Fourth-largest Bitcoin treasury Metaplanet on Tuesday announced plans to establish a new capital allocation policy, share repurchase program, and $500 million credit facility. As a result, Metaplanet stock skyrockets more than 10%, extending its weekly run to over 25%.

Bitcoin Treasury Metaplanet Stock Gains on Capital Allocation Policy

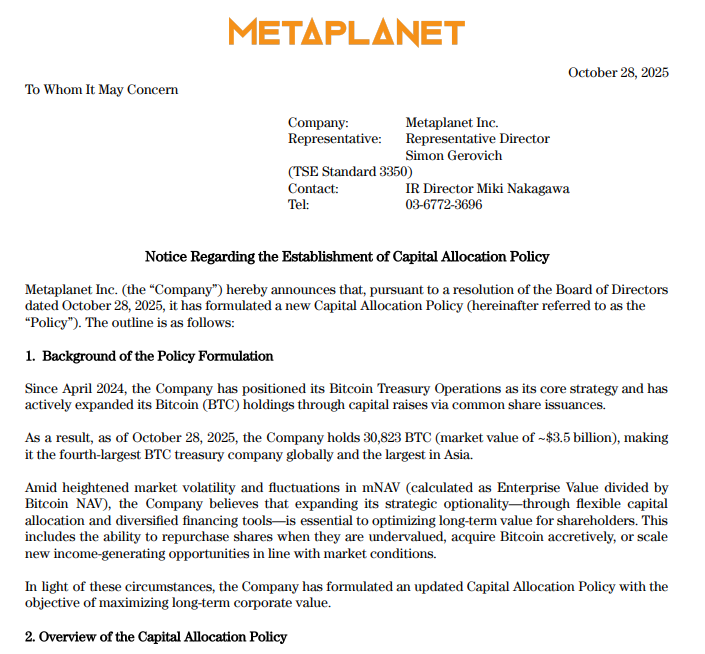

Metaplanet, aka Asia’s Strategy, announced a new capital allocation policy as agreed upon by its board of directors on October 28. The new capital allocation strategy will help the company maximize long-term corporate value and optimize long-term value for shareholders.

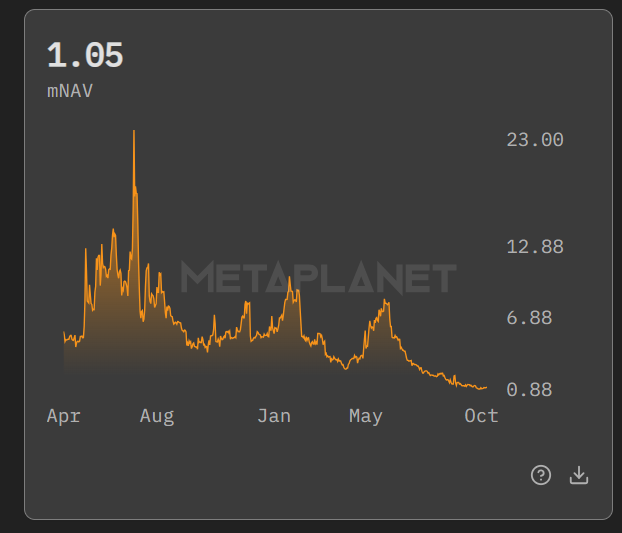

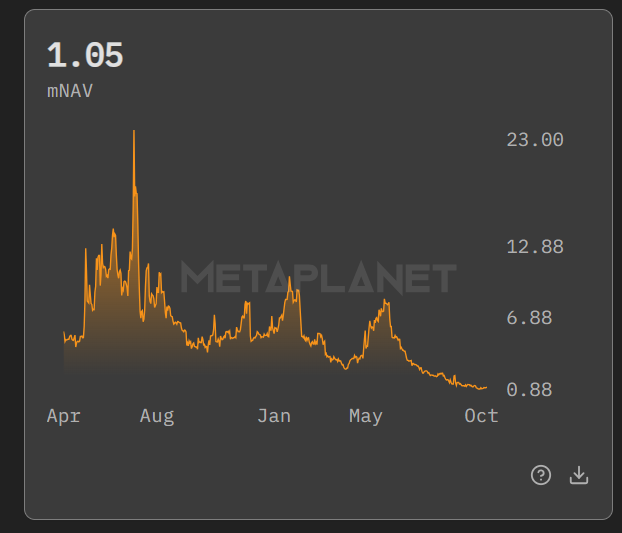

This comes following a drop in Metaplanet’s enterprise value below the value of its Bitcoin holdings, referred to as mNAV. During the recent BTC price crash to $102K levels amid heightened market volatility, mNAV fluctuated immensely. Metaplanet stock also saw massive selloffs by institutional and retail investors.

The capital allocation policy is designed to serve three fundamental principles. First, promoting the effective use of perpetual preferred shares to boost BTC yield. Also, pause in capital raising through common share issuance when mNAV falls below 1 and share buybacks to maximize BTC yield.

The Bitcoin treasury firm revealed that funding sources for share repurchases may include cash, proceeds from preferred share issuances, credit facilities, and income generated from the company’s Bitcoin income generation businesses.

Metaplanet stock jumped more than 10% to 519 JPY, before facing a slight profit booking on Tuesday. The 24-hour low and high are 464 and 541 JPY, respectively. Trading volume rocketed over 75 million, significantly higher than the average volume of 49 million.

Metaplanet stock has skyrocketed more than 25% in a week. A breakout above the descending trendline helped recover the year-to-date return to almost 53%.

Establishment of Share Repurchase Program

Today, the board of directors moved ahead with a plan to establish a share repurchase program. CEO Simon Gerovich confirmed that the share buyback will assist in enhancing capital efficiency and maximizing BTC yield. The company targets repurchasing 150 million shares by October 29, 2026.

“The Board also approved a credit facility to enable flexible execution as part of the company’s capital allocation strategy,” he added. The credit facility has a maximum borrowing capacity of $500 million. The Bitcoin treasury firm can use funds raised through the credit facility for additional BTC acquisitions, investments in the BTC income business, or share repurchases.

Metaplanet currently holds 30,823 BTC worth almost $3.5 billion, with a BTC yield of 496.4% YTD. At the time of writing, mNAV is 1.05 and the unrealized profit from BTC acquisitions is $281 million. The company has slowed BTC buying after achieving the target for this year, with a long-term objective of acquiring 210,000 BTC by 2027.

BTC price trades at $113,850, down 1.50% in the past 24 hours. The 24-hour low and high are $113,566 and $116,273, respectively. However, the trading volume has increased by 15% in the last 24 hours.