Market sentiment remains fragile this morning as reports continue to arrive that the US is planning strikes on Iran. This would be a major escalation in the conflict and could draw other allies into the fight.

The UK also held meetings on the possible implications of US strikes on Iran with the Iranians warning of significant retaliation. This has kept overall market sentiment on edge and this could continue ahead of the weekend.

Asian Market Wrap

MSCI’s regional stock index dropped about 1%, with Hong Kong stocks falling over 2%. U.S. stock futures also dipped slightly after the barely moved in the last session. The gained strength against most major currencies.

U.S. Treasury markets are closed on Thursday due to a holiday. Investors were already nervous after the Federal Reserve lowered its growth forecast for this year and predicted higher inflation, highlighting how tariffs are making it harder for the Fed to adjust its policies.

Swiss National Bank (SNB) Slashes Rates to 0%

The Swiss National Bank () lowered its interest rate to 0% in June 2025, as expected, marking the first time rates have been at zero since 2022. This decision was made because inflation is easing, and the global economy is slowing down. In May, Swiss consumer prices dropped by 0.1%, the first decline in four years, mainly due to cheaper tourism and oil prices. The SNB now predicts low inflation for the next few years: 0.2% in 2025, 0.5% in 2026, and 0.7% in 2027.

Switzerland’s economy grew strongly in early 2025, partly due to exports to the U.S. before new tariffs took effect, but overall growth is expected to slow. is forecast to grow by 1% to 1.5% in both 2025 and 2026. However, rising global trade tensions are creating uncertainty for Switzerland’s trade future.

The move will no doubt be welcomed by the business community, especially those relying on exports. The had gained significant ground due to its haven appeal against the Dollar and the in recent months, which saw the export community urge the Central bank to take action.

The SNB vowed not to follow the same path as 2015 and rate cuts became the only option available.

European Open

European stocks dropped on Thursday, with the index falling 0.6% to 537.37 points, hitting its lowest level in over a month.

Trading was quieter than usual since U.S. markets were closed for a holiday. rose due to the ongoing conflict, which helped energy stocks gain 0.6%.

On the other hand, travel and leisure stocks fell 1.5%, as higher oil prices hurt the sector.

The Euro STOXX Volatility Index, a measure of market uncertainty, hit its highest level since May 23, rising to 23.78.

On the FX front, the US Dollar was stronger this morning, and that could be down to safe-haven flows. However, we are seeing the Dollar retreat since the start of the European session.

Currency Power Balance

Source: OANDA Labs

Economic Data Releases and Final Thoughts

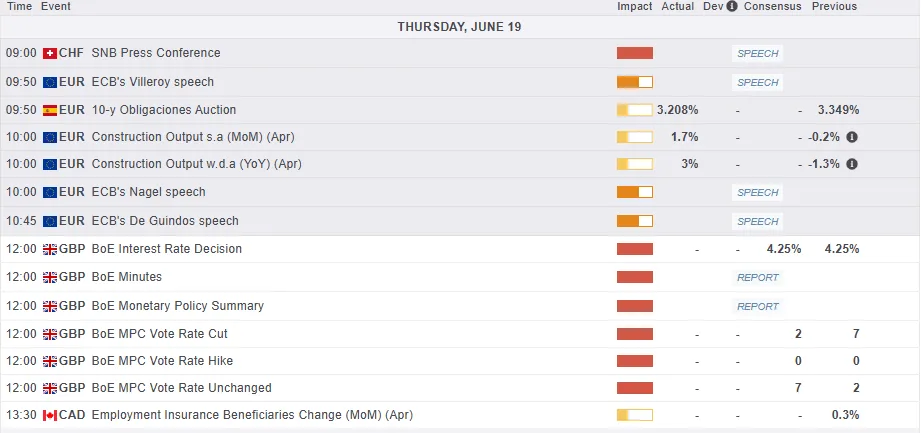

Looking at the economic calendar, market participants will be watching a host of ECB policymakers who are speaking.

Later, the kept the interest rates on hold despite a significant drop in services inflation yesterday. The recent rise in oil prices may also be a contributing factor in their decision later today.

Market participants fear an uptick in global inflation if oil prices remain elevated, and all of this may come to fruition before we get the full effects from tariffs.

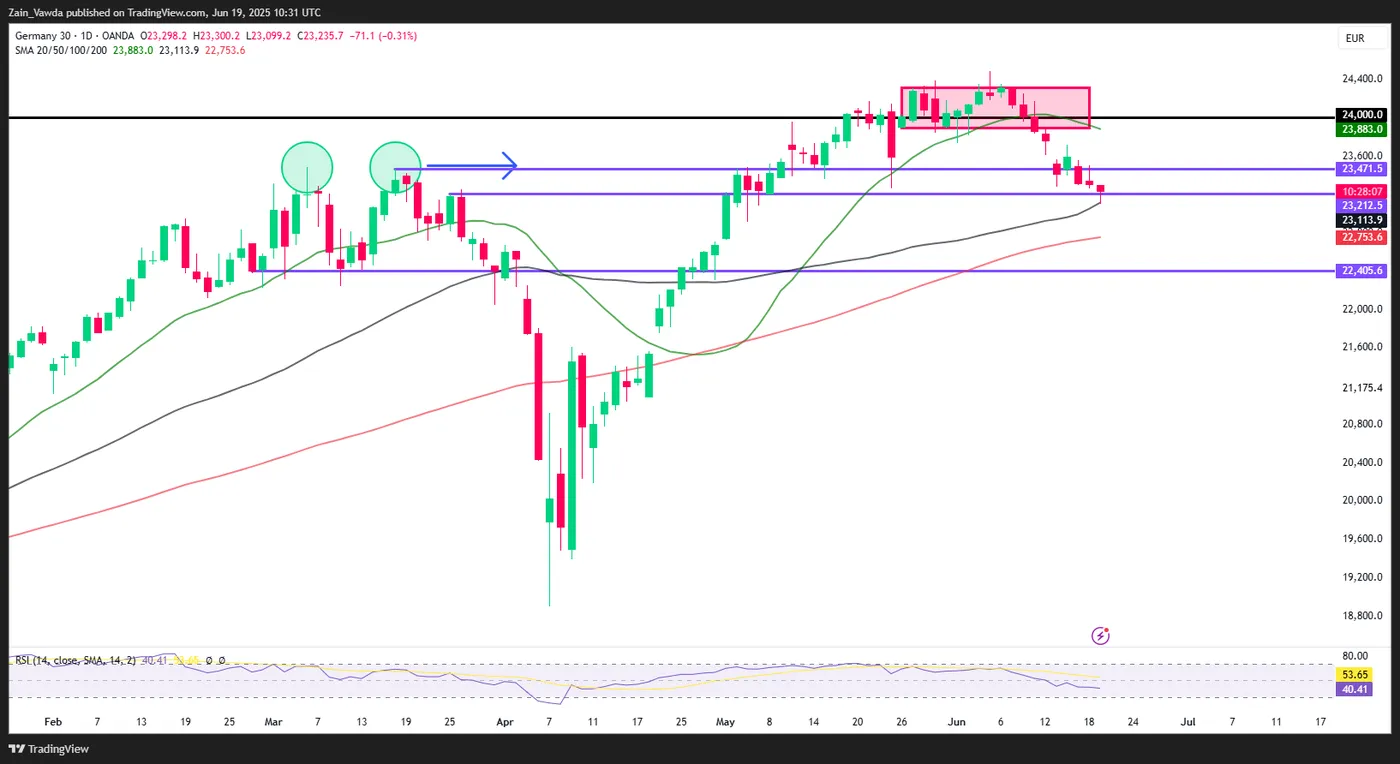

Chart of the Day – DAX Index

Source: TradingView.com

Key Levels to Watch for DAX Index:

Support

Resistance

Original Post