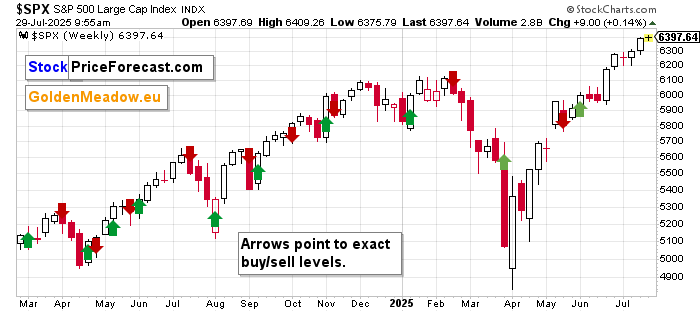

The extended its bull market once again, driven by the ongoing mania in AI stocks – but will it last?

The S&P 500 index closed just 0.02% higher on Monday, after reaching yet another record high of 6,401.07. The market was buoyed by a rebound in AI-sector stocks, including a new all-time high in Nvidia (NASDAQ:), whose market cap has now exceeded $4.3 trillion. Today, the S&P 500 is expected to open 0.2% higher, likely re-testing its all-time high.

Markets are bracing for Wednesday’s , along with key earnings reports from major tech companies – Meta (NASDAQ:) and Microsoft (NASDAQ:) report tomorrow, while Apple (NASDAQ:) and Amazon (NASDAQ:) follow on Thursday.

Investor sentiment has slightly deteriorated again, as reflected in last Wednesday’s AAII Investor Sentiment Survey, which reported that 36.8% of individual investors are bullish, while 34.0% are bearish.

On the daily chart, the S&P 500 continues to trade near record highs.

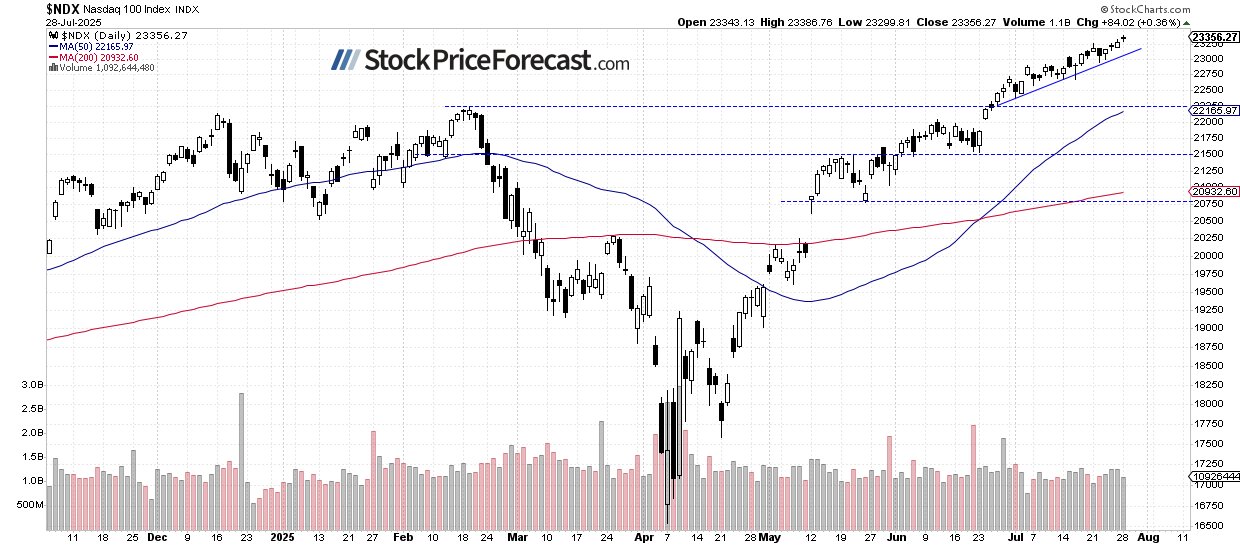

Nasdaq 100: New Highs Above 23,000

The climbed 0.36% on Monday, hitting a fresh record at 23,386.76. Investors are still piling into AI stocks, and the rally is starting to look more like a frenzy, with prices drifting further from fundamentals.

Investors are now closely watching earnings from Meta and Microsoft (Wednesday), and Apple and Amazon (Thursday), which could become short-term catalysts.

While no strong bearish signals have emerged yet, the recent price action may be forming a potential topping pattern.

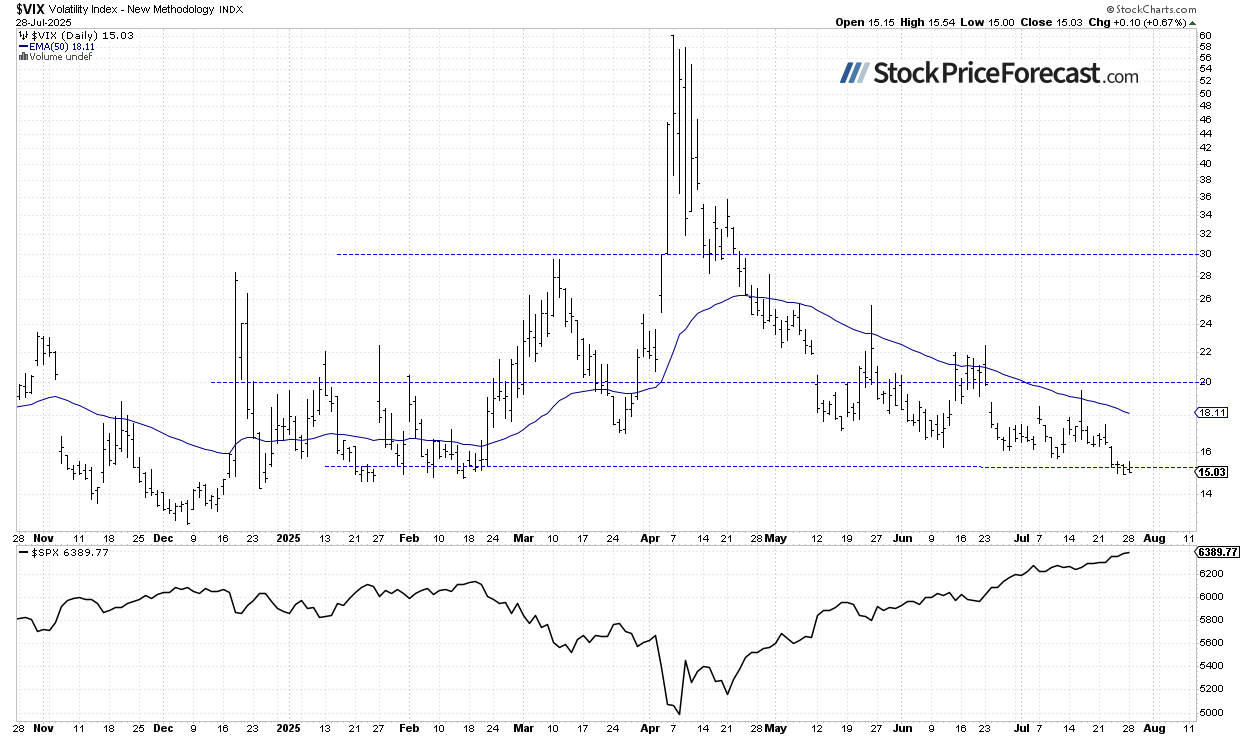

Volatility: Has It Bottomed Out?

The (Volatility Index) fell to a new local low of 14.92 on Friday, marking its lowest level since late February – coinciding with stocks hitting new highs. This reflects declining investor fear (declining gold prices indicate the same thing), but also raises the possibility of a short-term market top.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal. Conversely, the higher the VIX, the higher the probability of the market’s upward reversal.

My Volatility Breakout System remains long on the S&P 500 index since June 3, 2025, at 5,964.33 – currently showing a solid profit. The gains look likely to continue in the coming days.

Seasonal Trading Signal Suggests Caution

One important warning signal comes from Ryan Mitchell’s Seasonal Trading Primer, which suggests that the market may be nearing the end of its short-term seasonal strength.

S&P 500 Futures Contract: Short-Term Uncertainty

This morning, the contract is rebounding from Monday’s pullback low around 6,409, though the broader market remains within a potential topping range.

While there are no clear negative signals, the market remains within a potential topping pattern.

Resistance is now near 6,460, while support is at 6,400-6,420, among others.

Markets remain highly sensitive to tariff-related news and could stay volatile in the near term.

Crude Oil: Retesting Local Highs

gained 2.38% on Monday, benefiting from easing tariff concerns following the weekend’s U.S.–EU trade deal. The market is now retesting its recent highs and extending a short-term consolidation. As of this morning, prices are up 0.7%, nearing the $67 level.

As I’m writing in my Oil Trading Alerts, key developments worth monitoring include:

A new U.S.–EU framework deal eased tariff fears by setting a 15% levy on most EU exports to the U.S., down from a threatened 30%. The EU also pledged about $750B of U.S. energy purchases over the coming years, though analysts doubt the target is achievable.

Trump shortened Russia’s deadline to make progress toward ending the Ukraine war to “10 or 12 days,” warning of sanctions on Russia and buyers of its exports. ING flagged the prospect of 100% secondary tariffs on partners importing Russian oil, which could materially tighten supply if strictly enforced.

Monetary policy remains a key watchpoint as the Fed’s two‑day meeting begins Tuesday; markets expect rates to hold at 4.25%-4.50%, with a possible dovish tilt amid cooling inflation. Incoming U.S. data could sway the tone.

Market Outlook: Still Climbing a Wall of Worry

Stocks are expected to retest record highs this morning, but may remain in short-term consolidation mode ahead of the FOMC announcement and tech earnings.

The key question remains: Is this a topping pattern – or just another leg in the market’s climb up the wall of worry?

Here’s what I think is most likely:

The S&P 500 is expected to challenge its all-time high again today, led by continued strength in AI-related stocks.

The rally has extended gains for those using systematic approaches like my Volatility Breakout System.

There are no clear bearish signals yet, but a deeper downward correction is not out of the question at some point

A lack of strong bullish catalysts may limit further upside in the near term

For individual investors, this environment calls for careful position management. While the market continues to advance, the combination of low volatility, seasonal weakness signals, and stretched valuations suggests that defensive positioning may become increasingly important in the weeks ahead.