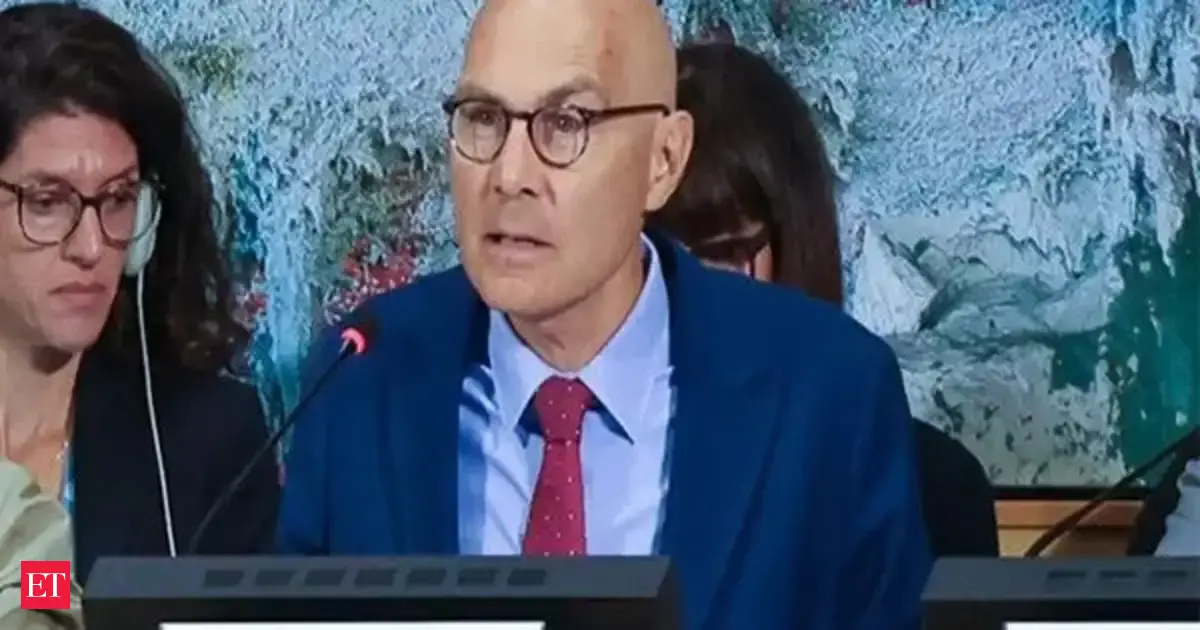

Jemal Countess / Getty Images for TIME

Ray Dalio thinks investors should allocate a considerable amount of their portfolios to gold.

Ray Dalio at an event Tuesday said investors should allocate about 15% of their portfolios to gold.

The precious metal recently traded around $4,000, reflecting a roughly 50% rise in 2025 alone.

Gold keeps rising. Some big-name investors say you should keep leaning in.

The latest is Bridgewater Associates founder Ray Dalio, who at an event on Tuesday said investors should allocate about 15% of their portfolio to the precious metal, citing its use as a source of downside protection. Gold futures recently traded at around $4,000 per troy ounce, reflecting a roughly 50% rise this year that has also lifted other metals.

“Gold is a very excellent diversifier in the portfolio,” Dalio said, according to a CNBC report. “If you look at it just from a strategic asset allocation perspective, you would probably have something like 15% of your portfolio in gold.”

Stocks are at highs, but that’s not the only reason investors have lately been piling into gold as a hedge against concerns about high stock valuations, inflation and various forms of uncertainty. Investors generally suggest some allocation to gold, but a few are pointing investors toward higher allocations lately.

Gold, he said, “is one asset that does very well when the typical parts of the portfolio go down.” He had in September suggested an allocation of 10% to 15%, saying he preferred gold to Treasurys as a safe-haven asset.

“The latest leg higher has been underpinned by the growing uncertainty over the U.S. government shutdown and fear-of-missing-out flows into physical gold ETFs,” LPL Chief Technical Strategist Adam Turnquist wrote Tuesday, citing “a macro backdrop consisting of a weaker dollar, the resumption of the rate-cutting cycle, U.S. deficit concerns, tariff-related inflation angst, and steady foreign central bank buying” as underpinning support for gold this year.

Experts generally recommend a range of allocations to gold, which is seen as a hedge against inflation and volatility as well as a source of possible appreciation. Broadly speaking, recommendations tend to land between about 5% and 20%, depending on market conditions and investors’ personal risk tolerance.

DoubleLine Capital founder Jeffrey Gundlach recently suggested that an allocation of closer to 25% wouldn’t be “excessive.”

Read the original article on Investopedia