Published on October 28th, 2025 by Felix Martinez

High-yield stocks pay out dividends that are significantly higher than the market average. For example, the S&P 500’s current yield is only ~1.2%.

High-yield stocks can be particularly beneficial in supplementing income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

Timbercreek Financial Corp. (TBCRF) is part of our ‘High Dividend 50’ series, which covers the 50 highest-yielding stocks in the Sure Analysis Research Database.

We have created a spreadsheet of stocks (and closely related REITs, MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-dividend stocks to review is Timbercreek Financial Corp. (TBCRF).

Business Overview

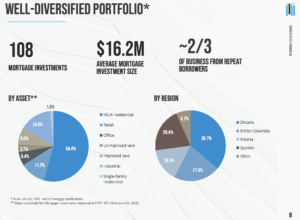

Timbercreek Financial is a Canadian non-bank lender specializing in short-term, structured financing for commercial real estate. The company primarily provides first-mortgage loans for income-producing properties, including multi-residential, retail, industrial, and office assets. Its loans support acquisitions, redevelopment, or transitional financing and are typically repaid through long-term financing or property sales. The firm’s portfolio is fully focused on commercial real estate, with around 92% of capital deployed in Ontario, British Columbia, Quebec, and Alberta.

Timbercreek emphasizes conservative risk management, maintaining a 63.3% loan-to-value ratio (year-end 2024) and floating-rate loans with rate floors to protect against market volatility while benefiting from interest rate movements. The company pays monthly dividends, appealing to income-focused investors, and has a market capitalization of CAD 460.8 million. Its disciplined lending model and urban-focused portfolio provide stable, high-quality exposure to Canada’s major real estate markets.

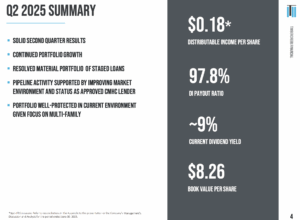

Source: Investor Relations

Timbercreek Financial reported Q2 2025 net income of $12.4 million, or $0.15 per share, slightly below expectations. Net investment income was $25.2 million, and distributable income totaled $14.6 million ($0.18 per share). The company declared $14.3 million in dividends ($0.17 per share), yielding 9.5% at the current share price.

The net mortgage portfolio grew to $1.114 billion, up 11% year-over-year, with new loans weighted toward the end of the quarter. Stage 2 and 3 loans totaling $80 million were resolved, freeing capital for higher-yield investments. Variable-rate loans with interest rate floors made up 87.4% of the portfolio, protecting against interest rate swings, while multi-family residential assets remain resilient.

The portfolio’s weighted-average LTV was 66%, with first mortgages accounting for 91.6% and cash-flowing properties accounting for 76.3%. Weighted average interest rates were 8.6%. Timbercreek’s disciplined underwriting, active loan management, and focus on high-quality urban assets continue to generate stable income and attractive risk-adjusted returns for shareholders.

Source: Investor Relations

Growth Prospects

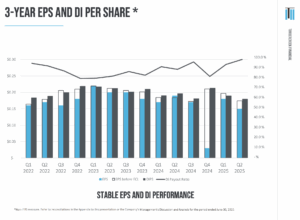

Timbercreek Financial grows by lending to new customers at attractive rates, primarily against income-producing properties. However, EPS has shown little growth over the past seven years, and U.S. investors face added risk from CAD/USD fluctuations. Even accounting for currency effects, Timbercreek’s bottom line has been mostly flat, and EPS is expected to remain stable over the next five years.

Over the past decade, EPS ranged from $0.36–$0.43 through 2017, fell to $0.23 in 2020 due to low rates and pandemic-related accounting adjustments, and rebounded to $0.43 by 2023. EPS declined to $0.28 in 2024 from higher-risk loan provisions and some portfolio runoff.

Distributable income per share is expected to stay around $0.36, and the monthly dividend has been stable at approximately $0.042 USD since 2017. Timbercreek remains a low-growth, income-focused investment with predictable dividends.

Source: Investor Relations

Competitive Advantages & Recession Performance

Timbercreek Financial’s competitive advantage lies in its focus on short-term, structured lending to commercial real estate investors, allowing faster execution and more flexible terms than traditional Canadian banks. Its disciplined underwriting, conservative loan-to-value ratios, and high percentage of first mortgages (over 90% of the portfolio) provide downside protection, while variable-rate loans with interest rate floors help the company benefit from rising rates and mitigate interest rate risk. Additionally, Timbercreek’s urban-focused, income-producing property portfolio ensures predictable cash flow and stable distributable income for shareholders.

During economic downturns, Timbercreek has demonstrated relative resilience. Its emphasis on cash-flowing properties, primarily multi-family residential assets, and conservative lending practices helps maintain loan performance even in softer markets.

While EPS can be volatile due to accounting adjustments or currency fluctuations, actual defaults have historically been limited, and the company has continued to generate steady distributable income. This defensive positioning makes Timbercreek a more stable choice compared with broader commercial real estate lenders during recessions.

Dividend Analysis

Timbercreek Financial’s annual dividend is $0.50 per share. At its recent share price, the stock has a high yield of 9.5%.

Given the company’s 2025 earnings outlook, EPS is expected to be $0.50 per share. As a result, the company is expected to pay out 100% of its EPS to shareholders in dividends.

Final Thoughts

Timbercreek Financial provides exposure to high-yield, short-term commercial real estate lending, benefiting from interest rate sensitivity and active portfolio management. The company offers attractive monthly dividends, but investors should exercise caution, as the current payout level may not be fully sustainable.

Its returns are tied to market conditions and the performance of income-producing properties, making it a higher-risk investment relative to more diversified or low-volatility options.

Given its current valuation and limited potential for dividend growth, we expect modest total returns, forecasting approximately 4.3% annualized through 2030. Considering the combination of elevated risk, stagnant earnings, and capped dividend upside, the stock is rated a sell, as its total return potential appears limited relative to alternative income-focused investments.

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].