Advanced Micro Devices, Inc. (NASDAQ: AMD) delivered a record performance in the most recent quarter and issued bullish guidance, fueled by its rapidly expanding data center AI segment. The chipmaker continues to invest heavily in its future, prioritizing a broader data center footprint and AI accelerator roadmap.

AMD’s stock has delivered exceptional gains this year, rising 68% over the past six months, although momentum has moderated in recent weeks following the sharp rally. Wall Street remains optimistic, with analysts projecting a further 32% upside over the next twelve months, underscoring confidence in the company’s long-term growth prospects. However, the pace of earnings and cash flow expansion has lagged the stock’s price appreciation, suggesting that much of the expected growth may already be priced in. This divergence raises concerns that the shares could be trading at an elevated valuation.

Q3 Results Beat

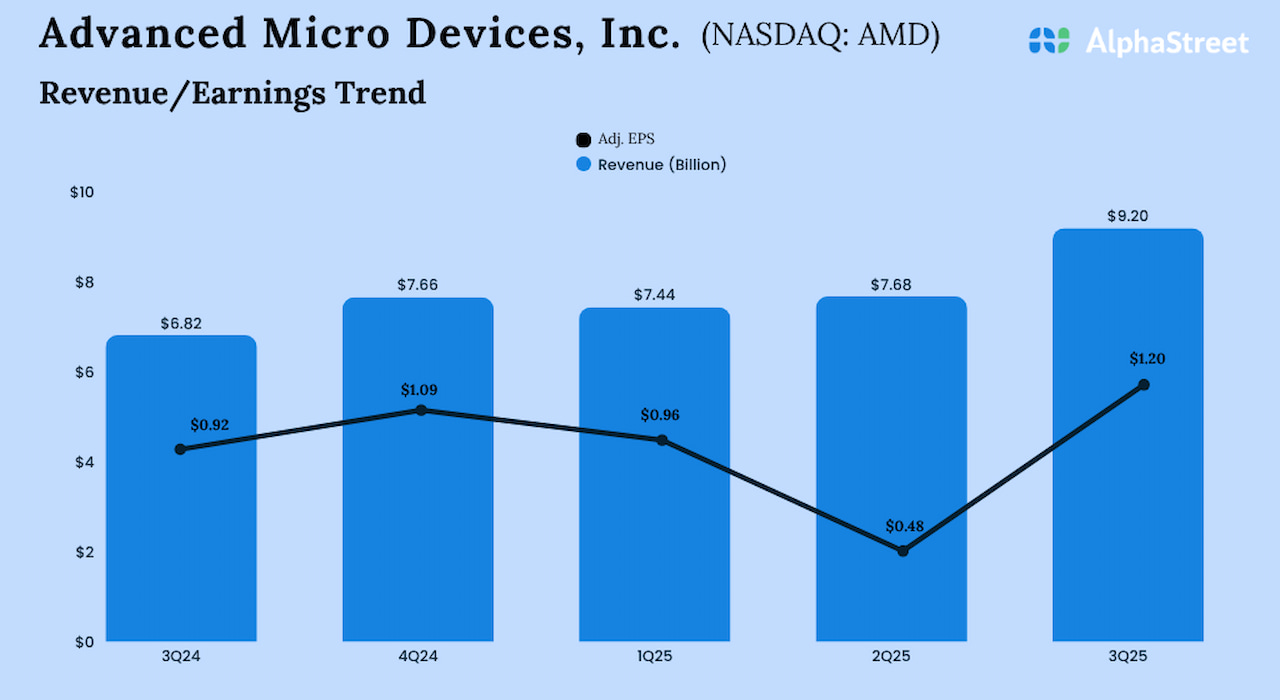

For the third quarter, AMD reported adjusted earnings of $1.20 per share, compared to $0.92 per share in the same period of 2024. On a reported basis, net income was $1.24 billion or $0.75 per share in Q3, vs. $771 million or $0.47 per share in the prior-year period. Driving the bottom-line growth, Q3 revenues increased to $9.25 billion from $6.82 billion in the comparable quarter last year. Both revenue and earnings exceeded analysts’ estimates. In fiscal 2025, total revenue is expected to reach around $34 billion, representing a 26% CAGR over the past decade.

From AMD’s Q3 2025 Earnings Call:

“Looking ahead, we remain on track to launch our next-generation 2-nanometer Venice processors in 2026. Venice Silicon is in the labs and performing very well, delivering substantial gains in performance, efficiency, and compute density. Customer pull and engagement for Venice are the strongest we have seen, reflecting our competitive positioning and the growing demand for more data center compute. Multiple cloud OEM partners have already brought their first Venice platforms online, setting the stage for broad solution availability and cloud deployments at launch.”

Outlook

The record performance reflects strong demand for the company’s EPYC CPUs and Ryzen processors in data centers and PCs, combined with its significant AI-focused investments. In a recent statement, the AMD leadership said it targets approximately 35% revenue CAGR through the next three to five years, with the data center business growing an estimated 60%. It is looking for an adjusted operating margin of above 35% and adjusted earnings per share of more than $20 for that period.

While AMD is accelerating its AI momentum through innovations like the MI300X and strategic partnerships with hyperscalers, it continues to face stiff competition from Nvidia, which dominates the AI chip market with roughly 85–90% share. Nvidia’s entrenched CUDA ecosystem creates a powerful network effect, making it difficult and costly for customers to switch to AMD—even though the latter’s hardware is highly advanced and increasingly compatible. The company also faces competition from tech majors like Alphabet and Amazon, which are developing their own custom AI accelerator chips.

The average price of AMD shares over the past 12 months is $150.16. It has gained around 6% in the past 30 days, outperforming the S&P 500 index. The value has more than doubled in the past seven months.