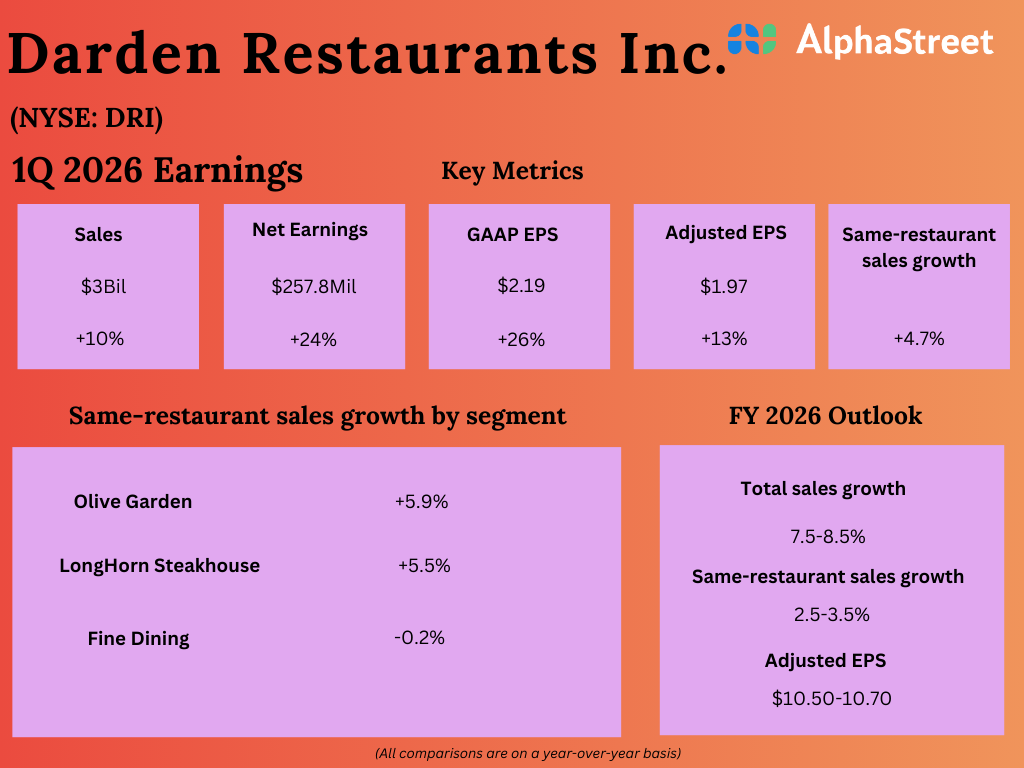

Shares of Darden Restaurants, Inc. (NYSE: DRI) were down over 2% on Friday. The stock has dropped 17% year-to-date. The restaurant operator delivered sales and earnings growth for the first quarter of 2026 and updated its outlook for the full year. The company benefited from positive same-restaurant sales across most of its segments. Here’s a look at its performance in Q1:

Solid Q1 results

Darden saw its sales and profits increase year-over-year in the first quarter of 2026. Net sales increased 10% to $3 billion, fueled by blended same-restaurant sales growth of 4.7%, as well as contributions from the Chuy’s acquisition and new restaurants. Adjusted earnings per share grew 12.6% to $1.97.

Strong segment performance

Darden recorded sales growth across all its segments in the first quarter. It also saw positive same-restaurant sales and traffic growth in all segments, barring Fine Dining. The Olive Garden segment saw sales increase by 7.6% YoY, driven by growth in same-restaurant sales and traffic. As mentioned on the quarterly call, sales from the addition of 18 new restaurants more than offset sales loss from the refranchising of eight restaurants in Canada.

Olive Garden’s same restaurant sales grew 5.9% in Q1. The segment benefited from menu innovation that catered to guests’ preferences for bold and flavorful offerings. Its initiative of offering smaller portions at lower prices to customers looking for value has also garnered good response.

Olive Garden is benefiting from the growth of its first party delivery service, which is attracting younger, affluent customers who spend more and prefer the convenience of delivery over a dine-in experience.

Total sales at LongHorn Steakhouse increased 8.8%, driven by same-restaurant sales growth of 5.5% and the addition of 18 new restaurants. Total sales in Fine Dining increased 2.7%, driven by the addition of five new restaurants, but same-restaurant sales dipped by 0.2%. These segments benefited from product innovation and menu offerings at affordable price points.

Sales in the Other Business segment increased 22.5% with the acquisition of Chuy’s and same-restaurant sales growth of 3.3%. Same-restaurant sales were driven by strong performances from Yard House, Cheddar’s Scratch Kitchen and Seasons 52. In particular, Cheddar’s is benefiting from first party delivery, which drove strong off-premise sales growth of 15% in Q1.

Guidance hike

Darden updated its guidance for the full year of 2026 based on its Q1 performance. The company raised its sales outlook to reflect the strong first quarter results, acceleration in its new unit pipeline, and incremental pricing that may be needed to offset commodities costs. It now expects total sales to grow 7.5-8.5% and same-restaurant sales to grow 2.5-3.5% in FY2026. The outlook for adjusted EPS remains unchanged at $10.50-10.70. DRI plans to open approx. 65 new restaurants during the year.