The carbon farming market is gaining momentum as the agriculture sector pivots toward sustainability and climate-conscious practices. Farmers, investors, and agritech companies are increasingly exploring opportunities to reduce greenhouse gas emissions while generating additional revenue streams.

According to BIS Research, the carbon farming market is projected to reach $2,341.2 million by 2034 from $531.8 million in 2024, growing at a CAGR of 15.98% during the forecast period 2024-2034.

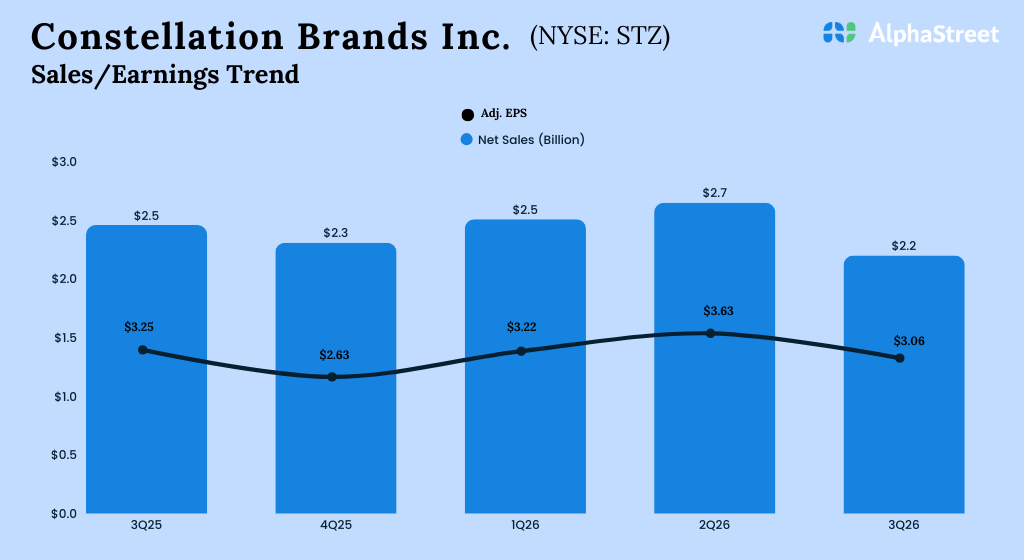

BIS Market Data

The market’s robust growth reflects the increasing importance of carbon sequestration in mitigating climate change. Programs that incentivize carbon credits are driving adoption among farmers, while technological innovations enhance measurement and verification of sequestered carbon. Carbon farming not only benefits the environment but also positions agricultural stakeholders to participate in emerging carbon markets and sustainability initiatives.

Key Drivers in the Carbon Farming Market

Government Initiatives: Regulatory frameworks and subsidies encourage farmers to adopt climate-smart practices. Nations worldwide are prioritizing low-emission agriculture, creating an enabling environment for carbon credit programs.

Corporate Sustainability Goals: Businesses increasingly purchase carbon credits to meet net-zero targets. This demand creates a lucrative market for farmers implementing regenerative practices.

Technological Advancements: Remote sensing, satellite imaging, and AI-based monitoring enable accurate tracking of carbon sequestration. Such innovations increase transparency and build confidence in carbon credits.

Financial Incentives for Farmers: Carbon farming provides farmers with additional revenue streams through verified carbon credit sales, encouraging widespread adoption.

Awareness of Soil Health: Improved soil management not only sequesters carbon but also enhances long-term farm productivity, making it a win-win solution.

Request A Detailed Sample of Carbon Farming Market – A Global and Regional Analysis: Focus on Application, Product, Carbon Credit and Debit, Opportunities for Agricultural Stake Holders and Country – Analysis and Forecast, 2024-2034

Key Trends in the Carbon Farming Market

Regenerative Agriculture Practices: Cover cropping, conservation tillage, and agroforestry are becoming mainstream, helping farms capture more carbon while improving biodiversity.

Participation in Voluntary Carbon Markets: Farmers increasingly engage in voluntary markets to monetize carbon sequestration, attracting both local and international buyers.

Integration of Climate-Smart Agriculture: Holistic strategies combining precision agriculture, soil carbon monitoring, and adaptive crop management enhance sustainability outcomes.

Focus on Technology-Enabled Verification: Platforms that verify carbon credits digitally are streamlining market participation and ensuring transparency.

Agroecology and Sustainable Land Use: There is a rising interest in practices that balance ecological health with productivity, further supporting carbon farming adoption.

Challenges & Opportunities

Challenges

Ensuring that carbon sequestration is long-term remains a technical and logistical challenge.

Multiple standards and protocols can confuse farmers and investors, slowing adoption.

Lack of infrastructure and technology limits expansion in some agricultural economies.

Opportunities are significant:

Adoption of digital tools, increasing demand for carbon credits, and supportive policy frameworks can accelerate market growth. Investment in farmer education and streamlined verification mechanisms can further unlock the market potential.

Conclusion

The carbon farming market represents a convergence of environmental stewardship, technological innovation, and economic opportunity. With a projected CAGR of 15.98% through 2034, the market offers a pathway for farmers and investors to contribute to climate goals while securing financial benefits. Adoption of regenerative practices, engagement with carbon markets, and integration of climate-smart technologies are critical for realizing the full potential of this evolving sector.

Trending FAQ on the Carbon Farming Market

What is carbon farming?

Carbon farming involves practices that capture and store atmospheric carbon in soil and vegetation, reducing net greenhouse gas emissions.

How do farmers benefit financially from carbon farming?

Farmers earn revenue by selling verified carbon credits from activities that sequester carbon.

Which practices are commonly used in carbon farming?

Key practices include regenerative agriculture, agroforestry, conservation tillage, cover cropping, and silvopasture.

What are voluntary carbon markets?

These markets allow entities to purchase carbon credits from projects like carbon farming to offset emissions voluntarily.

Click Here to Download the ToC

Who are the leading companies in the carbon farming market?

Nori, Inc.

Soil Capital Ltd.

Terramera Inc.

AgriWebb

Regrow

LI-COR, Inc.

SourceTrace

Boomitra

Cultyvate

AgroCares

CarbonFarm

SpaceNus Technologies GmbH

Agreena

Kheti Buddy

AgriProve Pty Ltd