Published on November 11th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Gladstone Capital (GLAD) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Gladstone Capital (GLAD).

Business Overview

Gladstone Capital Corporation (NASDAQ: GLAD) is a publicly traded business development company (BDC) based in McLean, Virginia. Founded in 2001, it provides debt and select equity financing to growth-oriented, lower-middle-market U.S. companies, typically with annual revenues of $20–$150 million.

Its investments include senior loans, subordinated debt, mezzanine financing, and occasionally preferred equity or warrants. Gladstone is industry-agnostic, focusing on sectors such as business services, healthcare, specialty manufacturing, and logistics.

Financially, GLAD generates income primarily from interest and fees on its loan portfolio and distributes a substantial portion to shareholders as regular dividends. The company has deployed over $3 billion across more than 280 investments since its inception.

Like other BDCs, it faces risks from credit cycles, interest-rate changes, and liquidity constraints, but its strategic debt issuance and diversified portfolio aim to balance yield generation with risk management.

Source: Investor Relations

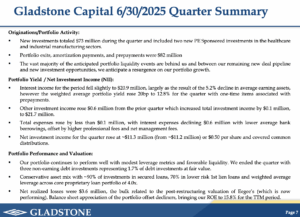

The company reported its financial results for the third quarter ended June 30, 2025, with net investment income of $11.3 million, or $0.50 per share, in line with expectations. Total investment income was $21.66 million, reflecting a modest 0.4% increase from the prior quarter, driven primarily by higher prepayment fees and dividend income, partially offset by a decline in interest income. Total expenses remained largely unchanged, as reductions in interest expense were balanced by higher management and incentive fees. The net increase in net assets from operations was $7.45 million, or $0.33 per share, slightly lower than the prior quarter.

During the quarter, Gladstone actively deployed $58.6 million in new investments and $14.4 million in existing portfolio companies. The portfolio continued to emphasize secured first lien assets, which represent over 70% of debt investments at cost. The company also strengthened its credit capacity, increasing its total facility commitment to $320 million and extending the revolving period to October 2027, with a final maturity in October 2029. Total investments at fair value stood at $751.3 million, slightly down from $762.6 million in the previous quarter, while net asset value per share decreased marginally to $21.25.

Subsequent to the quarter, Gladstone continued to expand its portfolio, including investments in MASSiv Brands, LLC; Alsay, Inc.; Snif-Snax, LLC; and OCI, LLC, totaling over $74 million. The company also declared quarterly distributions to common and preferred shareholders, totaling $0.495 and $0.3906 per share, respectively. Gladstone’s president, Bob Marcotte, highlighted the company’s strong balance sheet and funding capacity, noting that robust portfolio activity positions the firm to support continued shareholder distributions in upcoming quarters.

Source: Investor Relations

Growth Prospects

Gladstone Capital’s growth prospects are modest, with net investment income (NII) per share showing little change over the past decade. This year’s estimated NII of $2.01 is in line with historical results, and share issuances have increased total NII without significantly boosting per-share income.

Annual NII-per-share growth is expected to be just 0.5%, reflecting limited expansion above the company’s cost of capital.

Despite slow per-share growth, Gladstone has improved portfolio yields to over 12%, helping offset rising funding costs and support dividends. The company’s portfolio continues to grow in dollar terms, though lending spreads have compressed.

As a result, monthly dividends have increased from $0.07 to $0.165 ($1.98 annually), highlighting a stable, income-oriented strategy for investors even amid constrained growth.

Competitive Advantages & Recession Performance

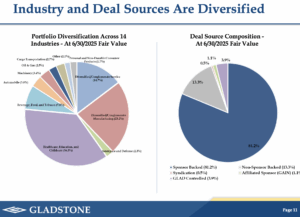

Gladstone Capital’s competitive advantage stems from its focus on lower-middle-market companies and its disciplined, secured-lending strategy. By emphasizing first-lien debt and diversifying across sectors like business services, healthcare, and manufacturing, the company reduces credit risk while earning attractive yields.

Its experience in structuring debt and equity deals allows it to target stable, cash-flow-positive companies more effectively than less specialized lenders.

The company has historically shown resilience during recessions due to its conservative portfolio and focus on senior-secured loans. While income and net assets can fluctuate, Gladstone’s first-lien positions and disciplined approach help mitigate losses.

It has consistently generated net investment income and maintained dividends, providing stability and confidence for shareholders through economic cycles.

Source: Investor Relations

Dividend Analysis

The company’s annual dividend is $1.98 per share. At its recent share price, the stock has a high yield of 9.3%.

Given the company’s 2025 earnings outlook, NII is expected to be $2.01 per share. As a result, the company is expected to pay out roughly 99% of its NII to shareholders in dividends.

Final Thoughts

We project total annual returns of approximately 10%% in the coming years. While the stock appears fairly valued, the dividend payout ratio has returned below 100%, providing some support. We factor in a 0.5% tailwind from the current valuation, alongside 0.5% expected growth and a 9.3% dividend yield. Given these factors, the stock maintains a hold rating, supported by slightly higher earnings estimates.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].