JPMorgan Chase CEO Jamie Dimon said Monday that tariffs announced by President Donald Trump last week will likely boost prices on both domestic and imported goods, weighing down a U.S. economy that had already been slowing.

Dimon, 69, addressed the tariff policy Trump announced on April 2 in his annual shareholder letter, which has become a closely-read screed on the state of the economy, proposals for the issues facing the U.S. and his take on effective management.

“Whatever you think of the legitimate reasons for the newly announced tariffs – and, of course, there are some – or the long-term effect, good or bad, there are likely to be important short-term effects,” Dimon said. “We are likely to see inflationary outcomes, not only on imported goods but on domestic prices, as input costs rise and demand increases on domestic products.”

“Whether or not the menu of tariffs causes a recession remains in question, but it will slow down growth,” he said.

Dimon is the first CEO of a major Wall Street bank to publicly address Trump’s sweeping tariff policy as global markets crash. Though the JPMorgan chairman has often used his platform to highlight geopolitical and financial risks he sees, this year’s letter comes at an unusually turbulent time. Stocks have been in freefall since Trump’s announcement shocked global markets, causing the worst week for U.S. equities since the outbreak of the Covid pandemic in 2020.

His remarks appear to backtrack earlier comments he made in January, when Dimon said that people should “get over” tariff concerns because they were good for national security. At the time, tariff levels being discussed were far lower than what was unveiled last week.

Trump’s tariff policy has created “many uncertainties,” including its impact on global capital flows and the dollar, the impact to corporate profits and the response from trading partners, Dimon said.

“The quicker this issue is resolved, the better because some of the negative effects increase cumulatively over time and would be hard to reverse,” he said. “In the short run, I see this as one large additional straw on the camel’s back.”

‘Not so sure’

While the U.S. economy has performed well for the past few years, helped by nearly $11 trillion in government borrowing and spending, it was “already weakening” in recent weeks, even before Trump’s tariff announcement, according to Dimon. Inflation is likely to be stickier than many anticipate, meaning that interest rates could remain elevated even as the economy slows, he added.

“The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and ‘trade wars,’ ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility,” Dimon said.

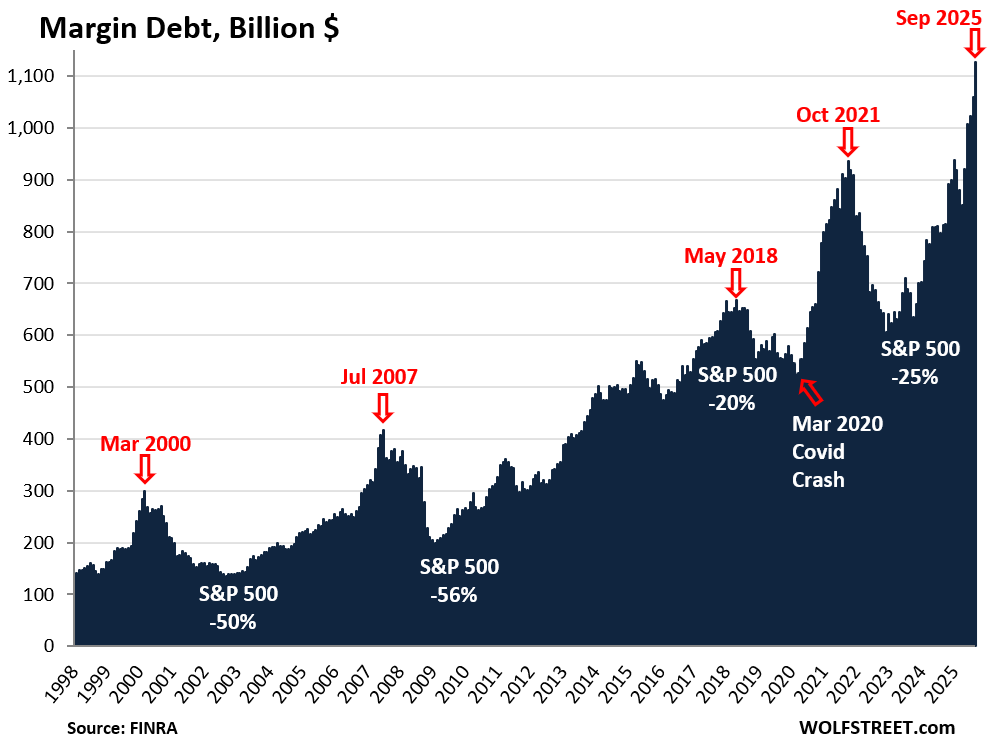

Dimon also struck a somewhat ominous note considering how much U.S. stocks have already fallen from their recent highs. According to the JPMorgan CEO, both stocks and credit spreads were still potentially too optimistic.

“Markets still seem to be pricing assets with the assumption that we will continue to have a fairly soft landing,” Dimon said. “I am not so sure.”

‘Critical crossroads’

Under Dimon’s roughly two decades of leadership, JPMorgan has become the largest U.S. bank by assets and market capitalization. Last year was its seventh in a row of record revenues, he noted.

But the bank is reliant on “whether the long-term health of America, domestically, and the future of the free and democratic world are strong,” Dimon said.

The U.S. and world are at a critical crossroads, according to Dimon. He argued for a deep reform and strengthening of the global system, led by America since the end of World War II, that has led to decades of peace and prosperity, rather than abandoning that order.

“If given the opportunity, that is exactly what our adversaries want to happen: Tear asunder the extensive military and economic alliances that America and its allies have forged,” Dimon said.

“In the multipolar world that follows, it will be every nation for itself – giving our adversaries the opportunity to set the rules and use military and economic coercion to get what they want.”

Dimon had several prescriptions to meet the challenges of the day, including restoring civic pride, acknowledging and addressing problems including uncontrolled immigration and unfair trade policies with common sense and maintaining the U.S. military “at whatever cost.”

“Economics is the longtime glue, and America First is fine, as long as it doesn’t end up being America alone,” Dimon said.