As the signals potential interest rate cuts in the near future, investors are eyeing growth stocks that could capitalize on a lower-rate environment. Lower interest rates typically reduce borrowing costs, boost consumer spending, and increase valuations for high-growth companies.

Among the top contenders are , , and . These companies are positioned to benefit from specific tailwinds, making them compelling buys before the Fed acts.

Below, we explore why these stocks are primed for growth and how they could thrive in a shifting economic landscape.

1. DraftKings

DraftKings, a leader in online sports betting and iGaming, is a high-growth stock that could see significant upside if the Fed cuts rates. As rates drop, consumer discretionary spending tends to rise, which could drive higher engagement on DraftKings’ platform.

The sports betting company boasts a rare blend: 30.1% revenue growth in FY2024, a projected 235.5% EPS surge this year, and a still-underappreciated 19.1% fair value upside. As the U.S. nears a rate cut, consumer discretionary names like DKNG—already riding a digital sports betting boom—could see even more wallet share.

Source: InvestingPro

Its recent Q2 saw a 37% YoY revenue jump and a record $301M EBITDA, beating consensus by 23%. Add in new state launches and product innovation (live betting, prediction markets), and DKNG’s “Strong Buy” consensus (1.47) feels well-earned.

Investors should consider entering DraftKings before monetary easing potentially further enhances its fundamental prospects. Moreover, as a company whose valuation is still largely based on its massive future profit potential, lower interest rates will make its long-term growth story significantly more attractive from a valuation perspective.

2. Lemonade

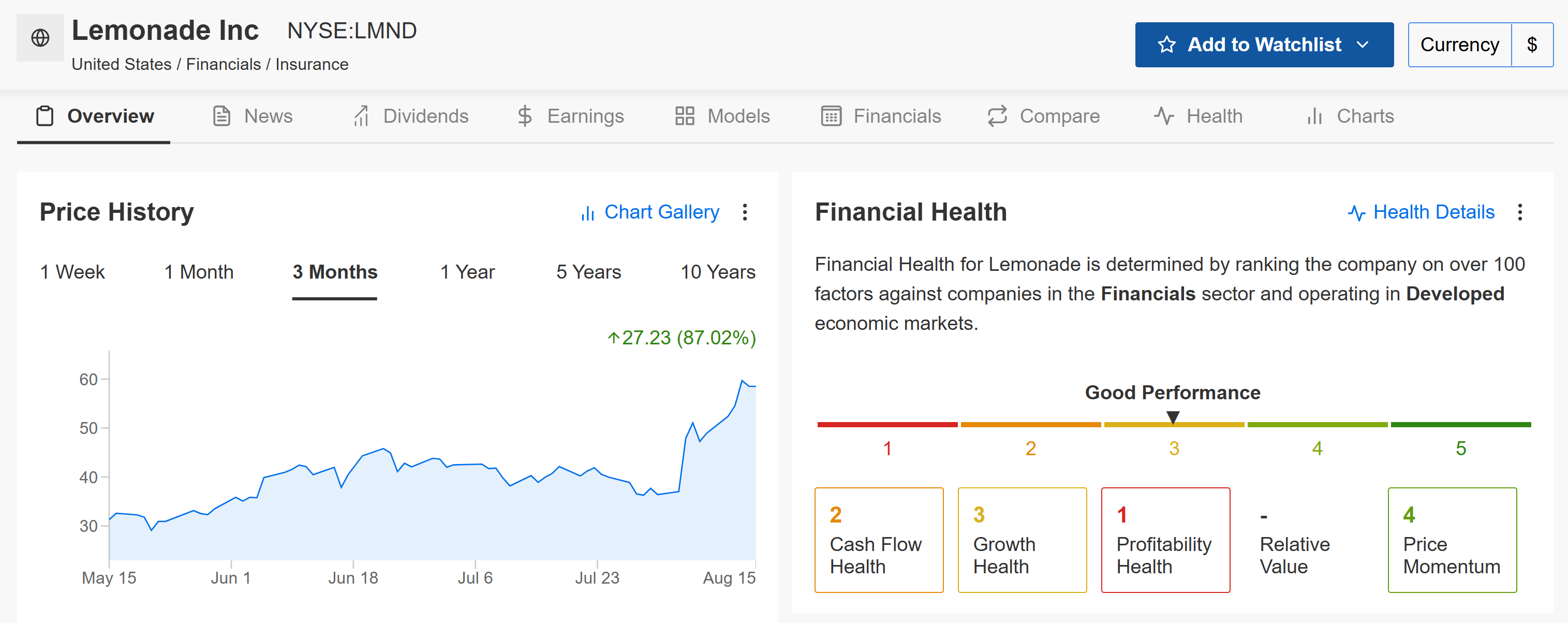

Lemonade, a disruptor in the insurance industry, uses AI and machine learning to offer renters, homeowners, and pet insurance. Its innovative model is gaining traction, and rate cuts could accelerate its growth.

The insurance company has staged a remarkable turnaround, with its stock up 87% in the past three months and a higher-than-peers financial health score of 2.60. While its fair value upside is modest at -3.9%, Lemonade’s tailwinds come from improving loss ratios, double-digit customer growth, and a growing tech moat in digital insurance.

Source: InvestingPro

Analysts and investors are warming to its operational progress—Cantor Fitzgerald just initiated with an “Overweight” and $60 target, while management eyes breakeven cash flow by end-2025. Rate cuts could ease financing costs and stoke further top-line momentum, making LMND a high-volatility, high-reward proposition as rates fall.

In a low-interest-rate environment, Lemonade stands to benefit from reduced financing costs, allowing for more aggressive expansion and customer acquisition strategies. Buying LMND now positions investors to benefit from both operational growth and a potential re-rating of the stock.

3. Datadog

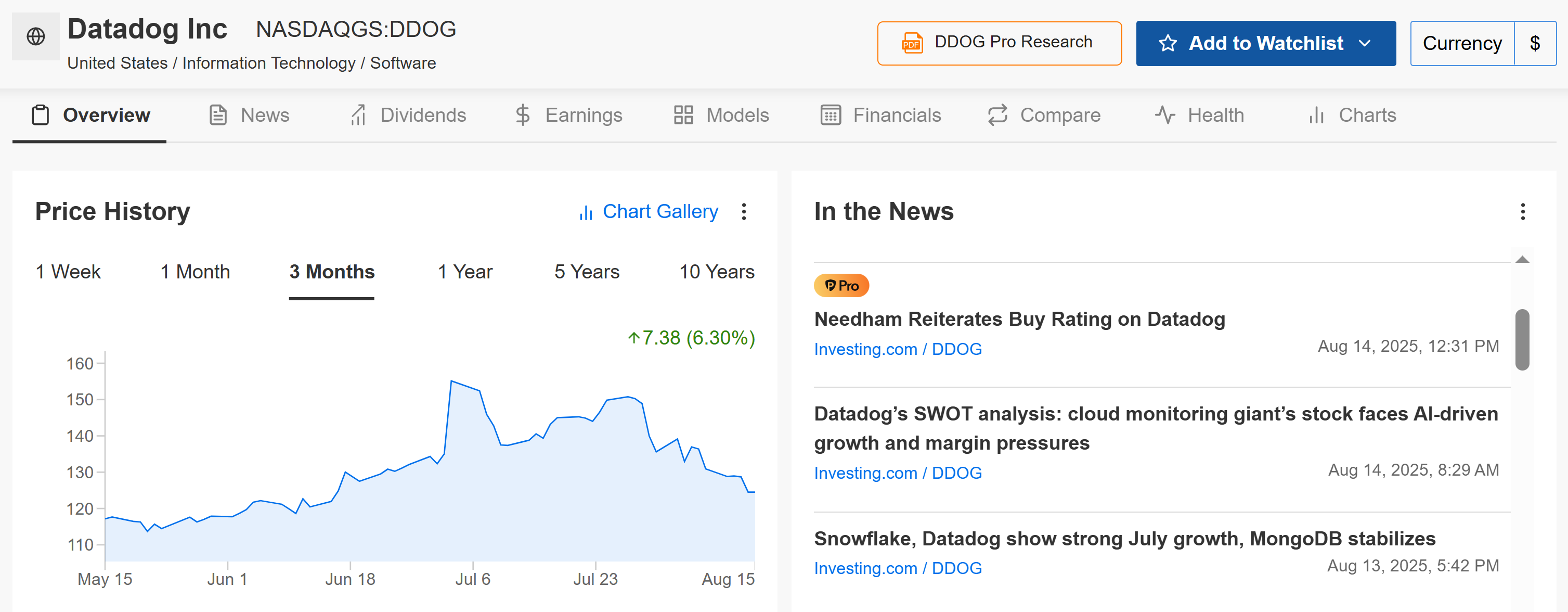

Datadog, a leader in cloud monitoring and analytics, is a key enabler of digital transformation for businesses. Lower interest rates could accelerate enterprise spending on cloud infrastructure, directly benefiting Datadog’s subscription-based revenue model. Its strong market position and robust growth make it a top pick before the Fed cuts rates.

The company sits at the heart of the AI/cloud infrastructure wave, posting 26.1% revenue growth last year and projecting a staggering 262.3% EPS jump for FY2025. The financial health score of 2.52 is “GOOD,” and while the fair value upside is slightly negative (-4.8%), analyst sentiment remains “Strong Buy” (1.55), with price targets as high as $200.

Source: InvestingPro

Fed rate cuts should unlock IT budgets and lift spending on observability—a space where Datadog’s AI-native platform is outpacing rivals. July’s data shows a sharp rebound in customer engagement, and recent earnings blew past expectations.

Furthermore, growth SaaS names like DDOG historically outperform when rates fall, as valuation multiples expand alongside revenue momentum. Buying before the cuts allows investors to lock in a position in a best-in-class software leader ahead of a more favorable macro backdrop.

Bottom Line

A Fed rate cut would provide a catalyst for high-growth, tech-centric stocks. DraftKings, Lemonade, and Datadog each stand out for their category leadership, strong top-line trajectories, and leveraged upside to a friendlier cost of capital environment—making them top candidates to buy now, before the Fed acts.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now and save 50% on all Pro plans and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.