Shares of Lamb Weston Holdings, Inc. (NYSE: LW) stayed green on Thursday. The stock has gained over 18% in the past three months. The frozen potato products maker delivered flat sales and lower profits for the first quarter of 2026, as growth in volumes was offset by unfavorable price/mix. The company expects volume growth to continue through fiscal year 2026 while headwinds from price/mix are anticipated to moderate in the second half of the year.

Q1 performance

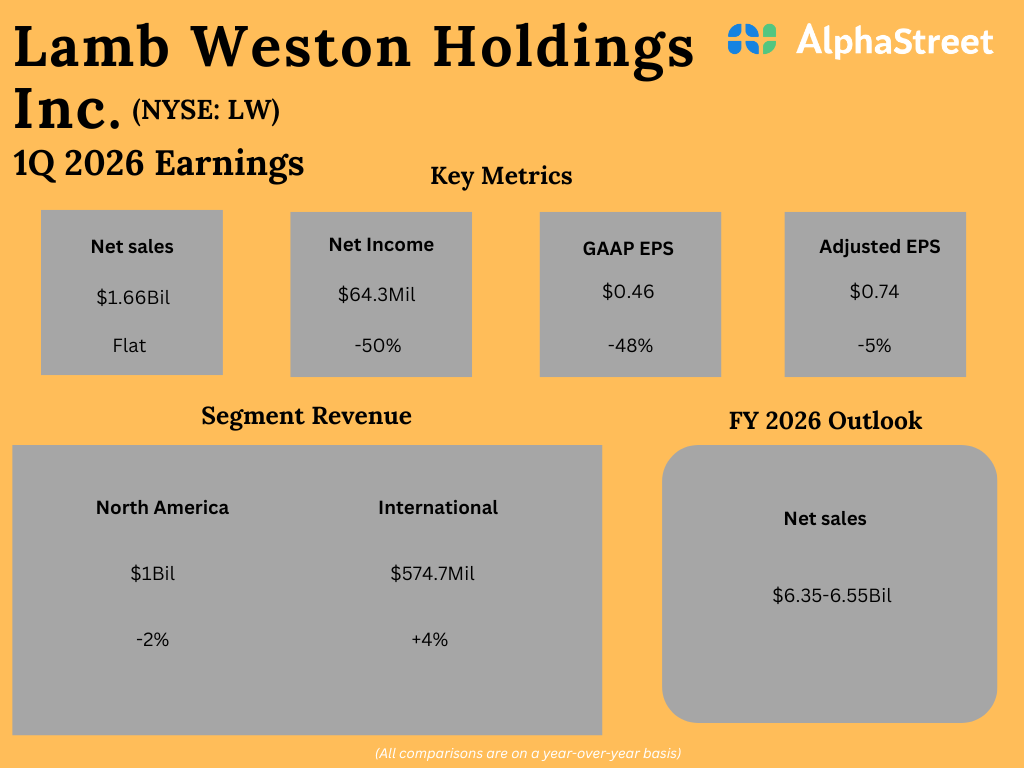

Lamb Weston’s net sales of $1.66 billion saw little change in the first quarter of 2026 compared to the same period a year ago. On a constant currency basis, net sales declined 1%. Volume increased 6%, driven by customer wins and retention, led mainly by gains in North America and Asia. This was offset by a 7% decline in price/mix.

The North America segment saw a 2% drop in sales, mainly due to lower prices. Volume grew 5%, helped by customer contract wins and growth across channels, while price/mix declined 7%. International segment sales grew 4%, with a 6% growth in volume. Price/mix declined 6%, mainly due to pricing actions in key international markets.

Lamb Weston’s earnings per share, on an adjusted basis, decreased 5% to $0.74 in the first quarter compared to the year-ago period.

Industry trends and French fry demand

As mentioned on its quarterly conference call, Lamb Weston saw restaurant traffic at several customer channels remain flat in Q1, including overall QSR traffic. However, some channels, including QSR Chicken, are seeing growth. Meanwhile, QSR Hamburger declined in the low-single-digits. Outside the US, restaurant traffic has been mixed. In certain markets, including the UK, traffic declined 4%.

Nevertheless, LW has a solid position within the strong French fry category. French fries continue to be an extremely popular and profitable item in restaurants. The fry attachment rate, which indicates how often customers order fries with their meals, remains high versus pre-pandemic levels. Global demand continues to grow, with an estimated 44% of global menus offering fries. In addition, as QSRs expand, they introduce fries in developing markets, generating further growth.

Focus to Win

Lamb Weston is making progress on its Focus to Win strategy, which involves focusing investments on priority global markets and segments, strengthening customer partnerships, strong execution, and product innovation.

Outlook

For fiscal year 2026, Lamb Weston expects net sales at constant currency to be down 2% to up 2%, ranging between $6.35-6.55 billion. It expects volume growth in both segments. In the North America division, volume is expected to grow throughout the year while in the International segment, volume in the latter half of the year is expected to be flat. Price/mix is anticipated to remain unfavorable, with the impact more pronounced in the first half of the year and a moderation expected in the second half.