Week in Review: Optimism Begins to Fade as Consumer Sentiment Deteriorates

Wall Street’s main indexes were set to end the week on a high note, thanks to a temporary truce in the U.S.-China trade war. The was on track for its fifth straight daily gain, with all three major indexes showing weekly growth.

Stocks bounced back earlier in the week, with strong rallies on Monday and Tuesday after the U.S. and China agreed to pause their trade war for 90 days.

This pushed the S&P 500 back into positive territory for the year, the first time since late February. However, it’s still about 4% below its all-time high.

However, sentiment has suffered toward the backend of the week, thanks in part to US data. Thursday’s data was , , and the NFIB small business optimism index, and these revealed some concerns which have weighed slightly on overall sentiment ahead of the weekend.

The biggest concern came from small businesses, who are getting more pessimistic about the economy.

The Index declined 1.6 points in April, to 95.8, its lowest since October 2024. 6 of the 10 index components decreased, with expected business conditions having the most negative contribution. Over the last 4 months, the index has fallen 9.3 points, the sharpest drop since the 2020 pandemic.

At the same time, the share of small firms expecting better business conditions 6 months from now has plummeted 37 percentage points, to 15%, the lowest since October 2024.

The mood remained sour after Friday’s release of the University of Michigan Preliminary Data, which showed the index dropped sharply to 50.8 in May 2025, down from 52.2 in April and much lower than the expected 53.4, based on early estimates. This is the fifth monthly drop in a row, the lowest since June 2022, and the second-lowest ever recorded.

Rising worries and concerns about tariffs are hurting confidence. Both the index (57.6 vs 59.8) and future expectations (46.5 vs 47.3) got worse. Personal finances took a big hit, falling nearly 10% due to weaker incomes. Nearly 75% of consumers mentioned tariffs as a concern, up from 60% in April, showing trade policy uncertainty is a major worry.

for the next year jumped to 7.3%, the highest since 1981, up from 6.5%, while also rose slightly to 4.6% from 4.4%.Source: LSEG

The consumer sentiment data has definitely dampened the mood heading into the weekend. However, the mood remains optimistic for now, but if data in the week and weeks ahead continue to deteriorate, even trade deals may not be enough to lift optimism around a potential global slowdown.

For a more in-depth outlook on and Crypto, the following articles may be worth a read:

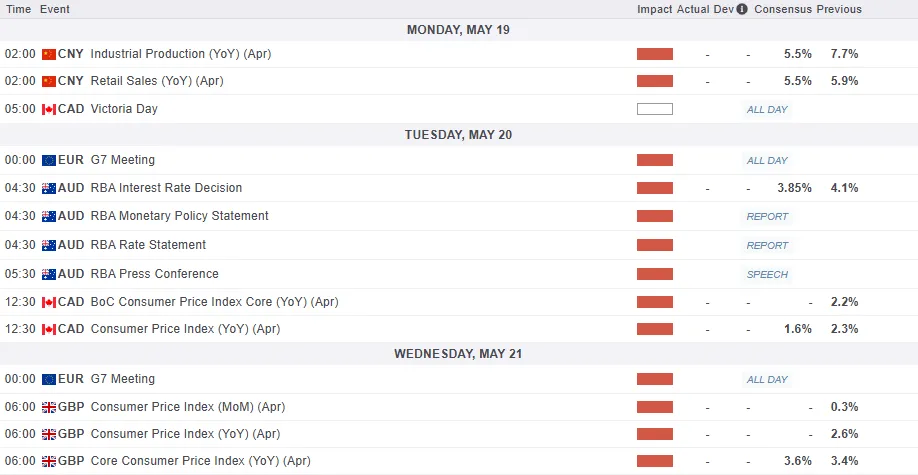

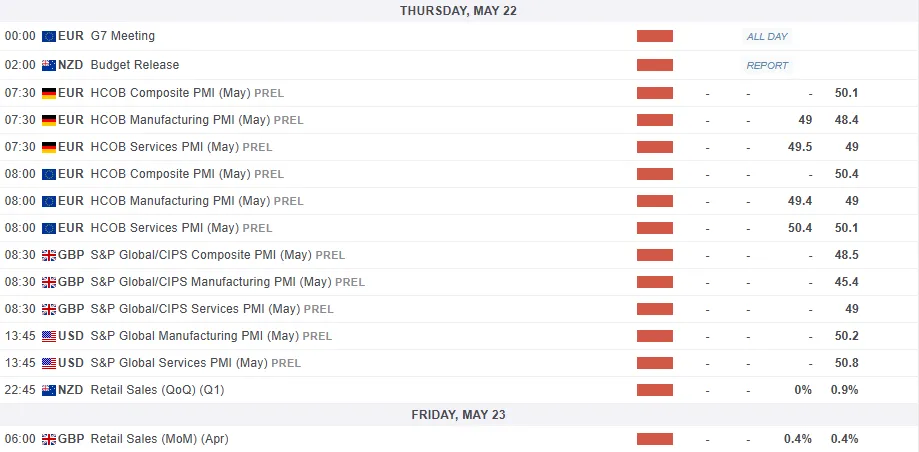

The Week Ahead: Central Banks in Asia Pacific and UK Inflation on Deck

The week ahead has several important data releases lined up. The US gets a bit of a data break in the week ahead, with Europe and the UK taking center stage. We will also have a busy week in the Asia Pacific region, where the data dump for China begins.

Asia Pacific Markets Outlook

The Reserve Bank of Australia (RBA) is expected to lower its cash rate by 0.25% to 3.85%. While April’s inflation numbers were higher than expected, core inflation, which the RBA focuses on, dropped to 2.9% year-on-year. This is the first time since 2021 that core inflation is within the RBA’s target range.

China’s April economic data kicks off on Monday. are expected to grow to 6.3% from 5.9% last year, showing stronger domestic demand. Fixed-asset investment should stay steady, rising slightly to 4.3%. may slow to 6.0% from 7.7%, as earlier and trade data hinted at a mild slowdown.

Property prices in 70 cities, also out Monday, will reveal if the market has hit bottom, with some cities stabilizing or seeing slight increases, though overall prices remain negative. On Tuesday, banks are likely to cut 1-year and 5-year loan rates by 0.10%, following a recent rate cut by the central bank.

Japan’s data is expected to weaken, as US tariffs impact exports and manufacturing. Flash is likely to drop. Exports should grow by 2.5% in April compared to last year, but slower than March. Strong exports to Asia will help offset the drop in US exports.

A big fall in imports should keep the trade surplus intact. Meanwhile, core inflation is expected to rise sharply in April, driven mainly by higher service prices.

Europe, US and UK Market Outlook

With 30-year mortgage rates stuck just below 7% and the average home loan at $450,000, monthly payments are nearly $3,000. This highlights how unaffordable the US housing market has become, leading to very low mortgage applications. Recent financial market volatility has made buyers even more hesitant, which explains why home builders are feeling so down.

This is reflected in the sharp drop in the NAHB sentiment index in May. All of this suggests that sales of new and existing homes will remain very slow in the next batch of data.

In the Euro Area, the economy hasn’t shown major problems from the trade war. April’s manufacturing data was surprisingly strong, likely boosted by businesses rushing to act before US tariffs hit. May’s data will reveal if the sector can handle global challenges. I am not too optimistic, but I do admit, I am a fan of surprises.

Consumer confidence will be key following the revelations from the US consumer confidence data this past week. Consumer confidence has dropped a lot recently, meaning people are less likely to spend the extra money they’re earning from higher wages. However, if people start worrying less about the global economy, we might see stronger spending at home.

We also have the EU-UK summit, which kicks off on Monday, and is mainly about agreeing on a defence partnership, but the UK also wants to make progress on economic issues. The UK is pushing for an agreement on food standards to reduce border checks. However, disagreements over migration and fishing are making it harder to improve economic ties.

April’s inflation data is important because many service prices go up annually during this time. In the past, this data has often been higher than expected.

However, we think services inflation will be lower than the Bank of England’s 5% forecast. If we’re right, it might not lead to a rate cut in June, but it could make one more likely in August.

Chart of the Week – US Dollar Index (DXY)

This week’s focus remains on the .

The index has struggled to build on Monday’s impressive gains following the US-China 90-day pause.

US data did little to assist the this week as it toiled around resistance at 101.18 since Wednesday.

The index is on course to close the week with marginal gains, and the trendline breakout still supports the idea of a move higher.

This is coupled with the period-14 RSI holding above the 50 neutral level, which is seen as a sign of bullish momentum still being in play.

The lack of data next week means the DXY may need another catalyst if the bulls are to take control. There have been rumors of potential trade deal announcements coming soon.

This could be the push the index needs right now for bulls to really make a serious push to the upside.

US Dollar Index (DXY) Daily Chart – May 16, 2025

Source: TradingView.com

Key Levels to Consider:

Support

Resistance

Original Post