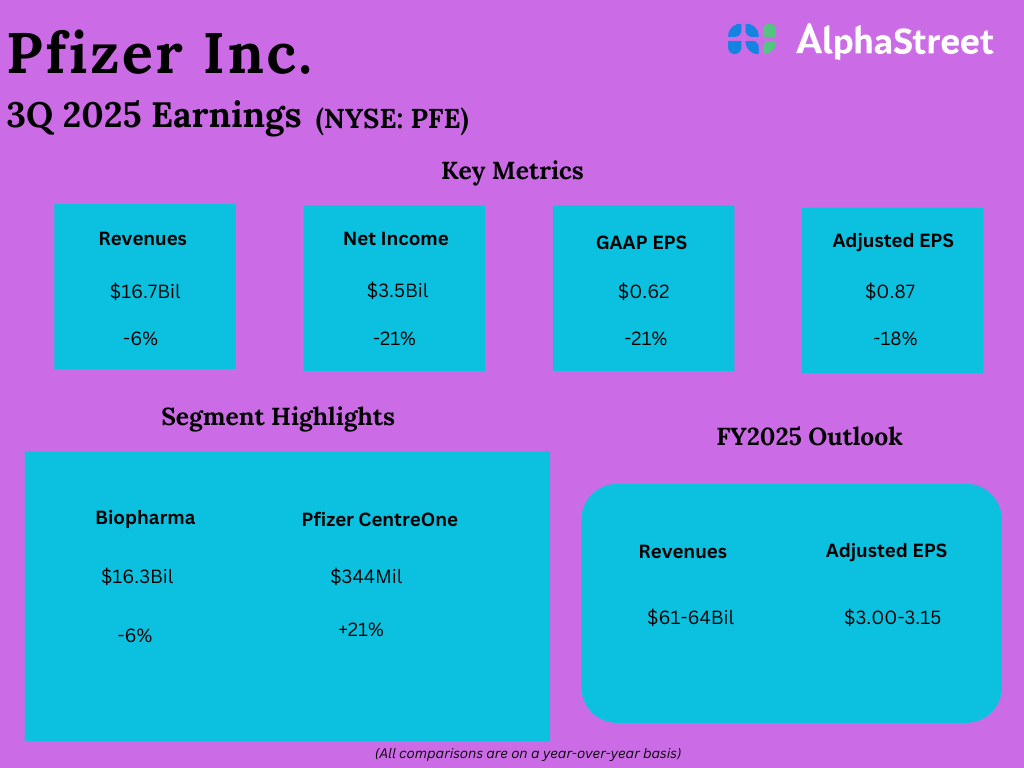

Shares of Pfizer Inc. (NYSE: PFE) stayed green during midday trade on Tuesday following the company’s announcement of its third quarter 2025 earnings results. The top and bottom line numbers declined on a year-over-year basis but managed to surpass expectations. In addition, the pharma giant raised its earnings guidance for the full year.

Results beat estimates

Pfizer’s revenues decreased 6% on a reported basis and 7% on an operational basis to $16.7 billion in the third quarter of 2025 compared to the year-ago period. Earnings, on a GAAP basis, decreased 21% YoY to $0.62. Adjusted EPS of $0.87 was down 18% from the previous year. Revenue and adjusted EPS beat expectations.

Business performance

During the quarter, Pfizer’s top line was impacted mainly by a decline in revenues from its COVID-19 products Paxlovid and Comirnaty. Paxlovid revenues decreased 55% on an operational basis, primarily due to lower infection rates across US and international markets and lower international government purchases. There was also a one-time benefit from a favorable US government stockpile purchase in the year-ago period, which was absent this quarter. Comirnaty revenues were down 20% operationally due to a narrower recommendation for vaccination in the US and delayed approval of the new variant vaccine.

Meanwhile the company’s other products witnessed revenue growth. Revenues from Eliquis were up 22% operationally, driven by a rise in demand worldwide and favorable pricing in the US. This was partly offset by the entry of generic products and price erosion in some international markets.

The Vyndaqel family saw operational revenue growth of 7% in Q3, fueled by strong demand, and better patient affordability in the US. This was partly offset by lower prices in the US due to higher manufacturer discounts and new payer contracts.

Nurtec revenues were up 22% operationally, helped by strong demand in the US and recent launches in certain international markets. This was partly offset by lower prices in the US.

Raised outlook

Pfizer raised its adjusted EPS guidance for full-year 2025 to a range of $3.00-3.15 from the previous range of $2.90-3.10, based on its year-to-date performance, confidence in its business, and progress on cost savings. The company reaffirmed its revenue guidance of $61-64 billion.