Yves here. This Wolf Richter provides some important context on the status of the dollar. Recall that 1994 was just after the fall of the USSR and hence during peak US hegemony, at least militarily. And independent of the Trump Administration’s considerable self-inflicted wounds, the position of the dollar as reserve currency should be expected to diminish over time as US share of global GDP falls.

By Wolf Richter, editor at Wolf Street. Originally published at Wolf Street

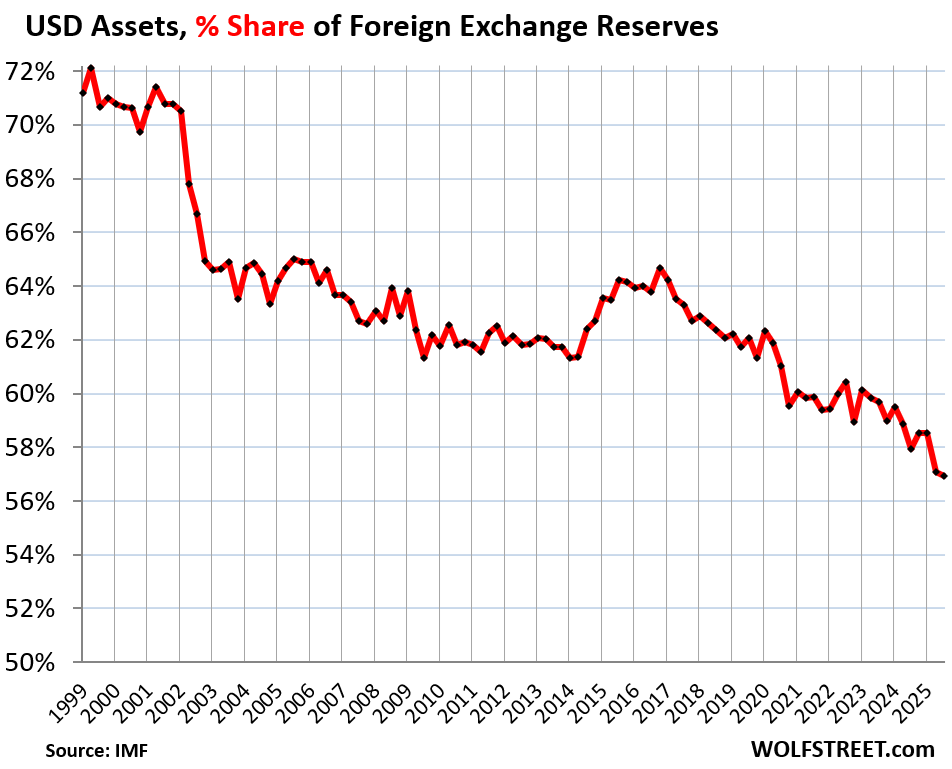

The share of USD-denominated assets held by other central banks dropped to 56.9% of total foreign exchange reserves in Q3, the lowest since 1994, from 57.1% in Q2 and 58.5% in Q1, according to the IMF’s new data on Currency Composition of Official Foreign Exchange Reserves.

USD-denominated foreign exchange reserves include US Treasury securities, US mortgage-backed securities (MBS), US agency securities, US corporate bonds, and other USD-denominated assets held by central banks other than the Fed.

Excluded are any central bank’s assets denominated in its own currency, such as the Fed’s Treasury securities or the ECB’s euro-denominated securities.

It’s not that foreign central banks dumped US-dollar-denominated assets, such as Treasury securities. They did not. They added a little to their holdings. But they added more assets denominated in other currencies, particularly a gaggle of smaller currencies whose combined share has surged, while central banks’ holdings of USD-denominated assets haven’t changed much for a decade, and so the percentage share of those USD assets continued to decline.

As the dollar’s share declines toward the 50% line, the dollar would still be by far the largest reserve currency, as all other currencies combined would weigh as much as the dollar. But it does have consequences.

Why Is Having the Top Reserve Currency Important for the US?

Foreign central banks buying USD-denominated assets, such as Treasury securities, helps push up prices and push down yields of those assets. Being the dominant reserve currency had the effect of helping the US borrow more cheaply to fund its huge twin deficits – the trade deficit and the budget deficit – and thereby has enabled the US to run those huge twin deficits for decades. At some point, this continued decline as a reserve currency, as it reduces demand for USD debt, would make the trade deficit and the budget deficit more difficult to sustain.

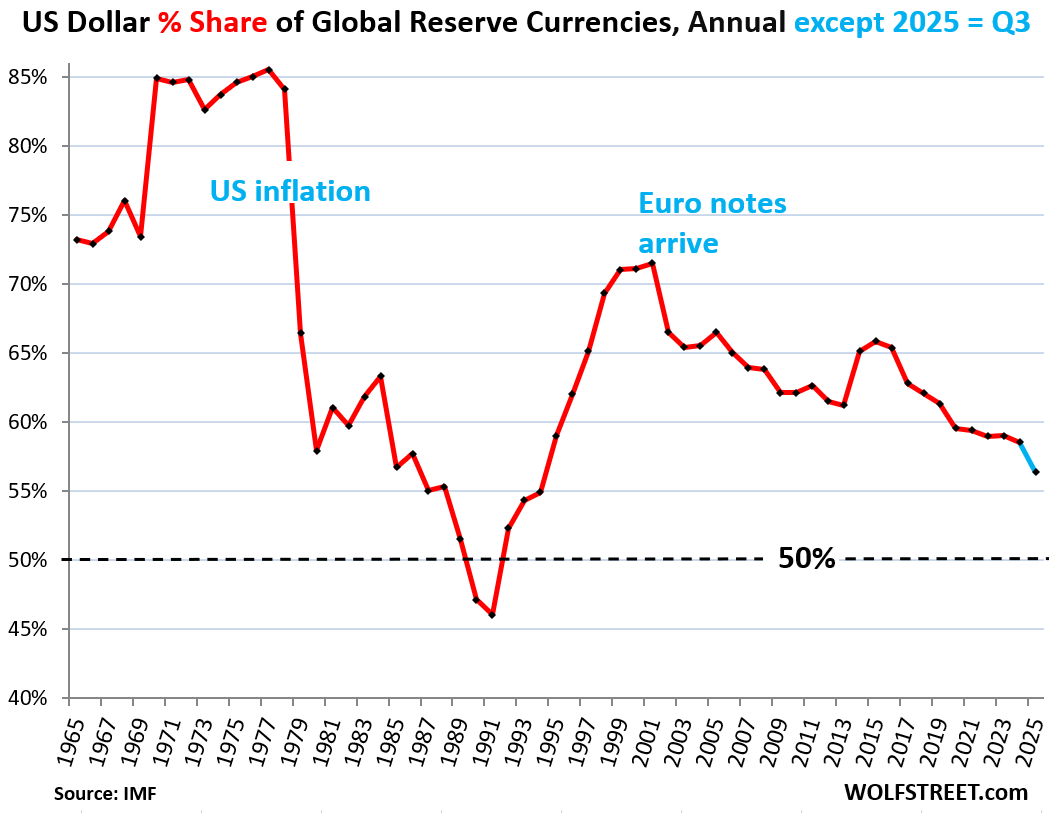

The dollar’s share had already been below 50% before, in 1990 and 1991, after a long plunge from the peak in 1977 (share of 85.5%). This plunge accompanied a deep crisis in the US with sky-high inflation and interest rates, and four recessions over those years, including the nasty double-dip recession. Central banks lost confidence in the Fed’s willingness or ability to do what it takes to get this inflation under control that had washed over the US in three ever larger waves.

The dotted line in the chart below indicates the 50%-share. The dollar’s share bottomed out at 46% in 1991, by which time the Fed had brought inflation under control, and soon, central banks began loading up on dollar-assets.

Then came the euro, which turned into the next set-back for the dollar, but not nearly as much as European politicians had promised when pushing the euro through the system; they were talking about parity with the dollar. That talk ended with the Euro Debt Crisis that began in 2009.

Then, over the past 10 years, came dozens of smaller “non-traditional reserve currencies,” as the IMF calls them.

The chart shows the dollar’s share at the end of each year, except 2025 where it shows the share in Q3:

But They Didn’t Actually Dump USD-Denominated Securities

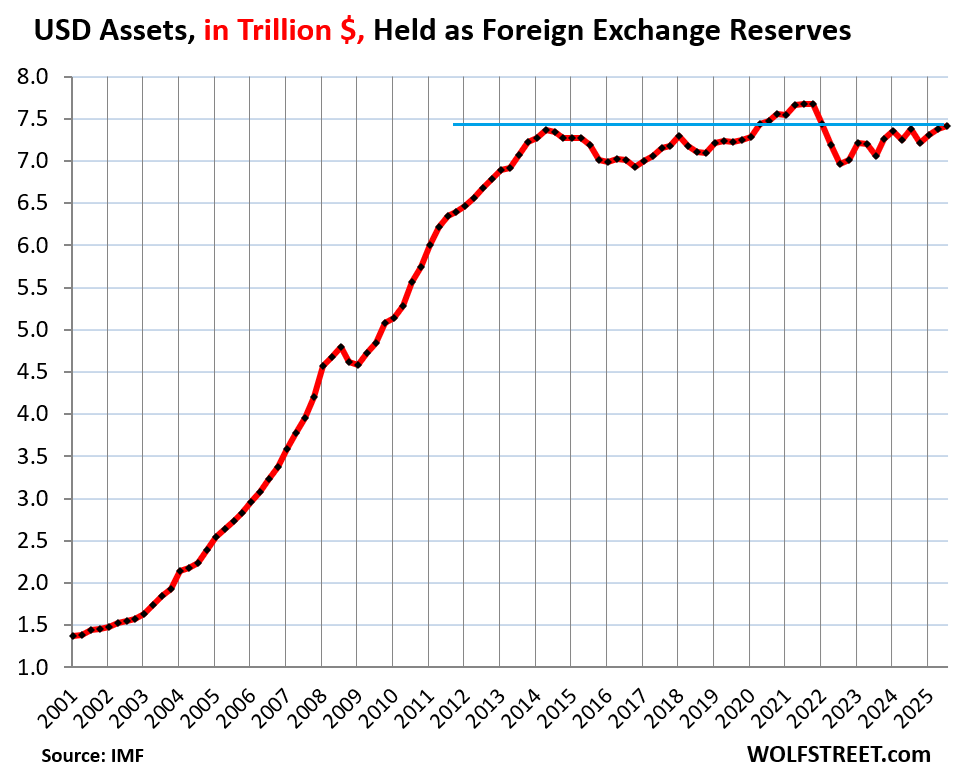

Foreign central banks increased their holdings of USD-denominated assets by a hair in Q3 to $7.4 trillion, the third increase in a row.

Since mid-2014, despite some sharp ups and downs, their holdings of USD-assets have remained essentially flat.

So, what has caused the percentage share of USD assets to decline over the years is the growth of foreign exchange reserves denominated in other currencies, particularly many smaller currencies, as central banks have been diversifying their growing pile of foreign exchange assets.

The chart below shows foreign central banks’ holdings of USD-denominated assets – US Treasury securities, US MBS, US agency securities, US corporate bonds, etc. – in trillions of dollars:

The Top Foreign Exchange Reserves by Currency

Central banks’ holdings of foreign exchange reserves in all currencies, and expressed in USD, rose to $13.0 trillion in Q3.

Top holdings, expressed in USD:

USD assets: $7.41 trillion

Euro assets (EUR): $2.65 trillion

Yen assets (YEN): $0.76 trillion

British pound assets (GBP): $0.58 trillion

Canadian dollar assets (CAD): $0.35 trillion

Australian dollar assets (AUD): $0.27 trillion

Chinese renminbi (RMB) assets: $0.25 trillion

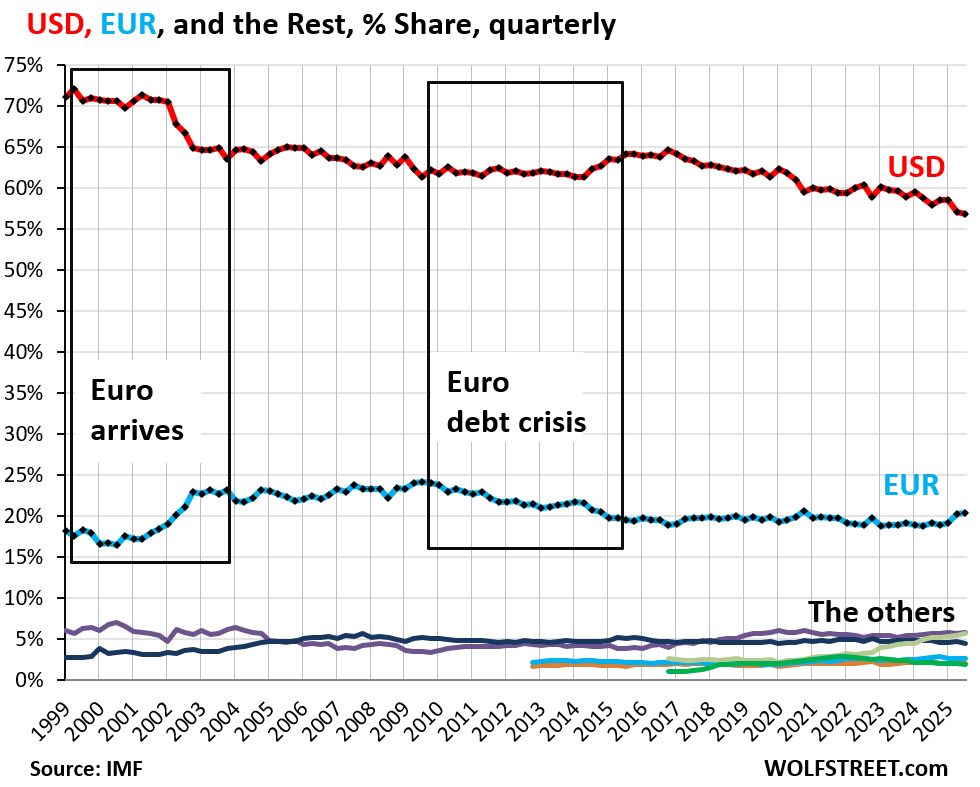

The euro’s share, #2, has been around 20% since 2015. Before the Euro Debt Crisis, it was on an upward trajectory and had already risen to nearly 25%.

The rest of the reserve currencies are the colorful spaghetti at the bottom of the chart (more in a moment). Combined, they have gained share over the years, at the expense of the dollar, while the euro’s share has remained roughly stable since 2015.

The rise of the “non-traditional” reserve currencies

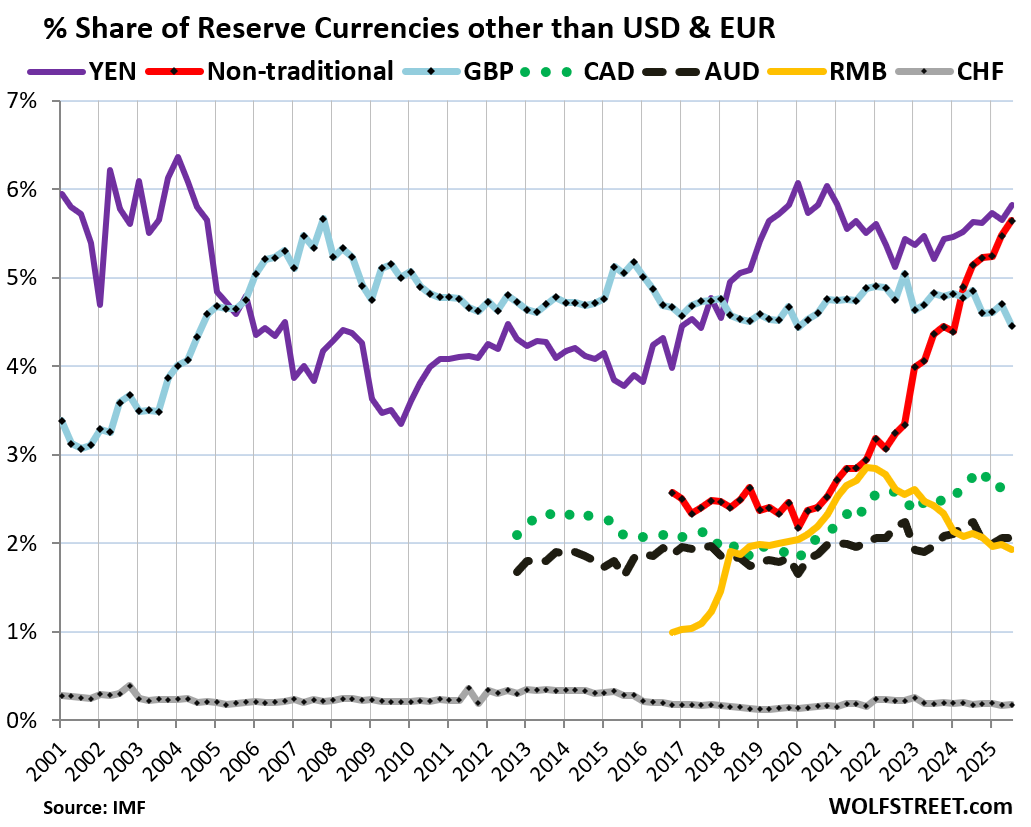

The chart below takes a magnifying glass to the colorful spaghetti at the bottom of the chart above.

The soaring red line shows the combined surge of assets denominated in dozens of smaller “nontraditional reserve currencies,” as the IMF calls them. Combined, they reached a share of 5.6%, just below the yen-denominated assets (5.8%).

But the share of the RMB (yellow) has been declining since Q1 2022, and its share is now back where it had been in 2019, amid ongoing capital controls, convertibility issues, and a slew of other issues.

In other words, the USD and the RMB both have given up share to the “non-traditional reserve currencies” as other central banks have been diversifying away from assets denominated in USD and RMB.

In case you missed my update on a slightly less ugly situation: US Government Interest Payments to Tax Receipts, Average Interest Rate on the Debt, and Debt-to-GDP Ratio in Q3 2025