Money disagreements are one of the top causes of stress in relationships, especially in retirement when incomes are fixed. Couples often fight not because they lack money, but because they lack shared priorities. Goal-stacking—aligning short-term, mid-term, and long-term financial objectives—offers a structured way to create peace. Instead of arguing about where dollars go, couples use a system to balance competing needs. Here are 10 goal-stacking methods that help partners save, spend, and invest without constant conflict.

1. Define Shared Non-Negotiables

Every couple has core priorities, whether it’s keeping the house, funding healthcare, or helping family. Retirees should identify these non-negotiables before setting other goals. Knowing what comes first eliminates endless debates about trade-offs. Once essentials are secured, couples can focus on flexible spending. A strong foundation reduces financial anxiety.

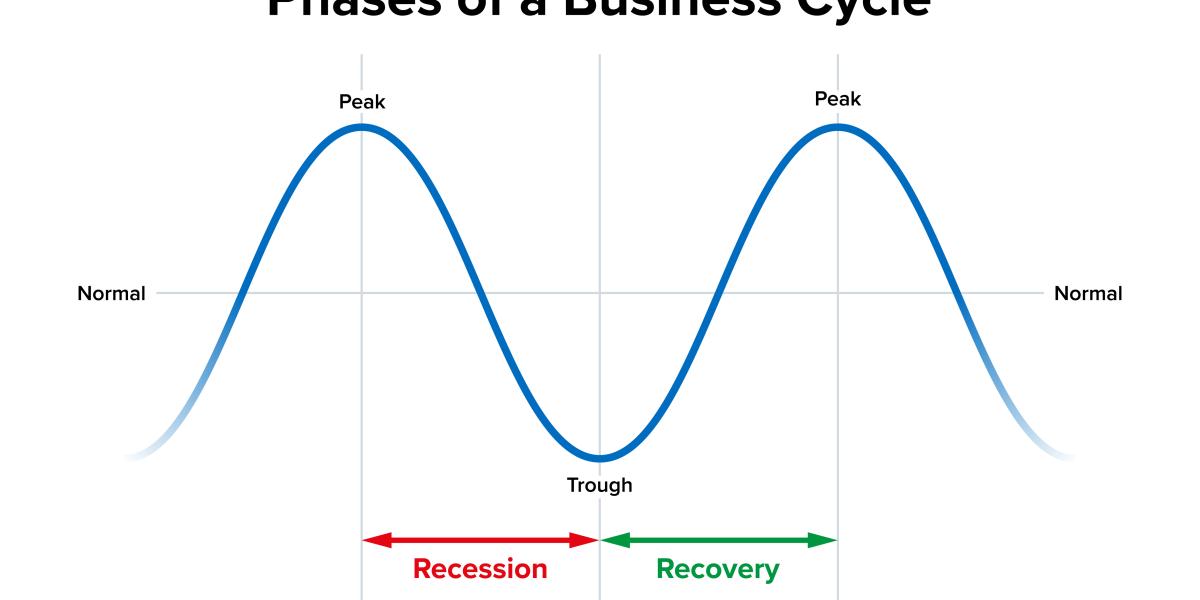

2. Rank Goals by Timeline

Goal-stacking works best when couples divide objectives into short-, mid-, and long-term. A short-term goal might be paying off a credit card, mid-term could be funding a home renovation, and long-term may involve legacy planning. Ranking helps couples see how goals relate, not compete. This prevents one partner from prioritizing today while the other fixates on tomorrow. Shared timelines create harmony.

3. Use Percentages Instead of Fixed Amounts

Instead of arguing over flat dollar amounts, couples can allocate percentages of income to each goal. For example, 50% toward living expenses, 20% to debt reduction, 20% to savings, and 10% to fun. Percentages adjust naturally as income shifts. This method feels fairer because both partners see their priorities represented. Flexibility makes the system sustainable.

4. Automate Contributions to Reduce Friction

Automation ensures money flows toward goals without monthly debates. Couples can set automatic transfers into retirement, travel, or emergency accounts. By removing decision-making, automation prevents conflict over spending. Retirees gain peace of mind knowing progress happens in the background. Less friction means more energy for enjoying life together.

5. Create Separate “Freedom Funds”

Even in retirement, couples benefit from individual discretionary funds. Each partner controls their own spending money without needing approval. This prevents resentment when one splurges on hobbies or gifts. Separate accounts work best when paired with transparency on shared expenses. A little independence goes a long way toward reducing fights.

6. Align on Big-Picture Dreams

Goal-stacking isn’t just about math—it’s about vision. Couples should talk about long-term dreams like travel, downsizing, or charitable giving. When both partners see how smaller goals build toward shared dreams, cooperation improves. Disagreements about daily spending matter less when the big picture is aligned. Unity starts with a shared vision.

7. Revisit Goals After Life Changes

Life in retirement isn’t static—health issues, family needs, or market changes can shift priorities. Couples should revisit their goal stack at least annually, or after major events. Adjustments keep the plan realistic and relevant. A flexible approach avoids resentment when old goals no longer fit. Updating the stack ensures stability.

8. Use Visual Tools to Track Progress

Charts, spreadsheets, or financial dashboards help couples see how goals stack up. Visuals reduce abstract arguments by showing real numbers and timelines. Retirees may feel more motivated when they see debt shrinking or savings growing. Shared visuals also improve accountability. Transparency turns conflict into collaboration.

9. Involve a Neutral Third Party

Sometimes, couples need help bridging differences. A financial advisor or counselor can act as a neutral guide in goal-stacking discussions. Retirees often find it easier to agree when an outsider validates both perspectives. Advisors also ensure goals remain realistic. Mediation turns tension into teamwork.

10. Celebrate Small Wins Together

Focusing only on long-term outcomes can feel discouraging. Couples should celebrate progress on short-term goals, like paying off debt or funding a vacation. These celebrations reinforce teamwork and create positive momentum. Small victories keep partners motivated for bigger challenges. Shared success strengthens financial trust.

Why Goal-Stacking Builds More Than Wealth

Money fights aren’t inevitable—when couples align priorities, structure timelines, and automate progress, harmony replaces conflict. Goal-stacking transforms abstract debates into clear, shared roadmaps. It’s not just about building wealth but about building trust, respect, and stability. Couples who master this approach invest as much in their relationship as in their accounts. Peace of mind is the greatest return.

Have you and your partner tried goal-stacking to reduce money fights? What methods brought the most peace to your relationship?

You May Also Like…

6 Money Fights Couple Every Couple Will Have At Least Once

8 Emotional Truths About Money That No One Likes to Admit

7 Awkward Money Talks to Have With Your Family (Before It’s Too Late)

Inheriting Money: 11 Things No One Tells You About the Drama

It’s Over: 10 Money Habits That Quietly End Relationships