Shares of Conagra Brands, Inc. (NYSE: CAG) rose over 4% on Wednesday after the company delivered better-than-expected results for the first quarter of 2026. Although revenue and profits declined versus the previous year, they surpassed market expectations. The company reaffirmed its outlook for the full year of 2026 even as it anticipates the operating environment to remain challenging during the period.

Results beat estimates

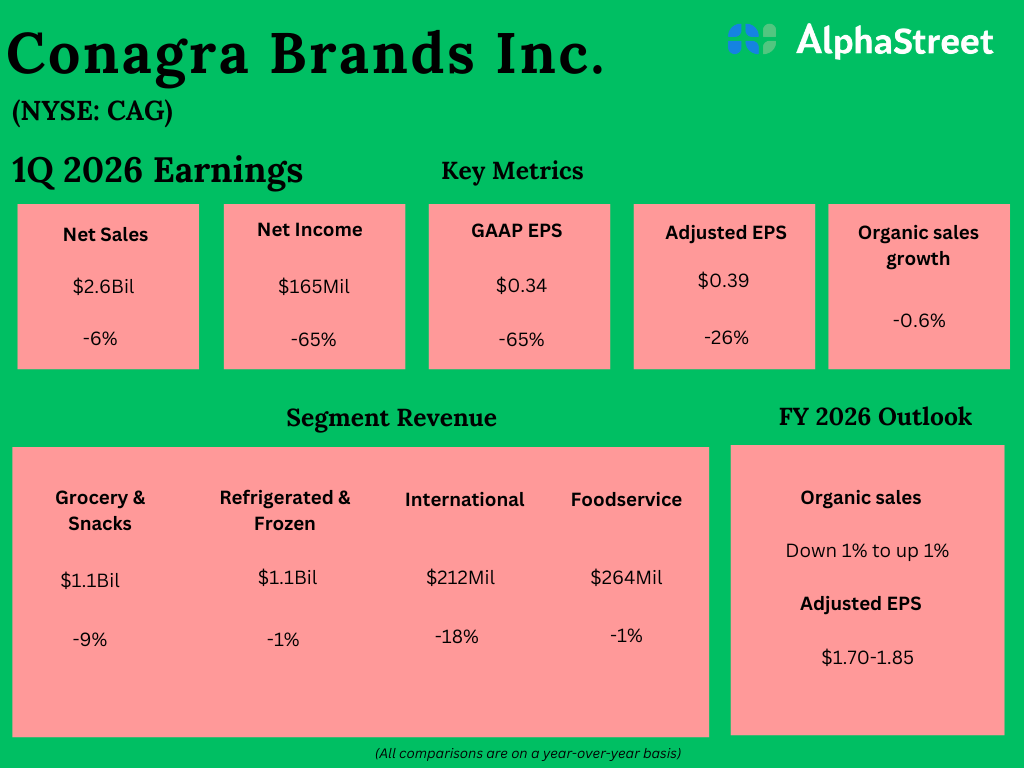

In Q1 2026, Conagra’s net sales decreased 5.8% year-over-year to $2.63 billion, but surpassed projections of $2.62 billion. Organic sales dipped 0.6%, driven by a 1.2% drop in volume. On a GAAP basis, earnings per share decreased nearly 65% to $0.34 versus the previous year. EPS, on an adjusted basis, declined 26% YoY to $0.39 but came ahead of the consensus target of $0.33.

Segment sales declines

Conagra saw sales decline across all its segments on a reported basis in Q1. Sales in the Grocery & Snacks segment decreased almost 9%, reflecting a 1% drop in organic sales driven by a 1.6% decrease in volume. Sales from the Refrigerated & Frozen segment dipped nearly 1%, but organic sales were up 0.2% and volume was up 0.5%.

International segment sales fell 18%, with a 3.5% decrease in organic sales and a 5.2% drop in volume. Foodservice segment sales dipped 0.8%, with a 0.2% rise in organic sales and a 3.6% decrease in volume.

During the quarter, CAG gained share in categories such as frozen vegetables, frozen meals, and frozen prepared chicken. In the snacks category, the company saw volumes grow in strategic protein snacks, with meat snacks up 4% and seeds up 2%. On the other hand, salty snacks and sweet treats saw declines. Baking mixes volumes were hurt by inflation-driven pricing for cocoa. In the staples portfolio, the Reddi-wip-owner is seeing volume gains in certain categories but the trend of consumers seeking value has impacted this domain.

Reaffirmed outlook

Looking ahead, Conagra anticipates a difficult environment with continued headwinds from inflation and weak consumer sentiment. The company forecasts impacts from inflation and tariffs to be higher than previously expected. Consumer sentiment remains muted with customers continuing to seek value in their purchases.

CAG has reaffirmed its outlook for fiscal year 2026 and continues to expect organic sales growth of down 1% to up 1%. Adjusted EPS is expected to range between $1.70-1.85.

The post Conagra Brands (CAG) anticipates inflation headwinds to persist in FY2026 first appeared on AlphaStreet.