in charge of monetary or fiscal policy and confidence was the dominant theme of the year.

The drums of war loudly rang throughout the world. The Middle East saw intense conflict between Israel and Palestine. The West gained strategic partnerships with formerly ousted partners and created new enemies. Europe continued to build its defenses as it braces for World War III, promoted by its own neocons who have refused to accept peace. Nations drifted deeper into debt as they prepared for the inevitable, propelling the sovereign debt crisis. Russia acknowledged that it is at war with NATO and has increased its nuclear power. There were over 110 ongoing wars across the globe in 2025, and tensions are intensifying.

Economic warfare persisted. April’s tariffs and market correction sent shockwaves through the economy. Nations were forced to rethink trade and restrategize all imports/exports. War tensions rose in the East as all eyes are on Taiwan. China and the US remain at odds and are fighting for the title of “financial capital of the world.” China’s growing middle class and technological advancements rapidly accelerated.

Donald Trump taking office marked a global shift away from the globalist agenda–for now. Trump steered the US in a 180-degree direction from Joe Biden’s policies on energy, immigration, trade, and most importantly, war. I warned that Donald Trump’s election could delay the inevitable but not prevent it. As expected, the opposition has opposed the president every step of the way, which led to the longest government shutdown in US history. Confidence cracked once more when it was revealed that Joe Biden did not assume authorship of his presidency, leaving the public to wonder who was in charge of leading the world’s top economy for the past four years.

The push toward the Build Back Better agenda collapsed after Trump, and we witnessed countless nations vote for candidates with nationalist ideologies. Klaus Schwab’s exit from the World Economic Forum was unexpected and marked a change in vision from the bureaucratic elites who can no longer rely on the lies of climate change to control the masses. The new leadership of the WEF signaled a new direction for the globalists. They have not relented on their mission but altered it to adjust to the changing tides.

The dawn of the AI age has led to a new rise of institutions and reframed the future. Semiconductor chips are of utmost priority, as well as rare earth minerals, both of which are in tight supply. Automation has begun to replace workers. Jobs are in tight supply as businesses no longer trust in tomorrow and will not expand even if there is an opportunity to borrow at lower rates.

The most widely read content reflected that reality. When Vietnam erased and froze 86 million bank accounts tied to digital ID compliance, the response was immediate and global. Readers understood this was not about Vietnam, but about the future of money itself. That concern deepened as similar systems expanded elsewhere. Thailand’s biometric control model illustrated how surveillance, banking, and identity are converging into a single permission-based framework. Digital IDs and CBDC are not only valid concerns but concrete plans. Governments are increasing surveillance, tightening their grip on the masses who no longer trust them. Capital has poured into equities and tangibles as a hedge against governments.

The most engaged blog posts of 2025 shared a common thread: capital controls, digital identity, surveillance, war risk, sovereign debt, and the loss of credibility in government data. It is clear that the public has lost all hope in a reliable government. Trust has been lost, and people are seeking ways to protect themselves from increasingly authoritarian regimes.

2025 was the confirmation year. As we move into 2026, volatility will not come as a surprise. The Economic Confidence Model points to a heightened risk of financial stress, political instability, and sudden shifts in capital flows as confidence in institutions continues to erode. This is the phase in the cycle when governments are forced to react, often resorting to control measures as volatility rises. Although 2026 will be far from a calm year, the computer will continue to guide the way and provide a bit of predictability amid an unstable world.