Published on October 6th, 2025 by Bob CiuraSpreadsheet data updated daily

Sure Dividend practices a long-term buy-and-hold strategy built on consistency.

That means avoiding speculation, resisting fads, and not overloading on one stock or sector – since even former Dividend Aristocrats like Walgreens (WBA) and V.F. Corp (VFC) can stumble.

Consistency also applies to investing habits. Instead of lump sums, steady contributions at regular intervals help you buy through both bull markets and downturns.

And holding during recessions is challenging but critical, as history shows markets rebound and reward patient investors.

There are many quality dividend stocks that have provided consistent dividend increases each year, even during recessions.

For example, the Dividend Champions are a group of stocks that have raised their dividends each year for at least 25 years in a row.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Investors are likely familiar with the Dividend Aristocrats, a group of 69 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

This article will provide a detailed analysis on 10 consistent dividend growth stocks on the list of Dividend Champions, that have recession-proof payouts.

These 5 Dividend Champions have the highest Dividend Risk Scores of ‘A’, with payout ratios below 70% and positive long-term growth potential.

The stocks below are ranked according to their dividend yield, from lowest to highest.

Table of Contents

Consistent Dividend Growth Stock #10: Coca-Cola Co. (KO)

Coca-Cola is the world’s largest beverage company, as it owns or licenses more than 500 unique non–alcoholic brands. Since the company’s founding in 1886, it has spread to more than 200 countries worldwide.

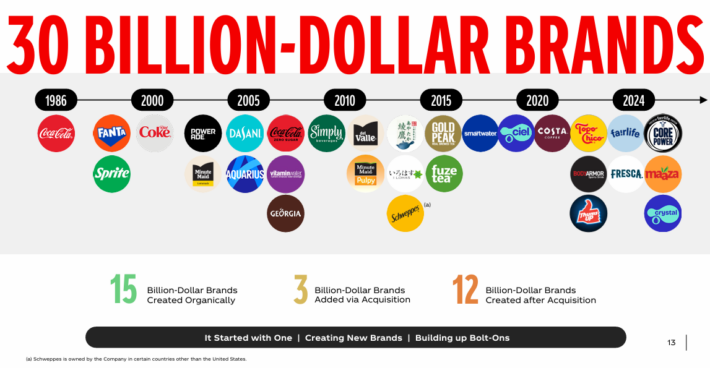

Coca-Cola now has 30 billion-dollar brands in its portfolio, which each generate at least $1 billion in annual sales.

Source: Investor Presentation

Coca-Cola posted second quarter earnings on July 22nd, 2025, and results were somewhat mixed. Adjusted earnings-per-share came to 87 cents, which was three cents ahead of estimates. Revenue was up 0.8% year-over-year to $12.5 billion, missing estimates by $80 million.

Organic revenue was up 5%, including 6% growth in pricing and mix, partially offset by a 1% decline in volumes. The company still expects to deliver 5% to 6% growth in organic revenue this year, unchanged from prior. Net revenue is expected to face a 1% to 2% headwind from currency impacts based on current positioning.

Sparkling soft drinks volume was off 1%, as Coca-Cola fell 1%. Coca-Cola Zero Sugar soared 14% as it grew in all geographic segments. Comparable operating margin expansion during the quarter was up to 37.1% of revenue, driven by organic growth, the timing of marketing investments, and effective cost management. Currency headwinds partially offset some of that..

Click here to download our most recent Sure Analysis report on KO (preview of page 1 of 3 shown below):

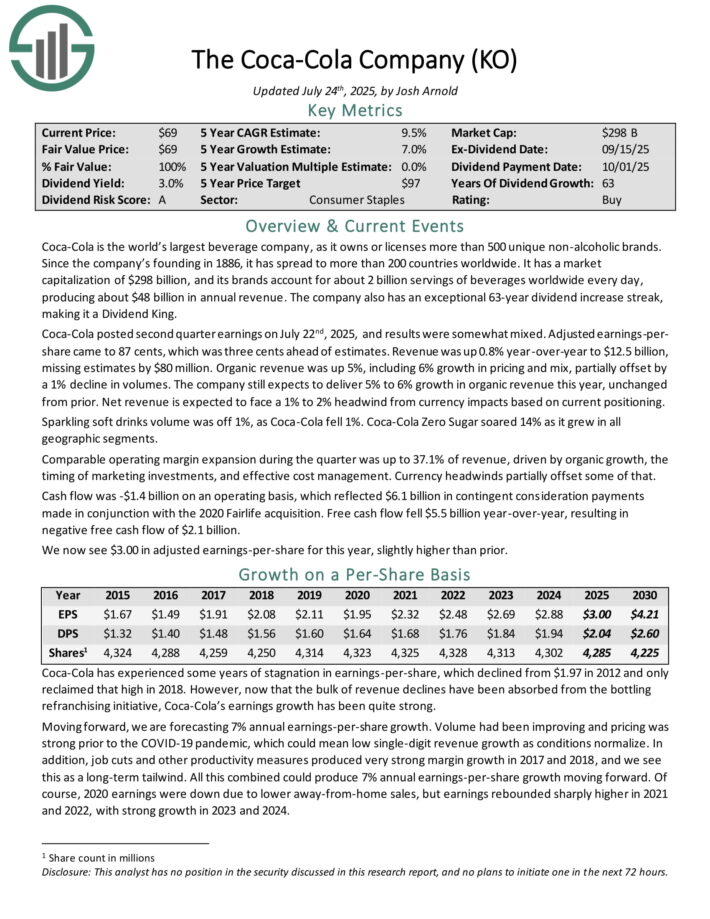

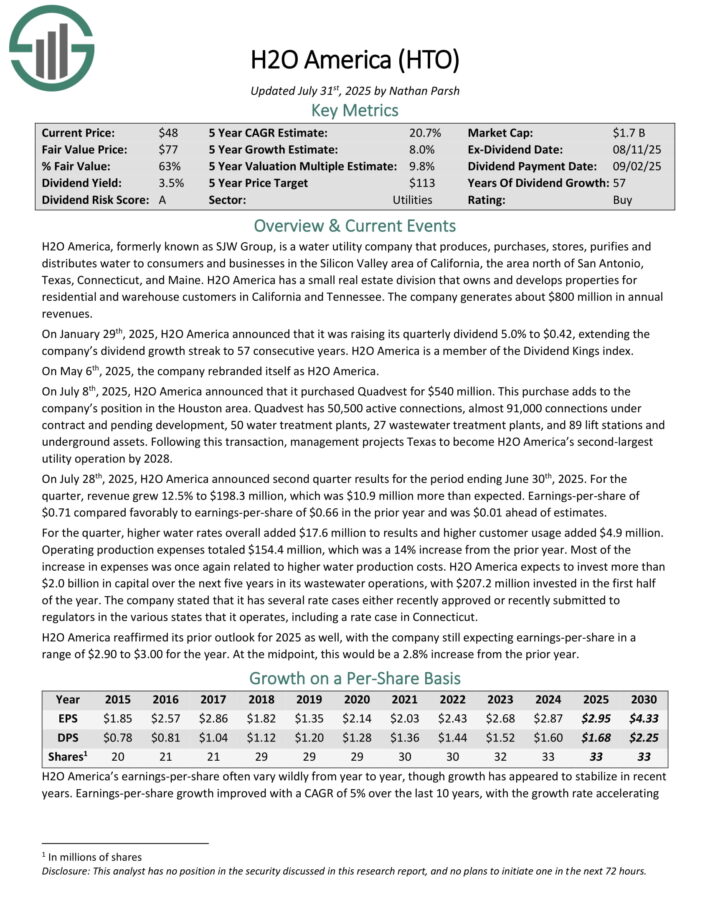

Consistent Dividend Growth Stock #9: Stepan Co. (SCL)

Stepan manufactures basic and intermediate chemicals, including surfactants, specialty products, germicidal and fabric softening quaternaries, phthalic anhydride, polyurethane polyols and special ingredients for the food, supplement, and pharmaceutical markets.

It is organized into three distinct business lines: surfactants, polymers, and specialty products. These businesses serve a wide variety of end markets. The surfactants business is Stepan’s largest by revenue.

Stepan posted second quarter earnings on July 30th, 2025, and results were much worse than expected on both the top and bottom lines. Adjusted earnings-per-share came to 52 cents, which was nowhere close to estimates for 90 cents. Revenue was up 7% year-over-year to $595 million, missing estimates by $3.6 million.

Surfactant sales were $412 million, with selling prices soaring 11% on pass-through of raw material costs, primarily. Sales volumes were down 1%. Polymers net sales were up 2% to $163 million. Volumes were up 7% but selling prices declined 7%. Specialty Product sales were $20.5 million, up 22%, but margins worsened.

Adjusted EBITDA was $51.4 million, up 8% year-over-year. Adjusted net income was $12 million. Cash from operations came to $11.2 million, and free cash flow was negative $14.4 million on higher working capital requirements, as well as raw material builds.

Click here to download our most recent Sure Analysis report on SCL (preview of page 1 of 3 shown below):

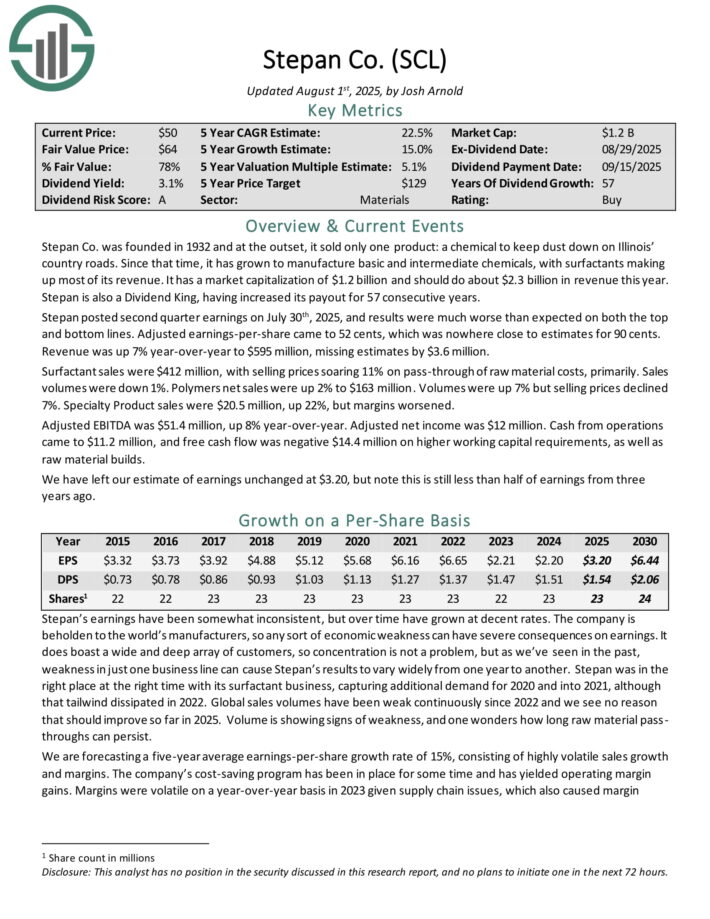

Consistent Dividend Growth Stock #8: H2O America (HTO)

H2O America, formerly known as SJW Group, is a water utility company that produces, purchases, stores, purifies and distributes water to consumers and businesses in the Silicon Valley area of California, the area north of San Antonio, Texas, Connecticut, and Maine.

It also has a small real estate division that owns and develops properties for residential and warehouse customers in California and Tennessee. The company generates about $670 million in annual revenues.

On July 8th, 2025, H2O America announced that it purchased Quadvest for $540 million. This purchase adds to the company’s position in the Houston area.

Quadvest has 50,500 active connections, almost 91,000 connections under contract and pending development, 50 water treatment plants, 27 wastewater treatment plants, and 89 lift stations and underground assets.

On July 28th, 2025, H2O America announced second quarter results for the period ending June 30th, 2025. For the quarter, revenue grew 12.5% to $198.3 million, which was $10.9 million more than expected.

Earnings-per-share of $0.71 compared favorably to earnings-per-share of $0.66 in the prior year and was $0.01 ahead of estimates.

For the quarter, higher water rates overall added $17.6 million to results and higher customer usage added $4.9 million. Operating production expenses totaled $154.4 million, which was a 14% increase from the prior year.

Click here to download our most recent Sure Analysis report on HTO (preview of page 1 of 3 shown below):

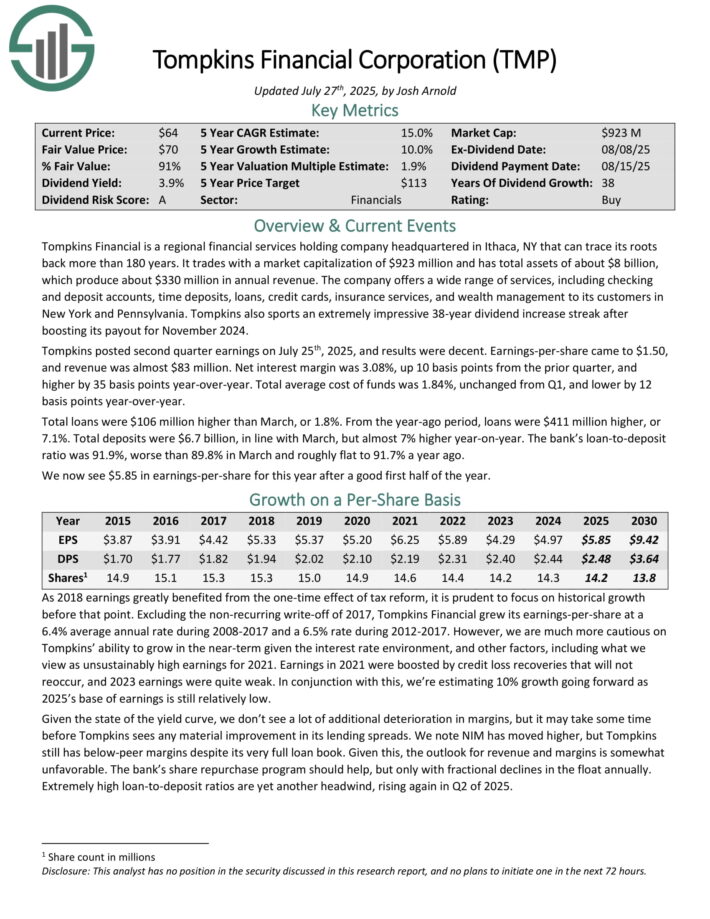

Consistent Dividend Growth Stock #7: Tompkins Financial (TMP)

Tompkins Financial is a regional financial services holding company headquartered in Ithaca, NY that can trace its roots back more than 180 years. It has total assets of about $8 billion, which produce about $300 million in annual revenue.

The company offers a wide range of services, including checking and deposit accounts, time deposits, loans, credit cards, insurance services, and wealth management to its customers in New York and Pennsylvania.

Tompkins posted second quarter earnings on July 25th, 2025. Earnings-per-share came to $1.50, and revenue was almost $83 million.

Net interest margin was 3.08%, up 10 basis points from the prior quarter, and higher by 35 basis points year-over-year. Total average cost of funds was 1.84%, unchanged from Q1, and lower by 12 basis points year-over-year.

Total loans were $106 million higher than March, or 1.8%. From the year-ago period, loans were $411 million higher, or 7.1%.

Total deposits were $6.7 billion, in line with March, but almost 7% higher year-on-year. The bank’s loan-to-deposit ratio was 91.9%, worse than 89.8% in March and roughly flat to 91.7% a year ago.

Click here to download our most recent Sure Analysis report on TMP (preview of page 1 of 3 shown below):

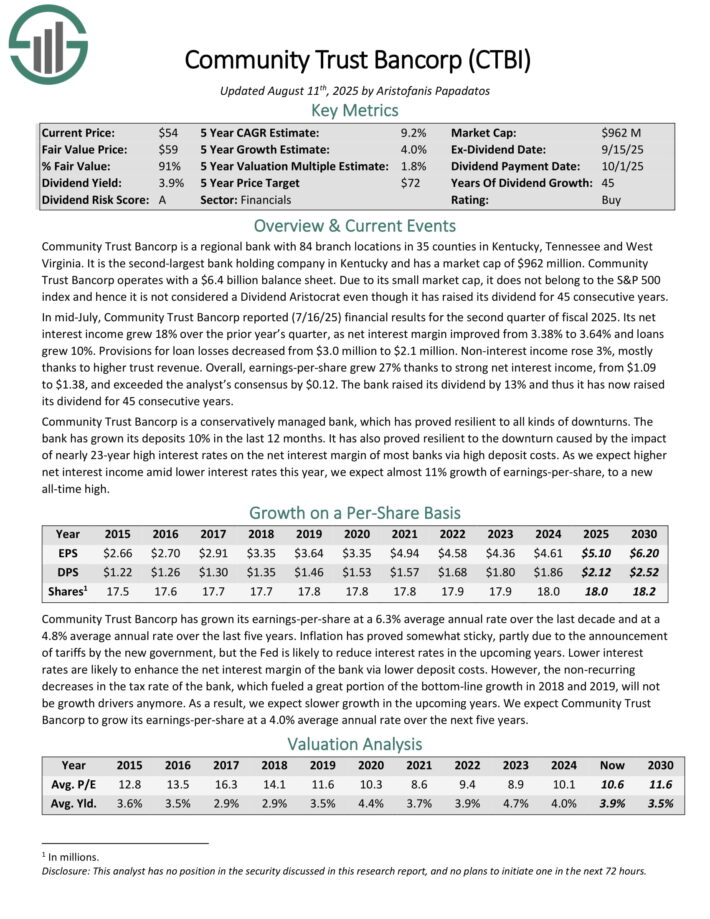

Consistent Dividend Growth Stock #6: Community Trust Bancorp (CTBI)

Community Trust Bancorp is a regional bank with 84 branch locations in 35 counties in Kentucky, Tennessee and West Virginia. It is the second-largest bank holding company in Kentucky and has a market cap of $962 million.

Community Trust Bancorp operates with a $6.4 billion balance sheet. It has raised its dividend for 45 consecutive years.

In mid-July, Community Trust Bancorp reported (7/16/25) financial results for the second quarter of fiscal 2025. Its net interest income grew 18% over the prior year’s quarter, as net interest margin improved from 3.38% to 3.64% and loans grew 10%.

Provisions for loan losses decreased from $3.0 million to $2.1 million. Non-interest income rose 3%, mostly thanks to higher trust revenue. Overall, earnings-per-share grew 27% thanks to strong net interest income, from $1.09 to $1.38, and exceeded the analyst’s consensus by $0.12. The bank raised its dividend by 13%.

Community Trust Bancorp is a conservatively managed bank, which has proved resilient to all kinds of downturns. The bank has grown its deposits 10% in the last 12 months. It has also proved resilient to the downturn caused by the impact of nearly 23-year high interest rates on the net interest margin of most banks via high deposit costs.

As we expect higher net interest income amid lower interest rates this year, we expect almost 11% growth of earnings-per-share, to a new all-time high.

Click here to download our most recent Sure Analysis report on CTBI (preview of page 1 of 3 shown below):

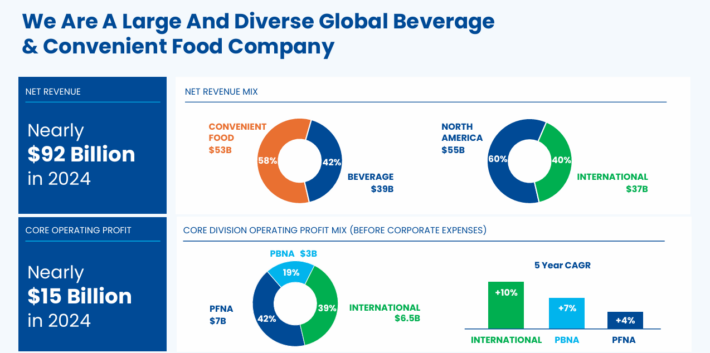

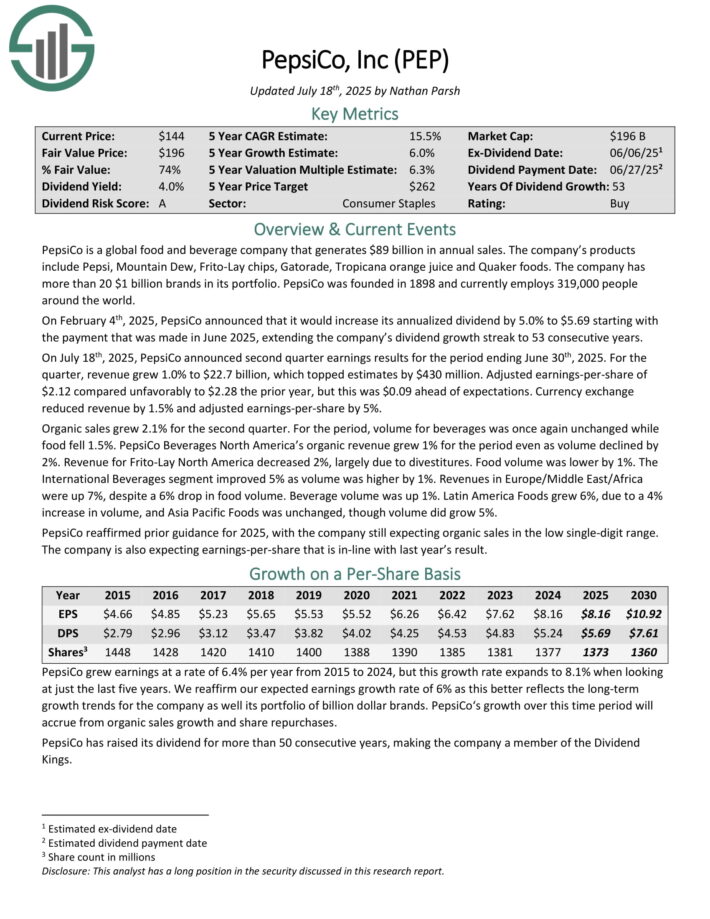

Consistent Dividend Growth Stock #5: PepsiCo Inc. (PEP)

PepsiCo is a global food and beverage company. Its products include Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker foods.

Its business is split roughly 60-40 in terms of food and beverage revenue. It is also balanced geographically between the U.S. and the rest of the world.

Source: Investor Presentation

On July 18th, 2025, PepsiCo announced second quarter earnings results for the period ending June 30th, 2025. For the quarter, revenue grew 1.0% to $22.7 billion, which topped estimates by $430 million.

Adjusted earnings-per-share of $2.12 compared unfavorably to $2.28 the prior year, but this was $0.09 ahead of expectations. Currency exchange reduced revenue by 1.5% and adjusted earnings-per-share by 5%.

Organic sales grew 2.1% for the second quarter. For the period, volume for beverages was once again unchanged while food fell 1.5%.

Click here to download our most recent Sure Analysis report on PEP (preview of page 1 of 3 shown below):

Consistent Dividend Growth Stock #4: Northwest Natural Holding (NWN)

NW Natural was founded in 1859 and has grown from just a handful of customers to serving more than 760,000 today. The utility’s mission is to deliver natural gas to its customers in the Pacific Northwest.

The company’s locations served are shown in the image below.

Source: Investor Presentation

On August 7, 2025, Northwest Natural Holding Company reported results for the second quarter ended June 30, 2025, showing steady growth in customer base and rate recovery despite seasonal weakness typical of warmer months.

The company recorded net income of $7.4 million, or $0.19 per diluted share, compared with $5.8 million, or $0.16 per share, in the same quarter last year. Operating revenue totaled $219.6 million, slightly down from $222.3 million in the prior year, as lower gas usage from mild weather offset the benefit of rate increases and customer growth.

Operating income was $28.9 million, up from $25.7 million, reflecting disciplined cost control and contributions from utility margin improvement. The gas distribution segment added nearly 11,000 new customers year-over-year, maintaining annual growth of about 1.4%, while infrastructure services contributed modestly to earnings.

Click here to download our most recent Sure Analysis report on NWN (preview of page 1 of 3 shown below):

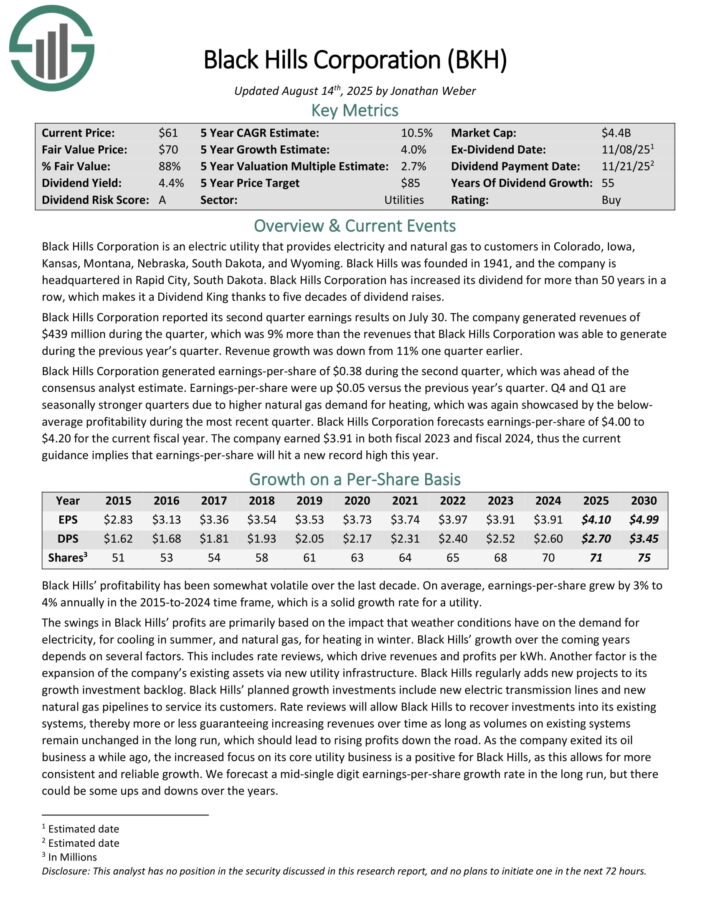

Consistent Dividend Growth Stock #3: Black Hills Corporation (BKH)

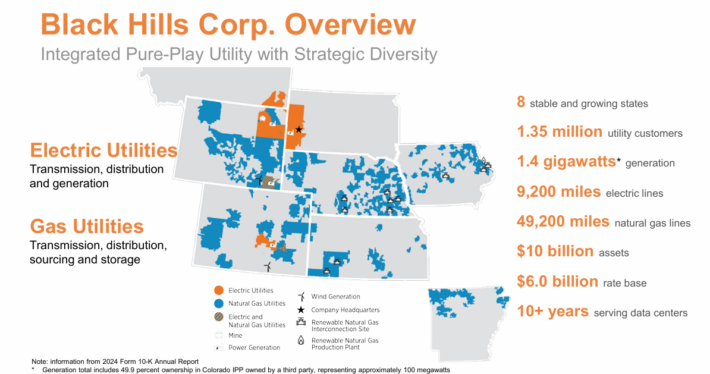

Black Hills Corporation is an electric utility that provides electricity and natural gas to customers in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The company has 1.35 million utility customers in eight states. Its natural gas assets include 49,200 miles of natural gas lines. Separately, it has ~9,200 miles of electric lines and 1.4 gigawatts of electric generation capacity.

Source: Investor Presentation

Black Hills Corporation reported its second quarter earnings results on July 30. The company generated revenues of $439 million during the quarter, up 9% year-over-year.

Black Hills Corporation generated earnings-per-share of $0.38 during the second quarter, which was ahead of the consensus analyst estimate.

Earnings-per-share were up $0.05 versus the previous year’s quarter. Q4 and Q1 are seasonally stronger quarters due to higher natural gas demand for heating.

Black Hills Corporation forecasts earnings-per-share of $4.00 to $4.20 for the current fiscal year.

Click here to download our most recent Sure Analysis report on BKH (preview of page 1 of 3 shown below):

Consistent Dividend Growth Stock #2: Sonoco Products (SON)

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets that use the company’s products include those in the appliances, electronics, beverage, construction and food industries.

The company generates over $5 billion in annual sales. Sonoco Products is now composed of 2 major segments, Consumer Packaging, and Industrial Packaging, with all other businesses listed as “All Other”.

On April 16th, 2025, Sonoco Products raised its quarterly dividend 1.9% to $0.53, extending the company’s dividend growth streak to 49 consecutive years.

On July 23rd, 2025, Sonoco Products announced second quarter results for the period ending June 29th, 2025. For the quarter, revenue grew 17.9% to $1.91 billion, which was in-line with estimates. Adjusted earnings-per-share of $1.37 compared to $1.28 in the prior year, but was $0.08 less than expected.

Revenues and earnings benefited from the addition of Eviosys. For the quarter, Consumer Packaging revenues surged 110% to $1.23 billion, mostly due to contributions from Eviosys.

Volume growth was strong and favorable currency exchange rates also aided results. Industrial Paper Packing sales fell 2% to $588 million due to the impact of foreign currency exchange rates and lower volume following two plant divestitures in China last year.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

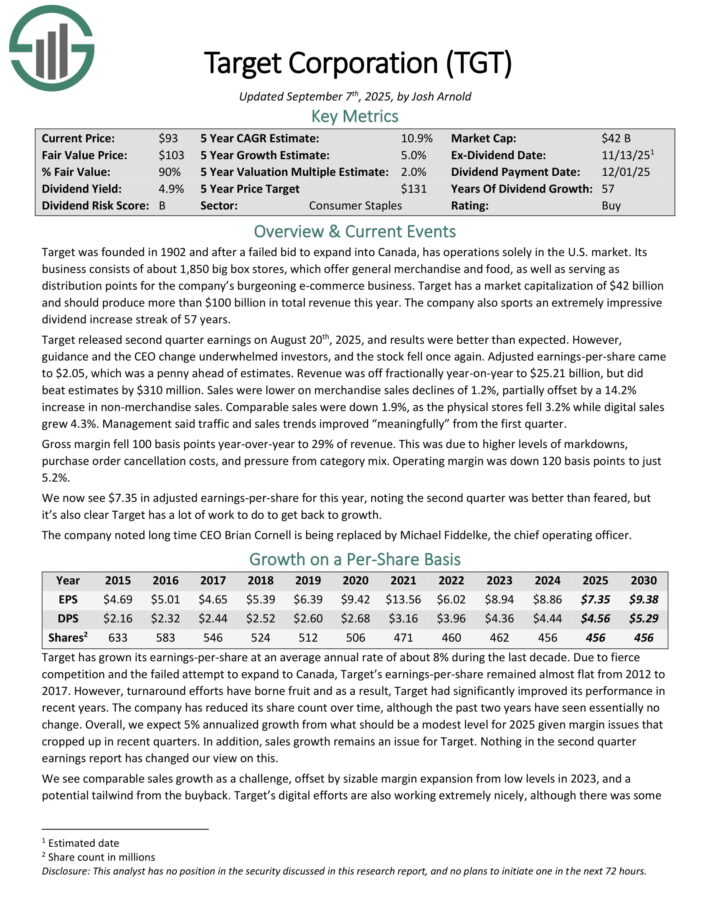

Consistent Dividend Growth Stock #1: Target Corp. (TGT)

Target was founded in 1902 and now operates about 1,850 big box stores, which offer general merchandise and food, as well as serving as distribution points for the company’s e-commerce business.

Target released second quarter earnings on August 20th, 2025, and results were better than expected. However, guidance and the CEO change underwhelmed investors, and the stock fell once again.

Adjusted earnings-per-share came to $2.05, which was a penny ahead of estimates. Revenue was off fractionally year-on-year to $25.21 billion, but did beat estimates by $310 million. Sales were lower on merchandise sales declines of 1.2%, partially offset by a 14.2% increase in non-merchandise sales.

Comparable sales were down 1.9%, as the physical stores fell 3.2% while digital sales grew 4.3%. Management said traffic and sales trends improved “meaningfully” from the first quarter.

The company is investing heavily in its business in order to navigate through the changing landscape in the retail sector. The payout is now 62% of earnings for this year, which is elevated from historical levels, but the dividend remains well-covered.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

Additional Reading

The following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].