As we approach the December Federal Reserve meeting, speculation about another rate cut is starting to subside. After two interest rate reductions earlier this year, growing concerns about inflation and signs of stability in the labor market have prompted more Fed policymakers to hold off on further easing.

December Fed Meeting: Rate Cut Uncertainty Looms

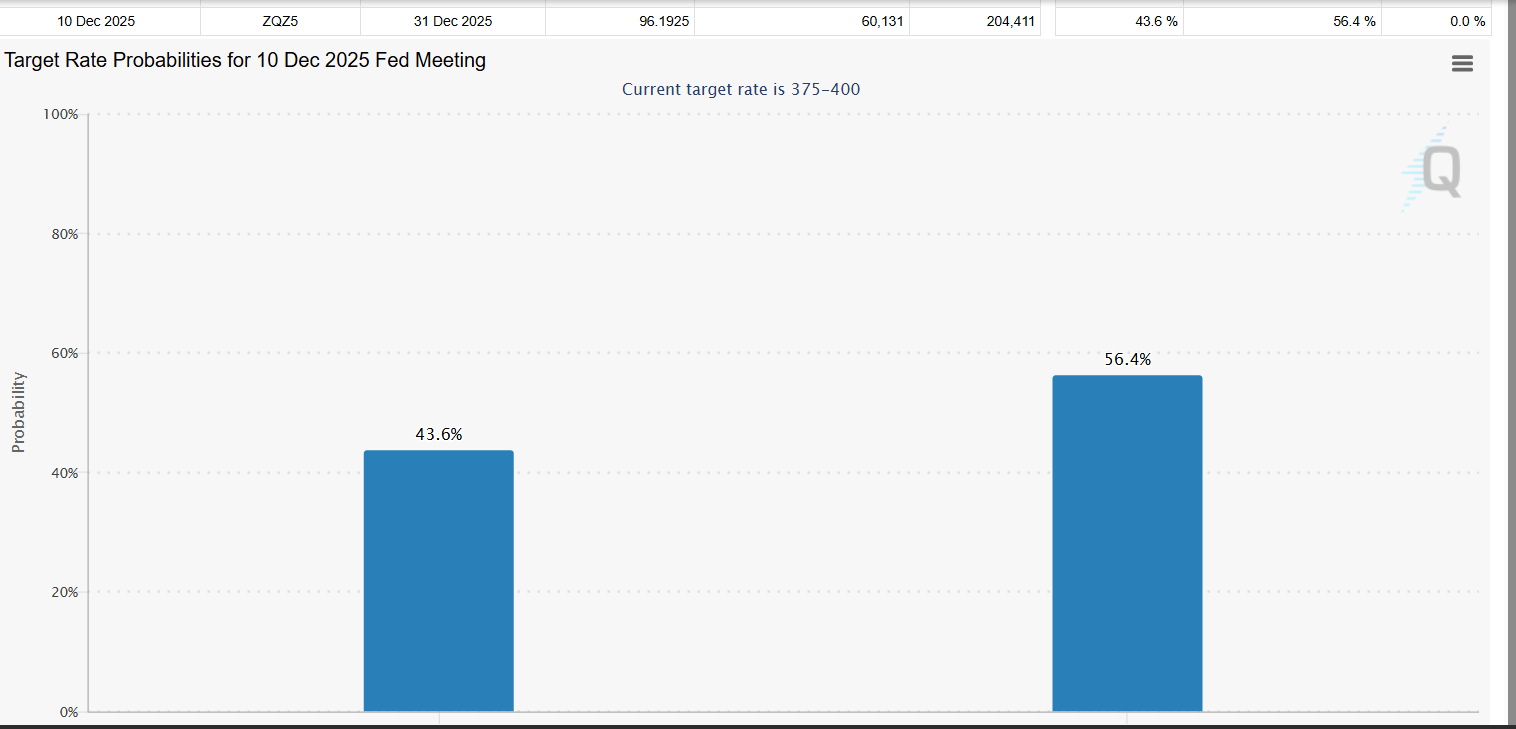

Financial markets, which had once expected a 25 basis point (bps) cut in December, are now revising their outlooks. The likelihood of a rate reduction has dropped to below 50%, signaling increasing uncertainty regarding the Fed’s next move.

According to data from CME FedWatch, the odds of a rate cut have fallen to 43%, down from 70% just before the last policy meeting.

This plunge is indicative of increasing doubt among traders and analysts as to the Fed being willing to ease policy further during the last meeting of 2025. Fed Chair Jerome Powell and other policymakers have been careful to make untimely judgments, worrying about unrelenting inflationary pressures and an incomplete economic picture because of the laggards in several vital economic indicators.

The decline in the expectation of a December rate cut has been in the context of statements by some of the major Fed officials, including the president of the Boston Fed, Susan Collins, who has voiced uncertainty on whether additional cuts are necessary.

Collins, who supported both of the rate cuts that were made earlier this year, has highlighted the dangers of inflation and mentioned that the labor market seems to be stabilizing.

Together with the uncertainty of the economic data as a result of the government shutdown, these remarks have led to the reassessment of the probability of further rate cuts in the market.

Inflation and Data Delays Cloud Fed’s Decision

The government shutdown is now a thing of the past, and there is now an increasing expectation of delayed economic information being released shortly. This information is, however, not very clear, which leaves the Fed in a position of limited visibility as to the current state of the economy.

The September jobs report and some other important data may be issued in the near future, yet it is not clear when this will happen. This unavailability of prompt information contributes to the complexity in making decisions as to the future interest rate movements.

Another issue that has been expressed by Kansas City Fed President Jeff Schmid is inflation. Dissenting in October to maintain the rates the same, Schmid has underlined that the main focus of the central bank should be inflation.

He reasoned that further reduction of the rates might not solve the inflationary pressures and in fact, made the economic situation worse. According to remarks made by Schmid, he might not advocate a reduction in the rate at December unless the threat of inflation is contained.

Crypto Market Reacts to Fed’s Mixed Signals

The fact that Fed is uncertain about its meeting in December has made some tangible effect in the cryptocurrency market. Bitcoin and other cryptocurrencies that had risen after the Fed cut its rates earlier this year have fallen considerably as the prospects of another rate cut go away.

Bitcoin price crashed below $100,000 after enjoying a surge of amazing returns. With the probability of the further reduction of the rates declining, the market participants are re-evaluating their anticipations, which results in the growth in volatility.

As the financial markets remain clueless on the future of the monetary policy of the U.S., everyone will be looking at the decision the Federal Reserve will make in December. Its result will probably influence both the conventional markets and the cryptocurrency area considerably.