The world of cryptocurrency is a rollercoaster of thrilling highs and stomach-churning drops. Everyone hears the success stories, but the fear of making a costly mistake keeps many on the sidelines. What if you could experience the market, learn the ropes, and build real skills without risking a single dollar of your own money?

You can. This is where a crypto trading simulator comes in. It’s your no-risk, all-reward training ground.

This guide will walk you through why you should practice, the different types of simulators available, and how you can get started today on your journey from crypto-curious to crypto-confident.

Why Bother Practicing Crypto Trading?

Jumping into the live crypto market without experience is like trying to sail in a storm without ever having been on a boat. A demo trading account is your calm harbor to learn before you face the waves.

Learn Without Financial Risk: The most obvious benefit. A practice account gives you a virtual portfolio (WallStreetSurvivor starts you with $100,000) to trade with. Make a bad trade? You lose virtual cash, not your rent money. This hands-on experience is invaluable.

Understand Market Dynamics: Experience the volatility firsthand. Watch how news affects prices and learn the natural rhythm of the market in a realistic environment without the fear of loss.

Build Confidence: Trading can be emotional. Practicing in a demo environment helps you build confidence in your strategy and your decision-making, reducing the anxiety that often leads to poor choices in live trading.

Master Risk Management: Success in trading isn’t just about picking winners; it’s about managing losers. A simulator is where you can practice setting stop-loss orders and determining position sizes to protect your capital.

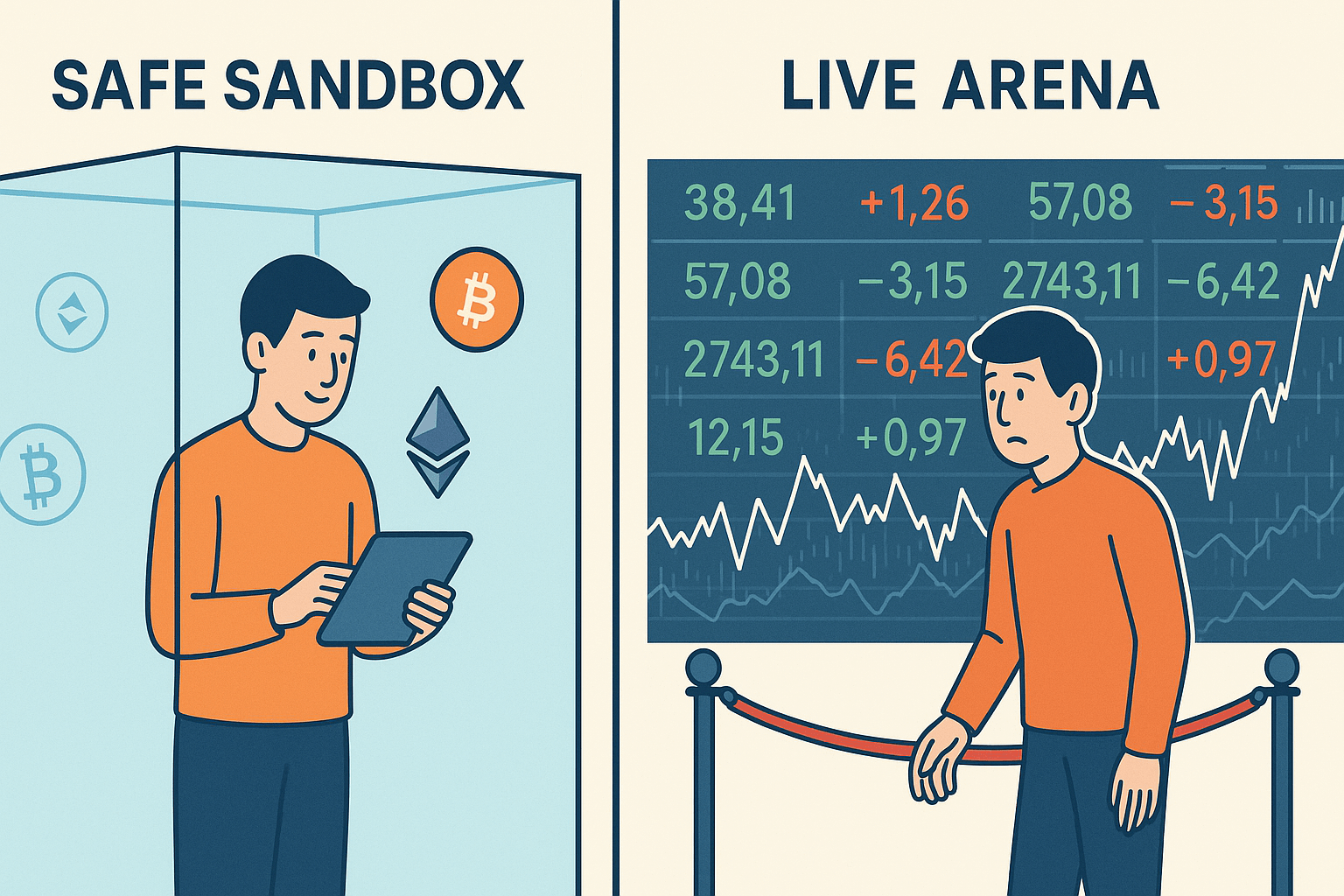

The Two Types of Simulators (And Which is Right for You)

Not all practice platforms are created equal. They generally fall into two categories, and choosing the right one depends on your experience level.

1. Dedicated Investor Training Platforms

These platforms are built from the ground up as purely educational tools. They are completely separate from any live exchange.

Key Features

Zero Connection to Real Money: You don’t connect a bank account or credit card. There is absolutely no way to accidentally place a real trade or deposit real funds.

No KYC (Know Your Customer): You can sign up with a simple email address, protecting your personal information.

Focus on Education: They combine the simulator with courses, articles, and tutorials designed to teach you the why behind investing, not just the how of clicking buttons.

Who it’s for: This is the best choice for absolute beginners. The sealed-off environment provides total safety, allowing you to focus 100% on learning without any fear or security concerns.

2. Exchange-Based Demo Accounts

Platforms like TradingView, eToro, Binance, and the Coinbase Advanced Trade (Sandbox) offer “demo modes” that are essentially clones of their real-money trading interfaces.

Key Features

Realistic Interface: You learn the exact layout, order types, and tools of the platform you might use for real trading later.

Often Requires Full Account: You may need to create a full account to access the demo mode.

One Click from Real Trading: The demo and live modes are often just a toggle switch away, creating a risk that a beginner might accidentally place a real trade.

Who it’s for: These are excellent tools for traders who already understand the basics and want to practice on the specific exchange they plan to use. It’s for learning the tool, not for learning the fundamentals.

Get Your Practice Crypto Trading Account

The smartest way to approach the crypto market is with education and practice. Don’t let the fear of losing money keep you from learning. A crypto trading simulator is the perfect tool to build your knowledge and confidence at your own pace. Ready to jump in?

Where to Start: The Best Simulators for Your Goals

The “best” crypto trading simulator depends entirely on what you want to accomplish. Are you trying to learn the absolute basics, master complex charting, or practice on a specific exchange? Each goal has a tool that’s right for the job.

Goal: “I Want to Learn the Absolute Basics, Safely.”

This is the most important goal for anyone new to crypto. Your priority is to learn the fundamentals—how to place a trade, how market volatility feels, and basic risk management—in an environment where it’s impossible to lose real money or compromise your personal information.

For this, a dedicated investor training platform is the best choice. Platforms like WallStreetSurvivor are designed as completely separate “sandboxes.” There is no connection to a live brokerage, no need to link a bank account, and no KYC (Know Your Customer) identity verification required to start. This creates a zero-risk environment where you can focus entirely on learning. In contrast, while many exchanges offer demo accounts, they often require a full account setup and keep you just one click away from the live market, which can be intimidating for newbies.

Goal: “I Want to Learn How to Read Charts and Technical Analysis.”

If your main interest is learning how to read price charts and use technical indicators to make trading decisions, you’ll want a platform with professional-grade charting tools.

TradingView is the industry standard in this category. Its platform offers an incredible suite of powerful charting tools, and its “Paper Trading” feature lets you practice buying and selling directly on these charts with a virtual portfolio. It is an exceptional tool for anyone serious about technical analysis. While platforms like WallStreetSurvivor provide all the essential charting capabilities a beginner needs to practice identifying support and resistance, TradingView offers a far deeper level of complexity for those who want to specialize in chart analysis.

Goal: “I Want to Practice on the Exact Exchange I Plan to Use.”

This is a logical step for someone who has already learned the basics and has decided which exchange they’ll use for real trading. The goal here is to get familiar with the specific interface, order types, and fee structure of that platform.

For this, using the exchange’s built-in demo mode or “testnet” is the best option. Binance, Bybit, and the Coinbase Advanced Trade (Sandbox) all offer robust demo environments that perfectly mirror their live platforms. This is an excellent way to avoid costly mistakes when you transition to real money. However, be aware that these platforms are not designed to teach you how to invest; they are designed to teach you how to use their software. Their interfaces can be overwhelmingly complex for a first-time user.

Goal: “I Want to Learn and Compete with Friends.”

Learning is often more effective and engaging when it’s a social activity. If you want to create a private league to learn alongside friends, challenge your colleagues, or even set up a classroom project, you’ll need a simulator with strong community features.

This is a standout feature of WallStreetSurvivor. It allows you to create fully customizable, private trading competitions where you set the rules, starting cash, and invite your friends. You can track each other’s progress on a live leaderboard, making it a fun and motivating way to learn together. Most exchange-based demo accounts are solitary experiences and lack this ability to create private, structured learning games.

What To Do With Your Practice Account

Okay, you’ve signed up, and you have a $100,000 virtual portfolio. Now what? Staring at a blank screen can be intimidating.

The goal of a simulator isn’t just to click buttons; it’s to build skills and habits that will protect you in the real world. Here’s a simple game plan to get you started.

Practice Different Trading Strategies

Don’t try to become a pro overnight. Start by testing two of the most fundamental approaches to the market.

The “HODL” Strategy (Buy and Hold)

This is the simplest strategy and a great way to understand long-term market volatility.

Use your virtual funds to buy a few major cryptocurrencies you’ve heard of (like Bitcoin and Ethereum). Then, don’t touch them for a few weeks. Log in each day to see how your portfolio value changes.

What You’ll Learn: You’ll experience the emotional highs and lows of seeing your balance swing without any real risk. It teaches patience and helps you stomach the volatility that scares many new investors away.

The “Trade the News” Strategy

This is a more active approach that teaches you how markets react to real-world events.

Keep an eye on crypto news. Did a major company just announce a partnership with Solana? Did a new regulation about crypto pass? When big news hits, place a small virtual trade on the affected coin and watch what happens next.

What You’ll Learn: You’ll begin to understand market sentiment and how news (both good and bad) can cause prices to move, often very quickly.

Learn Basic Chart Reading

“Technical analysis” sounds complex, but it’s just the practice of using charts to spot patterns and make predictions. You can learn the absolute basics in your simulator.

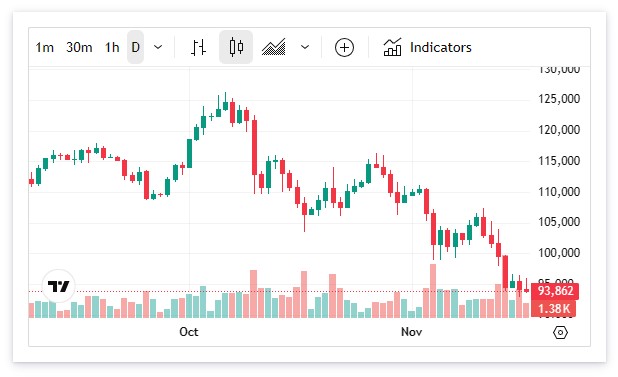

Focus on Candlestick Charts

These are the most common charts you’ll see. All you need to know to start is that green candles mean the price went up during that period, and red candles mean the price went down.

Find the Floor and the Ceiling

In the simulator, pull up a chart for Bitcoin. Look at the last few months. Can you draw a rough horizontal line connecting the lowest points the price has hit? That’s a potential support level. Now do the same for the highest points. That’s your resistance. Practicing this helps you identify potential entry and exit points.

Support (The Floor): A price level where a downtrend tends to pause or reverse because of buying interest. Think of it as a floor the price has trouble breaking through.

Resistance (The Ceiling): A price level where an uptrend tends to pause or reverse. It’s a ceiling the price struggles to push past.

Practice Risk Management Strategies

A simulator is the perfect place to build low-risk habits without getting hurt.

Rule #1: Position Sizing

Never put all your virtual eggs in one basket.

On every single practice trade you make, follow this rule: Never invest more than 5% of your total portfolio value in one cryptocurrency. If you have $100,000, your maximum trade size is $5,000. This habit alone will prevent a single bad decision from wiping you out.

Rule #2: Use Stop-Loss Orders

Think of this as your automatic eject button.

A stop-loss is an order you place that automatically sells your crypto if it drops to a specific price. Its job is to cut your losses before they become catastrophic.

On your next practice trade, set a stop-loss order 10% below the price you bought at. If you buy Bitcoin at $70,000, set your stop-loss at $63,000. This provides a safety net and removes the emotion from the decision to sell. Practicing this makes it a non-negotiable habit for real trading.

Your Checklist: What Makes a Great Crypto Simulator?

For a beginner focused on practicing investing in cryptocurrencies, here are the non-negotiable features to look for:

✅ Complete Separation from Real MoneyThis is the most important feature for a true beginner. A dedicated simulator like WallStreetSurvivor has no connection to your bank account and requires no KYC (Know Your Customer) identity verification. This means there is zero risk of accidentally placing a real trade or compromising your financial data.

✅ Real-Time Market DataThe simulator should use live or near-live prices. Practicing with delayed data is like training for a race with a slow watch—it doesn’t prepare you for the real thing.

✅ A Wide Variety of CryptocurrenciesYou should be able to practice trading not just Bitcoin and Ethereum, but also other popular altcoins like Solana, Cardano, and XRP. This helps you understand how different parts of the market move.

✅ Built-In Educational ResourcesA great platform doesn’t just give you a tool; it teaches you how to use it. Look for integrated courses, articles, and tutorials that explain the concepts you’re practicing, from blockchain basics to trading strategies.

✅ Tools for Analytics and ReviewYou need to be able to look back at your trading history to see what worked and what didn’t. Look for performance charts and trade journals that help you learn from your mistakes and successes.

Ready for Real Money? The Best Exchanges for Beginners

After you’ve spent time in a simulator, built confidence, and developed a strategy, you might feel ready to invest real, albeit small, amounts of money.

For Traders in the US: Our top recommendation is Robinhood, followed by Coinbase.

For Traders Outside the US: Coinbase is the most accessible and widely-trusted option.

Why Robinhood Over Coinbase for Beginners?

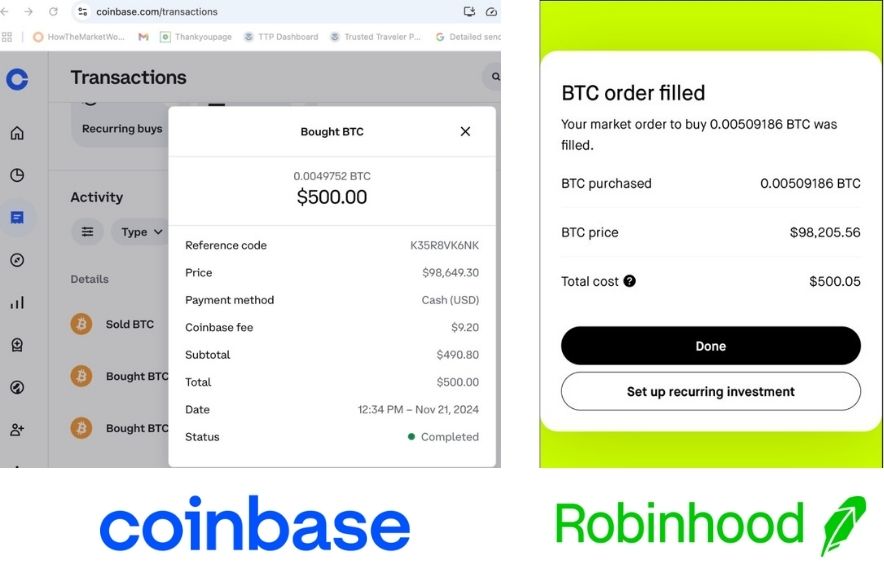

When you’re ready to invest real money, every fraction of a percent matters. The primary reason we recommend Robinhood for US beginners comes down to a simple outcome: you often get more crypto for your dollar.

While Coinbase charges transparent (but often high) trading fees on each transaction, Robinhood’s model avoids these commissions. This difference typically results in a better “fill price” for your trade.

But don’t just take our word for it. We ran a side-by-side test, buying the same amount of Bitcoin on both platforms at the exact same second. The difference in how much crypto we received was significant. To see the detailed breakdown, check out our guide: Is Robinhood Safe for Crypto? A Comprehensive Guide.

The Best Crypto Brokerages as of September 30, 2025

Ranking of Top Crypto Brokerages Based on Fees, Features, and Sign-Up Bonuses

We are experienced users of dozens of crypto platforms. We stay up to date on these platforms’ service offerings, subscription fees, trade commissions, and welcome bonuses. The brokerages listed below are for crypto investors, and are ranked in order of overall value received after taking advantage of their sign-up and/or referral offers.

Features:

✅ 36 cryptos

✅ No commission

✅ Crypto price alert

Sign-up Bonus:

Get up to 1.6% more crypto.

Learn more

Features:

✅ Beginner-friendly UI, simple & advanced trading modes

✅ Access to over 250 cryptocurrencies

✅ 24/7 customer support for verified users

Sign-up Bonus:

$3-$200 in free Bitcoin on your first trade with “spin the wheel” promo.

Learn more

Fees:

Simple: 1.49% + flat fees.ActiveTrader: starts at 0.40%

Full Review

Features:

✅ ActiveTrader platform with advanced tools

✅ Institutional-grade custody services with SOC 2 compliance

✅ Crypto rewards credit card with BTC/ETH back

Sign-up Bonus:

$25 in crypto after trading $100 (referral required).

Learn more

Fees, features, sign-up bonuses, and referral bonuses are accurate as of September 30, 2025. All information listed above is subject to change.

View Full List