Financial advisors’ confidence levels have continued to rebound but remain in the red overall.

That’s the overall sentiment reflected in Financial Planning’s May Financial Advisor Confidence Outlook (FACO), a survey of financial advisors and planners that measures confidence in the economy and other factors on a scale of minus-100 to 100.

In April, the overall outlook hit an all-time low of minus-24, before recovering slightly in May when it was up to minus-18. June’s figures saw an even greater bounce to minus-5.

By far the most significant factor behind this jump was the outlook for the overall economy. After being deep underwater in May at minus-29, that score jumped a whopping 42 points to a final score of 13 in June.

“Clients are seeking to take advantage of high current interest rates believing we will see rates fall in the second half of the year,” said one advisor. “They also feel the new budget bill will be very good for growth investments. I see a lot of emphasis on securing a guaranteed retirement income.”

READ MORE: Policy, economic concerns sinking advisor confidence

Faith in the global economic system was also up this month, but not by quite as much. In May, that category was at minus-62, but in June it was up to a slightly less-dismal minus-52.

One advisor said they were watching “geopolitical issues and news cycles affecting client expectations and outlooks.”

Confidence in government policy stayed exactly the same between May and June at a score of 8.

“Due to volatility and erratic behavior of the legislative branch, my clients and prospects are seeking a calming voice and comprehensive ideas to navigate this environment,” said one advisor.

READ MORE: Uncertainty drives sharp decline in advisor confidence

Several advisors reported feeling less than positive about the tumultuous first few months of the second term of President Donald Trump.

One advisor said they were worried about “the idiot in the White House and all of the unqualified clowns in this administration.”

Another advisor lamented the “anti-American, faux conservative, fake Christian president who wants to be a tin-pot dictator of a banana republic.”

Even those who were more sympathetic to the administration and its goals were feeling the anxiety. One advisor said that while many of their clients voted for Trump, they were still “confused by constant tariff talk, trade war and economic uncertainty.”

“Simply cut taxes and lay off tariffs,” they said.

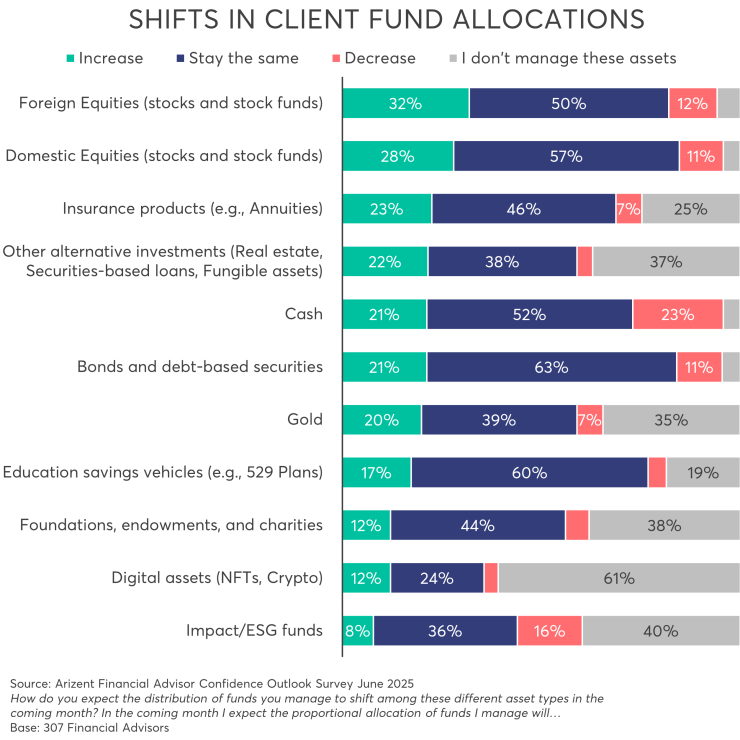

Asset allocations were still in the red but up from minus-14 in May to minus-7 in June.

One advisor said they were concerned about “more people not wanting investment advice because they don’t want to spend the money.”

Client risk tolerance also improved slightly from minus-28 in May to minus-18 in June.

One advisor cited the “financial stress of inflation, college education expenses and volatile market” as the cause of client anxiety in this area.

Practice performance also rose from 17 in May to 26 in June.

“I am working to increase the intellectual capital of my practice through training and building alliances with other advisers,” said one advisor.

Another advisor said that even though they were concerned about “tariffs and Trump as Dr. Jekyll and Mr. Hyde” causing “a recession as a likely outcome at some point this year,” they weren’t personally concerned about their firm’s prospects if this were to come to pass.

“If my thesis is correct, it would benefit my advisory practice,” they said.