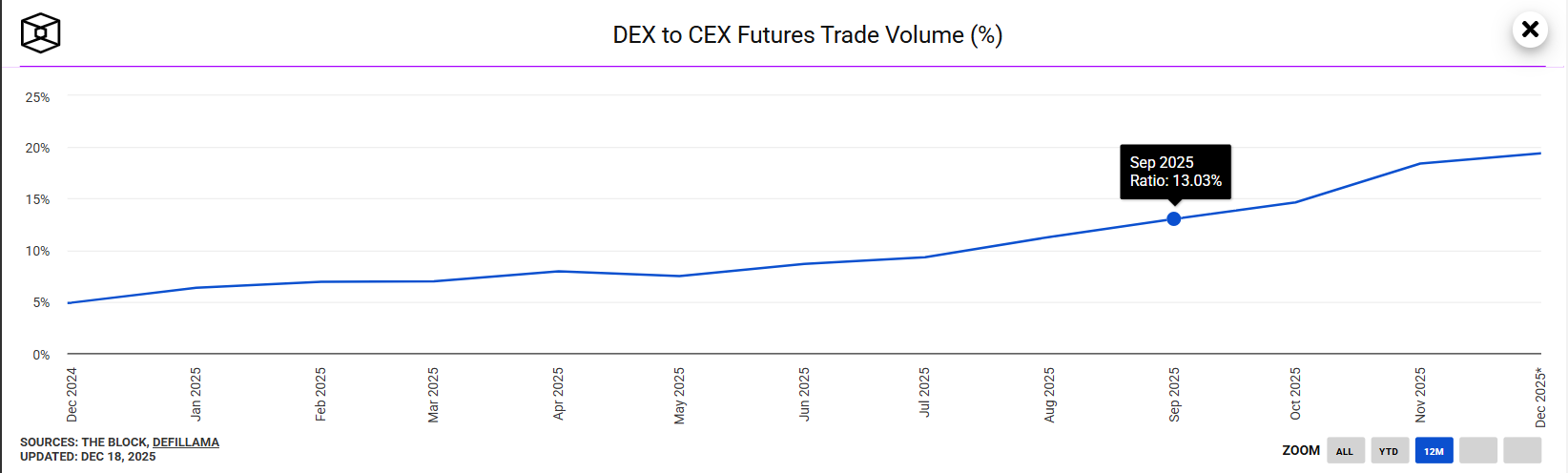

Decentralized perpetual trading platforms control over 8% of the total crypto Perps trading activity, challenging centralized exchanges for a share of the market. Crypto investors’ preference for decentralized perpetual exchanges is growing thanks to key attractions like privacy and financial security.

Image Source – Theblock.co

For a better understanding of how decentralized perpetual exchanges work, we will discuss the technical aspects of decentralized perpetual swaps and how they handle systemic operations to deliver a seamless perps trading experience for crypto traders.

We assume that anyone reading this article is already familiar with perpetual contracts and understands the basic concepts of crypto perpetual trading, such as funding rates.

Understanding Decentralized Perpetual Exchange

Decentralized perpetual exchanges are non-custodial protocols for trading crypto perpetual contracts. They leverage decentralized networks and smart contract technology to engineer an operational system that handles perpetual contract trades and processes like trade settlement, liquidation, and funding fee remittances.

Unlike centralized exchanges, decentralized exchanges do not rely on centralized systems for price updates and order matching, nor do they require third parties, such as clearinghouses, to operate. Therefore, to efficiently handle trading and settlements, it must develop a self-sufficient system that mostly works onchain. Systems that make this possible are the key components of the protocol

Primary Components of Decentralized Perpetual Exchanges

The primary components of a Decentralized perpetual exchange are the major systems that work in unison to handle perpetual swaps and achieve a functional trading system. They include;

Liquidity and Order Matching System

The liquidity and order matching system handles user trader requests. Decentralized swaps are unique in the order matching system, but can be classified under;

1. AMM Perpetual DEX

AMM-style perpetual Dexes use liquidity pools to serve trade requests. Assets in the liquidity pool are contributed by independent liquidity providers who are entitled to an equivalent share of the trading fees paid by traders. Traders borrow from the pools to the tune of their leverage multiplier.

2. Order Book Perpetual DEX

Order book-style perpetual swaps use onchain or hybrid order books to match trades. Counterparties are matched according to trade requests by validators who use a price-time priority matching system.

3. Hybrid Perpetual DEX

Hybrid Perpetual Dexes use a Request For Quote (RFQ) to match trade requests. This is similar to the intent-based model on Decentralized swaps. A taker creates an order (request) specifying the pair, size, side (long or short), and settlement requirements. The request is sent to a network of off-chain makers who compute a quote. Takers select from available quotes according to their preference. The transaction is then signed and settled onchain.

Read More: Order Book vs AMM vs. Peer to Pool

Price Data System

Decentralized perpetual swaps use decentralized Oracle networks like Chainlink to provide accurate and precise pricing data for the protocol. Price data are essential; most protocols resort to trusted Oracles only.

Risk Management System

Decentralized perpetual exchanges operate a risk engine that manages associated platform risks. The risk engine is a set of smart contracts that handle position liquidation, specify Auto-Deleveraging Mechanisms (ADL), and other procedures that safeguard the platform from bad loans and ensure seamless operation.

Platform Governance

Most decentralized perpetual swap protocols are managed by the community in the DAO style. Through governance processes that often utilize the protocol’s native token, community members decide important aspects of the protocol like fees, risk limits, treasuries, asset listings, and technical upgrades.

Trade Settlement

How a decentralized perpetual exchange settles payment for winning trades depends on its order-matching system.

1. AMM Perpetual DEX

Liquidity providers in an AMM-style perpetual Dexs (like GMX and Gains network) trade against traders on the platform. That is, if a trader takes a short position on an asset pool, the liquidity providers automatically take a long position.

For a winning trade, traders are settled from the liquidity pool. However, this settlement is usually compensated with liquidations from other traders in an opposite position, trading fees, and other management fees.

2. Order Book Perpetual DEX

Settlement on order book-style perpetual dex (like dYdX and Hyperliquid) is similar to centralized derivative exchanges. Winning profits are paid from the losing traders’ collateral.

Order book-style perps exchanges usually operate an insurance fund or vault that covers imbalances or bankrupt positions (for example, the HLP vault on Hyperliquid). These vaults are funded by fees and liquidated funds. In extreme cases, they use Auto-deleveraging (ADL) mechanisms to reduce profitable positions to balance.

3. Hybrid Perpetual DEX

Settlements are executed as specified in the quote accepted by the taker and maker during trade initiation.

In summary, when you create or take an order on a decentralized perpetual exchange, the matching system executes the trade using the liquidity pool or orderbook. The position is managed by the protocol by

Maintaining custody of the collateral using a smart contract

Using decentralized oracles to fetch the time-weighted average price (TWAP) of the asset,

Computing margins, funding rates, and the resulting funding fee for every interval, and handling remittances when due.

When you close a profitable trade, the protocol settles the payment from the liquidity pool or counter order. The risk-management system protects the protocol using the liquidation contract to close bad positions and Auto-deleveraging mechanisms to continuously safeguard the protocol.

Risks Associated with Decentralized Perpetual Exchanges

Here are some risks that may be associated with decentralized crypto perpetual contract trading platforms,

Smart Contract risk

Decentralized perp swaps run extensively on smart contracts and may be exposed to smart contract-related risks. Vulnerabilities like reentrancy attacks, malicious functions, syntax errors, and math errors may affect the protocol’s operation and cause significant losses for users.

Liquidity Constraints

Unlike a centralized perpetuals trading platform, decentralized perps swaps are still used by a smaller percentage of traders. Institutional market makers and traders are still exploring decentralized perps, while some have chosen to stay away due to regulatory uncertainties.

As a result, decentralized perpetual contract trading platforms are less liquid than their centralized alternatives. Low liquidity leads to high slippage and erodes users’ capital and profits significantly.

Regulatory Uncertainties

Decentralized perpetual swaps offer privacy; users are not required to verify their identities to use the protocols. This, however, attracts regulatory consequences. Decentralized swaps are in the grey zone of regulatory procedures. While this may improve in the future, current regulatory uncertainties limit usage and mass adoption.

Price Data-related Risks

Pricing is essential in Perps trading as even small price differences may have significant consequences. Decentralized perps swaps use decentralized oracles to feed the protocol with asset prices; this system is prone to manipulation and malfunctioning. Price data-related risks like delays in Oracle price updates during volatile conditions, onchain price manipulations through flash loans, and inconsistency in data aggregation can lead to significant UX constraints and losses, as the case may be.

Systemic Risks

Other systemic risks like poor interaction between key components, onchain issues like MEV exploits, and blockchain delays may also affect the operations of a decentralized perpetual exchange. These issues do not apply to centralized derivative trading platforms.

Generally, decentralized perps trading platforms are less refined than centralized trading platforms. Contemporary protocols are consistently working on improvements, but regardless, these systemic risks exist.

Conclusion

Decentralized perpetual exchanges offer self-custody privileges like privacy, accessibility, and security. Despite several risks, they serve a significant percentage of crypto investors and create new possibilities for blockchain technology. We discussed how these platforms work, highlighting the systems that handle the cores of perpetual swaps on decentralized exchanges.

For the everyday perp trader, a good understanding of these technical basics enables better usage and may influence trading strategies. However, we recommend that users on decentralized perpetual trading platforms understand the associated risks and adjust their operations accordingly.

Keep in mind that Decentralized perps trading as a technology is still young, and many systems are prone to changes and malfunctions.