The Walt Disney Company (NYSE: DIS) is expected to report mixed results for the fourth quarter of FY25. Investors will be watching key areas such as theme park performance, streaming subscriber growth, and the impact of ongoing challenges in traditional TV and sports broadcasting. The results could offer insight into how Disney is navigating a shifting media landscape.

What to Expect

When the entertainment behemoth reports Q4 earnings on November 13, before the opening bell, analysts will be expecting adjusted earnings of $1.02 per share on revenues of $22.78 billion. In the prior-year quarter, the company earned $1.14 per share and generated revenues of $22.57 billion. In the most recent quarter, earnings topped expectations, marking the ninth beat in a row. Meanwhile, revenues fell short of expectations after delivering a mix of hits and misses in recent quarters.

After recovering from the April lows, Disney’s stock has maintained an uptrend. This week, the shares traded broadly in line with their 12-month average value of $110.37. Having traded sideways since mid-year, the stock’s last closing price almost matches the levels seen at the beginning of 2025. The optimistic outlook from analysts suggests further upside for DIS, supported by robust theme park results and a recovering streaming segment.

Financials

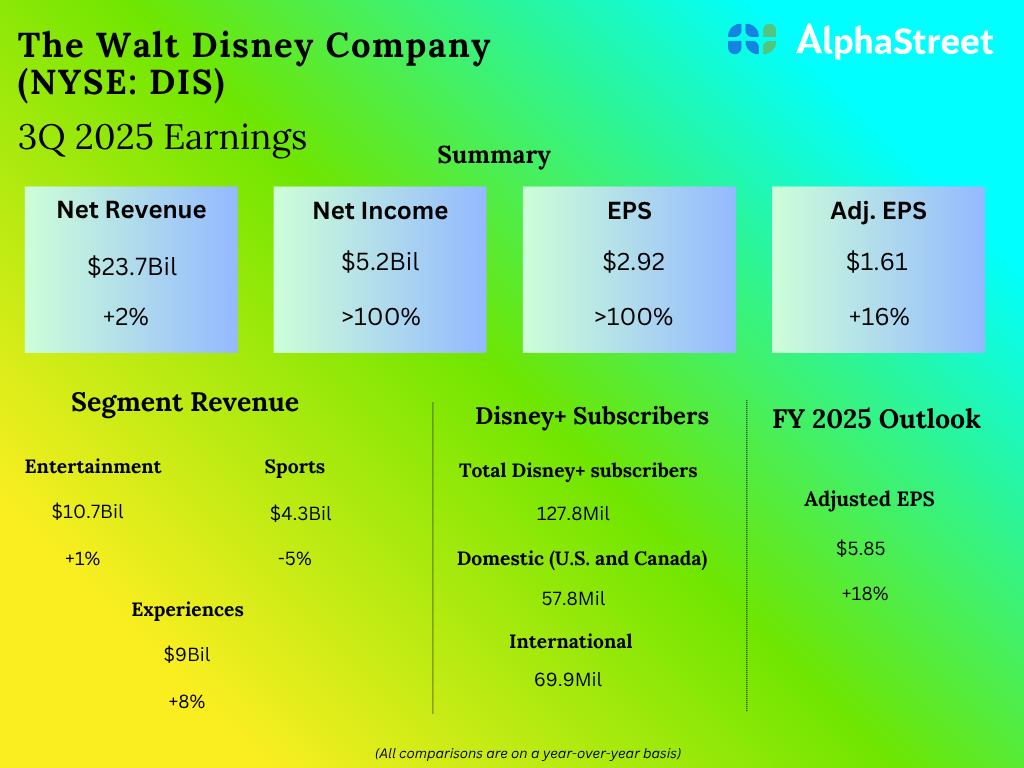

In the third quarter of FY25, Disney’s revenues increased modestly by 2% from last year to $23.7 billion. Earnings, on an adjusted basis, jumped 16% year-over-year to $1.61 per share in the June quarter. Net income attributable to the company nearly doubled to $5.2 billion or $2.92 per share in Q3 from $2.6 billion or $1.43 per share in the year-ago quarter.

From Disney’s Q3 2025 Earnings Call

“We have now signed four e-commerce customers since entering this exciting new market last year, and we anticipate many more in the coming quarters. We recently celebrated our third anniversary as a stand-alone company, and I am tremendously proud of all we have accomplished. The separation unleashed the opportunity for us to expand our pipeline and grow as an independent organization. We have continued to expand beyond pay TV, which has been our core business historically, and into new growth opportunities in semiconductors, OTT, social media, and e-commerce.“

Road Ahead

Notably, the management lowered its full-year revenue guidance, mainly to reflect the filing of litigation against AMD and the unlikelihood of closing a license agreement with the chipmaker. For fiscal 2025, Disney forecasts adjusted earnings of $5.85 per share, representing an increase of 18% over fiscal 2024. The company has embarked on a cost-reduction drive to streamline operations and enhance profitability.

Disney’s shares have grown an impressive 21% in the past six months. On Wednesday, the stock opened at $111.35 and gained modestly in early trading.