Social Security is the backbone of retirement for millions—but even small rule changes can ripple through budgets overnight. Most retirees assume benefits are stable, yet policy updates often roll out quietly, buried in federal notices or administrative memos. Eligibility tweaks, COLA adjustments, or calculation shifts can alter monthly checks with little public explanation. Without preparation, seniors may face sudden shortfalls or delays they never expected. Understanding how and why these changes occur is essential for financial stability.

Administrative Changes Can Shift Payout Timing

Sometimes Social Security rule adjustments don’t reduce benefits—they delay them. Updates to payment schedules, direct deposit systems, or verification processes can push checks back days or even weeks. For retirees relying on precise cash flow, this small delay creates major stress. SSA rarely provides widespread alerts, leaving many confused about missing payments. Building a one-month cushion protects against administrative surprises.

Eligibility Requirements Can Tighten Quietly

Each year, the SSA refines definitions around full retirement age, earnings limits, or disability thresholds. Even minor wording shifts can exclude thousands from benefits they expected. According to AARP, overlooked adjustments in earnings test rules have cost working retirees hundreds. Staying updated with annual statements and SSA bulletins prevents unpleasant shocks. Rules evolve faster than retirees realize.

Medicare and SSA Interactions Create Confusion

Social Security changes often coincide with Medicare adjustments, compounding the impact. For instance, higher-income thresholds for Medicare premiums can be triggered by SSA’s reported income data. Retirees may suddenly owe more despite stable earnings. These crossover effects make it crucial to review both programs together each year. Coordination, not assumption, keeps costs in check.

Automatic Adjustments Aren’t Always in Your Favor

COLA increases aim to fight inflation, but simultaneous adjustments in Medicare Part B premiums can cancel them out. Some retirees see “raises” that vanish instantly. When policy shifts overlap, net income may shrink even as gross benefits rise. Reviewing your statement after each COLA announcement clarifies the true impact. Numbers on paper don’t always translate to more cash.

Communication Gaps Leave Retirees Unprepared

The SSA posts changes on its website and in mailers, but many seniors miss or misunderstand the details. No formal requirement exists for personalized notices about every update. That means retirees must proactively check SSA.gov and sign up for alerts. Relying on news headlines alone is risky. Awareness is your first defense.

How Sudden Shifts Affect Widows and Disabled Beneficiaries

Vulnerable groups—like survivors or the disabled—feel rule changes most sharply. Adjustments to eligibility age, income counting, or documentation requirements can delay crucial aid. Many don’t learn about revisions until benefits are denied. Consulting a Social Security specialist annually catches evolving criteria early. Knowledge prevents the hardship that paperwork alone can’t fix.

Preparing for the Next Surprise

Policy shifts are inevitable as Congress and agencies respond to budgets, demographics, and inflation. Retirees who track statements, attend workshops, and maintain emergency funds stay resilient. Partnering with a financial planner who monitors regulatory updates adds another safeguard. Treat Social Security as a living system—not a fixed promise. Flexibility keeps your retirement steady when Washington moves the goalposts.

Have you ever seen your Social Security check change unexpectedly? How did you handle it? Share your experience below.

You May Also Like…

COLA Raise Forecast 2026 Could Be Wiped Out by Rising Drug Costs — What to Watch

You Might Be Eligible for a Benefit Few Widows Ever Learn About

The First Few Weeks Without a Pension Check — And The Hidden Ripple Effect

Could State Medicaid Recovery Leave Your Children Without an Inheritance?

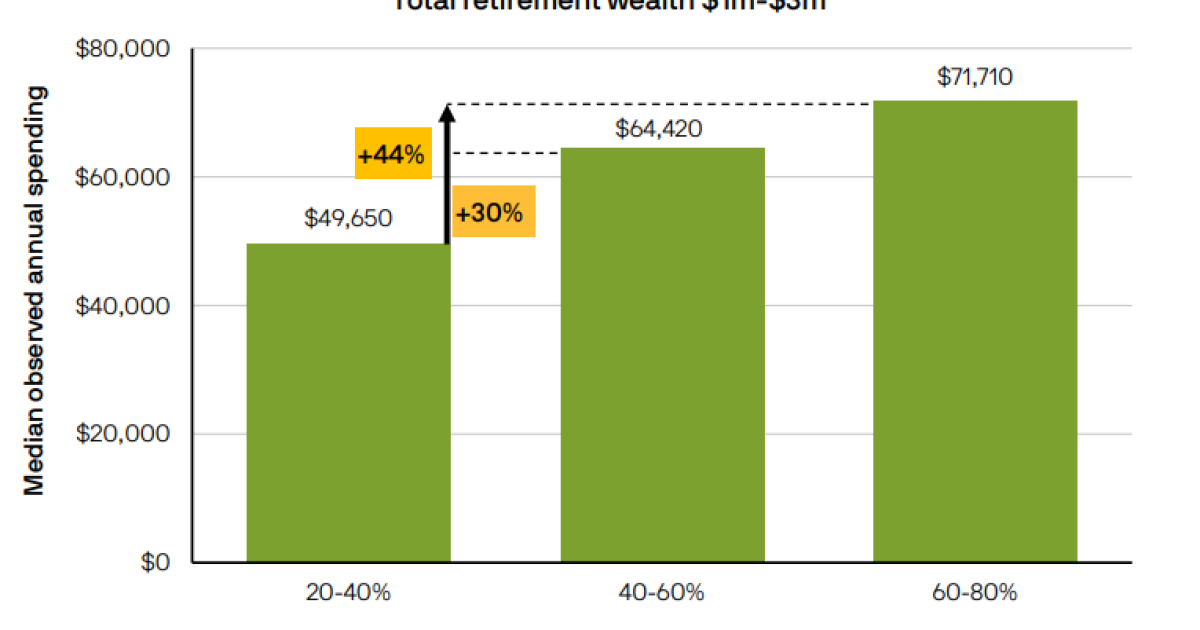

8 Retirement-Spending Rules That Aren’t the 4% Rule