Yves here. Michael Hudson makes a short but devastating indictment of the destruction Trump policies are inflicting on the agriculture sector. The most visible example is soybeans, which had until Trump tariffs, had had China as their biggest buyer. But other types of farmers, as well as farm suppliers like John Deere, are also in a world of hurt.

In a bit of synchronicity, Nikkei has just published US soybean farmers face crisis as China keeps orders frozen, which add color to Hudson’s account. Key sections:

Trump and Chinese President Xi Jinping are speaking on Friday about a U.S. TikTok operation and other tariff issues. It is unclear whether agricultural purchases and the plight of American soybean farmers will come up. Either way, analysts say the soybean standoff is revealing China’s tactics and priorities while also highlighting U.S. vulnerabilities….

“If it was a hot war, China wants to know that it is possible to get through an extreme situation for food security,” she [Even Pay, director at Trivium China] said. “China also wants to know that it can’t be backed into a corner by a hostile U.S. administration.”

Pay added that China has also been pursuing a long-term plan to diversify sourcing, due to concerns that the country was overly reliant on American soybeans….

Johnny Xiang, founder of Agradar Consulting in Beijing, said that China’s purchasing of Brazilian soybeans this year has been quite “aggressive,” and that it now has a steady supply of soymeal from Argentina and Uruguay as well. “China’s purchases of U.S. soybeans depend entirely on whether the Trump administration removes the tariffs on Chinese goods,” he said.

Chinese buyers historically purchase American soybeans in September, as the Brazilian harvest comes to an end. Experts are mixed about whether China can completely forgo U.S. supplies — which are also subject to 34% Chinese tariffs — this year if a trade deal does not come to pass. Some say China’s current supply will not last until Brazil begins picking new crops in February, but Trivium’s Pay said China’s policy rhetoric could suggest otherwise.

“Someone is going to have to eat some pain,” she said….

The U.S. Department of Agriculture this week made its lowest soybean export forecast since 2013, at 1.65 billion bushels.

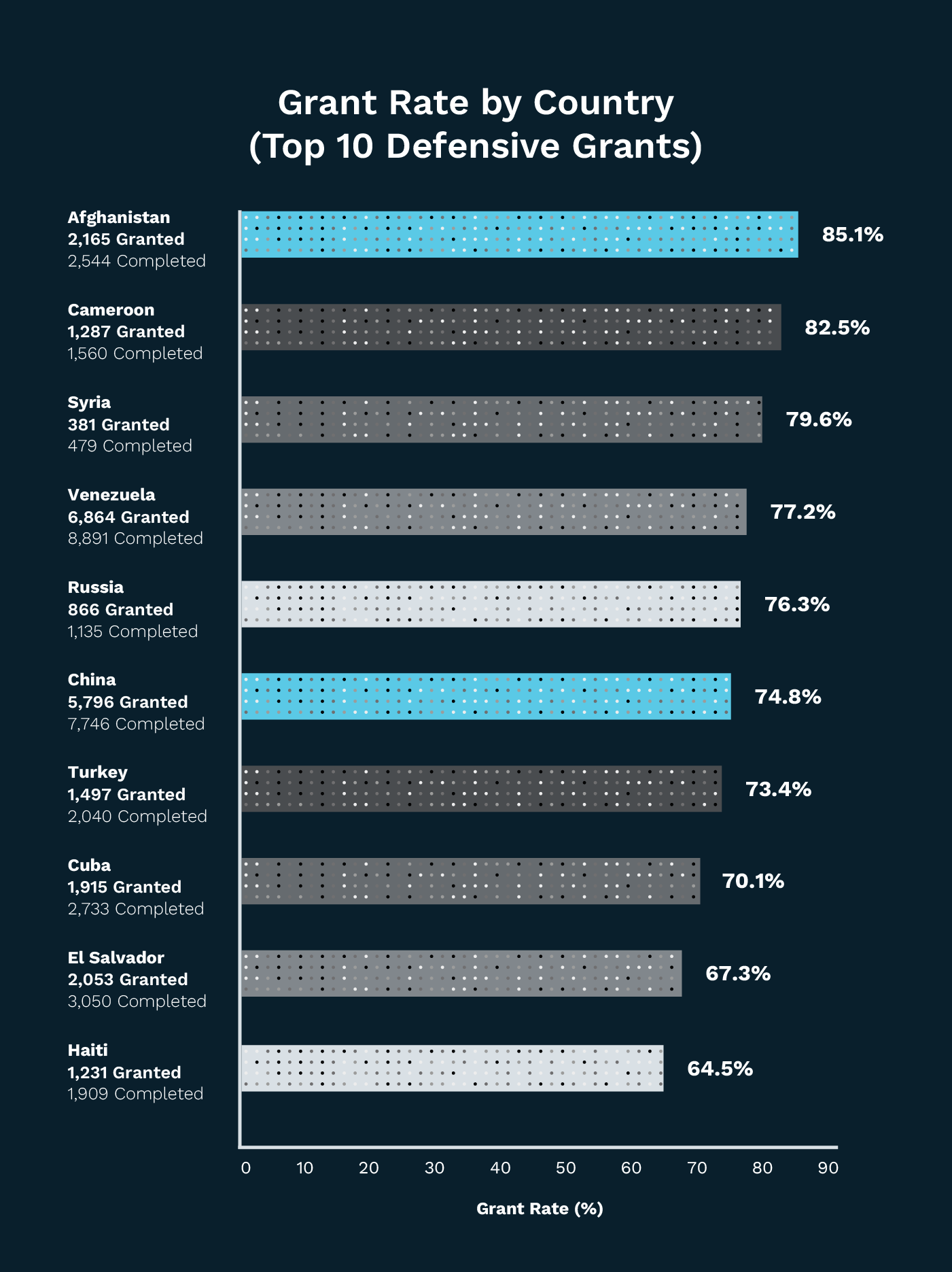

In North Dakota, where agriculture makes up over a quarter of the state’s economic output, 90% of soybean production is exported, according to the North Dakota Soybean Council — most of it, under normal circumstances, to the world’s top buyer, China. Unlike states further south and east, such as Illinois, which are better positioned to shift their supply to other markets such as Europe and Mexico, North Dakota’s soybeans are farmed near railroad infrastructure purpose-built for sending harvests to the West Coast and on to China.

Nikkei points out that US soybean farmers went through a similar crunch in Trump 1.0, when a China trade war led to a sharp cut in soybean buys. That Administration made $23 billion in payouts to farmers in 2018 and 2019 to offset the damage.

By Michael Hudson, a research professor of Economics at University of Missouri, Kansas City, and a research associate at the Levy Economics Institute of Bard College. His latest book is The Destiny of Civilizatio

Trump has created a crisis for U.S. agriculture with his Cold War weaponization of foreign trade with China and Russia, for manufacturing as a result of his steel and aluminum tariffs, for consumer price inflation mainly from his tariffs, and for affordable housing with his tax cuts that have kept long-term interest rates high for mortgages, auto and equipment purchases, and deregulation of markets giving a free hand to monopoly pricing.

Trump’s Impoverishment of U.S. Agriculture

Trump has created a perfect storm for U.S. agriculture, first in his Cold War policy that has closed off China as a soybean market against and Russia, second in his tariff policy blocking imports and thus raising prices for farm equipment and other inputs, and third in his inflationary budget deficits that are keeping interest rates high for housing and farm mortgage loans and equipment financing – while keeping farmland prices low.

The most notorious example is soybeans, America’s major farm export to China. Trump’s weaponization of U.S. foreign trade treats exports and imports as tools to deprive foreign countries dependent on access to U.S. markets for their exports, and on U.S.-controlled exports of essential commodities such as food and oil (and most recently, high technology for computer chips and equipment). After Mao’s revolution in 1945, the U.S. imposed sanctions on U.S. grain and other food exports to China, hoping to starve out the new Communist government. Canada broke this food blockade – but it has now become an arm of U.S. NATO foreign policy.

Trump’s weaponizing of foreign trade – keeping open a constant U.S. threat to cut off exports on which other countries have come to depend – has led China to totally stop its advance purchases from this year’s U.S. soybean crop. China understandably seeks to avoid being threatened by a food blockade again, and has imposed 34% tariffs on U.S. soybean imports. The result has been a shift in its imports to Brazil, with zero purchases in the United States so far in 2025. This is traumatic for U.S. farmers, because four decades of soybean exports to China have resulted in half of U.S. soybean production normally being exported to China; in North Dakota the proportion is 70%.[1]

China’s shift in its soybean purchases to Brazil is irreversible, as that country’s farmers have adjusted their planting decisions accordingly. As a member of BRICS, especially under President Lula’s leadership, Brazil promises to be much a more reliable supplier than the United States, whose foreign policy has designated China as an existential enemy. There is little chance of China responding to a U.S. promise to restore normal trade by shifting its imports away from Brazil, because that would be traumatic for Brazilian agriculture and would make China an unreliable a trade partner.

So the question is, what is to become of the enormous amount of U.S. farmland that has been devoted to soybean production? Unable to find foreign markets to replace China, farmers are reported to suffer a loss on their soybean production, which is piling up in excess of existing crop storage capacity. The result is a threat of farm foreclosures and bankruptcy, which would lower prices for farmland. And as interest rates remain high for long-term loans such as mortgages, this deters small farmers from acquiring troubled properties. The result is to accelerate the concentration of farmland in the hands of large absentee financial funds and the wealthy.

This shift is irreversible. Despite the Supreme Court ruling that Trump’s tariffs are unconstitutional and therefore illegal, it seems likely that Trump could simply have the bipartisan anti-China Congress and Senate impose these tariffs. In any case, Trump’s policy represents a sea change, a quantum leap into U.S. coercive trade aggression.

There is zero chance of U.S. China trade in soybeans or other basic Chinese needs from being revived. Neither it nor other countries threatened by U.S. trade aggression can take the risk of depending on the U.S. market.

America’s agricultural cost and income squeeze goes far beyond soybean sales. Production costs are also rising as a result of Trump’s tariffs, especially on farm machinery, fertilizer and credit tightness as the risk of farm debt arrears increase.

Trump’s tariffs are raising U.S. industrial costs of production

Trump’s tariff anarchy also is causing losses and layoffs of two thousand employees for John Deere and Company, with a demand also falling for other manufacturers of farm equipment. The most serious problem is that its harvesting equipment, like automobiles and all other machinery, is made out of steel, along with aluminum. Trump has broken the basic logic for tariffs – to promote the competitiveness of high-profit capital-intensive industry (especially for established monopolies), largely by minimizing the cost of raw materials. Steel and aluminum are basic raw materials.

These tariffs have hit John Deere in two ways. For its domestic production, sales are low because of the depression of farm income cited above. Yields have soared this year for corn as well as soybean, leading their prices and farm income to decline. That limits the ability of farmers to buy new machinery.

Deere imports about 25 percent of the components of its products, whose cost of is increased as a result of Trump’s tariffs.[2] Deere’s manufacturing facilities in Germany have been especially hard hit. Trump surprised Deere by ruling that over and above his 15% import tariffs on imports from the EU, he is imposing a 50% tax on the steel and aluminum content of these imports.

That also hits foreign producers of farm equipment, leading to new complaints by EU about Trump’s constant “surprises” in adding to his demand for “givebacks” in exchange for not raising tariffs on imports from the EU even further.

Trump’s Fight to Accelerate Foreign Reliance on Oil and Hence Global Warming

Opposing any alleviation to global warming, Trump has withdrawn from the Paris agreement and has cancelled subsidies for wind power, and also for public transportation. This is the effect of lobbying by the oil industry. Not only is U.S. foreign policy dominated by the demand to control oil as the key to weaponizing foreign trade sanctions, but also U.S. domestic economic policy. Soon after World War II ended, Los Angeles tore up its streetcars, forcing its inhabitants to join the automobile economy. Dwight Eisenhower initiated the interstate highway program to favor auto transportation – and with it the consumption of oil.

Also plaguing U.S. agriculture is a deepening water shortage for crops and destruction caused by flooding, drought and other extreme weather. One cause is the extreme weather resulting from global warming, which Trump denies as part of his policy to support U.S. oil and coal while actively fighting against wind and solar energy production. He has withdrawn U.S. support for the Paris Agreement with other nations to de-carbonize world production.

Insurance costs are rising to unaffordable levels for many areas most prone to storms and flooding, much as the annual cost of housing has soared in Miami and other Florida cities and the southern border states threatened by hurricanes.

A parallel disruption is the rising electric price as well as a water shortage caused by the rising demand to cool the computers needed for Trump’s support of automatic intelligence and quantum computing. The increasing demand for electricity far beyond the investment plans by power utilities to increase their production. Such planning takes many years – and utilities are happy to see the shortages push demand far above supply, enabling prices for electricity to be one of the major contributors to inflating the cost of production.

Trump and his cabinet have made fun of China for spending so much money on its high-speed train service. Western calculations of economic efficiency leave out the all-important balance-of-payments effects of this rail development: It avoids forcing Chinese to drive cars using imported oil. China has no domestic oil industry to dominate its economic planning or foreign policy. In fact, its foreign policy aims regarding the oil trade are the opposite of those in in the United States.

Trump’s Sanctions to Weaponize U.S. Exports to Its Designated Enemies

Trump’s (and Congress’s threat) to sabotage exports of computer switches with secret “kill switches” to turn them off by U.S. fiat has led China to cancel its planned purchases from Nvidia. The company has warned that without the profits from exports to China, it will be unable to afford the R&D needed to keep competitive and maintain its monopoly on chip manufacturing.

These trade policies slashing U.S. export markets and imports are just one reason why the dollar is weakening. Other causes are declining tourism as a result of U.S. harassment, especially of foreign students from China, on which U.S. universities have depended as the highest-paying students.

These non-trade balance-of-payments trends explain why Trump’s high-tariff policy has not led the dollar’s exchange rate to strengthen despite its effect on discouraging imports. Normally that would increase the trade balance. But Trump’s war against all other countries (mainly his European allies, Japan and Korea) has led to a shift of their dependency on U.S. exports (such as soybean) and products against which they are retaliating in order to protect their own balance of payments, e.g., cutbacks in foreign tourism to the U.S., foreign students, dependency on U.S. arms exports – and most of all, financial capital flight seeing that the shrinking U.S. home market must cut into foreign profits and the dollar’s decline will reduce its valuation in foreign-currency terms.

Also, as BRICS and other countries conduct trade in their own currencies, this reduces their need to hold foreign-exchange reserves in dollars. They are shifting to each others’ currencies, and of course to gold, whose price has just soared over $3,500 an ounce.

Trump’s Sharp Increase in Inflation, from Electricity and Housing to Industrial Products Made Out of Aluminum and Steel, or Subject to Crippling Tariffs on the Supply of Parts and Necessary Inputs

Trump’s decision to impose tariffs on basic inputs, headed by aluminum and steel, are increasing prices for every industrial product made out of these metals.

And of course, his tariffs generally are rising prices across the board as companies have waited a polite month or so before raising prices as their existing inventories of goods produced by China, India and other countries are exhausted.

Trump’s deportation of immigrants has increased the cost of construction, which relied largely on immigrant labor – as did agriculture in California and other states at harvest time. It is not clear who, if anyone, will replace this labor.

Instead of attracting foreign investment as Trump has demanded that Europe and other trade “partners” provide, he has made this market much less desirable. What he has done is provide an object lesson in what other countries need to avoid in creating regulations, tax rules and trade policy to minimize their costs of production and become more competitive.

Monetary Policy Is Sharply Increasing Long-Term Interest Rates, Even if Short-Term Rates Decline

Long-term interest rates determine the cost of mortgages, and thus the affordability of housing. Trump’s inflationary policy also increased interest rates for long-term bonds. The effect is to concentrate borrowing at short-term maturities, concentrating the problems of rolling over debt in times of financial crisis. This impairs the resilience of the economy.

Many consumer goods imports are bought by the ultra-rich – the 10% of the population who are reported to account for 50% of consumer spending, For them, higher prices simply increase the prestige of such conspicuous-consumption status items (including expensive food delicacies).

–––––––––

[1] Alan Rappeport and Tim Gruber, “China’s Snub of U.S. Soybeans Is Creating a Crisis for Farmers,” The New York Times, September 16, 2025.

[2] Kevin Draper, “John Deere Sputtering As Farmers Struggle,” The New York Times, September 15, 2025.