Qualcomm, Inc. (NASDAQ: QCOM) has reported stronger-than-expected earnings and revenues for the fourth quarter of fiscal 2025. The company, a leading manufacturer and supplier of digital wireless communication products, is thriving on its dominance in premium Android smartphone chips. Despite the positive Q4 outcome, the stock declined, reflecting investor concern over rising costs and the management’s cautious long-term outlook for the business.

Stock Dips

Qualcomm shares traded lower on Wednesday evening, reversing the uptrend experienced ahead of the earnings. QCOM is still trading 13% above the levels seen at the beginning of the year, though it underperformed the S&P 500 index. While Q4 numbers beat estimates across the board, a non-cash charge of $5.70 billion related to the new tax legislation came as a dampener.

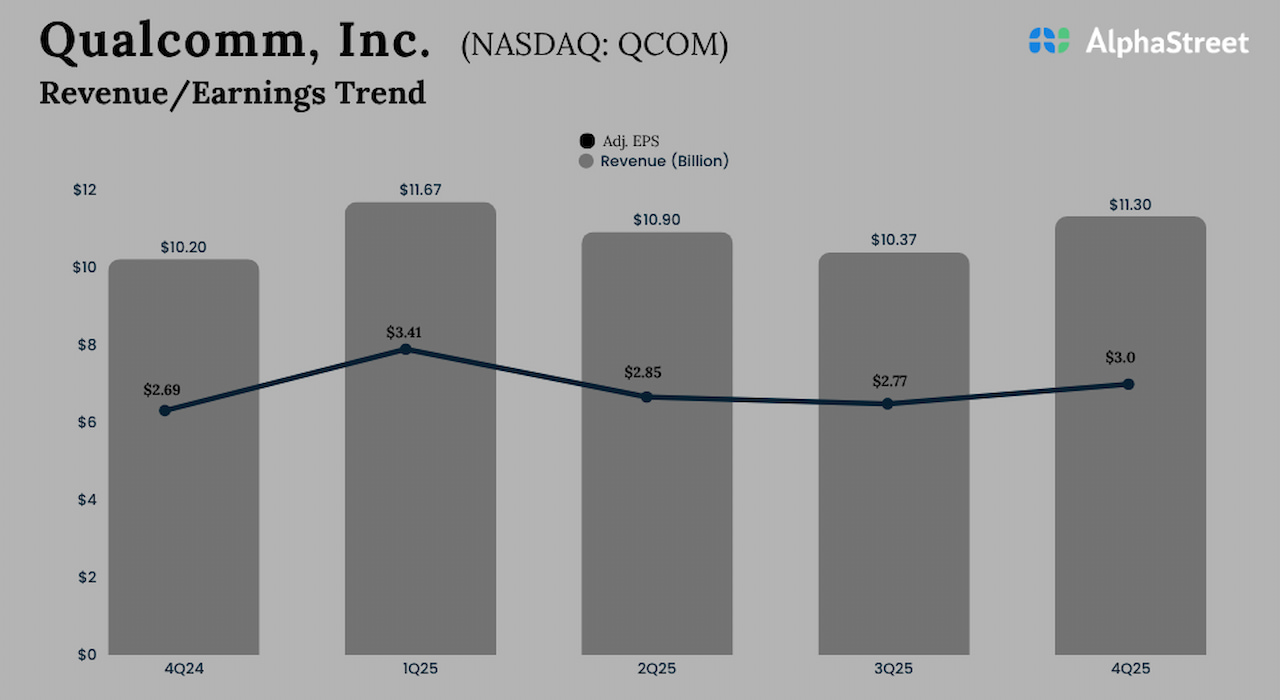

The tech firm’s revenues rose to $11.27 billion in the final three months of FY25 from $10.24 billion in Q4 2024, exceeding estimates. A 13% growth in revenue from Qualcomm CDMA Technologies (QCT) more than offset a 7% drop in Technology Licensing revenue. Total QCT revenues, excluding the Apple business, jumped 18% YoY, with combined fiscal year Automotive and IoT revenue growth of 27%.

Earnings Beat

Excluding one-off items, fourth-quarter earnings increased to $3.0 per share from $2.69 per share last year, which is above Wall Street’s expectations. On a reported basis, the company posted a net loss of $3.12 billion or $2.89 per share for Q4, compared to a profit of $2.92 billion or $2.59 per share last year. It generated a record free cash flow of $12.8 billion in fiscal 2025, which was almost entirely returned to stockholders through share repurchases and dividends.

For the first quarter of fiscal 2026, the management projects adjusted revenue of $11.8 billion-$12.6 billion and adjusted earnings in the range of $3.3 per share to $3.5 per share. The guidance for Q1 QCT revenue is $10.3 -$10.9 billion, with an estimated EBT margin of 30-32%. The QTL segment is expected to generate revenue between $1.4 billion and $1.6 billion in the December quarter, with an EBT margin of 74-78%. Automotive revenue is expected to be flat to slightly up on a sequential basis in Q1.

Qualcomm’s CEO Cristiano Amon said at the Q4 earnings call, “We are incredibly excited about the size of the opportunity and the next phase of data center build-out, where there’s going to be real growth as we go from training to inference. We have been focused on two areas. One is, we believe we have one very strategic asset in the industry, which is a very competitive, power-efficient CPU. That is both for the head node of AI clusters as well as general-purpose compute. And then we also have been building what we think is a new architecture dedicated to inference.”

Dominance

Sanpdragon, Qualcomm’s flagship product, is probably the most widely used processor in premium smartphones. With the demand for AI-based gadgets like smart glasses and wearables growing steadily, the company sees a significant opportunity in that area. Meanwhile, heavy investments in growth initiatives, particularly in data center, have resulted in cost escalation, putting pressure on margins. Of late, the company’s capital spending strategy has been focused on shifting from mature businesses to growth areas. The management now expects data center revenue to begin in fiscal 2026 — a year ahead of its original FY27 target.

Extending the post-earnings downturn, Qualcomm shares traded down 3.5% on Thursday afternoon. The last closing price is well below the stock’s 12-month average price of $158.11.

The post Important takeaways from Qualcomm’s (QCOM) Q4 2025 report first appeared on AlphaStreet.