Published on November 11th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Gladstone Commercial Corporation (GOOD) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Gladstone Commercial Corporation (GOOD).

Business Overview

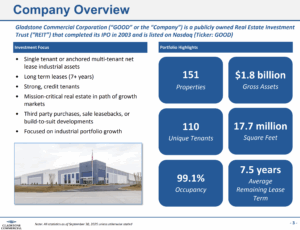

Gladstone Commercial Corporation (NASDAQ: GOOD) is a real estate investment trust (REIT) that focuses on acquiring, owning, and managing single-tenant and anchored multi-tenant net-leased office and industrial properties across the United States. Founded in 2003, the company’s portfolio includes 151 properties in 27 states, totaling approximately 17 million square feet and leased to over 100 tenants. Its strategy emphasizes long-term leases with creditworthy tenants, targeting stable income and diversification across industries and geographies.

The company is known for delivering consistent income to shareholders through monthly cash distributions and maintaining high occupancy levels, which stood at 99.1% as of mid-2025. Gladstone Commercial is increasingly focusing on industrial assets, which now account for about 67% of its annualized rent, reflecting a strategic shift away from non-core office properties. This focus positions the REIT for steady rental income and modest, reliable growth, appealing primarily to income-oriented investors seeking stability.

Source: Investor Relations

Gladstone Commercial Corporation reported third-quarter 2025 results with total operating revenue of $40.8 million, up 3.3% from the prior quarter. Net income available to common stockholders was $1.0 million, or $0.02 per share, down 32.5%, while Core FFO rose 1.8% to $16.4 million, or $0.35 per share, driven by acquisitions and leasing activity.

During the quarter, the company collected 100% of rents, acquired a six-property, 693,236-square-foot portfolio for $54.8 million, sold a non-core industrial property for $3.0 million, and completed leasing on 734,464 square feet across 14 properties. It also raised $23.0 million through its at-the-market stock program and continued monthly cash distributions to shareholders.

After the quarter, Gladstone expanded its credit facility to $600 million, extended loan maturities, repaid $3.1 million of mortgage debt, and maintained full rent collection. These actions reinforce the company’s focus on stable income, disciplined capital management, and strategic portfolio growth.

Source: Investor Relations

Growth Prospects

Gladstone Commercial is positioned for steady growth through its strategic focus on industrial properties, which now make up about 67% of its annualized rent. By acquiring fully leased, long-term industrial assets and disposing of non-core office properties, the company is improving portfolio quality and cash flow stability.

High occupancy levels, near 98–99%, and long average lease terms support consistent rent collection and reduce vacancy risk.

Growth is expected to be modest but stable. Core FFO rose 1.8% in Q3 2025 to $16.4 million ($0.35 per share), reflecting contributions from acquisitions and leasing, though per-share growth is tempered by equity issuance and rising costs.

Key risks include higher interest rates and challenges in the office sector. For investors, Gladstone’s appeal lies in reliable income and incremental portfolio growth rather than rapid expansion.

Competitive Advantages & Recession Performance

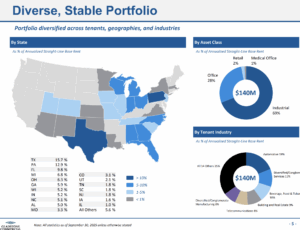

Gladstone Commercial’s competitive advantages stem from its focus on high-quality, net-leased industrial and office properties with creditworthy tenants and long-term leases. This strategy ensures predictable cash flow and reduces tenant turnover, while its disciplined acquisition approach targets fully leased properties in growth markets.

The company also maintains a diversified portfolio across industries and geographies, mitigating concentration risk and providing stability in varying market conditions.

The company has historically demonstrated resilience during economic downturns due to its strong tenant base, long lease terms, and net lease structure, which shifts most property expenses to tenants.

Occupancy has remained consistently high—near 98–99%—even in slower economic periods, allowing Gladstone to sustain cash distributions and Core FFO. This combination of stable income, diversified holdings, and conservative financial management helps the REIT weather recessions better than many peers.

Source: Investor Relations

Dividend Analysis

The company’s annual dividend is $1.20 per share. At its recent share price, the stock has a high yield of 10.9%.

Given the company’s 2025 earnings outlook, FFO is expected to be $1.45 per share. As a result, the company is expected to pay out roughly 83% of its FFO to shareholders in dividends.

Final Thoughts

We project total annual returns of 13% for Gladstone Commercial going forward. With a current yield of 10.9%, the stock appears undervalued. We view the company’s strong recession resilience and consistent FFO per share positively, though we assign a sell rating due to the lack of recent dividend increases.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].