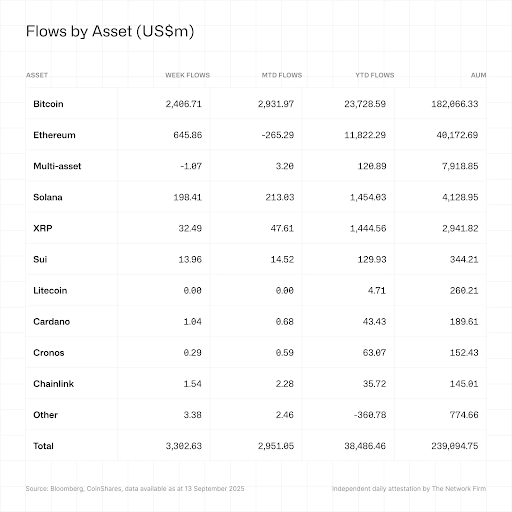

Last week was a good week for digital asset investment products, which attracted a collective $3.3 billion in inflows, according to the latest weekly report from CoinShares. The latest inflow numbers pushed assets under management (AuM) back to $239 billion, just shy of August’s all-time high of $244 billion. The rebound in inflows, which came after shedding $352 million the previous week, was due to softer-than-expected US macroeconomic data and strong end-of-week price gains across the crypto market.

Bitcoin And Ethereum Lead The Turnaround

Unsurprisingly, Bitcoin recorded the strongest shift in sentiment. Particularly, investment products based on the leading cryptocurrency witnessed $2.4 billion in inflows, its largest weekly total since July. The prevailing bullish sentiment throughout the week meant that short-Bitcoin products saw modest outflows that pushed their AuM to just $86 million.

Ethereum also swung back into positive territory after eight consecutive trading days of outflows. It registered $646 million in inflows, buoyed by four straight daily sessions of positive investor sentiment. This was a quick turnaround from the $912 million in outflows the previous week.

Other assets also benefited, with Solana-based products achieving their largest-ever single-day inflow of $145 million on Friday and ending the week at a $198 million inflow total. XRP-based products added $32.49 million, while SUI, Cardano, and Chainlink products saw inflows of $13.96 million, $1.04 million, and $1.54 million, respectively. The recovery across multiple altcoins is a noteworthy improvement in institutional confidence compared to earlier weeks of downward pressure.

Regional Trends Show US Dominance

The flows into digital asset funds were overwhelmingly concentrated in the United States, which saw $3.2 billion in inflows. Most of these were into Spot Bitcoin and Spot Ethereum ETFs, which witnessed $2.34 billion and $637.69 million inflows last week, according to data from SoSoValue.

Digital asset funds based in Germany followed with $160 million and capped the week with their second-largest daily inflow on record. However, Switzerland-based products stood out on the downside and registered $92 million in outflows that partially offset Europe’s gains.

Looking at providers, iShares ETFs in the US attracted $1.1 billion in new funds, Fidelity’s Wise Origin Bitcoin Fund added $850 million, and Bitwise and ARK 21Shares ETFs combined for over $360 million. Meanwhile, Grayscale drew in nearly $147 million, though it is still on net outflows year-to-date.

The recovery in fund flows has lifted overall AuM for digital asset investment products to $239 billion, just 2% below August’s all-time high of $244 billion. Continued inflow this week could see the overall AuM hitting a new all-time high this week.

Bitcoin is dominating the AuM ranks with $182 billion, which is a 76.15% stake. Ethereum, on the other hand, accounts for $40 billion. The third highest AuM is Solana with $4.1 billion. Although it is far behind, Solana has witnessed impressive AuM growth this year.

Featured image from Pixabay, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.