We often read of a variety of schemes put forward by pundits and politicians as a good way to pay down the national debt, even while ignoring the fact the federal government continues to rack up trillions more in debt every year. For example, Jonathan Russo at The Hill last year insisted that it is very important to pay off the debt, and said a good way to do this is to “Eat the Boomers.” More specifically, Russo says the US government should raise taxes on people born between 1946 and 1964.

(In truth, the plan consists of little more than taxing away the inheritances of people born after 1964, and giving that money to the federal government.)

Meanwhile, the Trump administration has put forward a few cockamamie schemes that it says will pay down the debt. When the Trump administration in February suggested it would (somehow) use cryptocurrencies to pay down the national debt, Trump provided no details. But, he clearly thinks talking about paying down the debt is a winning issue. This may explain why Trump said in February that he would use revenue from selling green cards to millionaires—at $5 million per person—to pay off the debt. The plan can’t work (for reasons explained here), but raising the issue helps to convince Trump’s more gullible supporters that Trump is some sort of debt hawk.

Note that in none of these cases does the advocate for paying down the debt mention the problem of continually mounting new debt.

If we are actually serious about addressing the problem of crushing federal debt—which now requires interest payments that are spiraling upward—there are only two strategies that are worth talking about. The first is cutting federal spending in every way possible. The best way to get the federal debt under control is to, first and foremost, stop making it bigger. Until federal politicians are forced to stop running up huge new two-trillion dollar deficits, there’s no point to talking about “paying down” the mountain of federal debt that already exists. Unfortunately, this strategy is politically unpopular because spending cuts are unpopular with voters who have grown accustomed to “free stuff” paid for by the dwindling numbers of net taxpayers.

The second strategy is to get serious about repudiating the debt. After all, the taxpayers of today ought to be under no obligation to pay off the federal deficits incurred by politicians years ago to pay for the regime’s various lost wars and other boondoggles.

Unless spending cuts and repudiation are at the center of the discussion, anything that politicians and pundits mention as the way to deal with the national debt is probably nothing more than a political gimmick. The gimmicks are just ways to score political points while doing nothing meaningful about the federal debt.

Step One: Stop Deficit Spending

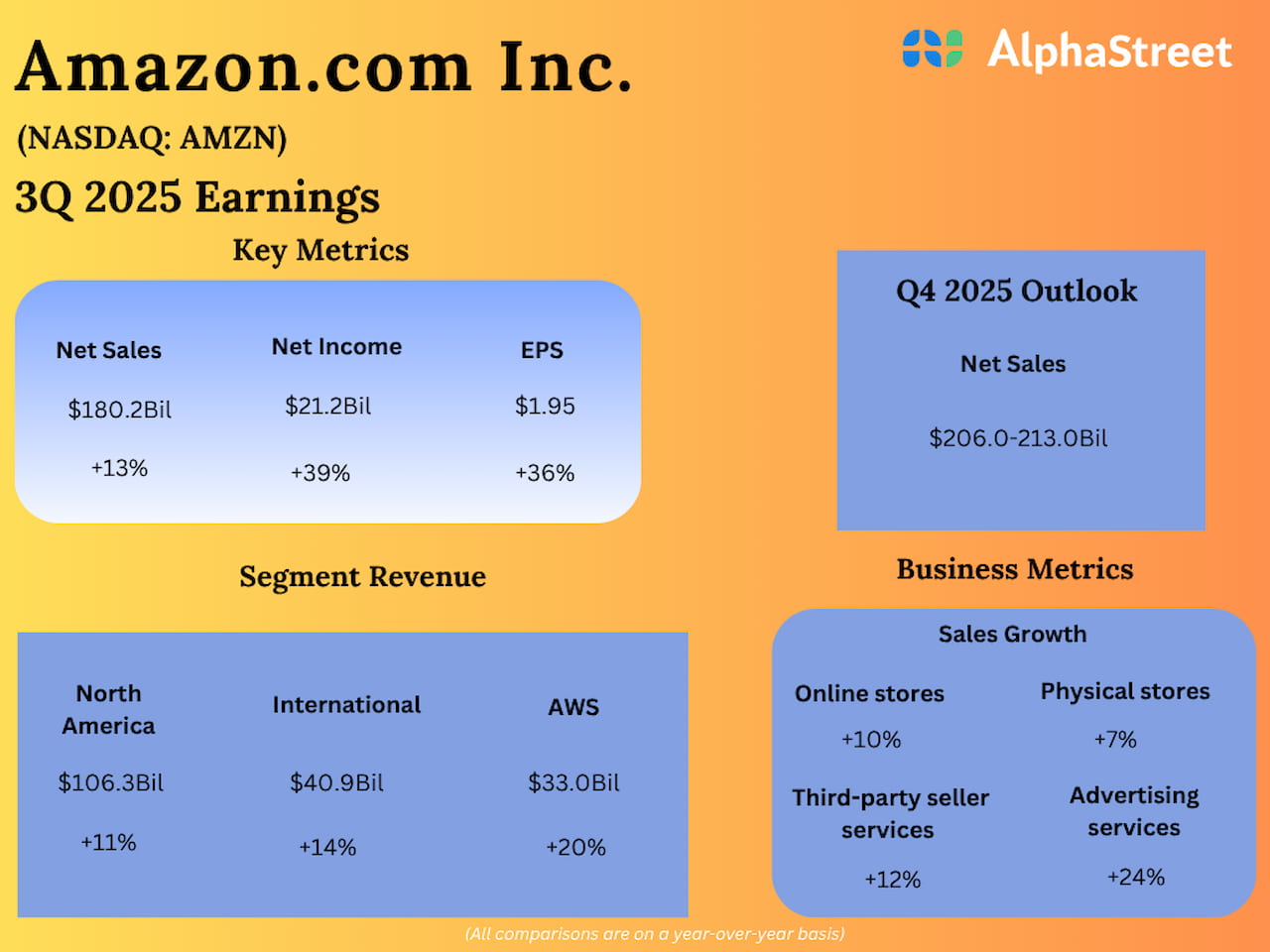

For the current fiscal year, the US is looking at an annual deficit of more than two trillion dollars. This means that any politician who is actually serious about reducing the national debt would be very concerned with not adding another two trillion to the current debt total that is rapidly ballooning to 37 trillion. Simply stated, the most straightforward way to address debt reduction now is to reduce federal spending. Any politician who claims to care about the national debt, but also supports the US’s current spending levels, is either a fool or a liar. Or both.

The fact that Trump is now pushing for a trillion-dollar defense budget, and has pledged to not touch major programs like Social Security, is ample evidence that debt reduction is nothing more than a bullet point on stump speeches for him. This was further illustrated when Trump said that he plans to use funds freed up by DOGE to increase discretionary spending. That is, the small amount of DOGE spending cuts (totaling, at most, $150 billion) will not lead to spending cuts but will simply enable more spending in other areas of federal spending.

What this all means is that under Trump’s watch, the total national debt at the end of the fiscal year will be about $38 trillion. Had Trump been serious about cutting the national debt, he could have simply worked to reduce the amount added to the debt this year via spending cuts. Instead, he chooses to talk about gimmicks.

Step Two: Repudiate the Debt

It may seem pointless to talk much about paying down the debt while the federal government is still racking up trillions in new debt every year. But, let’s say that the federal government somehow manages to eliminate the annual deficits. What then? The other strategy for reducing the national debt that must always be on the table is debt repudiation. It’s the only moral, honest, and transparent way of reducing the debt that has already been incurred.

We can see this when we consider the other options, all of which are reprehensible. How could the debt be paid down without repudiation? The first is to tax future taxpayers not-yet-born at crippling levels in order to pay off the debt incurred by politicians of the past. We are told that today’s toddlers must devote every increasing amounts of their future earnings to paying off past debts that were incurred, among other things, to keep AARP happy and to keep executives at Raytheon well funded.

In truth, the taxpayers of today and tomorrow did not vote for that and never signed any contract or were a party to any type of agreement to keep making payments of the debt of others. It’s unfortunate that many voters of the past were so despicable and irresponsible as to blithely accept endless deficit spending, but it’s simply not the job of today’s young people to pay for that.

Of course, this truth won’t prevent wealthy 79-year-old oligarchs like Janet Yellen from loftily declaring that the taxpayers must be fleeced at ever higher levels because “America always pays its bills.” When she says “America” she means “the taxpayers” and when she talks about paying bills, she means she wants to make sure the financial sector, which is heavily invested in federal debt, continues to get its money at the expense of regular people. Put another way, she’s saying this: “let’s tax the working people into oblivion to make sure we don’t upset the apple cart of Treasurys that my fellow oligarchs like so much.”

There is no reason why the recipients of this wealth transfer—i.e., Wall Street and the financial sector—should be regarded as sacrosanct while the taxpayer exists only to keep the cash flowing into the federal government’s coffers. After all, no investment is risk free, which means that there has never been any guarantee that federal debt would be paid off in full. Yes, it’s true that interest rates would go up with any repudiation of debt—either full or partial—but that would be offset by the advantages of repudiating the debt. The tax burden would go down for many Americans, and the endless tsunami of new federal debt would stop crowding out productive investments as it does now.

Meanwhile, the holders of Treasurys would simply face the real world for once. The real world is a place where no investment is guaranteed risk free, and this certainly should include government debt. That has always been true, even if American technocrats like Jerome Powell like to pretend otherwise.

Moreover, the oligarchs like Yellen and Powell are lying when they claim that “America pays its bills.” In the past, the US has straight-up repudiated some of its debt. But, more important to the current situation: the US already engages in ongoing repudiation of its debt via monetary inflation. Yellen and Powell know this. The US government has long used the strategy of reducing the real dollar value of the national debt by incessantly inflating away the value of the dollar. This allows the federal government to pay its debt in devalued dollars. That’s a type of repudiation.

The federal government prefers this type of stealth repudiation because, like all monetary inflation, it is a wealth transfer that benefits the federal government and its friends. Specifically, monetary inflation favors wealthy asset holders at the expense of those who own few assets. Regular people face rising prices for the basic necessities of living while gaining little from asset price inflation. Meanwhile, the federal government benefits from monetary inflation in the same way that a counterfeiter benefits from printing his own money.

This inflation-based repudiation favors the wealthy and the government itself while the more honest type of repudiation—a transparent refusal to pay off old debt at full value—favors more ordinary taxpayers. So, it’s no wonder that the regime prefers the former.

For now, the number one thing we can to do make the federal debt less costly and more manageable is to just stop making it bigger. The best thing we can do for our children and the future right now is to stop the bleeding we endure through new deficits added to the debt with every passing day.