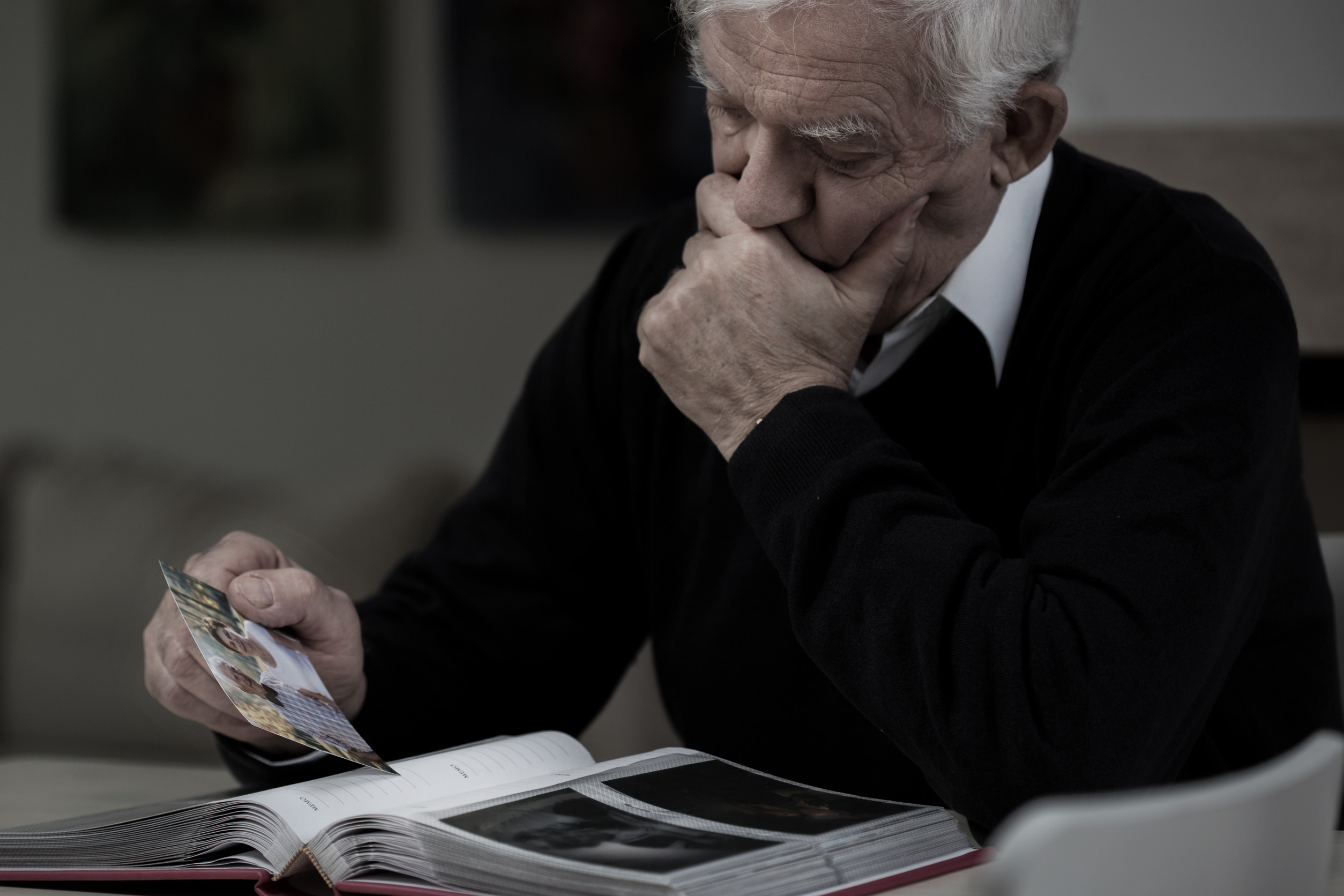

Social Security survivor benefits are often misunderstood. Retirees know they exist but don’t realize how timing affects payouts. Claiming too early reduces checks for life, while delaying can maximize income. Different timelines create dramatically different outcomes. Understanding them ensures survivors don’t leave money on the table.

Claiming at Age 60

Widows and widowers can start survivor benefits as early as 60, giving them a much-needed lifeline during a difficult time. But claiming this early locks in reduced checks permanently, often cutting benefits by 28% or more compared to waiting until full retirement age. For households struggling financially, it can still provide stability and cover essentials like housing, food, and medical costs. The trade-off is long-term income loss, since the lower benefit amount never increases to the full rate. This timeline is most suitable for individuals requiring immediate assistance who lack alternative income sources or savings to cover the gap. Retirees who can lean on part-time work or other assets may be better off delaying, but for those in crisis, early claiming can mean survival.

Waiting Until Full Retirement Age

At full retirement age (FRA), survivors receive 100% of the deceased spouse’s benefit. This is the break-even point where reductions disappear. For many retirees, waiting until the FRA maximizes income. It requires other income sources in the meantime. Patience pays in the form of bigger checks.

Switching Between Survivor and Retirement Benefits

Some retirees start with survivor benefits, then switch to their own retirement benefit later. Others do the reverse. These strategies depend on which benefit is larger at different ages. Switching timelines can increase lifetime income significantly. Flexibility is the key advantage.

Delaying to Age 70

While survivor benefits themselves don’t grow after FRA, retirement benefits do. Survivors who switch from survivor benefits to their own at 70 often maximize total income. This requires careful timing and enough savings to bridge the gap. The payoff is substantial for those who can wait.

Early Claiming While Working

Survivors who work while claiming before the FRA face earnings limits. Excess earnings reduce benefits temporarily. Many retirees are surprised when their checks shrink. Understanding these rules avoids frustration. Timing benefits around employment matters.

Survivor Benefits for Disabled Spouses

Disabled widows and widowers can claim survivor benefits earlier—at 50. This little-known timeline helps those who cannot work. But the reduction is steep, and long-term payouts shrink. It’s a last-resort option for those with no alternatives.

Survivor Benefits With Children in the Household

Widows or widowers caring for children under 16 qualify for survivor benefits regardless of age. This provides critical support for families still raising kids. Once children age out, eligibility changes. Parents must plan for this shift carefully.

Why Timelines Shape Financial Security

Survivor benefits aren’t one-size-fits-all. The right timeline depends on income needs, work status, and future retirement benefits. Retirees who understand the math make better choices and avoid locking in permanent reductions by mistake. Survivor timelines can make or break retirement stability, influencing not only monthly checks but also long-term financial resilience. Choosing wisely can add thousands of dollars in lifetime income, while a rushed decision may create unnecessary strain for years to come.

Have you calculated your survivor benefit timeline? Which strategy would maximize your household income?

You May Also Like…

10 SSA Account Settings You Must Check Before You Claim

8 Financial Changes That Quietly Reduce Your Social Security Payments

7 Mistakes You’re Making With Social Security Benefits And Don’t Know It

Here’s What No One Tells You About Taking Your Spouse’s Social Security Check Instead of Your Own

9 Social Security Assumptions That Will Cost You Thousands