Published on May 28th, 2025 by Bob Ciura

Canadian oil stocks have proven over the past decade that they can navigate downturns in commodity prices.

Canadian oil stocks also tend to pay higher dividends than many U.S.-based oil stocks, making them potentially more appealing for income investors.

Valuations have also remained quite low recently, boosting their respective total return profiles as a result.

In this article, we’ll take a look at 7 major Canadian oil stocks:

Canadian Natural Resources (CNQ)

Suncor Energy (SU)

Enbridge, Inc. (ENB)

Whitecap Resources (SPGYF)

Paramount Resources (PRMRF)

Tamarack Valley Energy (TNEYF)

Freehold Royalties Ltd. (FRHLF)

In this article, we will rank them in order of highest expected annual returns over the next five years.

Note: Canada imposes a 15% dividend withholding tax on U.S. investors. In many cases, investing in Canadian stocks through a U.S. retirement account waives the dividend withholding tax from Canada, but check with your tax preparer or accountant for more on this issue.

These top 7 Big Oil stocks in Canada are shareholder-friendly companies, with attractive dividend payouts. With this in mind, we created a full list of nearly 80 energy stocks.

You can download a free copy of the energy stocks list by clicking on the link below:

More information can be found in the Sure Analysis Research Database, which ranks stocks based on their dividend yield, earnings-per-share growth potential, and changes in the valuation multiple.

The stocks are listed in order below, with #1 being the most attractive for investors today.

Read on to see which Canadian oil stock is ranked highest in our Sure Analysis Research Database.

Table Of Contents

You can use the following table of contents to instantly jump to a specific stock:

The top 7 Canadian oil stocks are ranked based on total expected returns over the next five years, from lowest to highest.

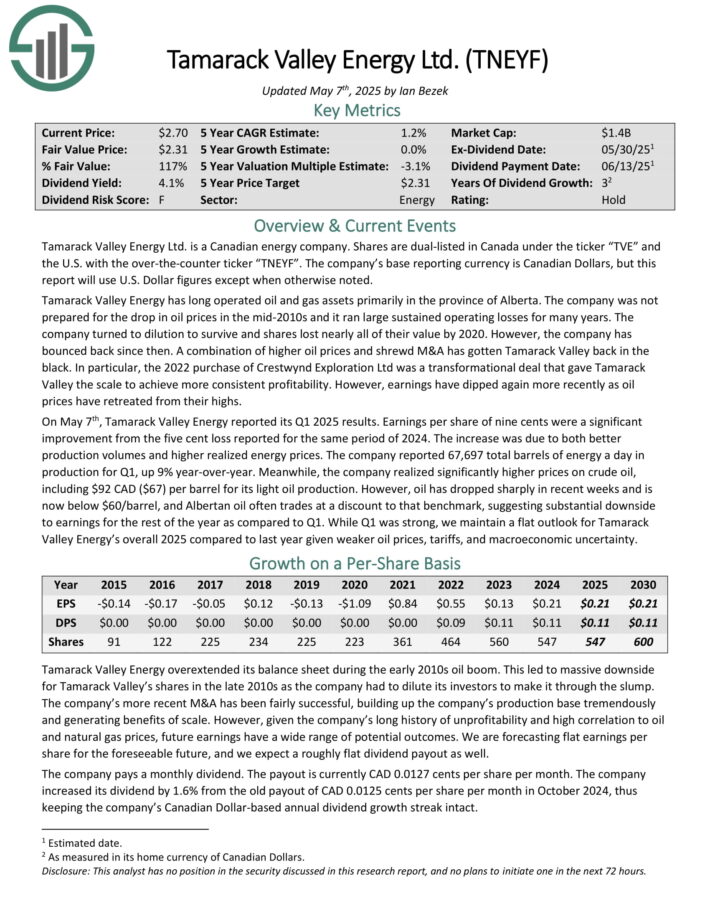

Canadian Oil Stock #7: Tamarack Valley Energy (TNEYF)

5-year expected returns: -2.5%

Tamarack Valley Energy Ltd. is a Canadian energy company. Shares are dual-listed in Canada under the ticker “TVE” and the U.S. with the over-the-counter ticker “TNEYF”.

The company’s base reporting currency is Canadian Dollars, but this report will use U.S. Dollar figures except when otherwise noted. Tamarack Valley Energy has long operated oil and gas assets primarily in the province of Alberta.

On May 7th, Tamarack Valley Energy reported its Q1 2025 results. Earnings per share of nine cents were a significant improvement from the five cent loss reported for the same period of 2024. The increase was due to both better production volumes and higher realized energy prices.

The company reported 67,697 total barrels of energy a day in production for Q1, up 9% year-over-year. Meanwhile, the company realized significantly higher prices on crude oil, including $92 CAD ($67) per barrel for its light oil production.

However, oil has dropped sharply in recent weeks and is now below $60/barrel, and Albertan oil often trades at a discount to that benchmark, suggesting substantial downside to earnings for the rest of the year as compared to Q1.

Click here to download our most recent Sure Analysis report on TNEYF (preview of page 1 of 3 shown below):

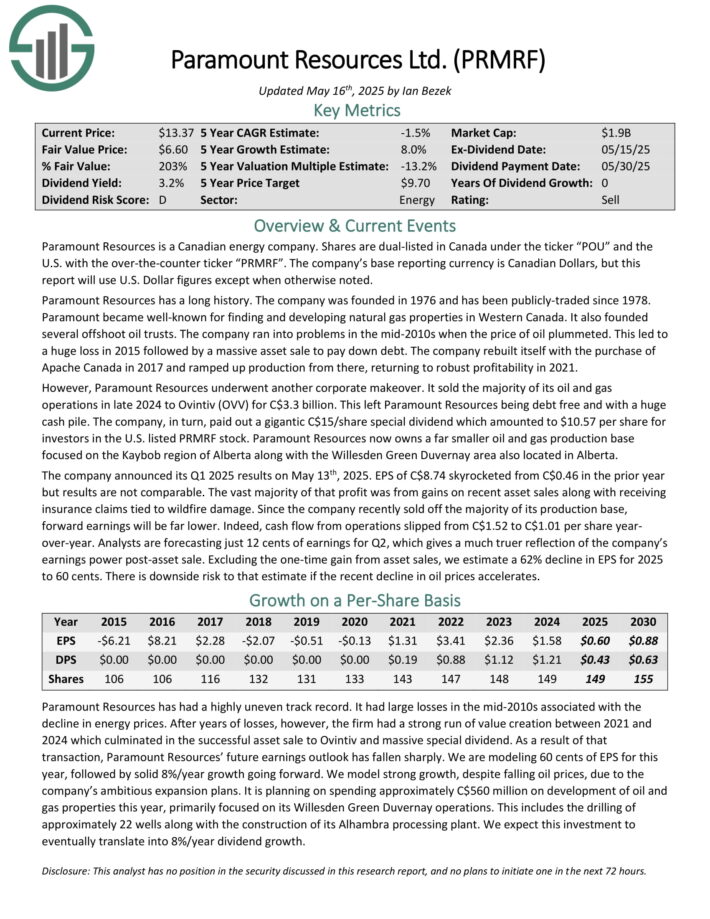

Canadian Oil Stock #6: Paramount Resources (PRMRF)

5-year expected returns: -2.4%

Paramount Resources is a Canadian energy company. Paramount Resources has a long history. The company was founded in 1976 and has been publicly-traded since 1978.

Paramount Resources now owns a far smaller oil and gas production base focused on the Kaybob region of Alberta along with the Willesden Green Duvernay area also located in Alberta.

The company announced its Q1 2025 results on May 13th, 2025. EPS of C$8.74 skyrocketed from C$0.46 in the prior year but results are not comparable. The vast majority of that profit was from gains on recent asset sales along with receiving insurance claims tied to wildfire damage.

Since the company recently sold off the majority of its production base, forward earnings will be far lower. Indeed, cash flow from operations slipped from C$1.52 to C$1.01 per share year-over-year.

Analysts are forecasting just 12 cents of earnings for Q2, which gives a much truer reflection of the company’s earnings power post-asset sale.

Click here to download our most recent Sure Analysis report on PRMRF (preview of page 1 of 3 shown below):

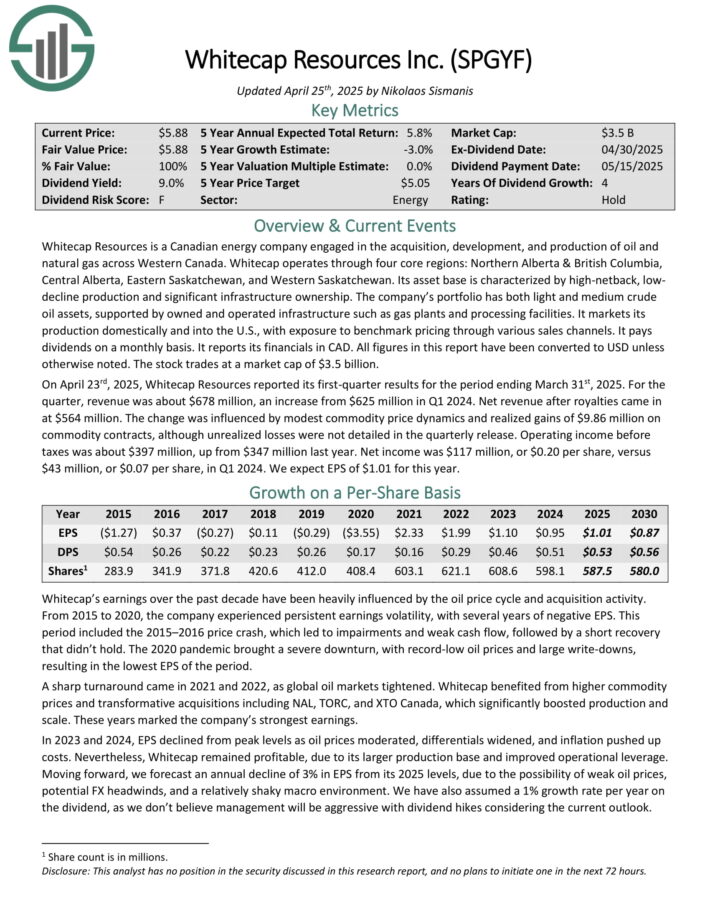

Canadian Oil Stock #5: Whitecap Resources (SPGYF)

5-year expected returns: 3.9%

Whitecap Resources is a Canadian energy company engaged in the acquisition, development, and production of oil and natural gas across Western Canada. Whitecap operates through four core regions: Northern Alberta & British Columbia, Central Alberta, Eastern Saskatchewan, and Western Saskatchewan.

It markets its production domestically and into the U.S., with exposure to benchmark pricing through various sales channels. It pays dividends on a monthly basis. It reports its financials in CAD. All figures in this report have been converted to USD unless otherwise noted.

On April 23rd, 2025, Whitecap Resources reported its first-quarter results for the period ending March 31st, 2025. For the quarter, revenue was about $678 million, an increase from $625 million in Q1 2024. Net revenue after royalties came in at $564 million.

The change was influenced by modest commodity price dynamics and realized gains of $9.86 million on commodity contracts, although unrealized losses were not detailed in the quarterly release. Operating income before taxes was about $397 million, up from $347 million last year.

Click here to download our most recent Sure Analysis report on SPGYF (preview of page 1 of 3 shown below):

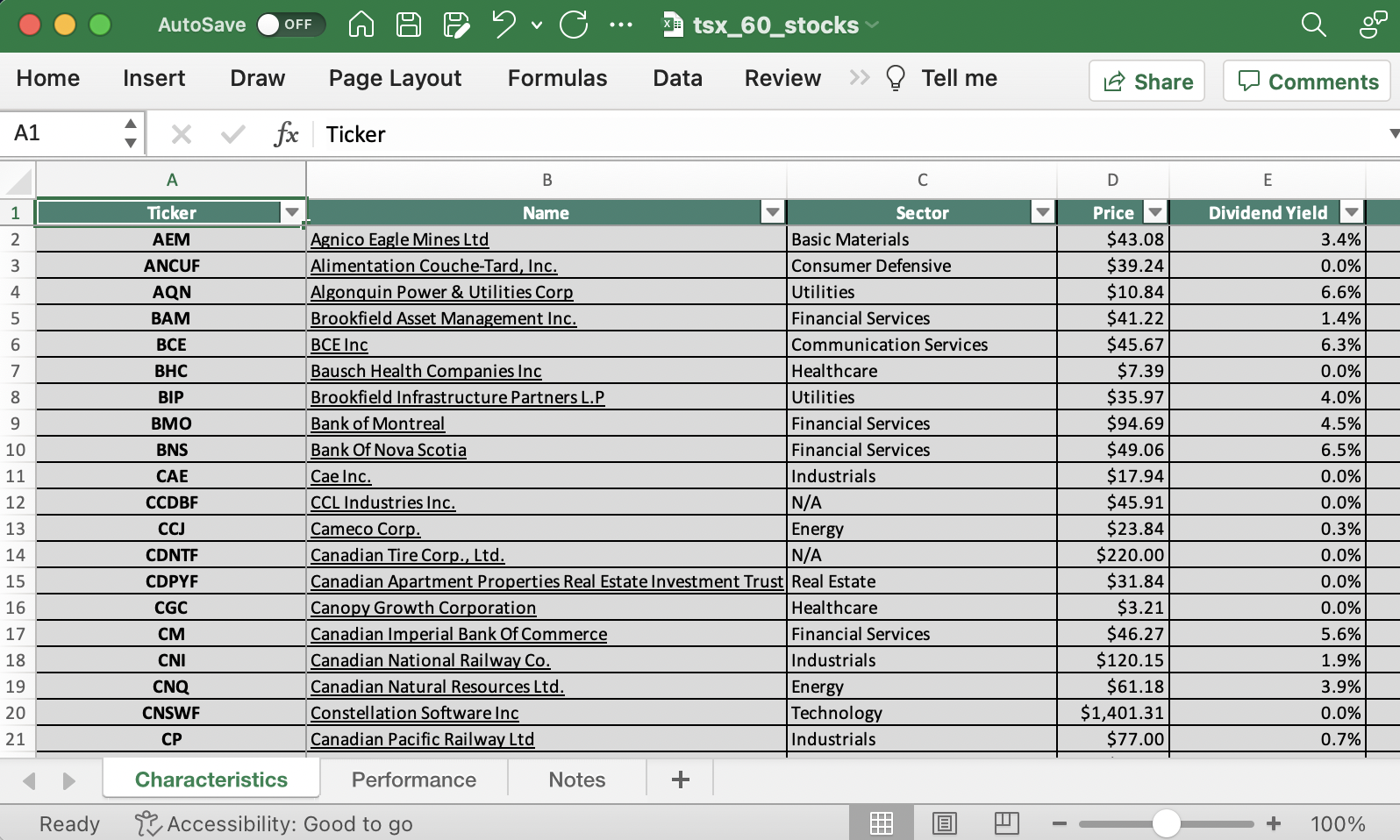

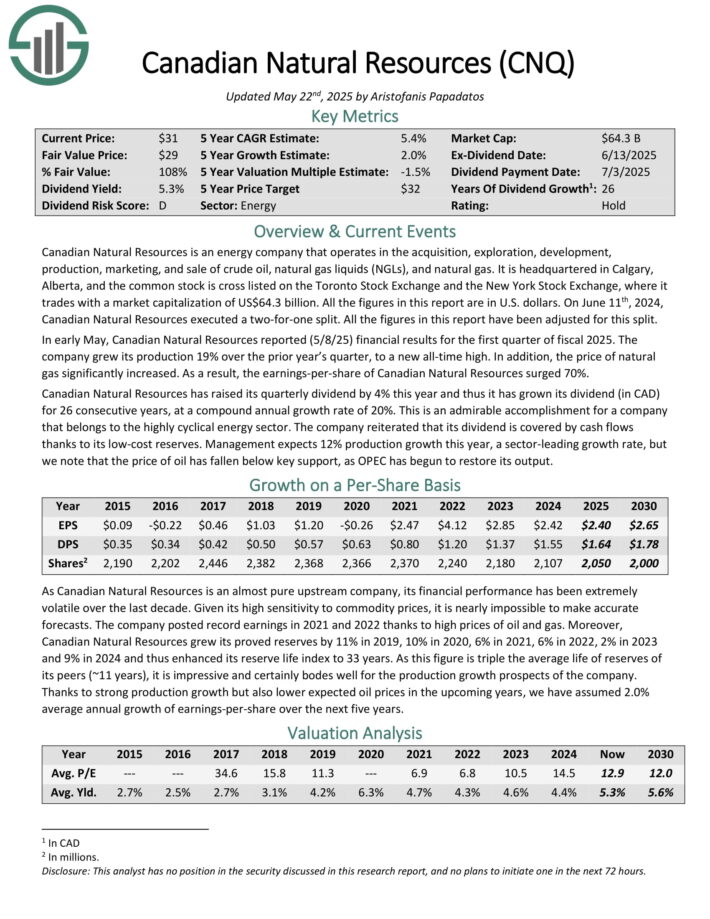

Canadian Oil Stock #4: Canadian Natural Resources (CNQ)

5-year expected returns: 5.5%

Canadian Natural Resources is an energy company that operates in the acquisition, exploration, development, production, marketing, and sale of crude oil, natural gas liquids (NGLs), and natural gas.

It is headquartered in Calgary, Alberta. All the figures in this report are in U.S. dollars. In addition to trading on the New York Stock Exchange, CNQ stock trades on the Toronto Stock Exchange.

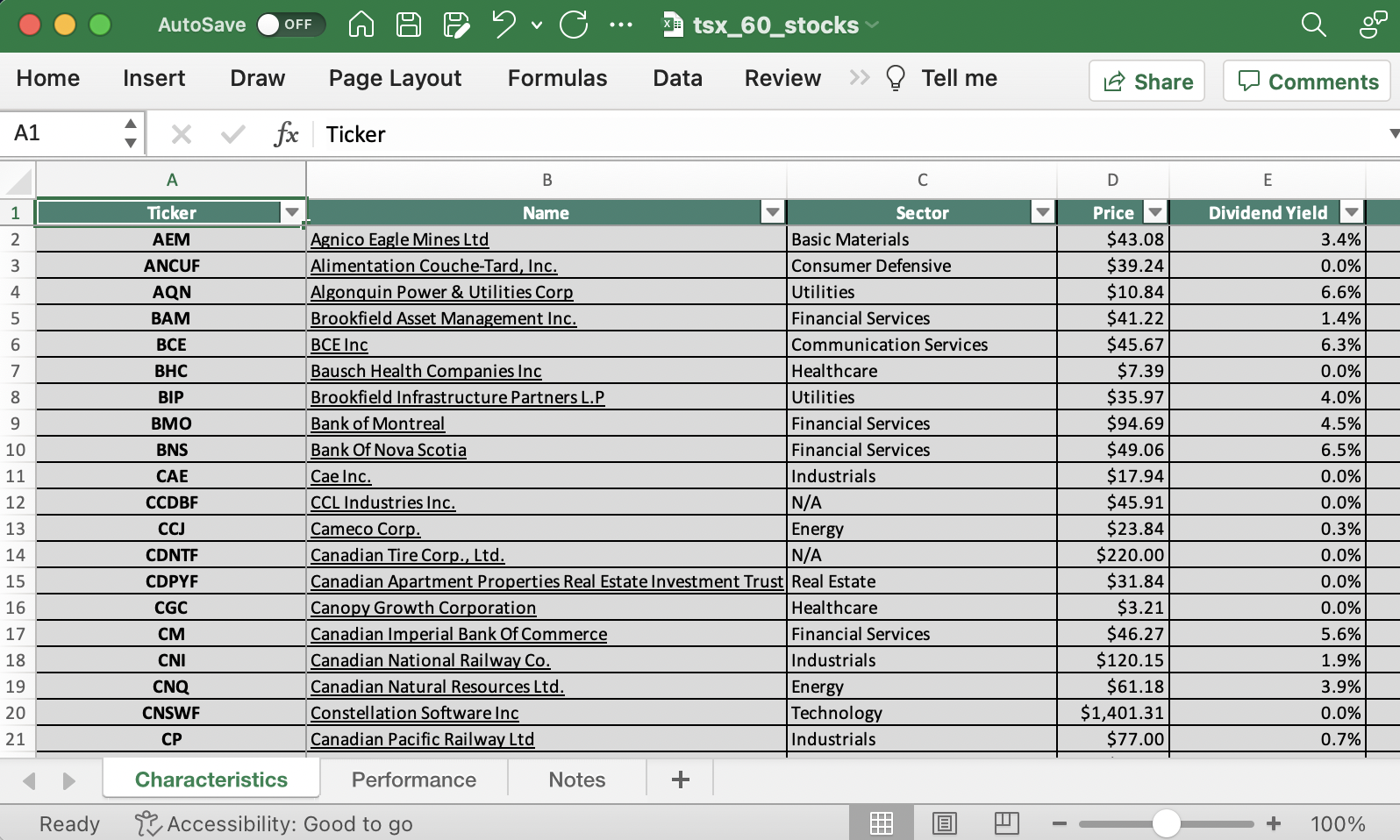

You can download a full list of all TSX 60 stocks below:

In early May, Canadian Natural Resources reported (5/8/25) financial results for the first quarter of fiscal 2025. The company grew its production 19% over the prior year’s quarter, to a new all-time high. In addition, the price of natural gas significantly increased. As a result, the earnings-per-share of Canadian Natural Resources surged 70%.

Canadian Natural Resources has raised its quarterly dividend by 4% this year and thus it has grown its dividend (in CAD) for 26 consecutive years, at a compound annual growth rate of 20%.

This is an admirable accomplishment for a company that belongs to the highly cyclical energy sector. The company reiterated that its dividend is covered by cash flows thanks to its low-cost reserves. Management expects 12% production growth this year.

Click here to download our most recent Sure Analysis report on CNQ (preview of page 1 of 3 shown below):

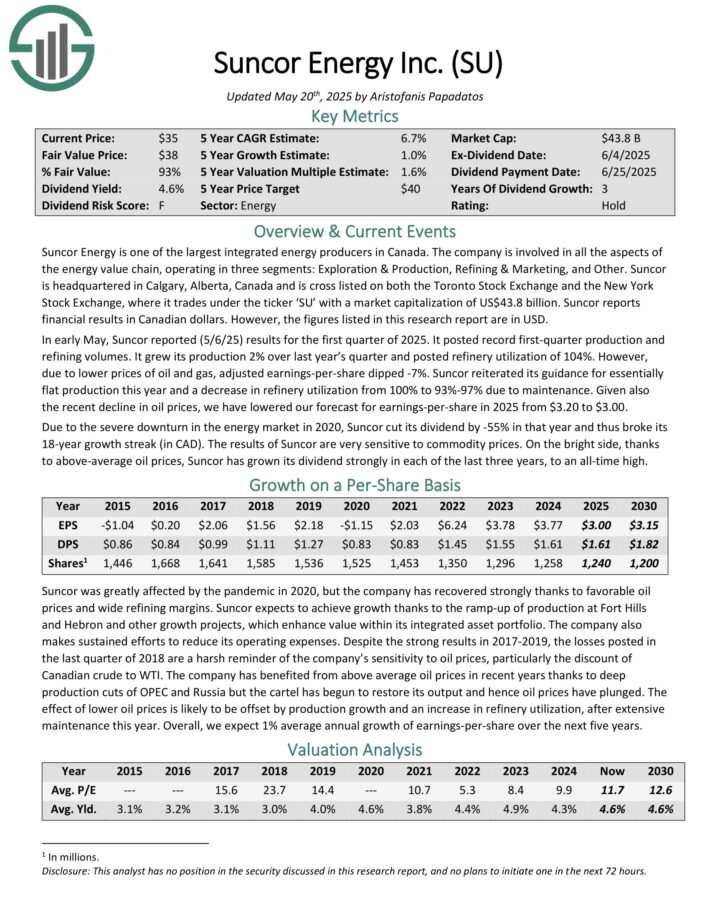

Canadian Oil Stock #3: Suncor Energy (SU)

5-year expected annual returns: 6.4%

Suncor Energy is one of the largest integrated energy producers in Canada. The company is involved in all the aspects of the energy value chain, operating in three segments: Exploration & Production, Refining & Marketing, and Other.

Suncor is headquartered in Calgary, Alberta, Canada and is cross listed on both the Toronto Stock Exchange and the New York Stock Exchange. Suncor reports financial results in Canadian dollars. However, the figures listed in this research report are in USD.

In early May, Suncor reported (5/6/25) results for the first quarter of 2025. It posted record first-quarter production and refining volumes. It grew its production 2% over last year’s quarter and posted refinery utilization of 104%. However, due to lower prices of oil and gas, adjusted earnings-per-share dipped -7%.

Suncor reiterated its guidance for essentially flat production this year and a decrease in refinery utilization from 100% to 93%-97% due to maintenance. Given also the recent decline in oil prices, we have lowered our forecast for earnings-per-share in 2025 from $3.20 to $3.00. .

Click here to download our most recent Sure Analysis report on SU (preview of page 1 of 3 shown below):

Canadian Oil Stock #2: Enbridge Inc. (ENB)

5-year expected annual returns: 7.0%

Enbridge is an oil & gas company that operates the following segments: Liquids Pipelines, Gas Distributions, Energy Services, Gas Transmission & Midstream, and Green Power & Transmission. Enbridge bought Spectra Energy for $28 billion in 2016 and has become one of the largest midstream companies in North America.

Enbridge was founded in 1949 and is headquartered in Calgary, Canada.

Enbridge reported its fourth quarter earnings results on February 14. The company generated revenues of CAD$16.2 billion during the period, which was up by 36% compared to the previous year’s quarter, and which pencils out to US$11.2 billion.

During fiscal 2024, Enbridge grew its adjusted EBITDA by 13% year over year, to CAD$18.6 billion, up from CAD$16.5 billion during the previous year’s quarter.

During fiscal 2024, Enbridge was able to generate distributable cash flows of CAD$12.0 billion, which equates to US$8.3 billion, or US$3.84 on a per-share basis.

Enbridge is forecasting distributable cash flows in a range of CAD$5.50 – CAD$5.90 per share for the current year. Using current exchange rates, this equates to USD$3.95 at the midpoint of the guidance range, which would be up 3% versus 2024.

Click here to download our most recent Sure Analysis report on ENB (preview of page 1 of 3 shown below):

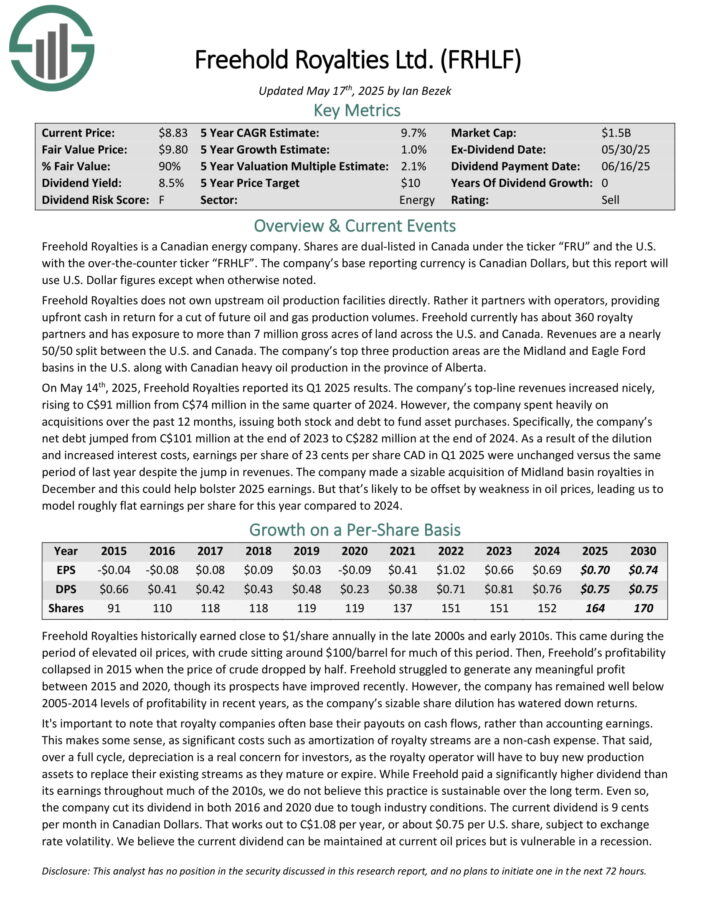

Canadian Oil Stock #1: Freehold Royalties Ltd. (FRHLF)

5-year expected annual returns: 9.2%

Freehold Royalties is a Canadian energy company. Shares are dual-listed in Canada under the ticker “FRU” and the U.S. with the over-the-counter ticker “FRHLF”. The company’s base reporting currency is Canadian Dollars, but this report will use U.S. Dollar figures except when otherwise noted.

Freehold Royalties does not own upstream oil production facilities directly. Rather it partners with operators, providing upfront cash in return for a cut of future oil and gas production volumes. Freehold currently has about 360 royalty partners and has exposure to more than 7 million gross acres of land across the U.S. and Canada.

The company’s top three production areas are the Midland and Eagle Ford basins in the U.S. along with Canadian heavy oil production in the province of Alberta.

On May 14th, 2025, Freehold Royalties reported its Q1 2025 results. The company’s top-line revenues increased nicely, rising to C$91 million from C$74 million in the same quarter of 2024.

As a result of the dilution and increased interest costs, earnings per share of 23 cents per share CAD in Q1 2025 were unchanged versus the same period of last year despite the jump in revenues.

Click here to download our most recent Sure Analysis report on FRHLF (preview of page 1 of 3 shown below):

Final Thoughts

Canadian oil stocks do not get nearly as much coverage as the major U.S. oil stocks. However, income and value investors should pay attention to the big 7 Canadian oil stocks.

All 7 Canadian oil stocks have reasonable valuations, many with dividend yields that are well above the U.S. oil stocks.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].