The trading week is shaping up to be very interesting. The and stock indexes have reached new all-time highs, while and lag slightly behind.

Investors are wondering whether they, too, will break their records during this week. What is certain is that to push equity markets higher, fuel is needed, and that could come from upcoming events.

One of these will be Chairman Jerome Powell’s , scheduled for Tuesday at 2:30 pm.

However, it is unlikely that the Federal Reserve chairman will be the one to give the markets a decisive boost, since he has been fairly cautious in providing favorable guidance on interest rates recently.

Instead, a real boost might come from the earnings season, especially the quarterly reports of some major companies that are set to report earnings on Wednesday: Alphabet (NASDAQ:), Tesla (NASDAQ:) and International Business Machines (NYSE:).

When it comes to building a well-rounded portfolio, striking the right balance between growth and resilience is no easy task. But two stocks—Alphabet and IBM—stand out as a compelling duo that could help strike that balance.

These two offer complementary strengths:

Alphabet delivers high growth, solid efficiency, and strong active returns relative to the market. It’s a great pick if you’re aiming for long-term outperformance and can stomach a bit more volatility.

IBM plays a different role. It brings lower volatility and shallower drawdowns to the table, which makes it a strong candidate for diversifying and stabilizing your portfolio.

In this analysis, I’ll walk you through how these two stocks perform in terms of annualized returns, risk, efficiency ratios, and active returns.

Let’s dive in.

1. Alphabet: Still Fairly Valued

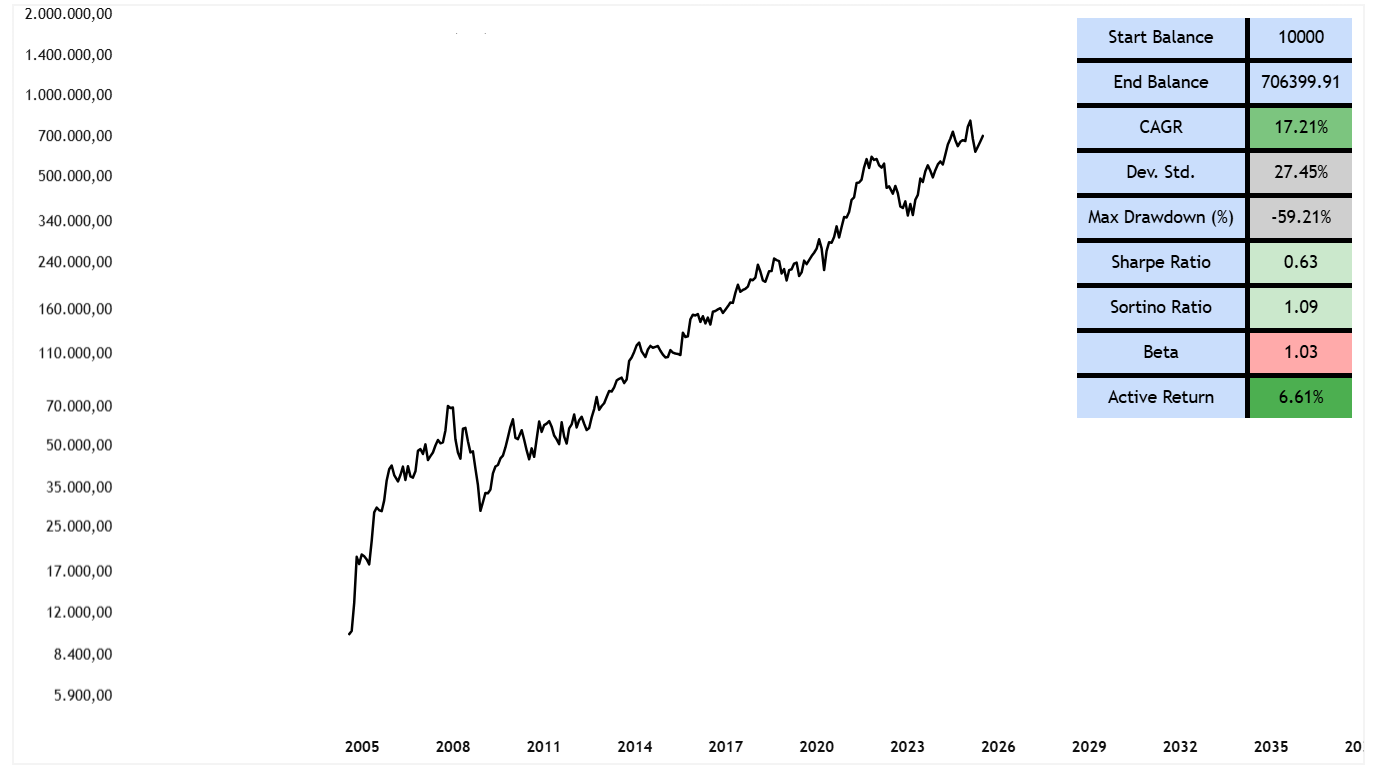

The figure below illustrates Alphabet’s performance, which has experienced a CAGR of 17.2% over the past 20 years, with a standard deviation—reflecting risk or price volatility—of 27.4%. The largest drawdown occurred during the 2008 crisis, with a drop of nearly -60%.

The stock’s efficiency, measured by Sharpe and Sortino ratios (excluding risk-free return), is 0.63 and 1.09, respectively. Its beta, relative to the S&P 500 ETF (NYSE: ) over the last five years, is 1.03, suggesting its fluctuations closely mirror those of the market. Additionally, the annualized active return compared to the benchmark stood at 6.61%, a notably positive figure.

I am convinced by Alphabet for two key reasons: it is not a tech stock with overly high valuations. Based on InvestingPro’s 15 fundamental valuation models, its estimated fair value is $193.15, suggesting a potential upside of +4.4% from current prices.

Source: InvestingPro

The company’s financial strength, rated as “very good,” reflects the strength of its fundamentals and its ability to withstand any market shocks.

Source: InvestingPro

Additionally, based on analyst consensus, Alphabet is considered a stock to buy. Forecasts project a minimum target of $160, a maximum of $250, and an average of $204.70, indicating a potential upside of slightly over 10%.

Thanks to InvestingPro data, you can create a true “value area” using both the fair value from quantitative models and the analysts’ average targets.

The outcome? Alphabet continues to have appealing growth margins and remains a strong option for value-seeking investors in the tech sector.

For instance, Alphabet’s stock has experienced significant swings, such as an +8.06% increase on April 25, 2024, and a sharp -8.74% decrease on January 30, 2024.

2. IBM: Could a Post-Earnings Pop Be on the Cards?

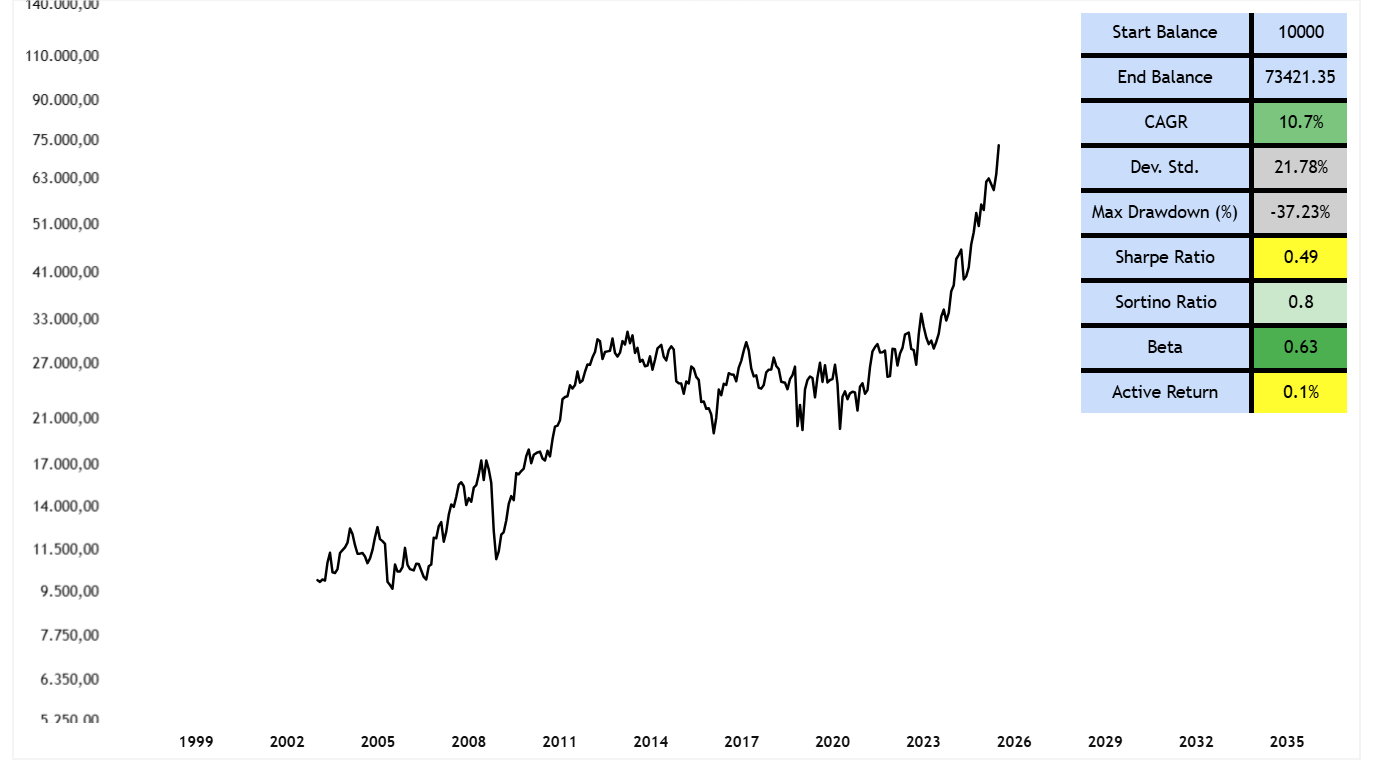

Analyzing IBM over a 20-year span, we see a CAGR of 10.7% and a standard deviation of 21.7%. Its Sharpe and Sortino ratios are lower than Alphabet’s at 0.49 and 0.80, respectively, yet it experienced a smaller maximum drawdown of -37.2%.

The beta is considerably lower at 0.63, indicating reduced volatility compared to the market. Nonetheless, the active return compared to the S&P 500 was nearly zero, showing performance that mirrors the market but with a more moderate risk level.

Turning now to IBM, according to InvestingPro, the stock is overvalued: based on 14 automated valuation models, the estimated fair value is $233, which suggests a potential decrease of 18.5% from current levels.

Source: InvestingPro

The company’s financial status gets a score of 3 out of 5, indicative of good financial strength.

Source: InvestingPro

However, analysts’ outlook on IBM is less optimistic than that for Alphabet.

The average target calls for a decline of -4.64%,

with a maximum target of $350

and a minimum target of $190.

Despite this, the consensus still leans toward a “buy.”

In this scenario, the value area—which merges fair value and analysts’ targets—is below IBM’s current market price. This indicates that IBM might not have the same short-term growth prospects as Alphabet. Nonetheless, it remains an appealing choice for investors looking for stability and reduced market volatility.

IBM has experienced increased volatility, with notable rises of over +14.4%, such as on January 29, 2025, and sharp declines like the -7.29% on April 24, 2024.

Source: InvestingPro

Therefore, all eyes are on Wednesday, when significant market movements are expected to occur. It’s essential to remember that earnings seasons often trigger high volatility, as shown in the following figures, where stocks typically react strongly on quarterly reporting days.

Bottom Line

In any case, I see both of these stocks as ideal for long-term holding, primarily due to their strong fundamentals, growth potential, and attractive valuations:

Alphabet boasts a robust growth rate (CAGR of 17.2%) combined with a reasonable valuation, with a fair value of $193.15 and an average analyst target of $204.70, suggesting further upside. Its high efficiency ratios and consistent active returns make it well-suited for investors seeking long-term gains in the tech sector.

IBM, though with more modest growth prospects, provides stability, lower market volatility (beta 0.63), and solid financial strength, making it a good fit for diversification. While the estimated fair value ($233) is below current trading levels and the average target indicates a slight downside, the stock remains attractive for those wanting a defensive asset with exposure to technology and enterprise services.

Overall, these stocks complement each other well: one offers growth and performance, the other stability and resilience—a great combination for a long-term investment approach.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

Subscribe now for up to 50% off amid the summer sale and instantly unlock access to several market-beating features, including:

ProPicks AI: AI-selected stock winners with proven track record.

InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Note: The opinions expressed in this article are solely those of the author and should not be considered as investment advice.