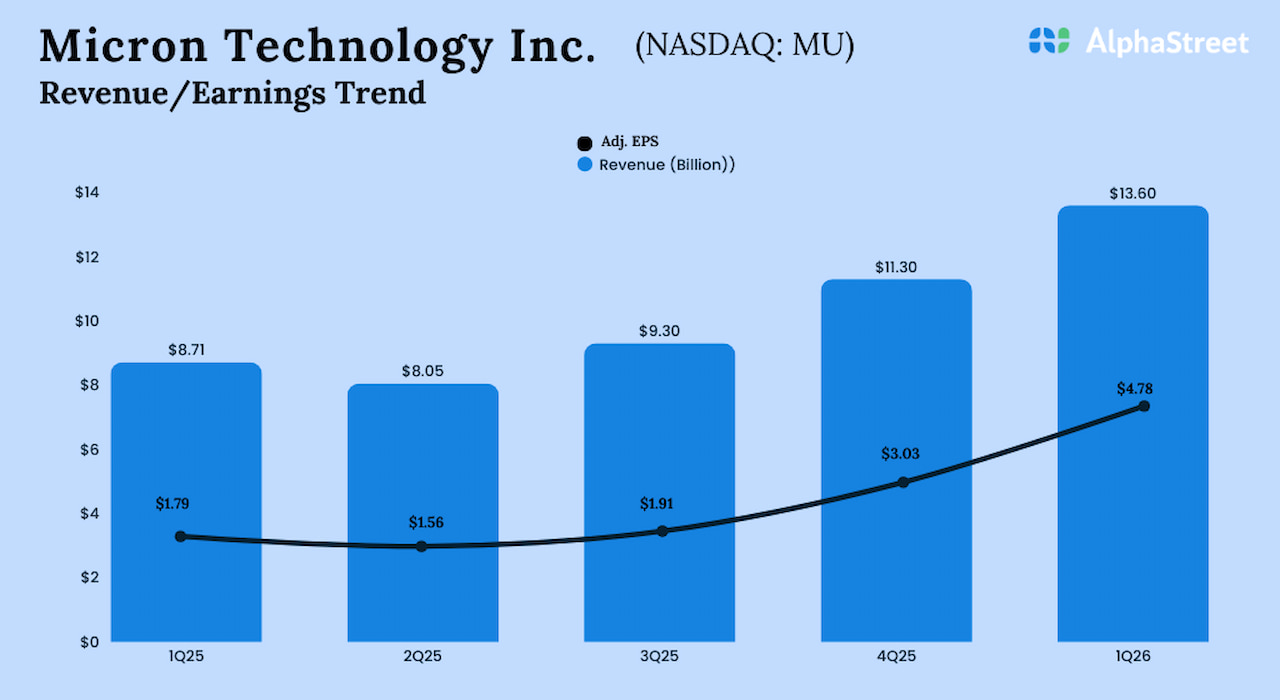

Memory chipmaker Micron Technology Inc. (NASDAQ: MU) on Wednesday reported stronger-than-expected earnings for the first quarter of fiscal 2026. Revenue increased 57% year-over-year.

First-quarter revenues rose sharply to $13.6 billion from $8.71 billion in the corresponding period of 2025, exceeding Wall Street’s expectations.

Adjusted earnings were $4.78 per share in the first quarter, compared to $1.79 per share in the year-ago period. Earnings beat estimates. On an unadjusted basis, net income was $5.20 billion or $4.60 per share in Q1, compared to $1.87 billion or $1.67 per share in the prior-year quarter.

For the second quarter, the Micron leadership forecasts revenues of $18.7 billion ± $400 million. The forecast for Q2 earnings per share, on an adjusted basis, is $8.42 ± $0.20.

Commenting on the results, Micron’s CEO Sanjay Mehrotra said, “Our Q2 outlook reflects substantial records across revenue, gross margin, EPS and free cash flow, and we anticipate our business performance to continue strengthening through fiscal 2026. Micron’s technology leadership, differentiated product portfolio, and strong operational execution position us as an essential AI enabler, and we are investing to support our customers’ growing need for memory and storage.”

The post Micron Q1 2026 earnings beat estimates; revenue surges 57% first appeared on AlphaStreet.