When advisory teams leave a large wirehouse or regional firm, they rarely do so to start their own business or join one of the aggregators pushing consolidation in the RIA industry.

Yet even as the appeal of going independent remains strong, many teams simply end up jumping to another wealth manager where they can continue working as direct employees and perhaps receive a big check for moving over clients.

Now a new partnership between Dynasty Financial Partners’ investment bank and the recruiting firm Diamond Consultants is betting that more wirehouse and regional teams would go in a different direction if given the proper assistance. Dynasty Investment Bank and Diamond this week announced the start of what they’re calling the Breakaway Investment Banking Initiative, which will help large advisory teams accurately value their practices and consider their many options should they want to leave their current firm.

Those avenues include joining a large independent broker-dealer or aggregator buying up advisory businesses. Or departing advisors might start their own RIA with an eye toward growing by means of mergers and acquisitions and advisor recruitment.

Sam Anderson, co-head of investment banking at Dynasty, said advisors often have trouble comparing the various pros and cons of the many options they have when they’re considering leaving a firm.

“How do you line all those up and make a decision that you’re going to be happy with and not regretful of once you’ve made it?” Anderson said. “Because I think we see a lot of folks as they’re thinking about it, not truly understanding their value as they’re thinking about their options.”

Wirehouses, RIAs speak different deal languages

Dynasty and Diamond Consultants’ Breakaway Investment Banking Initiative is mainly meant for teams with $1 billion or more under management at wirehouses or large regional wealth managers. Anderson said large advisory groups are often tempted by seemingly generous recruiting offers into thinking that they will be most at home at a firm closely resembling the one they’re planning to leave.

Among wirehouses and regional wealth managers, recruitment deals are often calculated as a multiple of the revenue a given advisory team produced over the previous year. These offers — which can be equal to two, three or even four times that trailing 12 months’ revenue — can result in upfront payments easily stretching into the millions.

RIA aggregators meanwhile tend to value firms at some multiple of their EBITDA, or earnings before interest, taxes, depreciation and amortization. It’s almost as though people in the wirehouse and RIA worlds are speaking different languages.

“There very definitely is a translation that happens between, ‘Hey, should I take the four-times revenue deal,’ right?” Anderson said. “Or what does that really mean from a valuation of the equity in the business, and how do we assess that?”

Financing always presents a big question to any advisory group that’s thinking of leaving a wirehouse or regional firm to start its own practice and achieve growth through M&A and recruiting deals. Anderson said Dynasty’s initiative can help departing teams walk through their options there as well, which include bringing in private equity partners, borrowing money or even an investment Dynasty itself.

Breaking record after record with RIA M&A

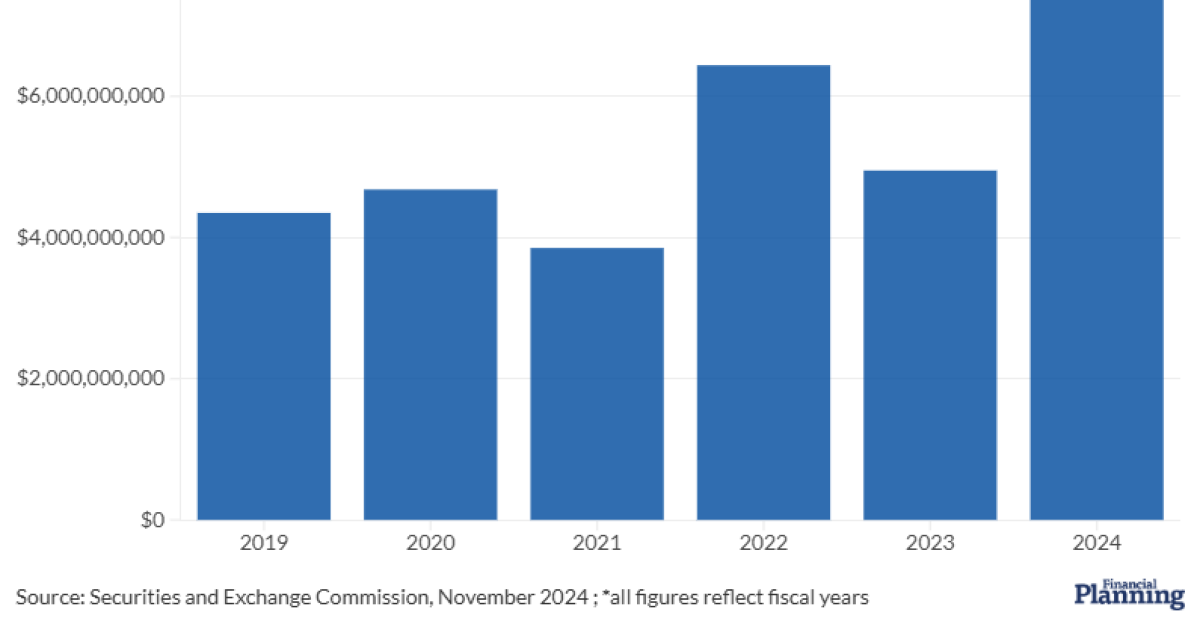

Dynasty Financial Partners, a network firm providing investing, marketing, compliance and other types to more than 500 independent advisors, started its investment bank in 2023 to meet the growing demand for advice on mergers and acquisitions among registered investment advisories. In 2024, it worked on 15 M&A and capital-raising transactions.

That same year saw a record number of RIA mergers and acquisitions. The industry-tracking firm DeVoe & Co. counted 272 M&A deals in total. Firm founder and CEO David DeVoe said in a report on RIA mergers and acquisitions that the pace of deals has been “redlining” for four consecutive quarters.

“2025 is set to break a new record and is on track to exceed 300 transactions,” DeVoe predicted.

Much of the consolidation came from large so-called aggregators, which often tap private equity money to finance their purchases of smaller firms. Aggregators, for instance, were behind nearly half of the quarterly record of 94 M&A deals DeVoe counted in the third quarter this year.

Why aren’t RIA aggregators getting more ex-wirehouse teams?

Louis Diamond, the CEO of Diamond Consultants, said it’s striking that large teams leaving wirehouses and regional firms have seldom been part of these mergers and acquisitions. That’s especially true as an increasing number of advisors look to set up as independent contractors with more ability than employees of large firms to run their businesses as they see fit.

A recent report on “Advisors in Transition: Challenges and Best Practices” from the research firm Cerulli and the JPMorgan-owned fintech firm 55ip predicted that the number of advisors at RIAs would increase by nearly 12% by 2028. Wirehouses, meanwhile, would see their headcounts fall by nearly 6% in the same time period.

Diamond said a big impediment to more former wirehouse teams being bought up by aggregators is a fundamental difference in business models. With departing wirehouse and regional teams, recruiters and acquirers have to take into account factors like left-behind deferred compensation, or money the advisors would have eventually been paid had they not left for a rival firm. It can also be harder to move client accounts to a new wealth manager.

That can be because many wirehouses and regional firms employ nonsolicitation clauses to set strict limits on advisors’ ability to reach out to former clients. Or it can be because the departing advisors have inherited clients from retired colleagues whose business may not be easy to move to a new wealth manager.

“There are a lot of nuances, and aggregators may sometimes undervalue a wirehouse team just because of where they are coming,” Diamond said. “We know how to position those teams and make them look as attractive as possible.”

Growing appeal of the RIA option

Diamond said he has long predicted that former wirehouse and regional teams would steadily become drawn into the gravitational pull of RIA aggregators.

“But there hasn’t been anyone who can really help these wirehouse teams really vet out their path, and the valuations and the mathe of these deals,” Diamond said. “But the independent or RIA world does solve for a lot of things that big wirehouse teams are looking for, so it’s a very important option for them to consider.”

Of course, Dynasty Financial Partners is among the many firms that would most likely be happy to see a few ex-wirehouse teams join its network. Acknowledging that possible conflict of interest, both Anderson and Diamond insisted they are committed to doing what’s best for their clients no matter where they eventually end up.

“Just because someone’s not going independent with Dynasty doesn’t mean we’re not supportive of the entire independence movement,” Anderson said. “Ensuring they are able to make good choices with clear information and doing what’s best for them, that’s something we pride ourselves on.”