Shares of Lowe’s Companies, Inc. (NYSE: LOW) turned red in midday trade on Thursday. The stock has dropped 10% over the past three months. The home improvement retailer put up a slightly better performance in the third quarter of 2025 compared to its rival Home Depot, delivering growth in both revenue and earnings versus the previous year, but it still faced headwinds from an uncertain macro environment. The company revised its outlook for the full year, raising expectations for sales but keeping its earnings forecast at the low end of its previous range.

Sales and earnings growth

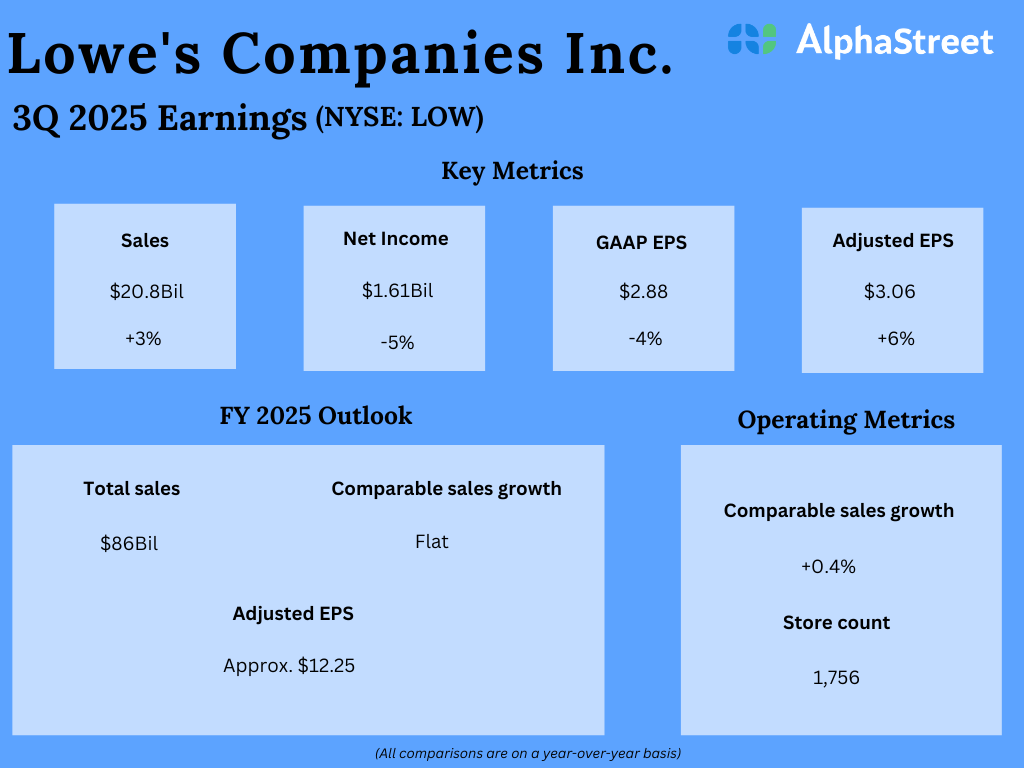

In the third quarter of 2025, Lowe’s sales increased 3% year-over-year to $20.8 billion. Comparable sales rose 0.4%, helped by double-digit growth in online sales and home services, along with continued sales growth in the Pro segment. Earnings, on an adjusted basis, grew 6% to $3.06 per share.

Consumer trends

As mentioned on the earnings call, in Q3, Lowe’s top line was pressured by soft demand in an uncertain macro environment, but the company saw improvement in DIY customer engagement and discretionary projects across many areas of the home. Similar to its peer HD, LOW saw comps turn negative in October, due to the lack of storm-related repair demand seen last year.

The retailer delivered positive comps in most of its product categories during the quarter. Comparable average ticket rose 3.4%, helped by strength in Pro and appliances, a shift in mix to larger-ticket purchases and modest price increases. Large discretionary purchases remain pressured by affordability and economic uncertainty.

Total Home Strategy

Lowe’s is performing well on all key initiatives of its Total Home Strategy. The company continues to see growth with small to medium Pro customers. It is improving its Pro offering through the Pro Extended Aisle, where sales associates can sell directly from their catalogs and suppliers can deliver directly to job sites. This helps expand product assortment and delivery capabilities for larger projects.

In online, LOW saw sales growth of 11.4% in Q3, driven by higher traffic and strong conversion. The company is working on improving the shopping experience across Lowes.com and its mobile app for both DIY and Pro customers. Lowe’s is gaining traction through its Loyalty ecosystem. The My Lowe’s Rewards program has 30 million members who spend 50% more than non-members.

In Home Services, the retailer saw double-digit growth with broad-based strength across product categories such as windows and doors, HVAC, and kitchens and bath. Under its Increasing Space Productivity initiative, the company is focusing on driving incremental sales opportunities through the optimization of its sales footprint. As part of this, it rolled out its Rural format in 150 additional stores in Q3, bringing the total to around 500. It is also on track to roll out the Workwear and Pet assortments to more than 1,000 stores.

Updated guidance

Lowe’s anticipates continued uncertainty in the macro environment, and there is no clarity on when there may be an inflection in the home improvement market. Against this backdrop, the company updated its guidance for fiscal-year 2025. It now expects total sales of $86 billion, which includes sales of around $1.3 billion from FBM. Comparable sales are now expected to be flat, which is at the bottom end of the previous guidance. Adjusted EPS is now projected to be approx. $12.25, which represents a 2% YoY growth, but is also at the bottom end of the prior range.