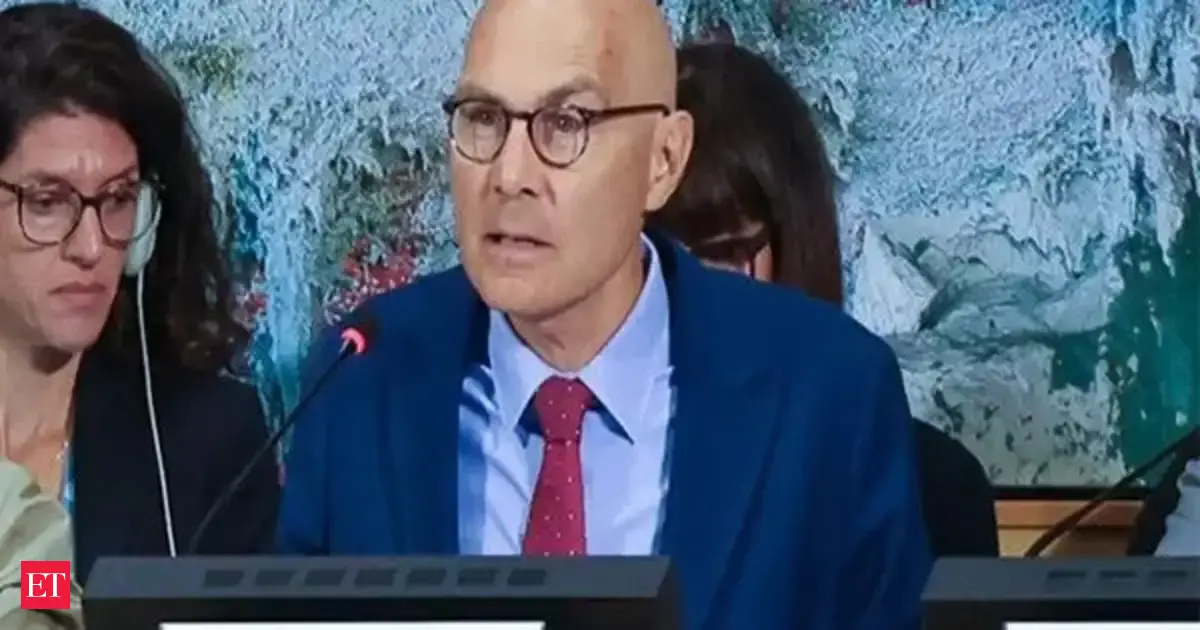

It would be reassuring for markets to hear Jamie Dimon, the leader of America’s biggest bank and a veteran of Wall Street, say he didn’t see a recession coming. Unfortunately, that’s not the case.

In his decades leading JPMorgan Chase, Dimon’s economic opinion has been seen as a barometer for the health of the U.S. economy. But those who follow Dimon also know he conducts rigorous stress testing at JP, making sure the institution can withstand a range of outcomes.

To this end, Dimon isn’t taking a recession off the table for next year—even though GDP at present is tracking upwards. According to latest figures, U.S. gross domestic product increased at an annual rate of 3.8% in the second quarter of 2025.

But there are questions outstanding for analysts: Particularly those like Dimon who refrain from falling to the overly bullish or bearish side. Those questions include the impact of tariffs on inflation (if or when those increases truly hit), as well as geopolitics, the labor market, and whether AI will deliver the returns investors are banking on.

Dimon echoed this caution in an interview this week, saying: “I think [a recession] could happen in 2026—I’m not worried about it is a different statement. We’ll deal with it, we’ll serve our clients, we’ll navigate through it. A lot of us have been through them before.”

Previously the billionaire banker has warned the American economy is weakening, saying in September following a measly jobs report from the Bureau of Labor Statistics that whether that weakness spills into economic contraction remains to be seen.

He struck a similar tone this week, saying in the conversation with Bloomberg: “You don’t wish it because you know certain people get hurt,” adding: “How it all sorts out? We’ll see.”

Dimon’s caution is at odds with some tried-and-trusted indicators. The Sahm Rule indicator—which signals the start of a recession when the three-month moving average of the national unemployment rate is 0.5 percentage points greater than the minimum of the three-month averages from the previous 12 months—sits at a comfortable 0.13%, assisted by a relatively stable unemployment rate.

Likewise JPMorgan itself wrote earlier this year the odds of a recession now sit at 40%, though global economist Joseph Lupton did note in the May release that the bank expects “material headwinds to keep growth weak through the rest of this year.”

Dimon, never one to bank on one outcome or another, did counter the warning with some reasons for optimism: “But I do think there are positives—like deregulation is a real positive, which also helps animal spirits … and you know, in the ‘One Big, Beautiful Bill’ there’s also more stimulus, that has positives for the economy but maybe negative for inflation.”

Shutdowns are a bad idea

One thing Dimon is sure on is that the current government shutdown isn’t good news for anyone. Washington is currently locked in a stalemate over funding, with threats lingering over furloughed workers not receiving backpay and potentially even their jobs when they return.

Similarly, the majority of traders are expecting the government shutdown to last for more than 15 days, with 52% expecting it to drag on for more than 20. This presents problems for the Fed, which will meet in a week to make a decision on the base rate without key data from federal releases.

“Look, I don’t like shutdowns. I think it’s just a bad idea—I don’t care what the Democrats or Republicans say, it’s a bad idea,” Dimon said. “It’s not a way to run a railroad.”

Even then Dimon, like many others on Wall Street, don’t expect the shutdown to materially impact the economy: “You know, one of them went for 35 days, I’m not sure … if it really affected the economy, the market in a real way.”