Investment mantras aren’t morning chants you recite with closed eyes and crossed legs. “They are what you believe are at the foundation of your whole investment and portfolio management strategy,” the PMS fund manager, who runs First Global, writes in her book published by Penguin.

Here’s the list:

1. Be the House, Not the Gambler

Want to win in the long run? Then stop being the guy tossing chips in Vegas and start being the casino. The “house” wins not by betting big, but by stacking odds in its favor, again and again. It’s not luck; it’s expected value. And if you’re playing with just a handful of stocks, you’re not investing—you’re rolling dice.“When you take very few bets—meaning, invest in very few securities—you are essentially banking on luck, which may even help you get returns for a certain period of time,” Mehra says, adding that the only way to ensure that your results reflect your skills is to have a large number of stocks in your basket. It essentially means having a diversified portfolio.

2. Protect in Down Markets. Participate in Up Markets

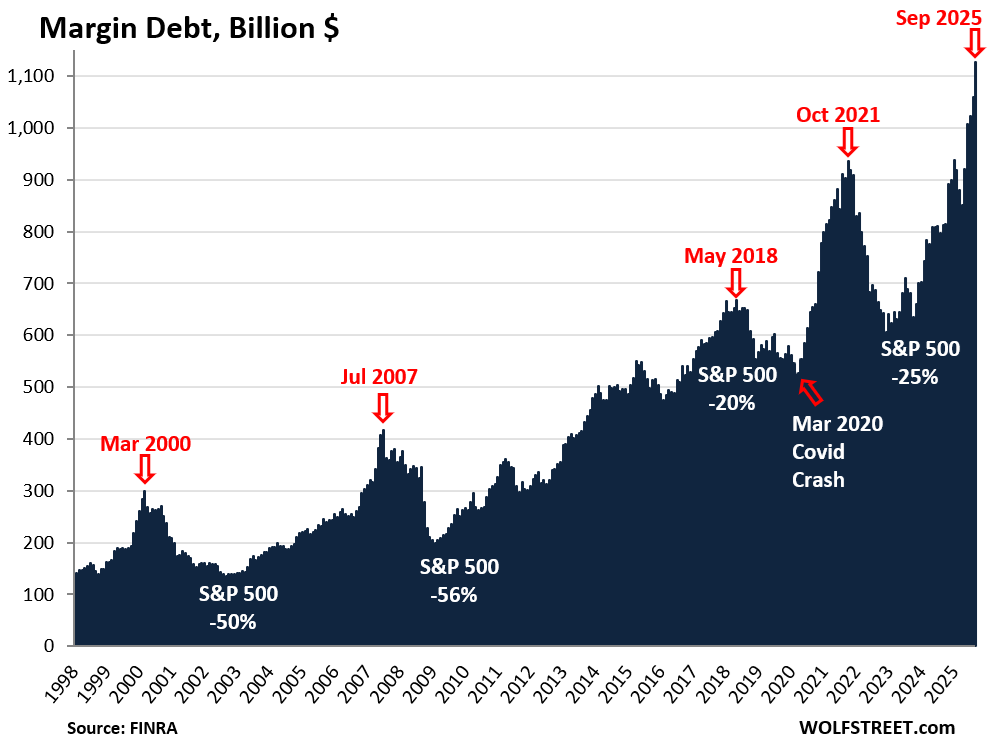

Here lies the quiet genius of compounding: avoiding destruction. As Mehra puts it, the real alpha comes not from catching every rally but surviving every crash. Fall 50%, and you need a 100% bounce to break even. “The boring mantras of diversification across sectors, creating stop losses, hedging, asset allocation, et al., are what will save you when the market crashes, and over a period of time that is what is going to help your portfolio outperform,” reads the book.

3. Play for Singles, Not Sixes

Just like in cricket if you try to hit a six on every ball you are most likely to be out of the game before you know it, chasing multibaggers more often than not ends in tears because many of the stocks on a tear can go down just as easily as they have gone up.Boring can be good in portfolio management if your aim is to maximize your returns over a period of time rather than be the centre of attraction at parties, Mehra emphasises in the book.

4. Play Everything. Believe Nothing

Conviction is overrated. Flexibility is underrated. Mehra’s rule? Fall in love with your family, not your stocks. Buy based on data. Sell based on data. “Even companies with the steadiest of businesses have their stocks go through long periods of underperformance in the market,” points out the ace fund manager.

5. Not Bullish. Not Bearish. Be Hare-ish

Are you a bull or a bear? Wrong question. Be the hare—quick, agile, and ready to pivot. Mehra’s mascot at First Global isn’t the majestic lion; it’s the humble hare that sees in 360 degrees and runs before others even flinch. In investing, rigidity is death—ask any cardiac surgeon.

6. Great Trades Are Like Buses—There’s Always One Coming

When a theme has been doing well for some time is when it comes on your radar and you want to clamber on to this bus which has already left the bus station, the book says warning that in running after a fast-moving vehicle and trying to climb on to it you are more likely than not to just fall to the ground.

“Investing in something which has been already doing well over a period of time will usually just result in underperformance of what you have bought. This is the data. This is the same reason why you should avoid thematic funds,” Mehra argues.

7. No Storification. Just Datafication

The human mind craves stories. The market, on the other hand, laughs at them. Mehra’s seventh commandment is brutal: kill the narrative. Stick to numbers.

“To keep to the discipline of sticking to data and objective facts means you have to let go of the temptation of telling fascinating stories. That is the price you pay for predictable outperformance over a period of time,” she says.

8. Rigidity Kills—in Arteries and Investing

Just as arteries need to stay supple to prevent heart attacks, portfolios need to breathe and evolve. Otherwise, they’ll flatline—with your wealth. Rigidity, Mehra asserts, doesn’t work in the markets as investing is a game of probabilities.

9. Avoid Big Losses

This is the final gospel, and arguably the one everything else hinges on. Investing is a loser’s game—win by not losing. If you can protect on the downside, the market will give you plenty of room to make gains.