When family and friends put him down for dreaming, Jack Kellogg kept studying.

He knew what was possible and was determined to stick with it.

He knew college wasn’t for him. But, he managed to save $10K from his valet job. And he knew he wanted to invest that money.

So right out of high school, he joined my trading challenge in 2017.

Early on, he almost gave up after losing one-third of his account in two days. But he found consistency by September.

Then, Jack pushed it harder than any trader I know…

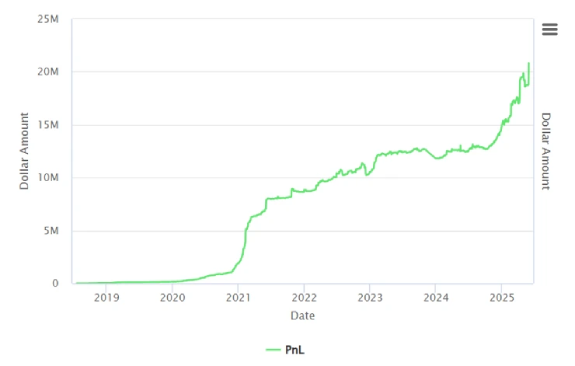

• 2020: Jack passes the $1 million milestone and closes the year with $1.9 million in career profits.

• 2021: Jack has a $624K day, a $1.3 million week, and hits $8.6 million in career profits.

• 2022: While the overall market was down, Jack added $1.7 million to his overall tally.

This year, Jack crossed $20 million in trading profits (including losses).

You can see Jack’s profit chart below:

I’m not telling you this to brag. I’m showing you that it’s possible. If you have the right tools…

Jack Kellogg is a trader who epitomizes what dedication, discipline, and a well-developed trading strategy can achieve in the stock market.

Finding The Right Stocks

Jack and I aren’t geniuses.

We just know which stocks to trade and how to trade them.

For example, here’s why we decided to trade a stock named Cardio Diagnostics Holdings Inc. (CDIO).

The stock was already on a multi-day run and it fit our framework of what a hot stock should look like:

• Low float: A low supply of shares helps the price spike higher when demand increases. CDIO had 16 million shares in the float. That’s decently close to our goal of 10 million shares or fewer.

• Hot sector: CDIO is a biotech stock. And biotechs are hot right now.

• With news: The stock received a notification that detailed it was at risk of delisting from the Nasdaq because it was trading under the minimum share-price requirement of $1. It was spiking to try and save itself from delisting.

My AI trading bot — XGPT — knows exactly which stocks to watch. And how to trade them! (For more details about how XGPT works, see here.)

Take a look at the alert we got for CDIO:

CDIO chart multi-day, 1-minute candles.

CDIO chart multi-day, 1-minute candles.

There are a lot of stocks that spike like this. We see new runners every week.

Our trade patterns mean nothing if we’re watching the wrong stocks.

The first step is to find the stock. Then …

The Patterns We Use

All of my millionaire students use these patterns …

Volatile stocks like to follow a specific framework because people are predictable during times of high stress.

People have always behaved similarly when they’re stressed. And that probably won’t change … ever.

It’s not rocket science. You just need to gain enough experience and put in the work to recognize these patterns in real time.

And adding an AI element is a great way to up your trading game.

Instead of waiting for analyst upgrades, media noise, or lagging indicators…

It helps traders like you:

• Spot breakouts and trend reversals early.

• Follow flow from big-money players.

• Simplify trading with AI-enhanced scans and alerts.

Find the right stocks. Trade the right patterns.

It’s a perfect one-two punch!

What do you think of Jack’s journey? Let me know at [email protected] and give Jack the props he deserves!

Have a great holiday!

Cheers,

Tim SykesEditor, Tim Sykes Daily

Tim SykesEditor, Tim Sykes Daily