Published on December 26th, 2025 by Bob Ciura

Conservative retirement investing is all about creating passive income with quality securities held for the long-run.

At Sure Dividend, we focus on dividend paying stocks to build a growing and reliable passive income stream. The Dividend Kings are a great example of this.

The Dividend Kings have increased their dividends for at least 50 consecutive years.

You can see the full downloadable spreadsheet of all 56 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

Conservative investors will naturally be drawn to higher quality businesses less likely to reduce their dividend payments during recessions.

And when you invest conservatively for income you get to profit from market volatility by choosing when you buy and sell instead of letting the market dictate your moves.

Picking exactly what to invest in can get complicated, but it doesn’t have to.

The 10 top retirement income stocks below are Dividend Kings based in the U.S., with current yields above 2.5%, equal to double the current dividend yield of the S&P 500 Index.

The 10 stocks are ranked by dividend yield below.

Table of Contents

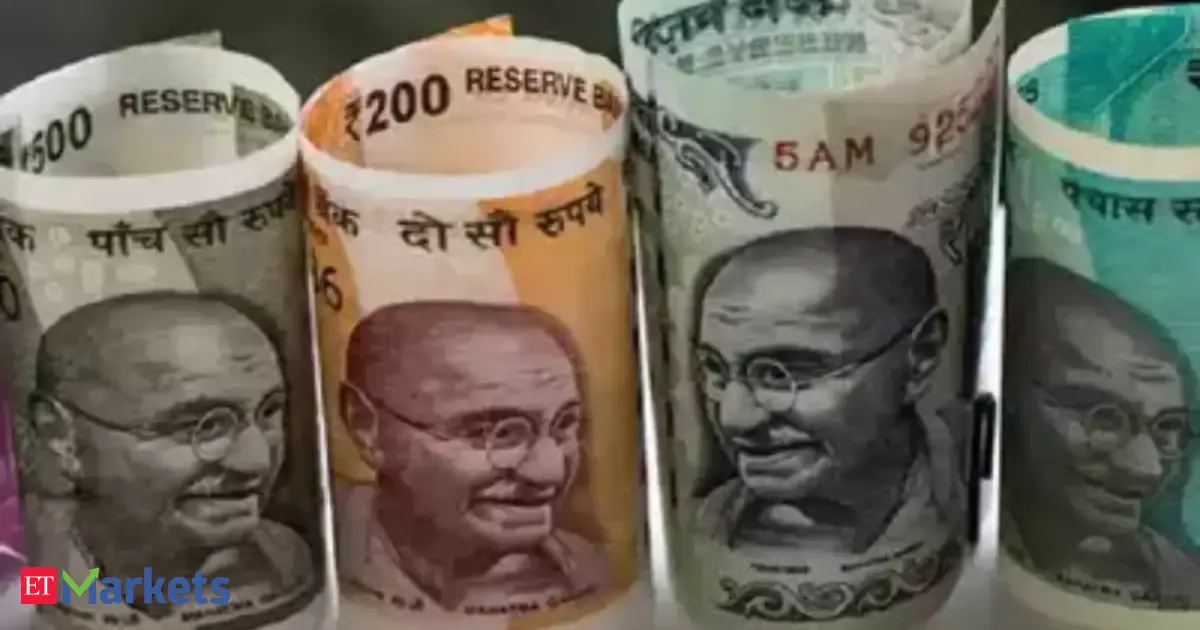

Conservative Retirement Income Stock: Colgate-Palmolive Co. (CL)

Colgate-Palmolive has been in existence for more than 200 years, having been founded in 1806. It operates in many consumer staples markets, including Oral Care, Personal Care, Home Care, and more recently, Pet Nutrition.

These segments afford the company just over $20 billion in annual revenue.

Colgate-Palmolive posted third quarter earnings on October 31st, 2025, and results were largely in line with expectations. Adjusted earnings-per-share came to 91 cents, which was two cents ahead of estimates.

Revenue was up 2% year-over-year to $5.13 billion, meeting expectations. Organic sales were up 0.4%, including a 0.8% negative impact from lower private label pet sales as the company exited that business.

Net sales were mixed across regions with North America down 0.4%, Asia-Pacific sales off 1%, Europe rising 1.2%, up 1.7% in Latin America, and up 6.8% in Africa/Euraisa. The company noted a modest increase in prices having helped offset lower volumes.

The company noted working capital as a percentage of sales improved to -4% from -5.2% last quarter. Guidance is for sales to be up low single-digits, including a flat to low single-digit negative impact from forex. Organic sales are expected to be up 1% to 2%.

Click here to download our most recent Sure Analysis report on CL (preview of page 1 of 3 shown below):

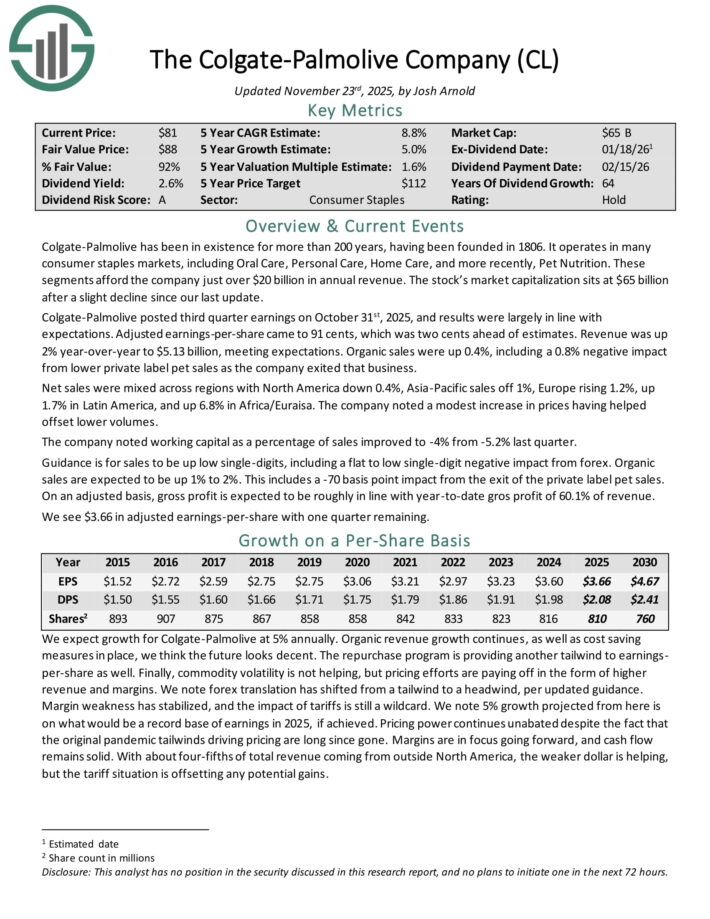

Conservative Retirement Income Stock: National Fuel Gas (NFG)

National Fuel Gas Co. is a diversified energy company that operates in four business segments: Upstream & Gathering, Pipeline & Storage, Utility, and Energy Marketing.

The largest segment of the company is Exploration & Production. With 55 years of consecutive dividend increases, National Fuel Gas qualifies to be a Dividend King.

In early November, National Fuel Gas reported (11/5/25) financial results for the fourth quarter of fiscal 2025. The company grew its production 21% over the prior year’s quarter, primarily thanks to strong performance in new pads.

In addition, the average realized price of natural gas grew 9%, from $2.40 to $2.61. As a result, earnings-per-share surged 58%, from $0.77 to $1.22, and exceeded the analysts’ consensus by $0.11.

The company has beaten the analysts’ estimates in 22 of the last 26 quarters. National Fuel Gas provided strong guidance for fiscal 2026, expecting earnings-per-share of $7.60-$8.10.

Accordingly, we expect earnings-per-share of $7.90. If this proves correct, it will mark 14% growth of earnings-per-share over the previous year.

Click here to download our most recent Sure Analysis report on NFG (preview of page 1 of 3 shown below):

Conservative Retirement Income Stock: Procter & Gamble Co. (PG)

Procter & Gamble is a consumer products giant that sells its products in over 180 countries. Notable brands include Pampers, Luvs, Tide, Gain, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Old Spice, Dawn, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and many more.

The company generated $84 billion in sales in fiscal 2024 and 2025. Procter & Gamble has paid a dividend for 134 years and has grown its dividend for 69 consecutive years – one of the longest active streaks of any company.

In late October, Procter & Gamble reported (10/24/25) results for the first quarter of fiscal 2025 (its fiscal year ends June 30th). Its sales and organic sales grew 3% and 2%, respectively, over last year’s quarter, thanks to higher prices and a favorable mix of products.

Core earnings-per-share grew 3%, from $1.93 to $1.99, beating the analysts’ consensus by $0.09. The firm sales amid sustained price hikes are a testament to the strength of the brands of Procter & Gamble.

However, we note a remarkable deceleration in price hikes in the last six quarters. This indicates that the company cannot keep raising its prices aggressively anymore.

Due to soft consumer spending amid increased economic uncertainty, Procter & Gamble reiterated its modest guidance for fiscal 2026. It expects 0%-4% growth of organic sales and 0%-4% growth of core earnings-per-share.

Click here to download our most recent Sure Analysis report on PG (preview of page 1 of 3 shown below):

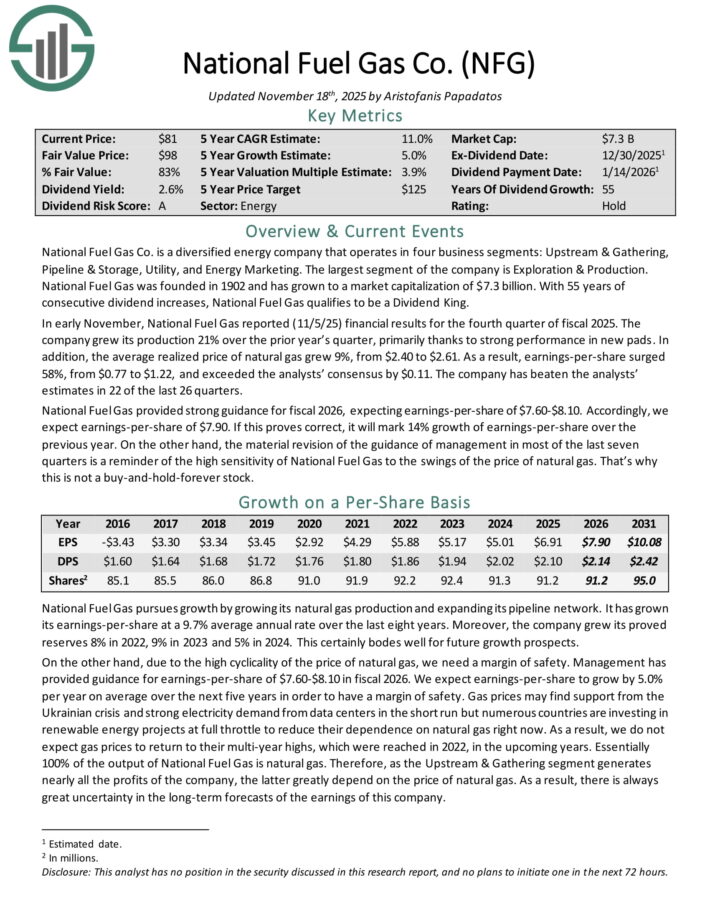

Conservative Retirement Income Stock: AbbVie Inc. (ABBV)

AbbVie is a biotechnology company focused on developing and commercializing drugs for immunology, oncology and virology. It was spun off by Abbott Laboratories in 2013 and has become one of the largest players in the biotechnology industry.

AbbVie reported its third quarter earnings results on October 31. The company was able to generate revenues of $15.8 billion during the quarter, which was 9% year-over-year growth.

Revenue was positively impacted by compelling growth from some of its major drugs, including Skyrizi and Rinvoq, while Humira sales declined by 55% due to competition from biosimilars and market share losses.

AbbVie earned $1.86 per share during the third quarter, which was 38% less than the company’s earnings-per-share during the previous year’s quarter.

Earnings-per-share beat the consensus analyst estimate by $0.08. Guidance for 2025 adjusted earnings-per-share is $10.61 – $10.65.

Click here to download our most recent Sure Analysis report on ABBV (preview of page 1 of 3 shown below):

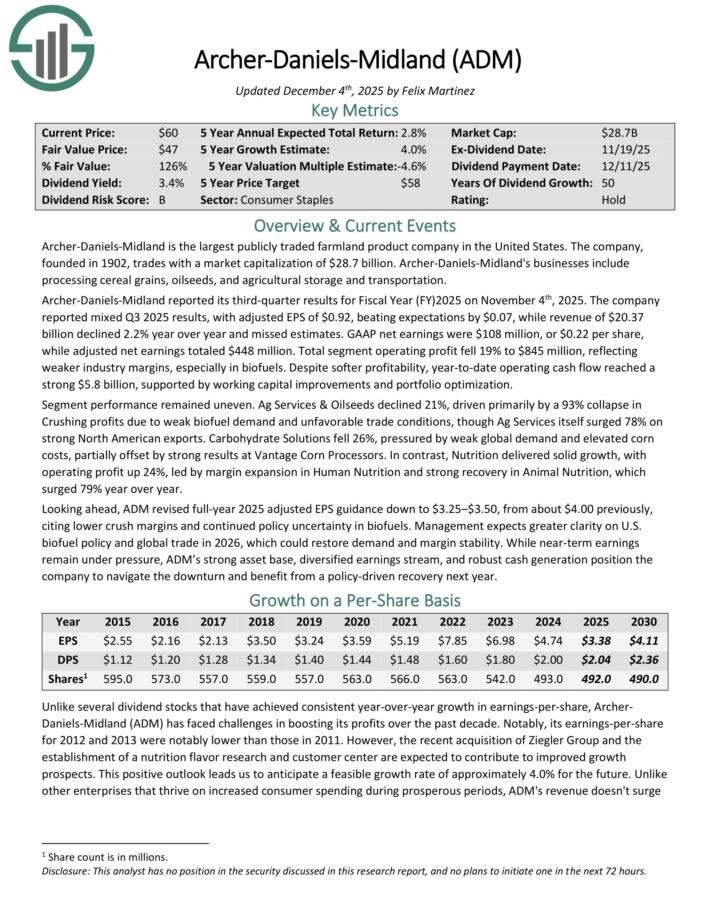

Conservative Retirement Income Stock: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. Its businesses include processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY)2025 on November 4th, 2025. The company reported mixed Q3 2025 results, with adjusted EPS of $0.92, beating expectations by $0.07, while revenue of $20.37 billion declined 2.2% year over year and missed estimates.

Total segment operating profit fell 19% to $845 million, reflecting weaker industry margins, especially in biofuels. Despite softer profitability, year-to-date operating cash flow reached a strong $5.8 billion, supported by working capital improvements and portfolio optimization.

Segment performance remained uneven. Ag Services & Oilseeds declined 21%, driven primarily by a 93% collapse in Crushing profits due to weak biofuel demand and unfavorable trade conditions, though Ag Services itself surged 78% on strong North American exports.

Carbohydrate Solutions fell 26%, pressured by weak global demand and elevated corn costs, partially offset by strong results at Vantage Corn Processors.

Looking ahead, ADM revised full-year 2025 adjusted EPS guidance down to $3.25–$3.50.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

Conservative Retirement Income Stock: PepsiCo Inc. (PEP)

PepsiCo is a global food and beverage company that generates $89 billion in annual sales. The company’s products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

The company has more than 20 $1 billion brands in its portfolio. On February 4th, 2025, PepsiCo increased its annualized dividend by 5.0% to $5.69 starting with the payment that was made in June 2025, extending the company’s dividend growth streak to 53 consecutive years.

On October 9th, 2025, PepsiCo reported third quarter earnings results for the period ending September 30th, 2025. For the quarter, revenue grew 2.7% to $23.9 billion, which beat estimates by $90 million. Adjusted earnings-per-share of $2.29 compared unfavorably to $2.31 the prior year, but this was $0.03 better than expected.

Organic sales grew 1.3% for the third quarter. For the period, volumes for both beverages and foods were down 1%. PepsiCo Beverages North America’s organic revenue grew 2% for the period even as volume declined by 3%.

Revenue for PepsiCo Foods North America decreased 3%, largely due to divestitures. Food volume decreased 4%. The International Beverages segment fell 1%, primarily due to lower volume. Revenues in Europe/Middle East/Africa were up 5.5%. Food volume declined 1%, but this was offset by a 1.5% gain in beverages.

PepsiCo reaffirmed prior guidance for 2025, with the company still expecting organic sales in the low single-digit range.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

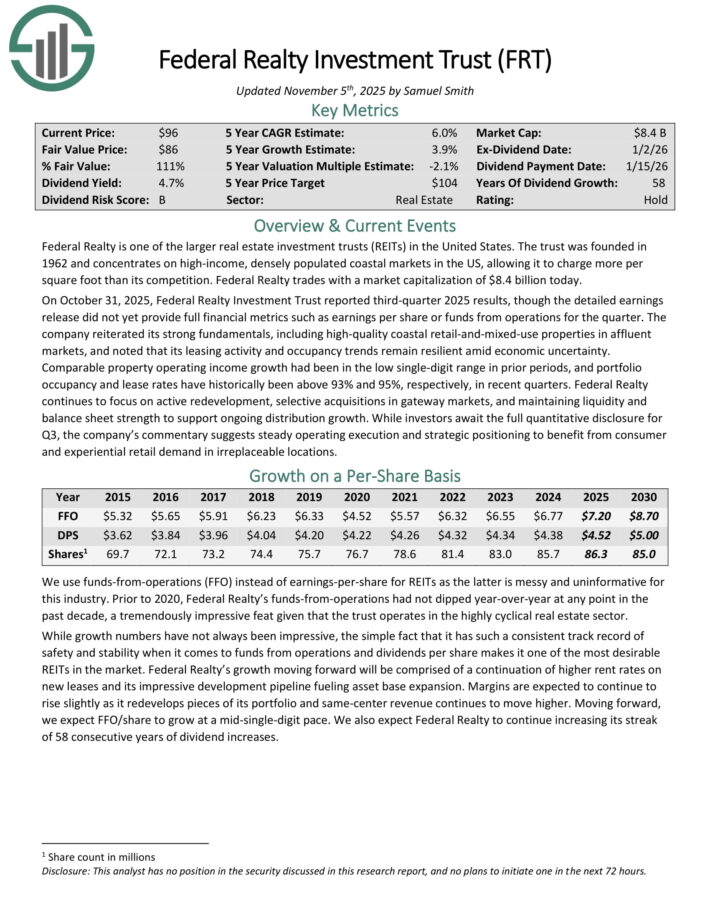

Conservative Retirement Income Stock: Federal Realty Investment Trust (FRT)

Federal Realty is one of the larger real estate investment trusts (REITs) in the United States. The trust was founded in 1962 and concentrates on high-income, densely populated coastal markets in the US, allowing it to charge more per square foot than its competition.

On October 31, 2025, Federal Realty Investment Trust reported third-quarter 2025 results, though the detailed earnings release did not yet provide full financial metrics such as earnings per share or funds from operations for the quarter.

The company reiterated its strong fundamentals, including high-quality coastal retail-and-mixed-use properties in affluent markets, and noted that its leasing activity and occupancy trends remain resilient amid economic uncertainty.

Comparable property operating income growth had been in the low single-digit range in prior periods, and portfolio occupancy and lease rates have historically been above 93% and 95%, respectively, in recent quarters.

Click here to download our most recent Sure Analysis report on FRT (preview of page 1 of 3 shown below):

Conservative Retirement Income Stock: Hormel Foods (HRL)

Hormel Foods was founded in 1891 in Minnesota. Since that time, the company has grown into a $13 billion market capitalization juggernaut in the food products industry with about $12 billion in annual revenue.

Hormel has kept its core competency as a processor of meat products for well over a hundred years but has also grown into other business lines through acquisitions.

The company sells its products in 80 countries worldwide, and its brands include Skippy, SPAM, Applegate, Justin’s, and more than 30 others. In addition, Hormel is a member of the Dividend Kings, having increased its dividend for 60 consecutive years.

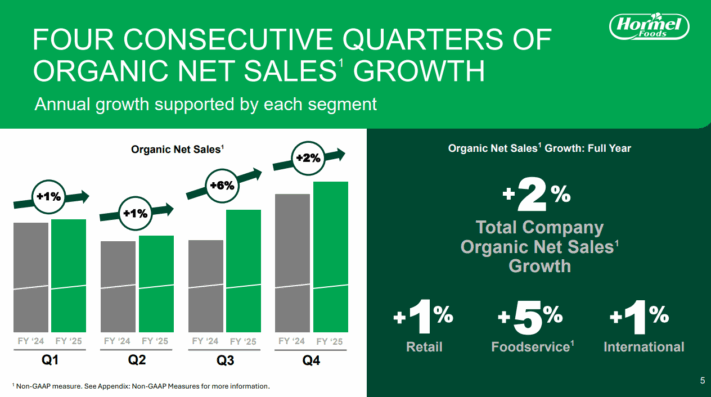

Hormel posted fourth quarter and full-year earnings on December 4th, 2025.

Source: Investor Presentation

The company saw 32 cents in adjusted earnings-per-share for the quarter, beating estimates by two cents. Revenue was up 1.6% year-over-year and missed estimates by $30 million, coming in at $3.19 billion.

Adjusted operating margin was 7.7% of revenue, while cash flow from operations was $323 million. Volumes in the fourth quarter were flat in the retail segment, down 5% in foodservice, and down 7% in the international segment.

Hormel raised its dividend for the 60th consecutive year, this time adding 0.9% to a new payout of $1.20 per share annually. We start 2026 with an estimate of $1.47 in adjusted earnings-per-share.

Click here to download our most recent Sure Analysis report on HRL (preview of page 1 of 3 shown below):

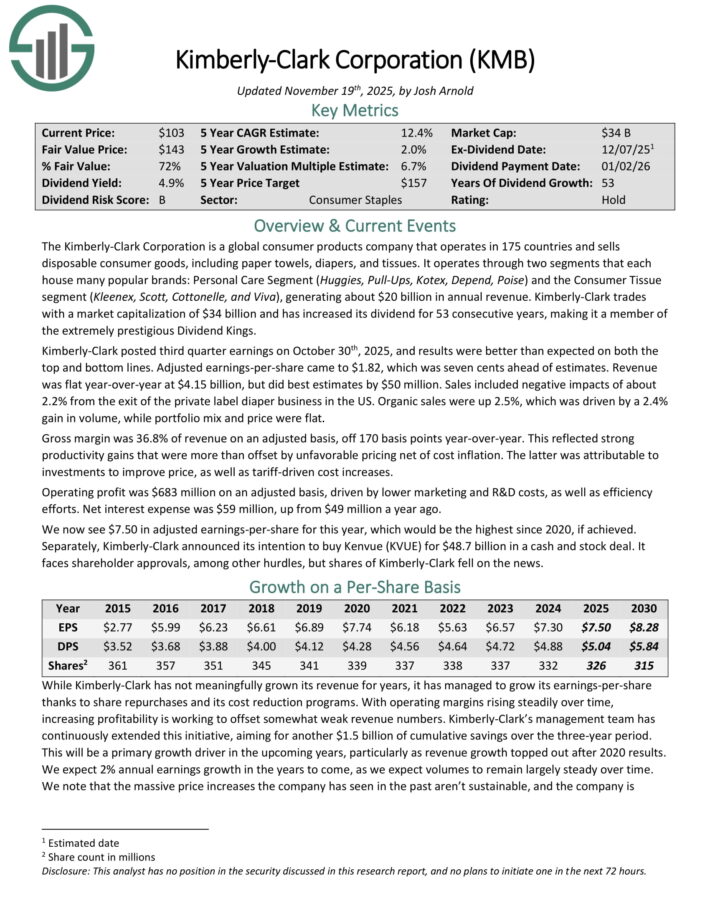

Conservative Retirement Income Stock: Kimberly-Clark Corp. (KMB)

The Kimberly-Clark Corporation is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating about $20 billion in annual revenue.

Kimberly-Clark trades with a market capitalization of $33 billion and has increased its dividend for 53 consecutive years.

Kimberly-Clark posted third quarter earnings on October 30th, 2025, and results were better than expected on both the top and bottom lines. Adjusted earnings-per-share came to $1.82, which was seven cents ahead of estimates.

Revenue was flat year-over-year at $4.15 billion, but did best estimates by $50 million. Sales included negative impacts of about 2.2% from the exit of the private label diaper business in the US.

Organic sales were up 2.5%, which was driven by a 2.4% gain in volume, while portfolio mix and price were flat.

On November 3rd, 2025, it was announced that Kimberly-Clark had agreed to purchase Kenvue (KVUE) in a cash and stock deal valued at $48.7 billion. This will make the new company a leading health and wellness company.

Click here to download our most recent Sure Analysis report on KMB (preview of page 1 of 3 shown below):

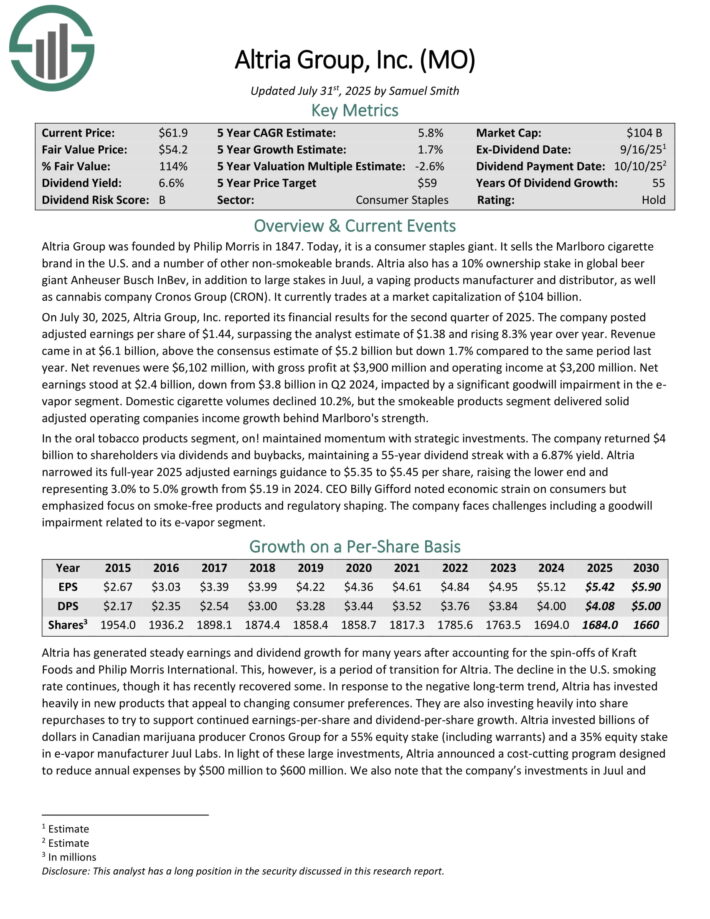

Conservative Retirement Income Stock: Altria Group (MO)

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

This is a period of transition for Altria. The decline in the U.S. smoking rate continues. In response, Altria has invested heavily in new products that appeal to changing consumer preferences, as the smoke-free category continues to grow.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the Canadian cannabis producer Cronos Group (CRON).

On July 30, 2025, Altria Group, Inc. reported its financial results for the second quarter of 2025. The company posted adjusted earnings per share of $1.44, surpassing the analyst estimate of $1.38 and rising 8.3% year over year.

Revenue came in at $6.1 billion, above the consensus estimate of $5.2 billion but down 1.7% compared to the same period last year. Net revenues were $6,102 million, with gross profit at $3,900 million and operating income at $3,200 million.

Net earnings stood at $2.4 billion, down from $3.8 billion in Q2 2024, impacted by a significant goodwill impairment in the e-vapor segment.

Domestic cigarette volumes declined 10.2%, but the smokeable products segment delivered solid adjusted operating companies income growth behind Marlboro’s strength.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

Additional Resources

The Dividend Kings are not the only high-quality dividend growth stock ideas.

Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].