Published on November 12th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Freehold Royalties Ltd. (FRHLF) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Freehold Royalties Ltd. (FRHLF).

Business Overview

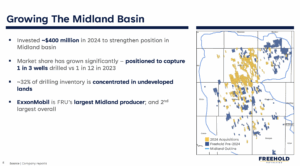

Freehold Royalties Ltd. is a Calgary-based energy royalty company that acquires and manages royalty and mineral title interests in oil, natural gas, and natural gas liquids across Western Canada and the United States. The company focuses on high-quality, liquids-heavy assets in premier basins, including the Permian, Midland, and Eagle Ford in the U.S., and Mannville, Clearwater, and southeast Saskatchewan in Canada.

Its business model generates revenue through royalties, lease bonuses, and production from third-party operators, allowing Freehold to benefit from oil and gas production without directly operating wells.

The company’s portfolio emphasizes growth and resilience, with U.S. assets delivering higher per-well production and Canadian assets providing steady oil-weighted volumes. Freehold maintains a strong balance sheet, consistently pays dividends, and invests in strategic mineral acquisitions and active leasing programs.

By focusing on liquids-rich, long-life assets and investment-grade operators, Freehold aims to deliver attractive, risk-adjusted returns while mitigating exposure to commodity price volatility.

Source: Investor Relations

Freehold Royalties delivered $78 million in revenue and $57 million in funds from operations ($0.35/share) in Q2 2025. Total production rose 2% from the previous quarter to 16,584 boe/d, with a liquids weighting of 67%. U.S. assets drove growth, while Canadian oil plays in Mannville, Clearwater, and southeast Saskatchewan contributed to a 10% year-over-year increase.

The company signed 40 new leases and drilled 271 gross wells (45 in Canada, 226 in the U.S.), while investing $12 million in mineral title acquisitions in the Midland and Delaware basins. Bonus and lease revenues reached $1.9 million for the quarter, up 50% from previous records.

Freehold maintained a strong balance sheet with $271 million in net debt (1.1× FFO) and paid $44 million in dividends ($0.27/share). Realized prices averaged $50.36/boe, with a 31% premium for U.S. production, reflecting the strength of its liquids-heavy, royalty-focused portfolio despite lower oil prices.

Growth Prospects

Freehold Royalties’ growth prospects are closely tied to the performance of its liquids-heavy royalty portfolio and the broader oil and gas market. Historically, the company earned near C$1/share annually during the late 2000s and early 2010s, when crude prices were around $100/barrel.

However, the collapse in oil prices in 2015 sharply reduced profitability, and Freehold struggled to generate meaningful earnings between 2015 and 2020. Since then, the company has strengthened its portfolio through acquisitions in premium U.S. basins and active leasing programs, boosting production and cash flow despite commodity price volatility.

Dividend sustainability and future growth remain linked to cash flow rather than accounting earnings, as royalties are paid from operational cash rather than net income. While Freehold has a history of maintaining high dividends relative to earnings, past cuts in 2016 and 2020 illustrate the vulnerability of payouts during downturns.

The current monthly dividend of C$0.09 ($0.77 annually) provides a steady return, but it could be reduced during prolonged recessions. Looking ahead, Freehold’s focus on high-quality, long-life liquids assets, coupled with strategic U.S. acquisitions, positions the company to generate stable cash flow and potential growth, though exposure to commodity cycles remains a key risk.

Source: Investor Relations

Competitive Advantages & Recession Performance

Freehold Royalties’ competitive advantage lies in its liquids-heavy, royalty-focused portfolio across premier North American basins. By owning royalty and mineral title interests rather than operating wells, the company benefits from production upside while avoiding the high capital and operating costs of traditional oil and gas producers.

Its strategic focus on high-quality U.S. and Canadian assets, combined with active leasing programs and selective acquisitions, provides exposure to long-life reserves, higher well productivity, and premium pricing for liquids, giving Freehold a resilient cash flow base relative to peers.

Despite these advantages, Freehold’s performance remains sensitive to commodity price cycles. During recessions or periods of low oil prices, such as in 2015 and the 2015–2020 downturn, the company’s profitability and dividend payments were materially impacted. While Freehold’s royalty model buffers it from direct operating risks, dividends are ultimately funded by cash flow, making payouts vulnerable during prolonged market weakness.

Nonetheless, its diversified, high-quality portfolio and focus on liquids-rich assets help mitigate downturns, supporting more stable operations and positioning the company for recovery when market conditions improve.

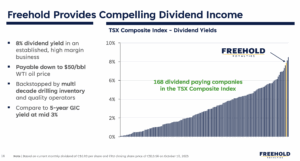

Dividend Analysis

Freehold Royalties currently offers a high dividend yield of 7.4%, significantly above the 1.2% yield of the S&P 500, making it attractive for income-focused investors. However, the dividend is vulnerable due to the cyclical nature of the oil and gas industry.

Earnings have declined sharply from a 10-year high of $1.03 per share in 2022, pushing the payout ratio from 68% to 90%, a level that is unsustainable over the long term.

The company has cut its dividend in three of the last ten years, highlighting the risk to income during market downturns. U.S. investors should also consider the impact of currency fluctuations on dividend payments.

From a valuation perspective, Freehold Royalties trades at 18.6 times trailing earnings, above an assumed fair P/E of 14.0. If the stock reverts to this fair valuation over the next five years, it could create a -5.0% annualized drag on returns.

Combined with flat earnings and the current dividend yield, the stock is expected to deliver only around 2.4% average annual total return, suggesting that investors may be better served by waiting for a lower entry point to improve the margin of safety and potential long-term returns from this highly cyclical company.

Source: Investor Relations

Final Thoughts

Freehold Royalties stands out for its strong production and reserve growth potential, an above-average dividend yield of 7.4%, and a solid balance sheet, making it appealing to income-focused investors.

However, the company’s performance has historically been volatile due to cyclical oil and gas markets, and the stock appears fully valued at current levels. Investors may be better served waiting for a more attractive entry point.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].