As widely anticipated, the cut rates by 25 basis points on Wednesday, and its forecasts still favor two further rate cuts by the end of the year.

Admittedly, the 50bp rate cut some had hoped for did not materialize, but last night’s Fed decision still marks the start of a rate-cutting cycle. What’s more, given Trump’s pressure for lower rates, the Fed is more likely to exceed market than disappoint them.

Against this backdrop, healthcare stocks could prove to be wise bets. First of all, it’s worth noting that Health Care is the worst-performing sector in the S&P 500 this year, which suggests it has more room to grow than other overvalued sectors such as Technology.

What’s more, there are also several specific reasons why the Fed’s rate cut could benefit healthcare stocks.

In particular, lower rates reduce the discount rate applied to future earnings, which mechanically increases the valuation of companies with long-term growth expectations. In the healthcare (NYSE:XLV) sector, biotech and R&D companies benefit directly from this phenomenon.

Finally, we must also consider the reasons behind the Fed’s rate cut. The central bank lowered rates not to celebrate the return of to target, but to support an increasingly troubled labor market, raising fears of a period of economic slowdown.

Yet in such climates, healthcare benefits from stable medical demand, and investors turn to stocks offering stable growth and steady dividends, a profile often found in the largest healthcare companies.

Which are the best healthcare stocks to buy to take advantage of the Fed’s rate cut?

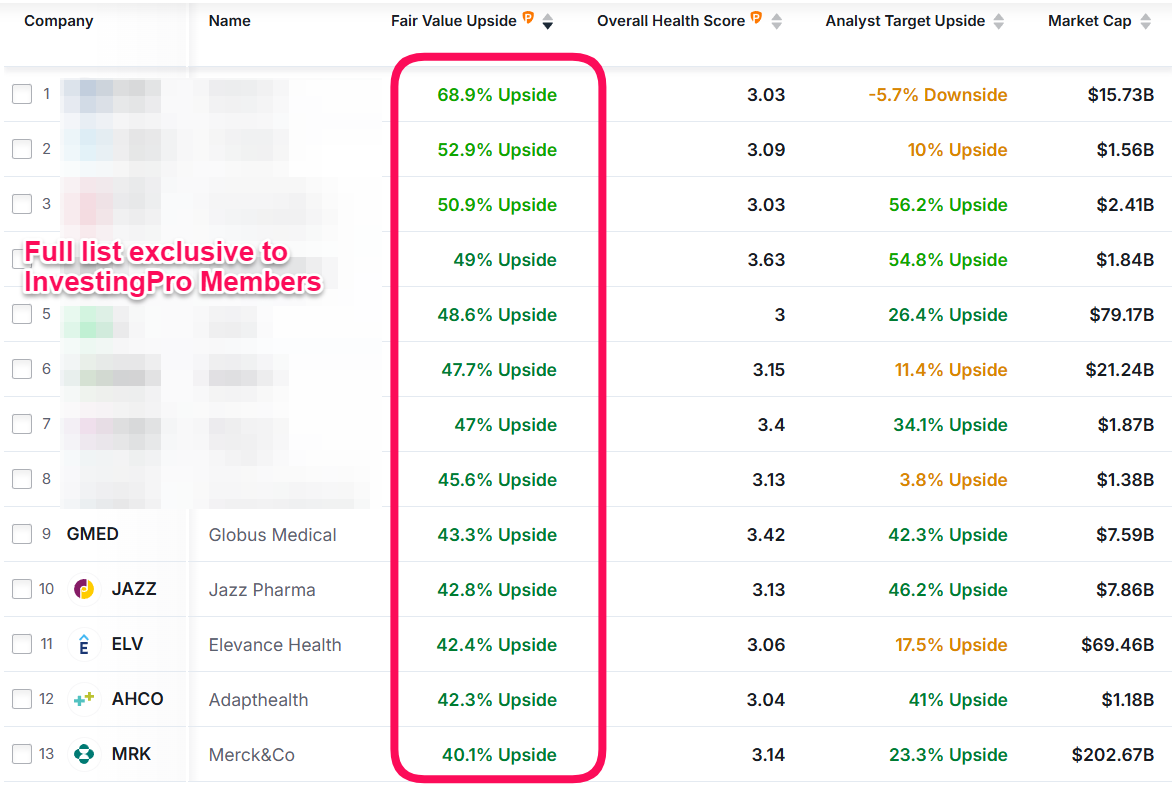

We set out to find the best US healthcare stocks to buy over the coming months, using the Investing.com screener. Specifically, we looked for US healthcare stocks with a market capitalization in excess of $1 billion, and with a potential upside of over 40% according to InvestingPro Fair Value, and an InvestingPro health score of over 3/5.

Here’s what it looks like in terms of screener parameters:

InvestingPro Fair Value calculates an intelligent average of several recognized valuation models for each stock on the market. The health score, on the other hand, is based on several key financial metrics and peer comparisons to assess companies’ level of financial strength.

This research enabled us to identify 13 stocks:

Are you an InvestingPro, plan Pro + member? Click on this link to access this custom screen.

According to InvestingPro Fair Value, these stocks could climb from +40.1% to +68.9%. What’s more, some of these stocks also show significant upside potential according to analysts, including 5 which they believe could rise by more than 40%.

Subscribe to InvestingPro by clicking here and gain access to the full list of stocks!

*iOS user? You can use this link instead to subscribe.

Finally, I’d like to point out that the features mentioned in this article are far from the only InvestingPro tools useful for market success. In fact, InvestingPro offers a whole range of tools to ensure that investors always know how to react in the stock market, whatever the conditions. These include:

Stock market strategies managed by AI and re-evaluated monthly

Subscriber-only analysis and stock-picking articles, in which our analysts “do the work for you” and offer turnkey stock selections

10 years of historical financial data for thousands of global stocks

A database of positions held by investors, billionaires and hedge funds

And many other tools that help tens of thousands of investors outperform the market every day!

Become an InvestingPro member today and discover how easy investing is when you have the right tools at your fingertips.