Updated on November 19th, 2025 by Bob Ciura

Stocks with low P/E ratios can offer attractive returns if their valuation multiples expand.

And when a low P/E stock also has a high dividend yield, investors get ‘paid to wait’ for the valuation multiple to increase.

We define a high-yield stock as one with a current dividend yield of 5% or higher.

The free high dividend stocks list spreadsheet below has our full list of individual securities (stocks, REITs, MLPs, etc.) with with 5%+ dividend yields.

You can download a free copy by clicking on the link below:

In this research report, we discuss the prospects of 20 undervalued high dividend stocks, which are currently trading at P/E ratios under 10 and are offering dividend yields above 5.0%.

International stocks were excluded from this report.

We have ranked the stocks by P/E ratio, from lowest to highest. For REITs, we use P/FFO in place of the P/E ratio. And for MLPs, we use P/DCF (which is distributable cash flows).

These are comparable metrics similar to earnings for common stocks.

These 20 dividend stocks have not been screened for dividend safety. Instead, these are the 20 most undervalued stocks in the Sure Analysis Research Database with high dividend yields.

Table of Contents

Keep reading to see analysis on these 20 undervalued high dividend stocks.

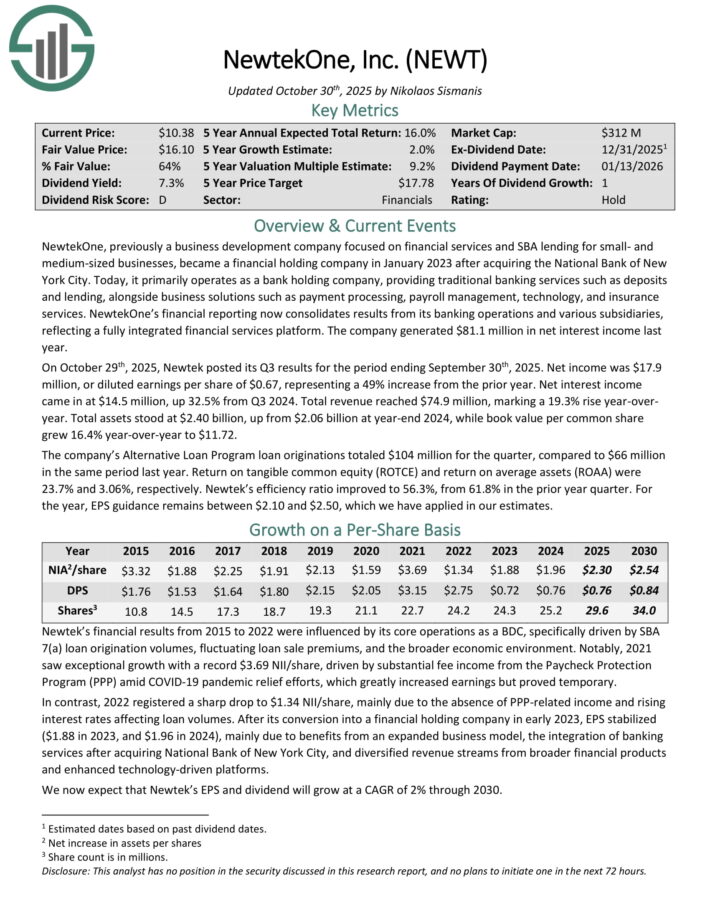

Undervalued High Dividend Stock #1: NewtekOne Inc. (NEWT) – P/E ratio of 4.2

NewtekOne, previously a business development company focused on financial services and SBA lending for small- and medium-sized businesses, became a financial holding company in January 2023 after acquiring the National Bank of New York City.

Today, it primarily operates as a bank holding company, providing traditional banking services such as deposits and lending, alongside business solutions such as payment processing, payroll management, technology, and insurance services.

NewtekOne’s financial reporting now consolidates results from its banking operations and various subsidiaries, reflecting a fully integrated financial services platform. The company generated $81.1 million in net interest income last year.

On October 29th, 2025, Newtek posted its Q3 results. Net income was $17.9 million, or diluted earnings per share of $0.67, representing a 49% increase from the prior year. Net interest income came in at $14.5 million, up 32.5% from Q3 2024.

Total revenue reached $74.9 million, marking a 19.3% rise year-over-year. Total assets stood at $2.40 billion, up from $2.06 billion at year-end 2024, while book value per common share grew 16.4% year-over-year to $11.72.

The company’s Alternative Loan Program loan originations totaled $104 million for the quarter, compared to $66 million in the same period last year. Return on tangible common equity (ROTCE) and return on average assets (ROAA) were 23.7% and 3.06%, respectively.

Click here to download our most recent Sure Analysis report on NEWT (preview of page 1 of 3 shown below):

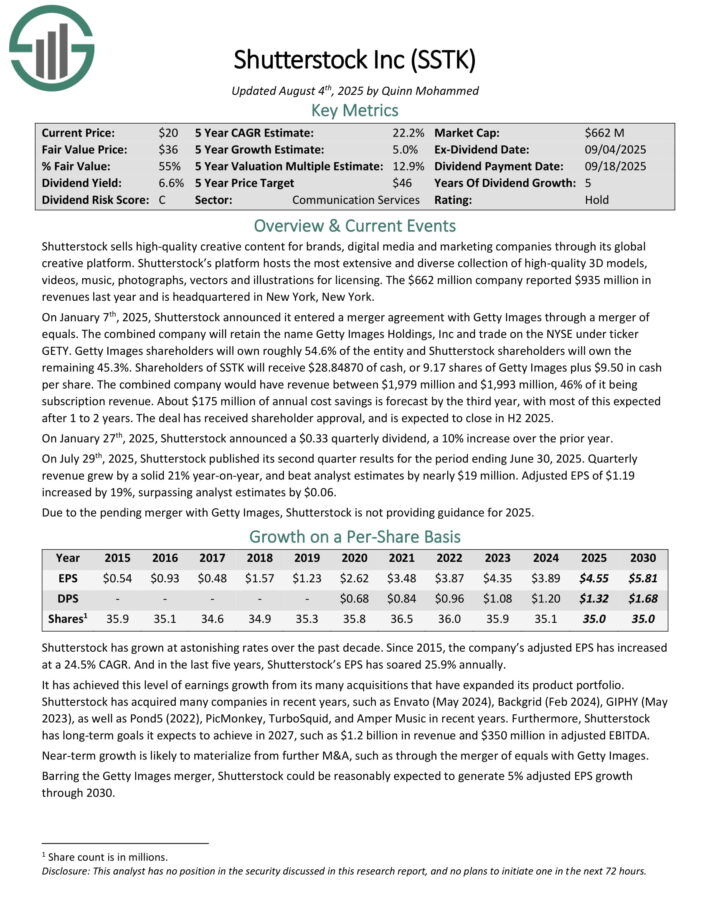

Undervalued High Dividend Stock #2: Shutterstock, Inc. (SSTK) – P/E ratio of 4.5

Shutterstock sells high-quality creative content for brands, digital media and marketing companies through its global creative platform.

Its platform hosts the most extensive and diverse collection of high-quality 3D models, videos, music, photographs, vectors and illustrations for licensing. The company reported $935 million in revenues last year.

On January 7th, 2025, Shutterstock announced it entered a merger agreement with Getty Images through a merger of equals. The combined company will retain the name Getty Images Holdings, Inc and trade on the NYSE under ticker GETY.

Getty Images shareholders will own roughly 54.6% of the entity and Shutterstock shareholders will own the remaining 45.3%. Shareholders of SSTK will receive $28.84870 of cash, or 9.17 shares of Getty Images plus $9.50 in cash per share.

The combined company would have revenue between $1,979 million and $1,993 million, 46% of it being subscription revenue. About $175 million of annual cost savings is forecast by the third year, with most of this expected after 1 to 2 years.

On July 29th, 2025, Shutterstock published its second quarter results for the period ending June 30, 2025. Quarterly revenue grew by a solid 21% year-on-year, and beat analyst estimates by nearly $19 million. Adjusted EPS of $1.19 increased by 19%, surpassing analyst estimates by $0.06.

Click here to download our most recent Sure Analysis report on SSTK (preview of page 1 of 3 shown below):

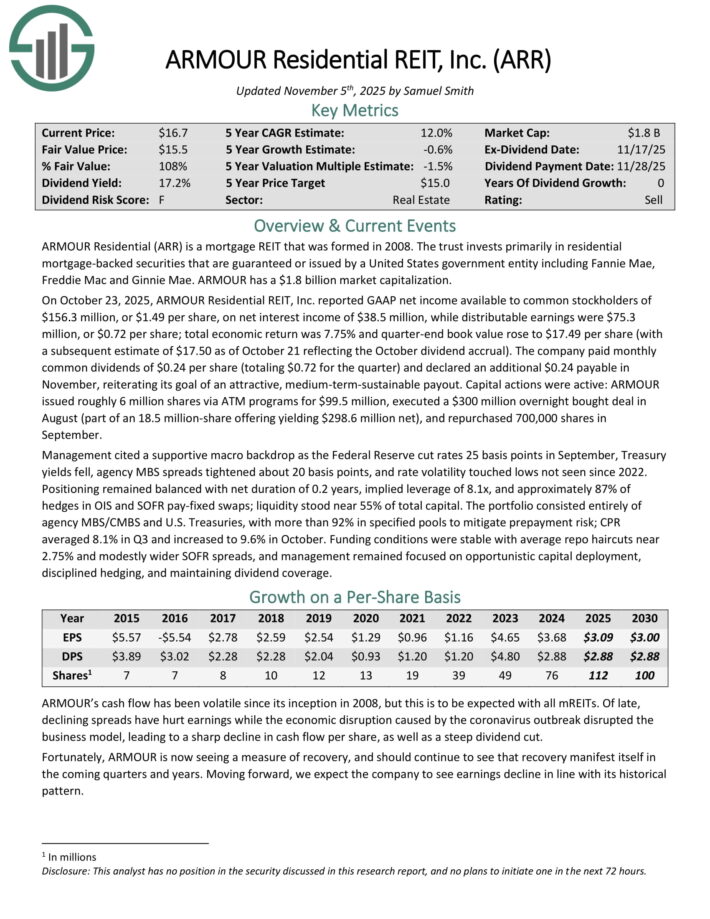

Undervalued High Dividend Stock #3: ARMOUR Residential REIT (ARR) – P/E ratio of 5.4

ARMOUR Residential invests in residential mortgage-backed securities that include U.S. Government-sponsored entities (GSE) such as Fannie Mae and Freddie Mac.

It also includes Ginnie Mae, the Government National Mortgage Administration’s issued or guaranteed securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate home loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, money market instruments, and non-GSE or government agency-backed securities are examples of other types of investments.

On October 23, 2025, ARMOUR Residential REIT reported GAAP net income available to common stockholders of $156.3 million, or $1.49 per share, on net interest income of $38.5 million, while distributable earnings were $75.3 million, or $0.72 per share.

Total economic return was 7.75% and quarter-end book value rose to $17.49 per share. The company paid monthly common dividends of $0.24 per share (totaling $0.72 for the quarter) and declared an additional $0.24 payable in November.

Click here to download our most recent Sure Analysis report on ARMOUR Residential REIT Inc (ARR) (preview of page 1 of 3 shown below):

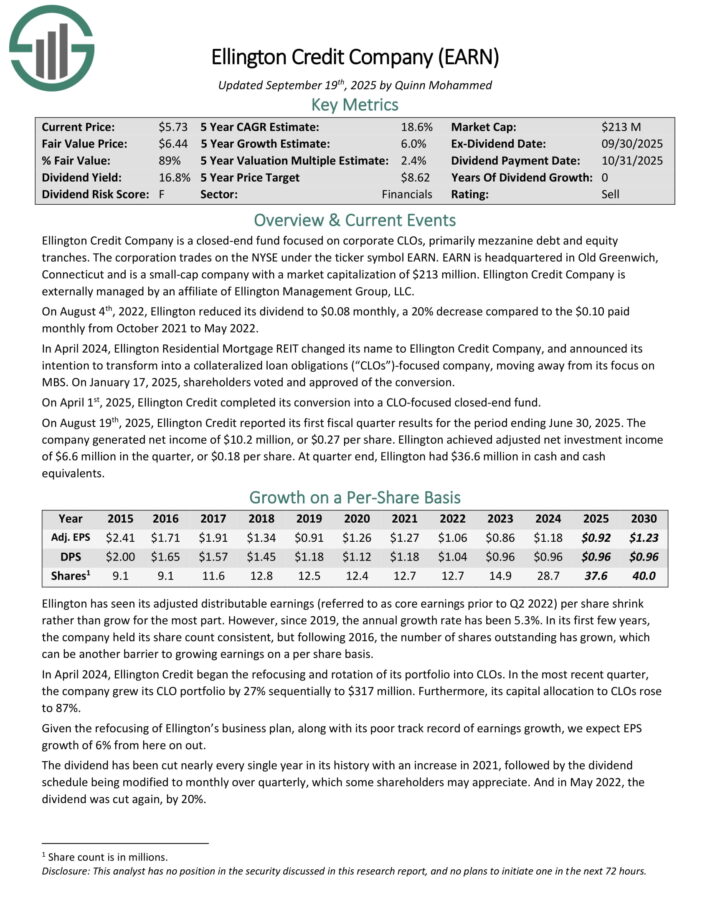

Undervalued High Dividend Stock #4: Ellington Credit Co. (EARN) – P/E ratio of 5.6

Ellington Credit Co. acquires, invests in, and manages residential mortgage and real estate related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government–sponsored enterprise.

Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

On August 19th, 2025, Ellington Credit reported its first fiscal quarter results for the period ending June 30, 2025. The company generated net income of $10.2 million, or $0.27 per share.

Ellington achieved adjusted net investment income of $6.6 million in the quarter, or $0.18 per share. At quarter end, Ellington had $36.6 million in cash and cash equivalents.

Click here to download our most recent Sure Analysis report on EARN (preview of page 1 of 3 shown below):

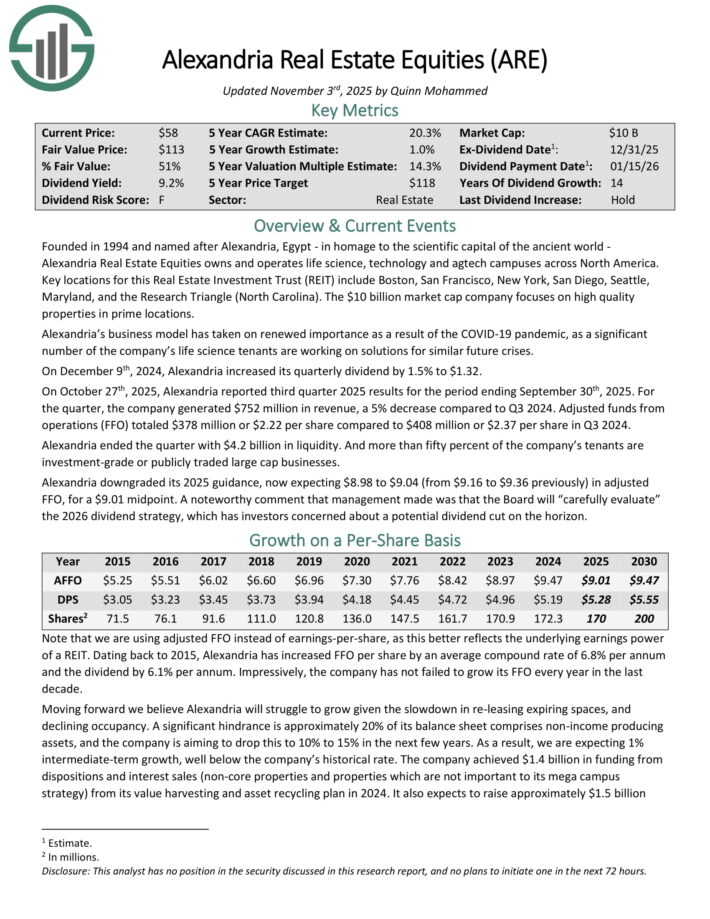

Undervalued High Dividend Stock #5: Alexandria Real Estate Equities (ARE) – P/E ratio of 5.6

Alexandria Real Estate Equities owns and operates life science, technology and ag-tech campuses across North America.

Key locations for this Real Estate Investment Trust (REIT) include Boston, San Francisco, New York, San Diego, Seattle, Maryland, and the Research Triangle (North Carolina).

On October 27th, 2025, Alexandria reported third quarter 2025 results for the period ending September 30th, 2025. For the quarter, the company generated $752 million in revenue, a 5% decrease compared to Q3 2024.

Adjusted funds from operations (FFO) totaled $378 million or $2.22 per share compared to $408 million or $2.37 per share in Q3 2024.

Alexandria ended the quarter with $4.2 billion in liquidity. And more than fifty percent of the company’s tenants are investment-grade or publicly traded large cap businesses.

Alexandria downgraded its 2025 guidance, now expecting $8.98 to $9.04 (from $9.16 to $9.36 previously) in adjusted FFO.

Click here to download our most recent Sure Analysis report on ARE (preview of page 1 of 3 shown below):

Undervalued High Dividend Stock #6: Horizon Technology Finance (HRZN) – P/E ratio of 5.7

Horizon Technology Finance Corp. is a BDC that provides venture capital to small and medium–sized companies in the technology, life sciences, and healthcare–IT sectors.

The company has generated attractive risk–adjusted returns through directly originated senior secured loans and additional capital appreciation through warrants.

On August 7th, 2025, Horizon announced its Q2 results for the period ending June 30th, 2025. For the quarter, total investment income fell 4.5% year-over-year to $24.5 million, primarily due to lower interest income on investments from the debt investment portfolio.

More specifically, the company’s dollar-weighted annualized yield on average debt investments in Q2 of 2025 and Q2 of 2024 was 15.8% and 15.9%, respectively.

Net investment income per share (IIS) fell to $0.28, down from $0.36 compared to Q2-2024. Net asset value (NAV) per share landed at $6.75, down from $9.12 year-over-year and $8.43 sequentially.

After paying its monthly distributions, Horizon’s undistributed spillover income as of the end of the quarter was $0.94 per share, indicating a considerable cash cushion. Management assured investors of the dividend’s stability by declaring three forward monthly dividends at a rate of $0.11.

Click here to download our most recent Sure Analysis report on HRZN (preview of page 1 of 3 shown below):

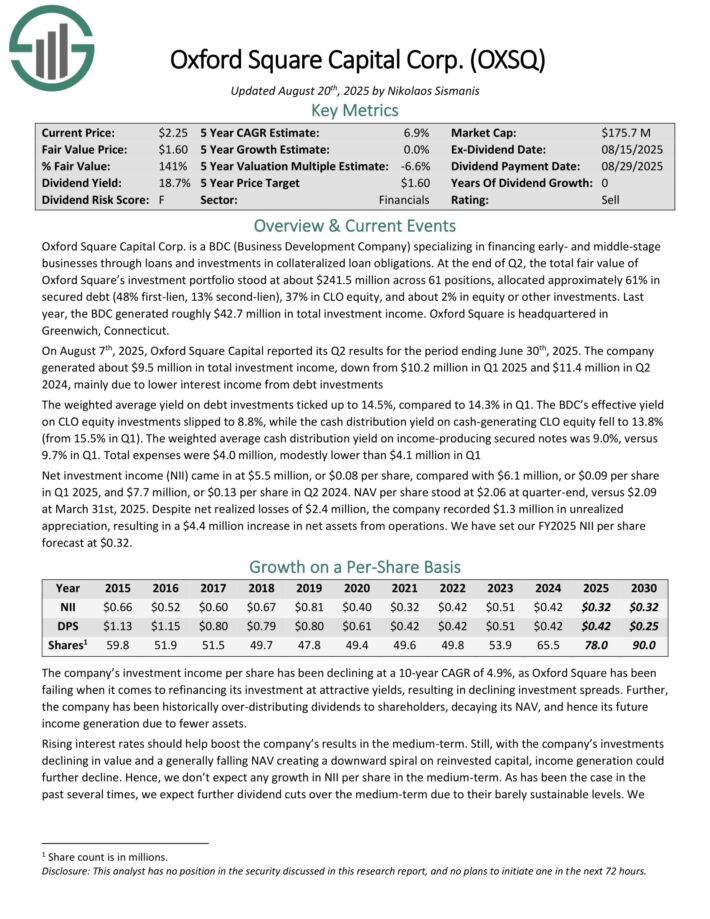

Undervalued High Dividend Stock #7: Oxford Square Capital (OSXQ) – P/E ratio of 5.9

Oxford Square Capital Corp. is a BDC (Business Development Company) specializing in financing early- and middle-stage businesses through loans and investments in collateralized loan obligations.

At the end of last quarter, the total fair value of Oxford Square’s investment portfolio stood at about $243.2 million across 61 positions, allocated approximately 61% in secured debt (48% first-lien, 13% second-lien), 38% in CLO equity, and about 1% in equity or other investments. Last year, the BDC generated roughly $42.7 million in total investment income.

On August 7th, 2025, Oxford Square Capital reported its Q2 results for the period ending June 30th, 2025. The company generated about $9.5 million in total investment income, down from $10.2 million in Q1 2025 and $11.4 million in Q2 2024, mainly due to lower interest income from debt investments.

The weighted average yield on debt investments ticked up to 14.5%, compared to 14.3% in Q1. The BDC’s effective yield on CLO equity investments slipped to 8.8%, while the cash distribution yield on cash-generating CLO equity fell to 13.8% (from 15.5% in Q1).

The weighted average cash distribution yield on income-producing secured notes was 9.0%, versus 9.7% in Q1. Total expenses were $4.0 million, modestly lower than $4.1 million in Q1.

Net investment income (NII) came in at $5.5 million, or $0.08 per share, compared with $6.1 million, or $0.09 per share in Q1 2025, and $7.7 million, or $0.13 per share in Q2 2024.

Click here to download our most recent Sure Analysis report on OXSQ (preview of page 1 of 3 shown below):

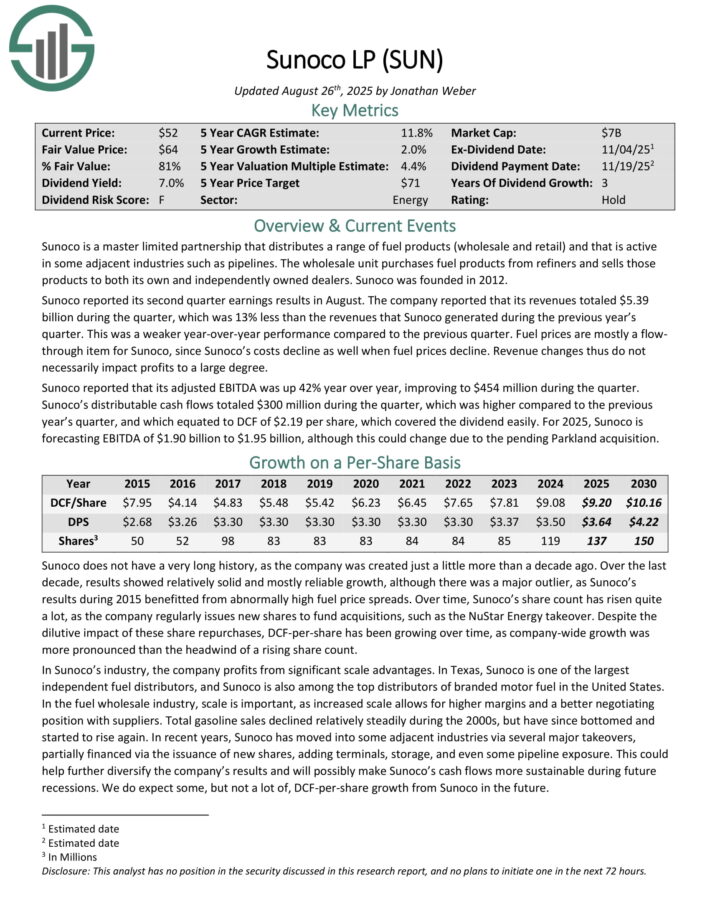

Undervalued High Dividend Stock #8: Sunoco LP (SUN) – P/E ratio of 5.9

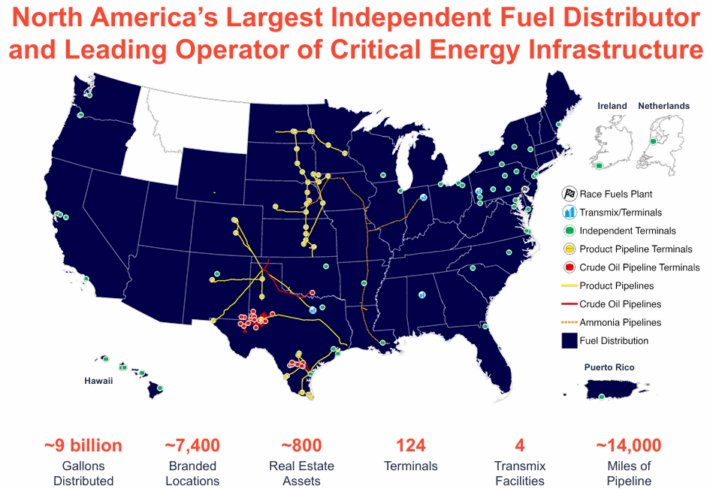

Sunoco is a master limited partnership that distributes a range of fuel products (wholesale and retail) and that is active in some adjacent industries such as pipelines.

The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently owned dealers.

Source: Investor Presentation

Sunoco reported its second quarter earnings results in August. The company reported that its revenues totaled $5.39 billion during the quarter, which was 13% less than the revenues that Sunoco generated during the previous year’s quarter.

This was a weaker year-over-year performance compared to the previous quarter. Fuel prices are mostly a flow through item for Sunoco, since Sunoco’s costs decline as well when fuel prices decline. Revenue changes thus do not necessarily impact profits to a large degree.

Sunoco reported that its adjusted EBITDA was up 42% year over year, improving to $454 million during the quarter. Sunoco’s distributable cash flows totaled $300 million during the quarter. This was higher compared to the previous year’s quarter, and equated to DCF of $2.19 per share, which covered the dividend easily.

Click here to download our most recent Sure Analysis report on SUN (preview of page 1 of 3 shown below):

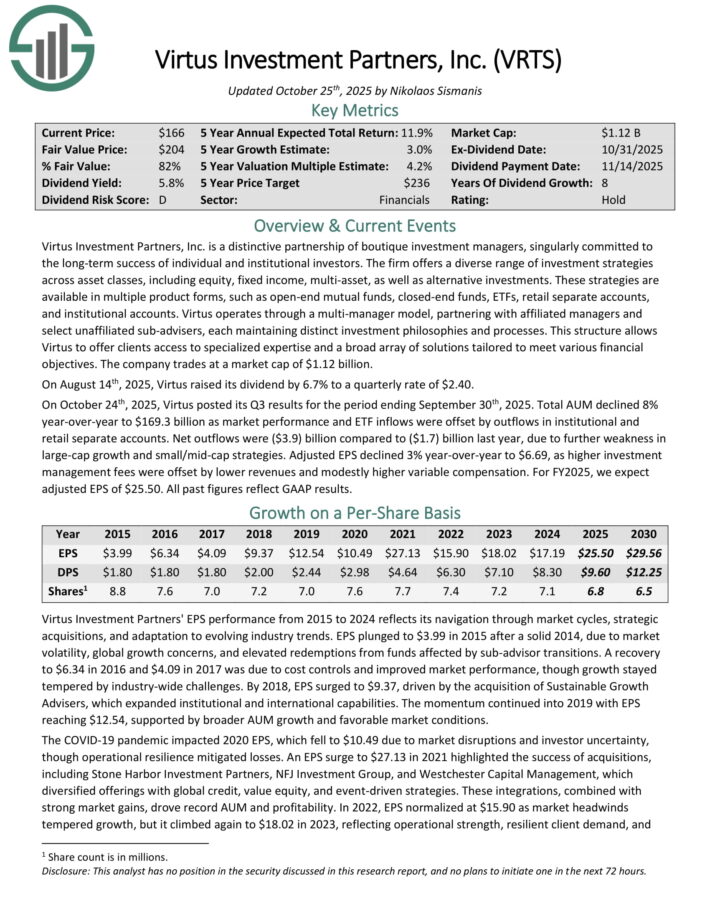

Undervalued High Dividend Stock #9: Virtus Investment Partners (VRTS) – P/E ratio of 6.1

Virtus Investment Partners, Inc. is a distinctive partnership of boutique investment managers. The firm offers a diverse range of investment strategies across asset classes, including equity, fixed income, multi-asset, as well as alternative investments.

These strategies are available in multiple product forms, such as open-end mutual funds, closed-end funds, ETFs, retail separate accounts, and institutional accounts.

Virtus operates through a multi-manager model, partnering with affiliated managers and select unaffiliated sub-advisers, each maintaining distinct investment philosophies and processes.

This structure allows Virtus to offer clients access to specialized expertise and a broad array of solutions tailored to meet various financial objectives.

On October 24th, 2025, Virtus posted its Q3 results for the period ending September 30th, 2025. Total AUM declined 8% year-over-year to $169.3 billion as market performance and ETF inflows were offset by outflows in institutional and retail separate accounts.

Net outflows were ($3.9) billion compared to ($1.7) billion last year, due to further weakness in large-cap growth and small/mid-cap strategies. Adjusted EPS declined 3% year-over-year to $6.69.

Click here to download our most recent Sure Analysis report on VRTS (preview of page 1 of 3 shown below):

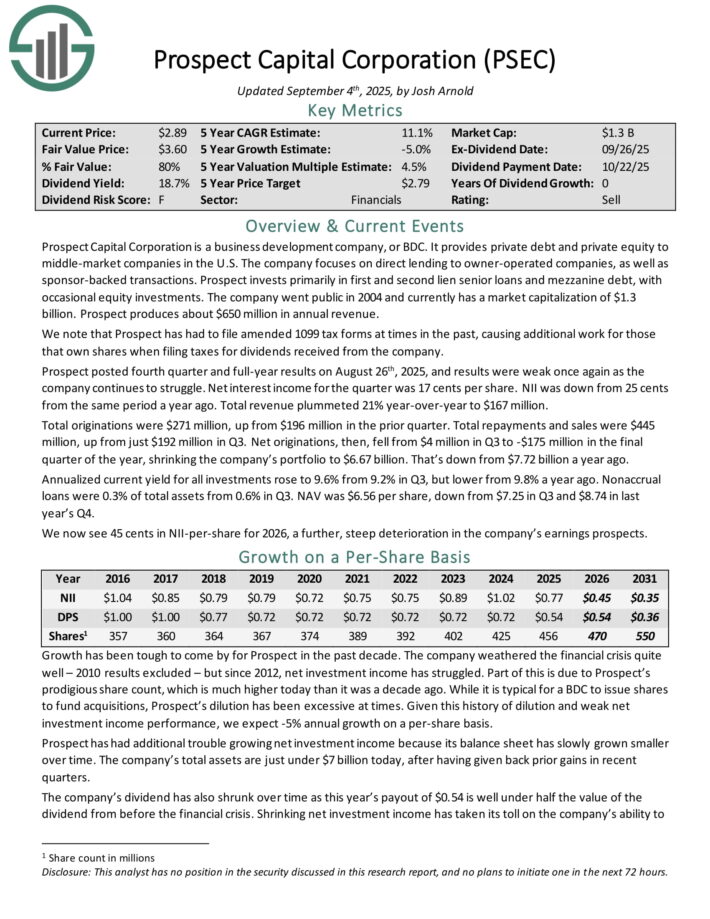

Undervalued High Dividend Stock #10: Prospect Capital (PSEC) – P/E ratio of 6.2

Prospect Capital Corporation is a Business Development Company, or BDC, that provides private debt and private equity to middle–market companies in the U.S.

The company focuses on direct lending to owner–operated companies, as well as sponsor–backed transactions. Prospect invests primarily in first and second lien senior loans and mezzanine debt, with occasional equity investments.

Prospect posted fourth quarter and full-year results on August 26th, 2025, and results were weak once again as the company continues to struggle. Net interest income for the quarter was 17 cents per share. NII was down from 25 cents from the same period a year ago. Total revenue plummeted 21% year-over-year to $167 million.

Total originations were $271 million, up from $196 million in the prior quarter. Total repayments and sales were $445 million, up from just $192 million in Q3. Net originations, then, fell from $4 million in Q3 to -$175 million in the final quarter of the year, shrinking the company’s portfolio to $6.67 billion. That’s down from $7.72 billion a year ago.

Annualized current yield for all investments rose to 9.6% from 9.2% in Q3, but lower from 9.8% a year ago.

Click here to download our most recent Sure Analysis report on PSEC (preview of page 1 of 3 shown below):

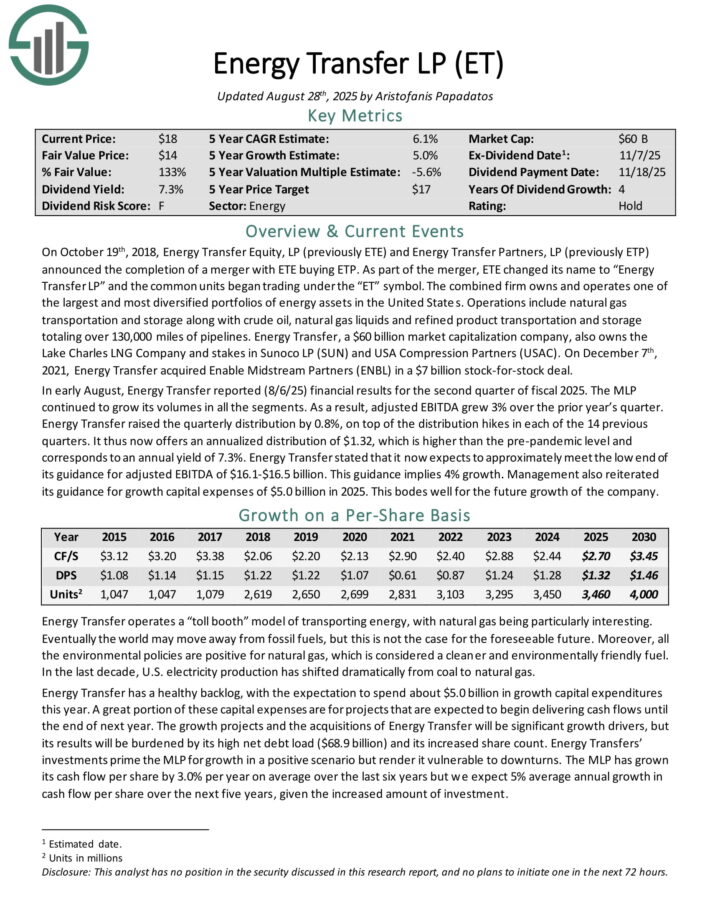

Undervalued High Dividend Stock #11: Energy Transfer LP (ET) – P/E ratio of 6.3

Energy Transfer LP owns and operates one of the largest and most diversified portfolios of energy assets in the United States. Operations include natural gas transportation and storage along with crude oil, natural gas liquids and refined product transportation and storage totaling over 130,000 miles of pipelines.

Energy Transfer also owns the Lake Charles LNG Company and stakes in Sunoco LP (SUN) and USA Compression Partners (USAC).

In early August, Energy Transfer reported (8/6/25) financial results for the second quarter of fiscal 2025. The MLP continued to grow its volumes in all the segments. As a result, adjusted EBITDA grew 3% over the prior year’s quarter.

Energy Transfer raised the quarterly distribution by 0.8%, on top of the distribution hikes in each of the 14 previous quarters.

Energy Transfer stated that it now expects to approximately meet the low end of its guidance for adjusted EBITDA of $16.1-$16.5 billion. This guidance implies 4% growth.

Click here to download our most recent Sure Analysis report on ET (preview of page 1 of 3 shown below):

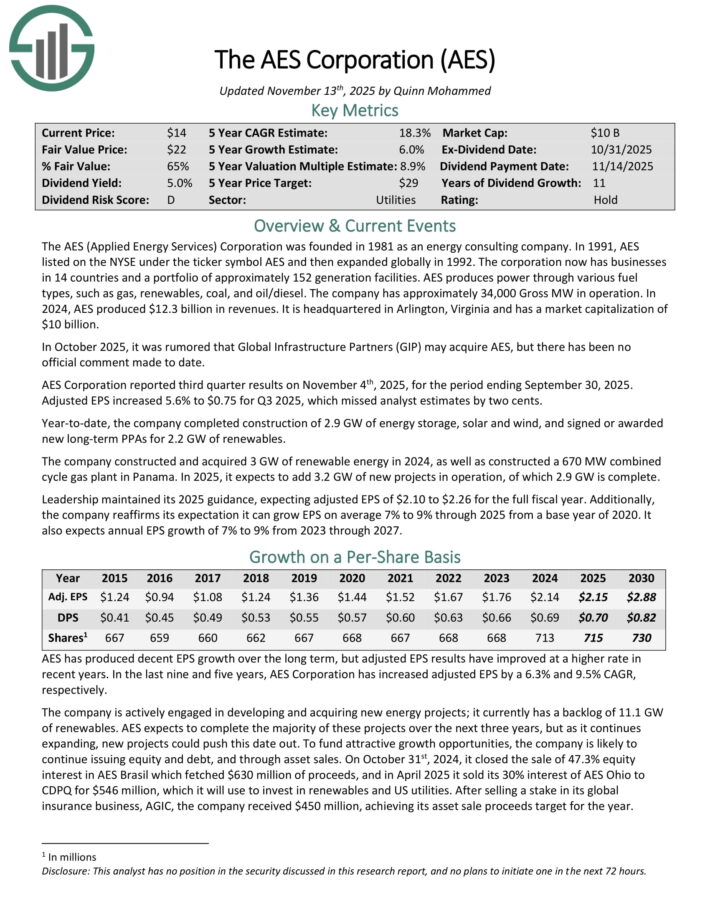

Undervalued High Dividend Stock #12: AES Corp. (AES) – P/E ratio of 6.4

AES is a utility stock with businesses in 14 countries and a portfolio of approximately 152 generation facilities. AES produces power through various fuel types, such as gas, renewables, coal, and oil/diesel.

The company has approximately 34,000 Gross MW in operation. In 2024, AES produced $12.3 billion in revenues.

AES Corporation reported third quarter results on November 4th, 2025, for the period ending September 30, 2025. Adjusted EPS increased 5.6% to $0.75 for Q3 2025, which missed analyst estimates by two cents.

Year-to-date, the company completed construction of 2.9 GW of energy storage, solar and wind, and signed or awarded new long-term PPAs for 2.2 GW of renewables.

The company constructed and acquired 3 GW of renewable energy in 2024, as well as constructed a 670 MW combined cycle gas plant in Panama. In 2025, it expects to add 3.2 GW of new projects in operation, of which 2.9 GW is complete.

Leadership maintained its 2025 guidance, expecting adjusted EPS of $2.10 to $2.26 for the full fiscal year.

Additionally, the company reaffirms its expectation it can grow EPS on average 7% to 9% through 2025 from a base year of 2020. It also expects annual EPS growth of 7% to 9% from 2023 through 2027.

Click here to download our most recent Sure Analysis report on AES (preview of page 1 of 3 shown below):

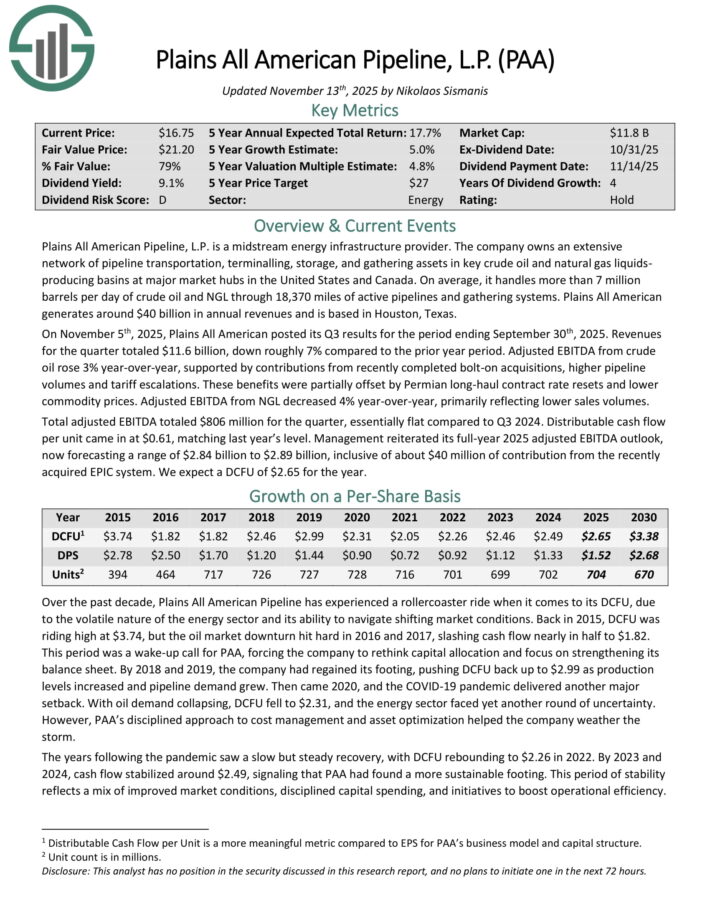

Undervalued High Dividend Stock #13: Plains All American Pipeline LP (PAA) – P/E ratio of 6.4

Plains All American Pipeline, L.P. is a midstream energy infrastructure provider. The company owns an extensive network of pipeline transportation, terminaling, storage, and gathering assets in key crude oil and natural gas liquids producing basins at major market hubs in the United States and Canada.

On average, it handles more than 7 million barrels per day of crude oil and NGL through 18,370 miles of active pipelines and gathering systems. Plains All American generates around $40 billion in annual revenues and is based in Houston, Texas.

On November 5th, 2025, Plains All American posted its Q3. Revenues for the quarter totaled $11.6 billion, down roughly 7% compared to the prior year period.

Adjusted EBITDA from crude oil rose 3% year-over-year, supported by contributions from recently completed bolt-on acquisitions, higher pipeline volumes and tariff escalations.

These benefits were partially offset by Permian long-haul contract rate resets and lower commodity prices. Adjusted EBITDA from NGL decreased 4% year-over-year, primarily reflecting lower sales volumes.

Click here to download our most recent Sure Analysis report on PAA (preview of page 1 of 3 shown below):

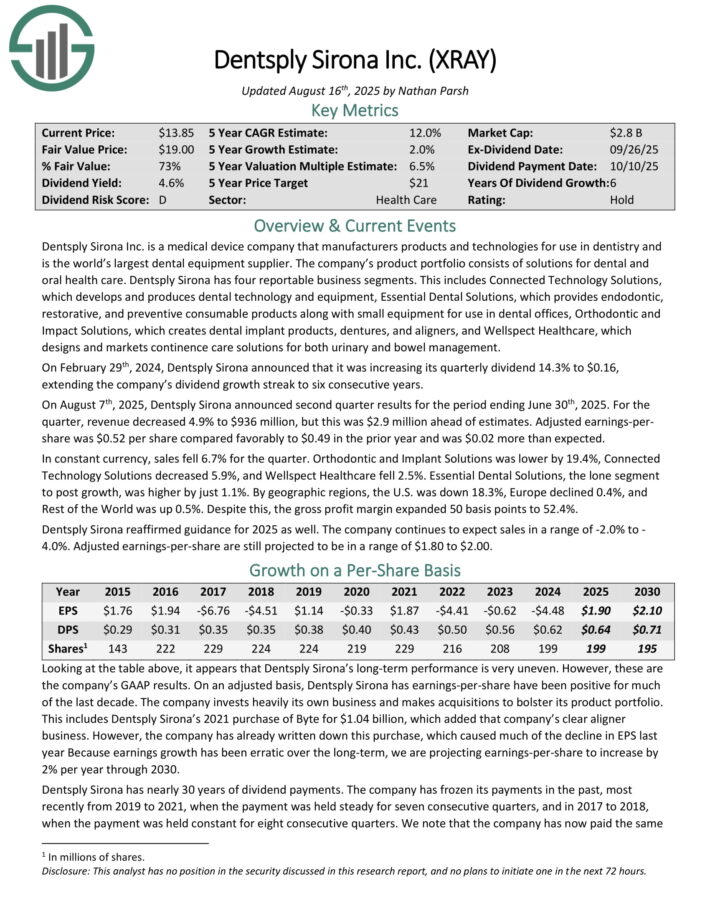

Undervalued High Dividend Stock #14: DENTSPLY Sirona (XRAY) – P/E ratio of 6.4

Dentsply Sirona Inc. is a medical device company that manufacturers products and technologies for use in dentistry and is the world’s largest dental equipment supplier.

The company’s product portfolio consists of solutions for dental and oral health care. Dentsply Sirona has four reportable business segments.

This includes Connected Technology Solutions, which develops and produces dental technology and equipment, Essential Dental Solutions, which provides endodontic, restorative, and preventive consumable products along with small equipment for use in dental offices, Orthodontic and Impact Solutions, which creates dental implant products, dentures, and aligners, and Wellspect Healthcare, which designs and markets continence care solutions for both urinary and bowel management.

On August 7th, 2025, Dentsply Sirona announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue decreased 4.9% to $936 million, but this was $2.9 million ahead of estimates. Adjusted earnings-per-share was $0.52 per share compared favorably to $0.49 in the prior year and was $0.02 more than expected.

In constant currency, sales fell 6.7% for the quarter. Orthodontic and Implant Solutions was lower by 19.4%, Connected Technology Solutions decreased 5.9%, and Wellspect Healthcare fell 2.5%.

Essential Dental Solutions, the lone segment to post growth, was higher by just 1.1%. By geographic regions, the U.S. was down 18.3%, Europe declined 0.4%, and Rest of the World was up 0.5%. Despite this, the gross profit margin expanded 50 basis points to 52.4%.

Click here to download our most recent Sure Analysis report on XRAY (preview of page 1 of 3 shown below):

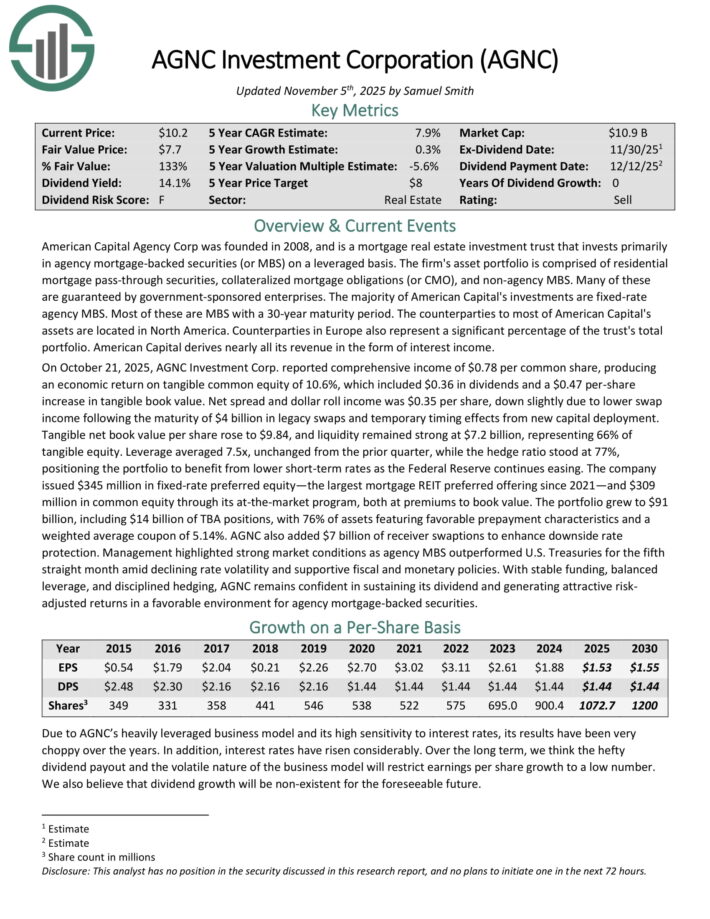

Undervalued High Dividend Stock #15: AGNC Investment Corporation (AGNC) – P/E ratio of 6.6

American Capital Agency Corp is a mortgage real estate investment trust that invests primarily in agency mortgage–backed securities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass–through securities, collateralized mortgage obligations (or CMO), and non–agency MBS. Many of these are guaranteed by government–sponsored enterprises.

On October 21, 2025, AGNC Investment Corp. reported comprehensive income of $0.78 per common share, producing an economic return on tangible common equity of 10.6%, which included $0.36 in dividends and a $0.47 per-share increase in tangible book value.

Net spread and dollar roll income was $0.35 per share, down slightly due to lower swap income following the maturity of $4 billion in legacy swaps and temporary timing effects from new capital deployment.

Tangible net book value per share rose to $9.84, and liquidity remained strong at $7.2 billion, representing 66% of tangible equity.

Click here to download our most recent Sure Analysis report on AGNC Investment Corp (AGNC) (preview of page 1 of 3 shown below):

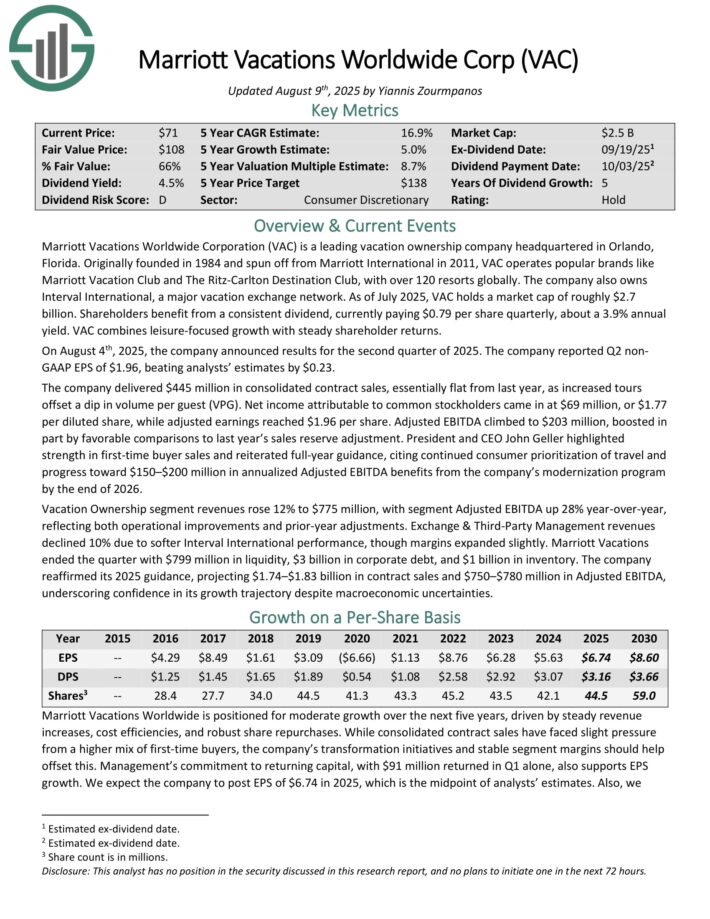

Undervalued High Dividend Stock #16: Marriot Vacations Worldwide (VAC) – P/E ratio of 6.9

Marriott Vacations Worldwide Corporation is a leading vacation ownership company headquartered in Orlando, Florida.

Originally founded in 1984 and spun off from Marriott International in 2011, VAC operates popular brands like Marriott Vacation Club and The Ritz-Carlton Destination Club, with over 120 resorts globally.

The company also owns Interval International, a major vacation exchange network.

On August 4th, 2025, the company announced results for the second quarter of 2025. The company reported Q2 non-GAAP EPS of $1.96, beating analysts’ estimates by $0.23.

The company delivered $445 million in consolidated contract sales, essentially flat from last year, as increased tours offset a dip in volume per guest (VPG). Net income attributable to common stockholders came in at $69 million, or $1.77 per diluted share, while adjusted earnings reached $1.96 per share.

Adjusted EBITDA climbed to $203 million, boosted in part by favorable comparisons to last year’s sales reserve adjustment.

Click here to download our most recent Sure Analysis report on VAC (preview of page 1 of 3 shown below):

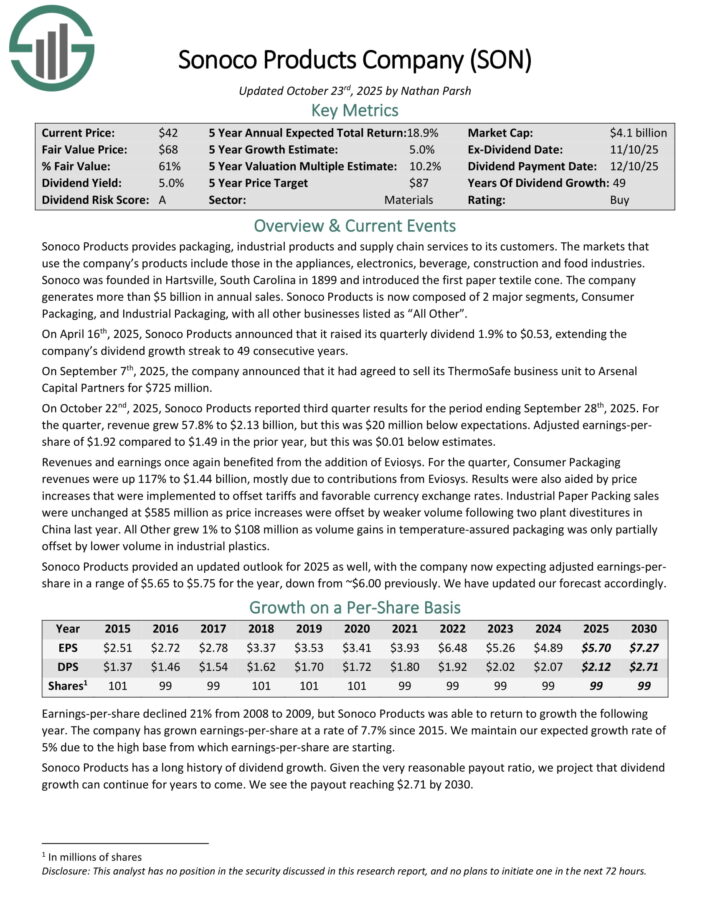

Undervalued High Dividend Stock #17: Sonoco Products (SON) – P/E ratio of 7.0

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates more than $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On October 22nd, 2025, Sonoco Products reported third quarter results for the period ending September 28th, 2025. For the quarter, revenue grew 57.8% to $2.13 billion, but this was $20 million below expectations. Adjusted earnings-per-share of $1.92 compared to $1.49 in the prior year, but this was $0.01 below estimates.

Revenues and earnings once again benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues were up 117% to $1.44 billion, mostly due to contributions from Eviosys. Results were also aided by price increases that were implemented to offset tariffs and favorable currency exchange rates.

Industrial Paper Packing sales were unchanged at $585 million as price increases were offset by weaker volume following two plant divestitures in China last year. All Other grew 1% to $108 million as volume gains in temperature-assured packaging was only partially offset by lower volume in industrial plastics.

Sonoco Products provided an updated outlook for 2025 as well, with the company now expecting adjusted earnings-per-share in a range of $5.65 to $5.75 for the year, down from ~$6.00 previously.

Click here to download our most recent Sure Analysis report on SON (preview of page 1 of 3 shown below):

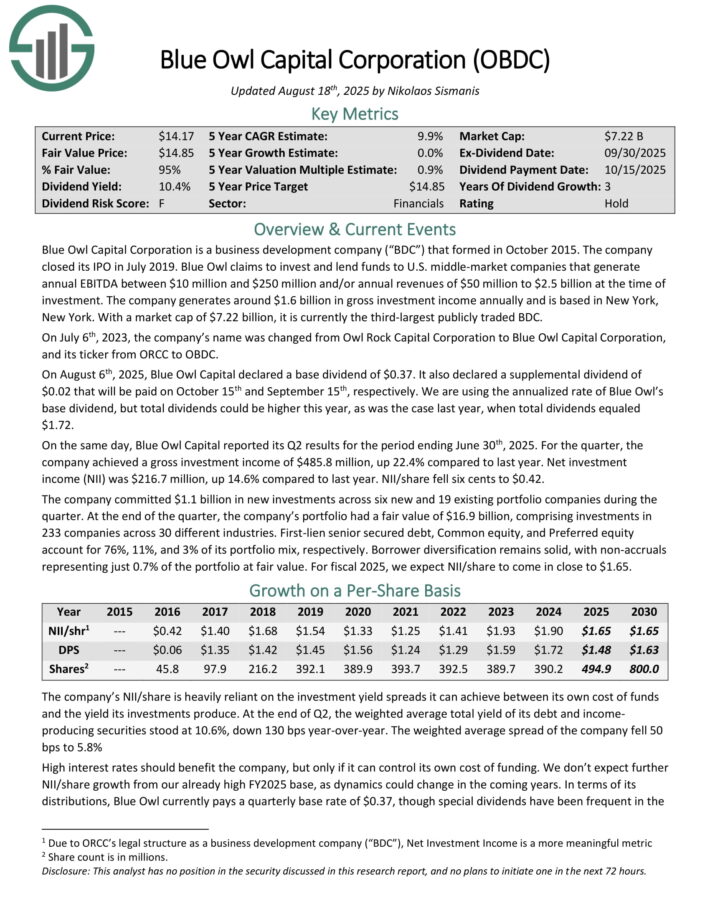

Undervalued High Dividend Stock #18: Blue Owl Capital (OBDC) – P/E ratio of 7.1

Blue Owl Capital Corporation invests and lends funds to U.S. middle-market companies that generate annual EBITDA between $10 million and $250 million and/or annual revenues of $50 million to $2.5 billion at the time of investment. The company generates around $1.6 billion in gross investment income annually and is based in New York, New York.

On August 6th, 2025, Blue Owl Capital declared a base dividend of $0.37. It also declared a supplemental dividend of $0.02 that will be paid on October 15th and September 15th, respectively. We are using the annualized rate of Blue Owl’s base dividend, but total dividends could be higher this year.

On the same day, Blue Owl Capital reported its Q2 results for the period ending June 30th, 2025. For the quarter, the company achieved a gross investment income of $485.8 million, up 22.4% compared to last year. Net investment income (NII) was $216.7 million, up 14.6% compared to last year. NII/share fell six cents to $0.42.

The company committed $1.1 billion in new investments across six new and 19 existing portfolio companies during the quarter. At the end of the quarter, the company’s portfolio had a fair value of $16.9 billion, comprising investments in 233 companies across 30 different industries.

First-lien senior secured debt, Common equity, and Preferred equity account for 76%, 11%, and 3% of its portfolio mix, respectively. Borrower diversification remains solid, with non-accruals representing just 0.7% of the portfolio at fair value.

Click here to download our most recent Sure Analysis report on OBDC (preview of page 1 of 3 shown below):

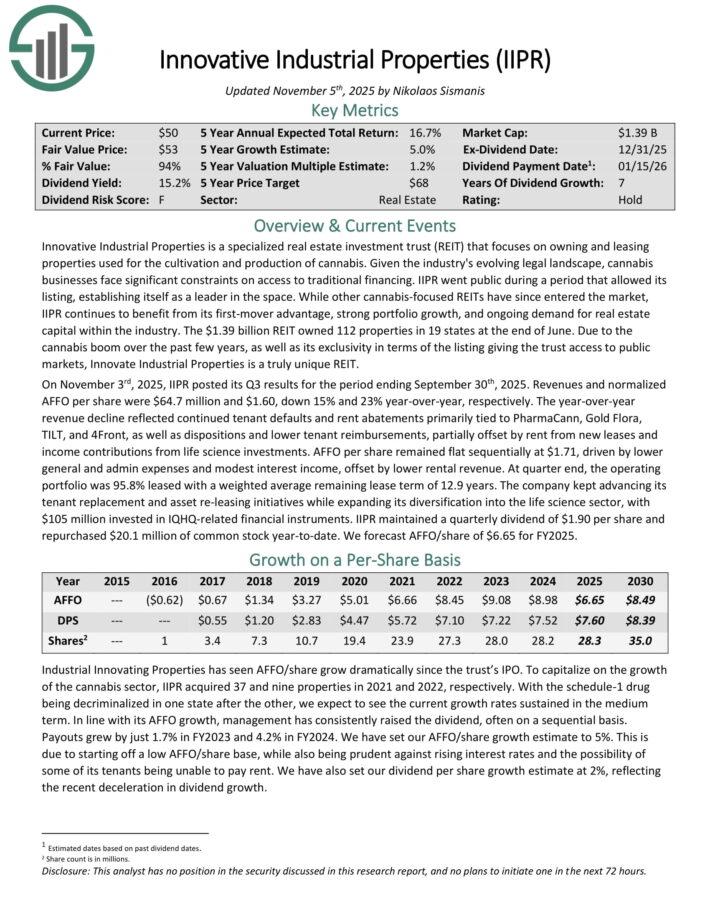

Undervalued High Dividend Stock #19: Innovative Industrial Properties (IIPR) – P/E ratio of 7.2

Innovative Industrial Properties is a specialized real estate investment trust (REIT) that focuses on owning and leasing properties used for the cultivation and production of cannabis.

Given the industry’s evolving legal landscape, cannabis businesses face significant constraints on access to traditional financing.

The REIT owned 112 properties in 19 states at the end of June. Due to the cannabis boom over the past few years, as well as its exclusivity in terms of the listing giving the trust access to public markets, Innovate Industrial Properties is a truly unique REIT.

On November 3rd, 2025, IIPR posted its Q3 results. Revenues and normalized AFFO per share were $64.7 million and $1.60, down 15% and 23% year-over-year, respectively.

The year-over-year revenue decline reflected continued tenant defaults and rent abatements primarily tied to PharmaCann, Gold Flora, TILT, and 4Front, as well as dispositions and lower tenant reimbursements, partially offset by rent from new leases and income contributions from life science investments.

AFFO per share remained flat sequentially at $1.71, driven by lower general and admin expenses and modest interest income, offset by lower rental revenue.

At quarter end, the operating portfolio was 95.8% leased with a weighted average remaining lease term of 12.9 years.

Click here to download our most recent Sure Analysis report on IIPR (preview of page 1 of 3 shown below):

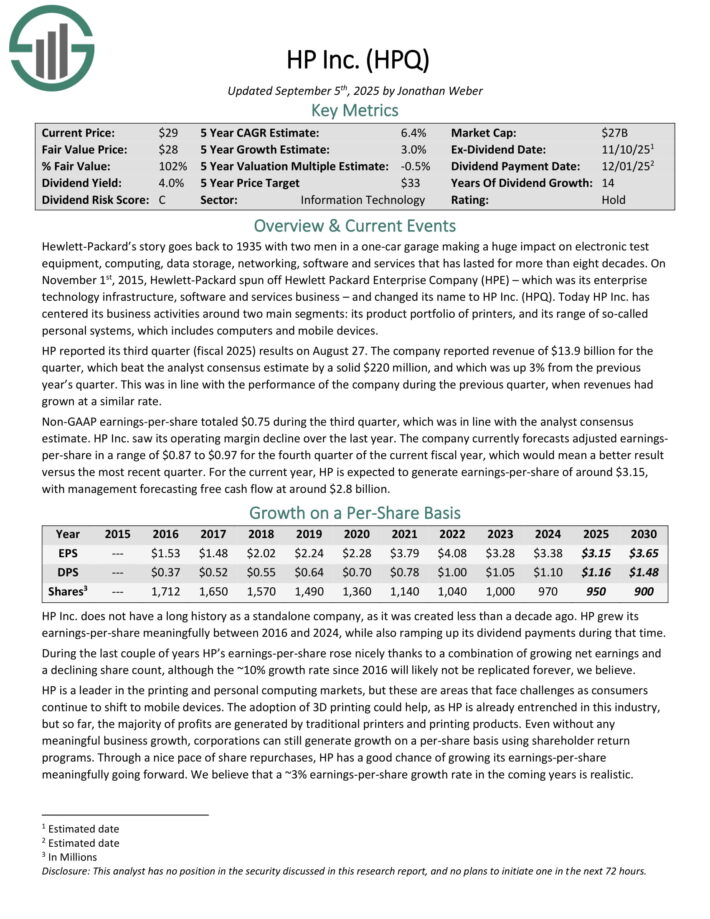

Undervalued High Dividend Stock #20: HP Inc. (HPQ) – P/E ratio of 7.2

HP Inc. has centered its business activities around two main segments: its product portfolio of printers, and its range of personal systems, which includes computers and mobile devices.

HP reported its third quarter (fiscal 2025) results on August 27. The company reported revenue of $13.9 billion for the quarter, which beat the analyst consensus estimate by a solid $220 million, and which was up 3% from the previous year’s quarter.

This was in line with the performance of the company during the previous quarter, when revenues had grown at a similar rate.

Non-GAAP earnings-per-share totaled $0.75 during the third quarter, which was in line with the analyst consensus estimate. HP Inc. saw its operating margin decline over the last year.

The company currently forecasts adjusted earnings-per-share in a range of $0.87 to $0.97 for the fourth quarter of the current fiscal year, which would mean a better result versus the most recent quarter.

For the current year, HP is expected to generate earnings-per-share of around $3.15.

Click here to download our most recent Sure Analysis report on HPQ (preview of page 1 of 3 shown below):

Final Thoughts

All the above stocks are trading at remarkably cheap valuation levels due to some business headwinds. Some of them have been hurt by high inflation or the latest economic slowdown whereas others are facing their own specific issues.

Moreover, all the above stocks are offering dividend yields above 5%. As a result, they make it much easier for investors to wait patiently for the business headwinds to subside.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].