Independent RIAs face many challenges, but advisors with first-hand experience say one stands out: balancing personalized service with the demands of growth.

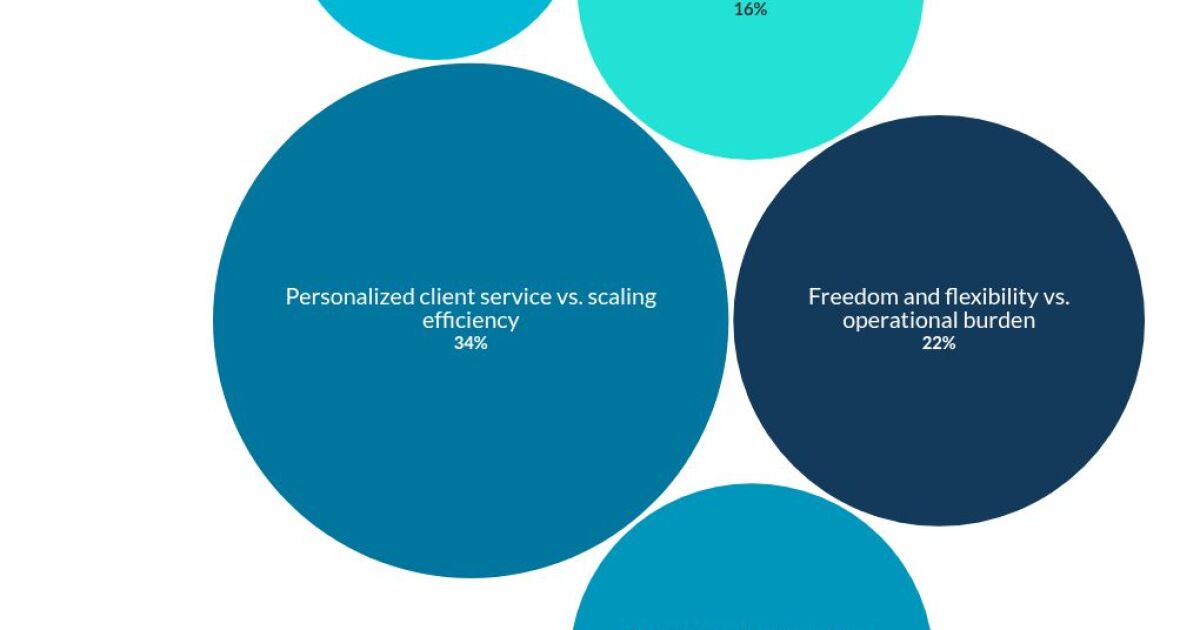

Financial Planning’s latest Financial Advisor Confidence Outlook (FACO) survey shows that one-third of advisors ranked “personalized client service vs. scaling efficiency” as the biggest trade-off they face.

Advisors say keeping an eye on both ends of the spectrum requires tough decisions about how to grow while making sure clients feel heard.

Making clients feel heard while scaling the business

There’s no way around it: Personalization takes time.

Hardik Patel, founder of Trusted Path Wealth Management in Santa Rosa, California, said independent RIAs often address this balancing act by using model portfolios, outsourcing investment management or fully standardizing the financial planning process.

However, that comes with a cost.

“Those approaches can limit how deeply tailored the advice is to each client,” he said.

Instead, Patel builds and manages each client’s portfolio based on their goals, preferences, tax considerations and unique circumstances. Behind the scenes, he uses streamlined workflows and organized processes to stay efficient.

READ MORE: When AI wastes more time than it saves for advisors

“But each client only receives the planning components that truly matter to them,” he said. “This allows me to preserve some efficiency while ensuring each client feels seen, understood, and supported.”

This focus limits the number of clients he can serve effectively, but Patel said that’s intentional.

READ MORE: This is the biggest cybersecurity threat for wealth firms

“I only take on new clients when there is a clear mutual fit, ensuring I can maintain the level of care, attentiveness and passion that defines my work,” he said.

Patel said he feels that clients hire him because he takes the time to understand their goals, values and the nuances of their lives.

“By working with a deliberately small number of clients, I can maintain a deep, personal connection and provide the guidance and attention each client deserves,” he said. “This approach naturally fosters strong, trusting relationships and often leads to referrals from clients who truly appreciate the care, thoughtfulness and dedication I provide.”

Peyton Falkenburg, executive vice president of NBC Securities in Birmingham, Alabama, said most of his firm’s advisory teams cite tailored communication as their main client-experience challenge, and investors consistently point to customized guidance as a core driver of trust.

“As firms grow, that pressure intensifies,” he said. “More clients mean more complexity, more questions and higher expectations for relevance and responsiveness.”

Freedom and flexibility versus operational burden

According to the November FACO survey, the second most difficult aspect of being an independent RIA is “Freedom and flexibility versus operational burden,” which was rated as the highest concern by over 20% of respondents.

This is true for Brandon Galici, financial planner and founder of Galici Financial in San Juan Capistrano, California. At his firm, he said it’s essential to have solid systems and processes in place so that nothing falls through the cracks and every client receives consistently high-quality service.

However, maintaining flexibility is also important, said Galici, as he needs to be able to adjust processes quickly based on client needs.

“I regularly ask myself, ‘What challenge am I really trying to solve?'” he said. “That keeps me focused on outcomes such as making sure clients feel truly seen and heard, rather than just blindly following procedures.”

The freedom and flexibility of independence often come with a heavier operational burden, pulling time and attention away from clients, said Falkenburg. Technology independence can introduce integration complexity that quietly drains productivity.

Even fee transparency and pricing pressure become more acute when advisors must demonstrate the value of both their planning and their operational investments, he said. And in periods of rapid hiring, the tension between speed and cultural alignment can directly affect the consistency of client experience.

“Ultimately, the real pressure point is staying productively responsive, addressing each client’s unique goals and concerns in a way that reinforces long-term confidence, not just reacting quickly,” said Falkenburg. “That requires removing operational friction wherever possible.”

When the back office scales smoothly and the operational burden recedes, advisors gain the capacity to be present, proactive and relationship driven, said Falkenburg.

“Clients feel the difference immediately: An advisor who is prepared, responsive and fully focused on them,” he said.